Aave Weekly 2021W23.pdf (279.3 KB)

Aave Weekly 2021W24.pdf (284.1 KB)

Hi,

Thanks for those third party sources.

The Block seems to list total revenue (supply side + protocol revenue) only with no way to break this out.

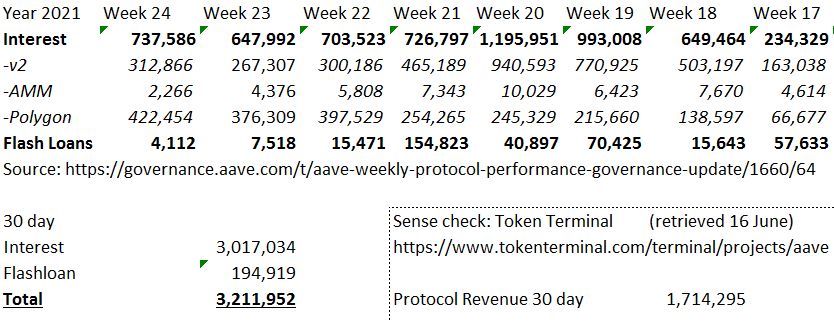

Token Terminal figures don’t seem to agree with the weekly reports you include here, they seem to be under reporting. This appears to be due to missing out the Polygon revenue.

Would be very grateful if you could let us know where you are getting the Polygon numbers, the link above isn’t easy to follow: https://aave-api-v2.aave.com/data/liquidity/v2?poolId=0xd05e3e715d945b59290df0ae8ef85c1bdb684744

It is possible to import Polygon data via TheGraph into dappquery.com where it can be queried in SQL. Might you make an official public query on dappquery for the polygon revenue numbers?

Could you please confirm that the “ecosystem collector” line below “interest for depositors” on your sheet refers to the income earned by AAVE protocol from the borrow-lend interest rate spread? Thanks.

Hi @iguana

All these calculations are computed via the API links shared above, no other data is used. For Polygon it is that exact link with the data extracted each week

Older reports however are more approximative, with figures estimated from average weekly APYs, weekly close liquidity, Dune queries for Flash Loans and Liquidations as well as the Coingecko weekly close prices

Besides from these APIs all the data is available and queriable on TheGraph - The Block and Token Terminal query it directly:

- https://thegraph.com/explorer/subgraph/aave/protocol-v2

- https://thegraph.com/explorer/subgraph/aave/aave-v2-matic?version=current

Since Aave is a community lead DAO, you can proceed to request dappquery.com integration of the Aave Polygon Market. You can even get support from Aave Grants DAO

Hard to comment on the discrepancies you have identified without seeing them. One thing is that Aave weekly uses the weekly close price. I think Token Terminal is still working on adding Polygon and the incentives

Yes ecosystem collector corresponds to what you call protocol revenue, the one below interests is generated by interests paid by borrowers as defined by the reserve factor while the one below Flash Loans is generated by V1 Flash Loan fees replacing referral fees

Thanks for your helpful response. What I was meaning is that the Protocol Income fields for the Polygon endpoint all have zero values e.g.

30DaysProtocolIncome: “0”

I have pointed the API issue for next update as it takes days to resync the subgraph

You can also calculate it by using the reserve factor which shows the share of interests collected by the ecosystem collector Polygon Market - Risk

Given: Depositors Interests = (1 - Reserve Factor) x Total Interests

Reserve Factor Collections = RF x TI = (RF x DI)/(1-RF)

Aave Weekly 2021W25.pdf (283.9 KB)

Thanks Alex, those weekly reports are very helpful. What would be super convenient to get the broader picture is to have consolidated financials over longer period (quarterly/annual/LTM/YTD). If I had the skills, I would apply for a grant to develop something similar to what they did at Yearn (https://www.yfistats.com/financials/IncomeStatement.html). Hopefully someone in the community will pick it up, otherwise I might start to learn and volunteer, but this will take time.

Yes, I hope so as well

If you are interested, please contact https://aavegrants.org/

There ideas and funding available

Thanks Alex for posting this. Super helpful. Do you happen to have the on-chain addresses for the ecosystem collectors? I see that the Ethereum ecosystem collector got ~$300k over the week. Where does the remainder of the $675k go? Is it a polygon address?

So you have

Ethereum Ecosystem Collector

Polygon Ecosystem Collector

Aave Weekly 2021W26.pdf (292.4 KB)

Aave Weekly 2021W27.pdf (284.2 KB)

Aave Weekly 2021W28.pdf (282.3 KB)

Aave Weekly 2021W29.pdf (283.3 KB)

hi,when W30 report will be released?

Aave Weekly 2021W30.pdf (280.7 KB)

Thanks for the reminder, its here

Aave Weekly 2021W31.pdf (282.0 KB)

Great summary as always, Alex. Liquidations seem to happen more often on Polygon as a ratio to liquidity when compared to V2 - why do we think that is?