[ARFC] Deploy BAL & aBAL from the Collector Contract

Author: @llamaxyz - DeFi_Consulting (@MatthewGraham) and @dydymoon

Created: 2023-02-05 (updated)

Simple Summary

This proposal presents two options for deploying the approximately 100k BAL tokens being acquired by AIP 115 and the aBAL holding in the Ethereum Collector Contract, [1].

Abstract

AIP 115 has been successfully implemented and Aave has acquired an additional 100k BAL on market. The total BAL and aBAL holding is now 308,978.30. With 200k BAL already committed to veBAL, this proposal will determine how to deploy the remaining 108,978.30 BAL with the overall objective of maximizing the growth potential of Aave, [4,16].

Aave Snapshot voters can choose between two options, each of which has varying degrees of complexity and represents different means of achieving similar goals over different time horizons.

Option 1) Locking veBAL.

Option 2) Staking auraBAL.

Option 1) is about locking B-80BAL-20WETH enabling Aave to participate in Balancer gauge and governance votes, and benefit from the Liquidity Provider (LP) boosting and protocol fees earnings.

Option 2) focuses on yield, forgoes governance influence (participating in votes) and presents a higher yield investment strategy that over time, will lead to more governance influence relative to Option 1).

A Snapshot will be posted enabling the community to choose between both options. Llama recommends voting for Option 1).

Motivation

This BAL holding has been acquired by the Aave with the goal of supporting Aave lending market adoption. In pursuit of driving growth to the Aave markets, the BAL holding needs to be deployed and utilised.

Aave has the following BAL and aBAL holdings on Ethereum:

- 200k BAL acquired via a token swap with Balancer DAO, [1].

- 100k BAL acquired via an on market acquisition swap contract, [4].

- 8,978.30 aBAL acquired through user borrowing BAL on Aave, [10].

This proposal will focus on how best to deploy the 100k BAL and 8,978.30 aBAL.

Option 1) Locking veBAL

The Balancer Liquidity Mining system is an automated program which governs the minting of all BAL tokens based on on-chain voting by veBAL holders. veBAL is obtained by joining the canonical 80/20 BAL/ETH Weighted Pool and then locking the Pool shares token (often called BPT, for ‘Balancer Pool Token’) for a time duration. The longer the 80/20 BPT is locked for, the more veBAL and voting power is obtained.

In Option 1), Aave DAO converts all BAL (incl. Redeem aBAL for BAL) with sufficient WETH to B-80BAL-20WETH. The B-80BAL-20WETH token is then deposited into the VotingEscrow veBAL contract and locked for the maximum duration, 1 year. This proposal will acquire the B-80BAL-20WETH and explain the goals of utilising the veBAL holdings while a separate proposal will detail how the veBAL is to be managed before being deployed to veBAL.

What’s veBAL ?

veBAL are not transferable and the voting influence decays on the veTokens balance over time requiring the veBAL to be relocked periodically to maintain maximum voting influence. The B-80BAL-20WETH can be locked from 1 week to 1 year. Ie: 1 B-80BAL-20WETH locked 1 year = 1 veBAL, locked 6 months = 0,5 veBAL etc

-

Gauge-weight Power

Voting power which influences the BAL emissions on the different gauges. The votes happen every week on Balancer governance. It can be used for several goals which will be described later on this post. -

Governance Power

Voting influence in Balancer DAO proposals. Since Balancer DAO utilities off-chain governance, the voting power can be delegated via Snapshot. Note: Llama is currently a Balancer DAO delegate. -

veBoost

Locking B-80BAL-20WETH earns a boost of up to 2.5x on the liquidity provided on Balancer. -

Protocol Fees

75% of all trading fees consolidated for bb-a-USD (stable) + BAL coming from the veBAL gauge are distributed to lockers, [9].

veBAL Position Overview

By maximising the veBAL holding and using over 308.9K BAL with the proportional amount of WETH (326.88) for a combined worth of $2,719,000 at the time of writing, Aave would receive an estimated ~153,520.38 units of B-80BAL-20WETH. Converted to veBAL, the ~153,520.38 units would represent approximately 1.10% of the BPT liquidity and 1.40% of the veBAL supply. Aave would be one of the largest veBAL holders along with Aave Companies, [5].

With 145,000 BAL tokens currently being minted and distributed each week across four networks and Aave holding 1.40% of veBAL supply, this is equivalent to controlling the distribution of 2036 BAL per week, or $14,496 per week ($753,8080 per year, assuming a BAL price $7.12).

BAL emissions reduce yearly as per the inflation schedule and the next reduction will occur at the end of March 2023, pivoting from 145,000 to 121,930 BAL/week. With 2023 emission and the same veBAL share, Aave would be able to redirect 1,712 BAL/week, or $12,189 per week or $633,850 per year, assuming a BAL price at $7.12.

Aave can utilise its veBAL holdings to support, not limited to, the below strategies:

- Redirect incentives on existing Balancer pools

- Optimise the yield on treasury strategies

- Bootstrap the Staked aToken Reserves

- Grow and sustain the GHO liquidity

- Help sustain the Safety Module yield

The boost amount received depends on the value of the funds deposited and the relative sizing of the veBAL holding. The boost can be used directly on the Collector Contract but considering the amounts of available funds, the boost is unlikely to be sufficient to boost all of Aave’s positions in Balancer Liquidity Pools. Therefore, it is likely any treasury strategies will be a mix of both depositing into Balancer gauges directly or via Aura Finance.

There remains the possibility to sell the veBoost on secondary markets like Warden, [6].

veBAL yield overview

The veTokens yield can vary a lot depending on several parameters:

- bb-a-USD fees depends on the trading volume (Swap fee: 0.67% APR)

- BAL rewards are coming from the veBAL gauge (BAL rewards: up to 0.91% APR)

- The veBoost yield is hard to estimate as it won’t be the same if used on POL (up to 2.5x the yield), or sold

In the second case, the current minimum price listed on Warden is 0.00014 BAL/veBAL/week

veBoost if sold: from 0.27% APR with a BAL price of 7.14$ and a veBAL price of $18.92

- Bribes: The biggest variation on the veBAL yield comes from the bribes received for the gauge weight power. Last week, the average cost was ~$0.085/veBAL vote/week. Gauges weight APR: 23.3%.

It’s important to note that the yield impact is better when some funds are deployed in strategies, farming boosted rewards on the pools voted.

Option 2) Staking auraBAL

Option 2) maximises earning whilst forgoing Aave’s ability to participate in BAL emission distribution votes. Both Option 1) and 2) involve obtaining the B-80BAL-20WETH position.

After the B-80BAL-20WETH position is obtained, Aave could deposit it into Aura Finance’s auraBAL wrapper contract to earn staking yield in the several forms (1.87% stables (bb-a-USD), 24.09% in BAL and 34.59% in AURA for a total of 60.56% APR), [8].

Depositing into the B-80BAL-20WETH/Aura pool and staking the BPT was considered, however this is more complex to execute and maintain for margin additional yield.

The yield received from the auraBAL holding can be compounded to earn additional yield.

- BAL (24.09% of 60.56%): BAL, aBAL and WETH from the Collector Contract can be swapped for B-80BAL-20WETH and staked on Aura Finance.

- bb-a-USD (1.87% of 60.56%): bb-a-USD can be deposited on Aura to earn 6.53% in (0.06% swap fees, 0.83% bb-a-USD, 2.30% BAL, 3.35% AURA).

- AURA (34.67% of 60.32%): AURA can be locked for vlAURA and used to vote where BAL and AURA incentives will be directed. The vlAURA position generates around 3.34% in auraBAL as well as gives vote weight for proposal and gauge weight voting, [11]. The vlAURA lock period is 16 weeks and 4 days, depending on locking date and after this time, the AURA can be redeemed and swapped.

Growing a vlAURA position over time in addition to the veBAL one will increase the total voting power controlled over time, which will help to drive TVL to Aave markets and generate more earnings.

With 200K BAL from the token swap + WETH to be deposited in veBAL and 108,978.30 BAL + WETH into the auraBAL staking contract, Aave will own ~54,220 auraBAL and ~99,600 veBAL.

By staking 54,220 auraBAL, Aave DAO will hold approximately 1,99% of the auraBAL supply, [7].

Option 2) is focused on depositing B-80BAL-20WETH on Aura to earn more BAL & AURA rewards.

Comments

To help with the decision making, the table below presents some pros and cons of each approach. The TL;DR: veBAL has an immediate impact whilst auraBAL is a longer term, higher return strategy that compounds over time.

Llama suggests Option 1) to focus on accumulating voting power as soon as possible, to support all possibilities mentioned above.

There are several more advanced strategies to which Aave could deploy assets to grow its strategic voting power over time which will be detailed in the RF strategies deployment proposal.

It is reasonable to think that, in time, AURA could be listed as collateral on Aave, generating aAURA revenue which could also be used to bolster this strategy. The compounding effects of using Aave’s revenue stream presents a unique opportunity to gain influence in how BAL and AURA incentives are distributed.

Implementation

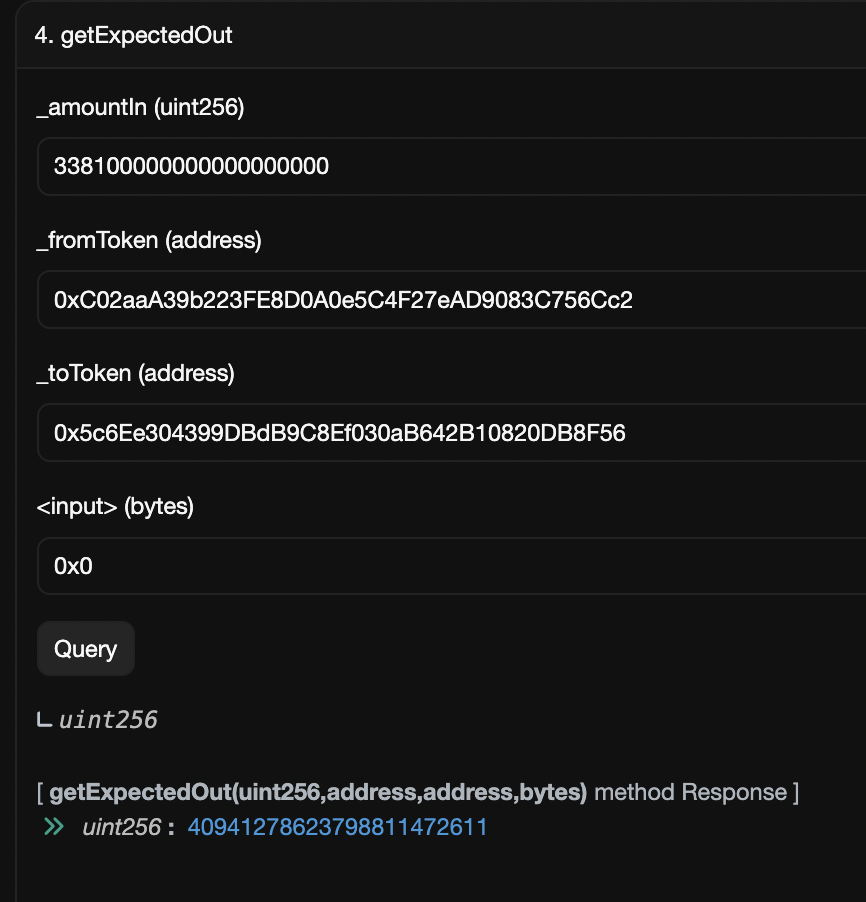

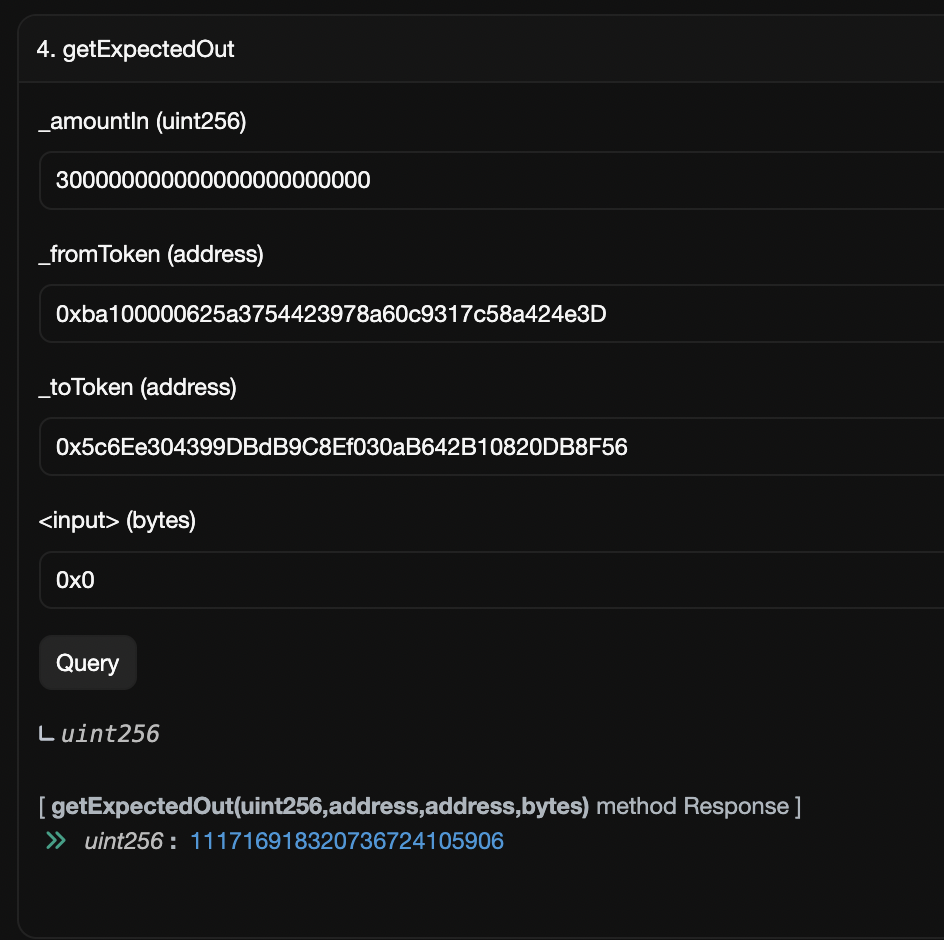

All BAL, aBAL and matching amount of wETH from the Collector Contract are to be converted to B-80BAL-20WETH via a swap contract.

Users will deposit the B-80BAL-20WETH BPT into the swap contract and receive BAL and wETH as per the ratio of BAL and wETH within the B-80BAL-20WETH pool. Traders will be encouraged to complete these transactions on Aave’s behalf for a 50 bps reward relative to the calculated book value of the B-80BAL-20WETH token.

Chainlink oracles will be used wherever possible and the payload will be peer reviewed by @bgdlabs.

Example:

When depositing into the pool if the ratio of BAL and WETH is not correct, the token in excess will be swapped to the other token and the user will incur higher gas fees.

75 bps on $25,000 is $187.5. This is sufficient to cover the gas costs and price exposure whilst performing the following transaction flow:

- Approval BAL and wETH

- Swap asset to BAL and wETH

- Deposit BAL and wETH into the pool

- Approve a budget for interacting with swap contract

- Deposit B-80BAL-20WETH into swap contract

- Swap BAL and wETH to preferred asset

- Remove permission to interact with swap contract

The larger the trade size and the more times the trader completes the swaps, the more economical it becomes. There is a balance between trying to include the majority of market participants, timely execution and cost.

Additional considerations in the swap contract:

- Query composition of B-80BAL-20WETH pool, if pools is outside 79.85-80.15% BAL range then don’t accept BPT deposits

- Distribute a fixed 80/20 ratio of BAL and wETH in return for B-80BAL-20WETH

- BAL and aBAL ceiling, current holding plus 1% at time of deployment

- awETH ceiling, sufficient awETH to convert all BAL and aBAL including the 1% BAL and aBAL buffer

- Creating the contract such that it can be easily updated to enable future revenue to be converted to B-80BAL-20WETH

An alternative execution philosophy would be to redeem aBAL for BAL, then deploy all BAL with a matching amount of wETH (80/20) into the B-80BAL-20WETH pool directly from the Collector Contract. The B-80BAL-20WETH pool is valued at $247.85m at the time of writing and Aave’s deposit would be 308,978.30 BAL and 326.88 wETH, representing 1.10% of the pool. There is MEV protection upon depositing into the pool and there is the ability to limit slippage and there would be a need to query the pool’s composition with predetermined conditions that when met enable Aave to deposit into the pool. Such a pre-condition would be the pool is 79.85-80.15% BAL.

The alternative option is a lot easier to execute from a smart contract perspective, does not rely on traders and avoids Aave paying traders a premium. The depositing on

Future Considerations

The above proposal focuses on whether Aave’s preference is for maximum governance influence or yield. Depending upon which direction Aave elects to proceed, there will be various other considerations and discussions that emerge.

Those considerations are:

- Determine how to use the veBAL and/or vlAURA holdings, GHO, staked aToken pools, pools include in the Safety Module upgrade

- Implementation of meta-governance, via Snapshot, AIP, multi-sig etc…, [3,4]

- Continual conversion of aBAL and awETH to veBAL, if Option 1) is voted

References

[1] Aave - Strategic Partnership with Balancer DAO Part 2 - 100k BAL Acquisition

[2] Snapshot

[3] Aave - Strategic Investment Part 1 - BAL <> AAVE Token Swap

[4] [ARFC] BAL Interest Rate Curve Upgrade - #19 by Llamaxyz

[5] veBAL Holders

[6] https://app.warden.vote/dashboard/

[7] Ethereum Transaction Hash (Txhash) Details | Etherscan

[8] Aura BAL (auraBAL) Token Tracker | Etherscan

[9] AaveLinearPool - Developers

[10] $7.07 | Aave interest bearing BAL (aBAL) Token Tracker | Etherscan

[11] Aura Finance

[12] Balancer

[13] Creative Commons — CC0 1.0 Universal

Copyright

Copyright and related rights waived via CC0, [13].