Scroll Risk Analysis and Initial Parameter Recommendations

Recommended Initial Parameters

Gauntlet and ChaosLabs recommend the following initial parameters for wETH, wstETH, and USDC on Aave V3 Scroll.

| Risk Parameter | WETH | wstETH | USDC |

|---|---|---|---|

| Isolation Mode | NO | NO | NO |

| Enable Borrow | YES | YES | YES |

| Enable Collateral | YES | YES | YES |

| Emode Category | ETH | ETH | No |

| Loan To Value | 75% | 75% | 77% |

| Liquidation Threshold | 78% | 78% | 80% |

| Liquidation Bonus | 6% | 10% | 5% |

| Reserve Factor | 15% | 15% | 10% |

| Liquidation Protocol Fee | 10% | 10% | 10% |

| Supply Cap | 400 | 130 | 1,000,000 |

| Borrow Cap | 320 | 45 | 900,000 |

| Debt Ceiling | N/A | N/A | N/A |

| uOptimal | 80% | 45% | 90% |

| Base | 0% | 0% | 0% |

| Slope1 | 3.3% | 7.0% | 5% |

| Slope2 | 80% | 300% | 60% |

Supply caps

We recommend setting supply caps at 2x the available liquidity under the Liquidation Penalty price impact. Given the low liquidity on DEXes for wstETH, we suggest launching with conservative supply caps equal to ~10% of the total circulating supply.

eMode

We recommend the ETH eMode pools start with the same parameters as Ethereum mainnet, Optimism, and Gnosis: 93% LT, 90% LTV, and 1% LB.

Supporting Data

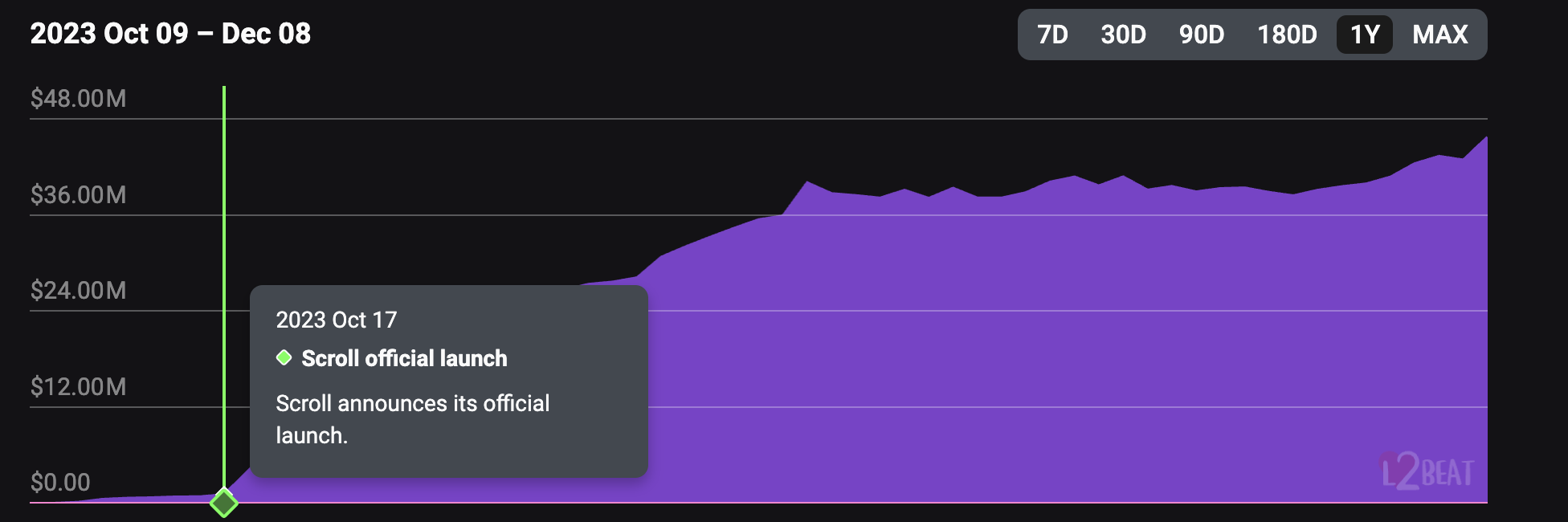

Since the official launch of Scroll on Mainnet, the total assets circulating has reached $45M with a TVL of $17M.

Contracts and Circulating Supply

| Contract | Token | Circulating Supply |

|---|---|---|

| 0x06eFdBFf2a14a7c8E15944D1F4A48F9F95F663A4 | USDC | 11,247,771.00 |

| 0x5300000000000000000000000000000000000004 | WETH | 1,764.82 |

| 0xf610A9dfB7C89644979b4A0f27063E9e7d7Cda32 | wstETH | 1,338 |

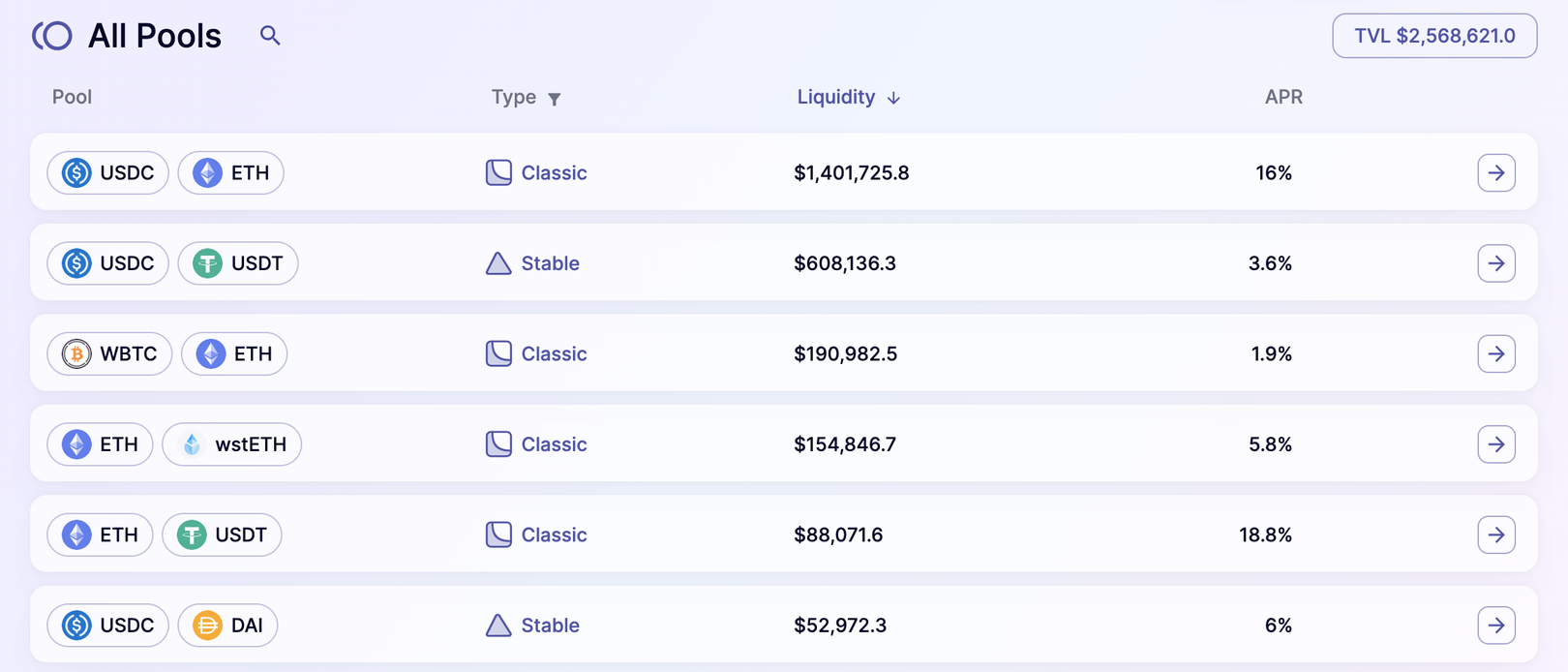

DEX Liquidity

- 400 WETH can be swapped into USDC at 6% slippage

- 120 wstETH can be swapped into WETH at 10% slippage

Top Pools on Scroll Dexes

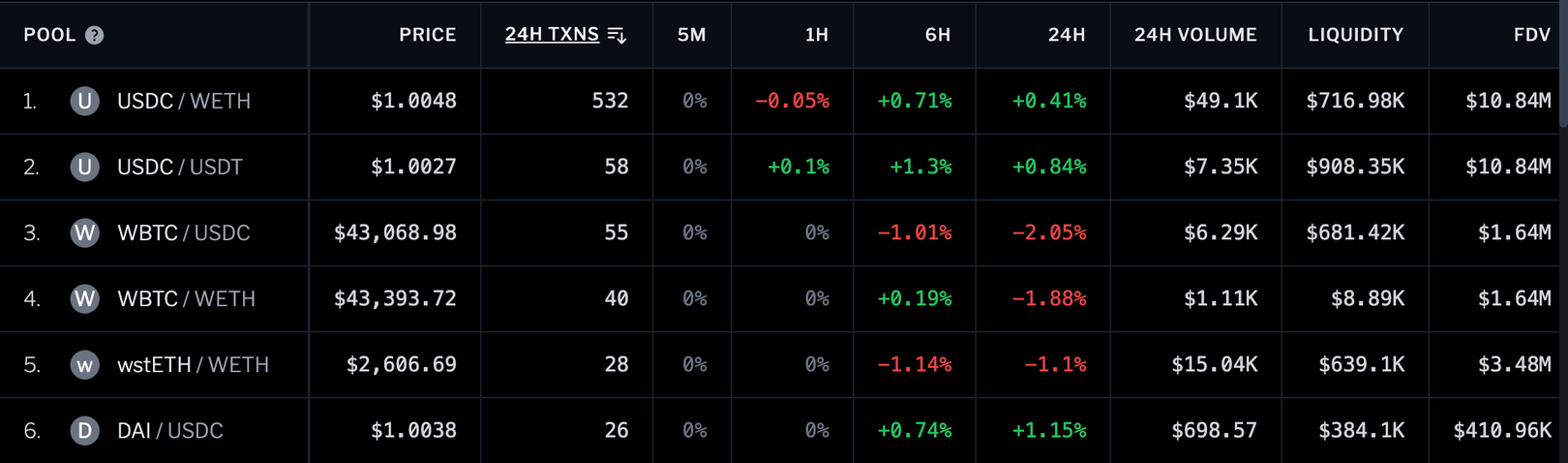

Zebra

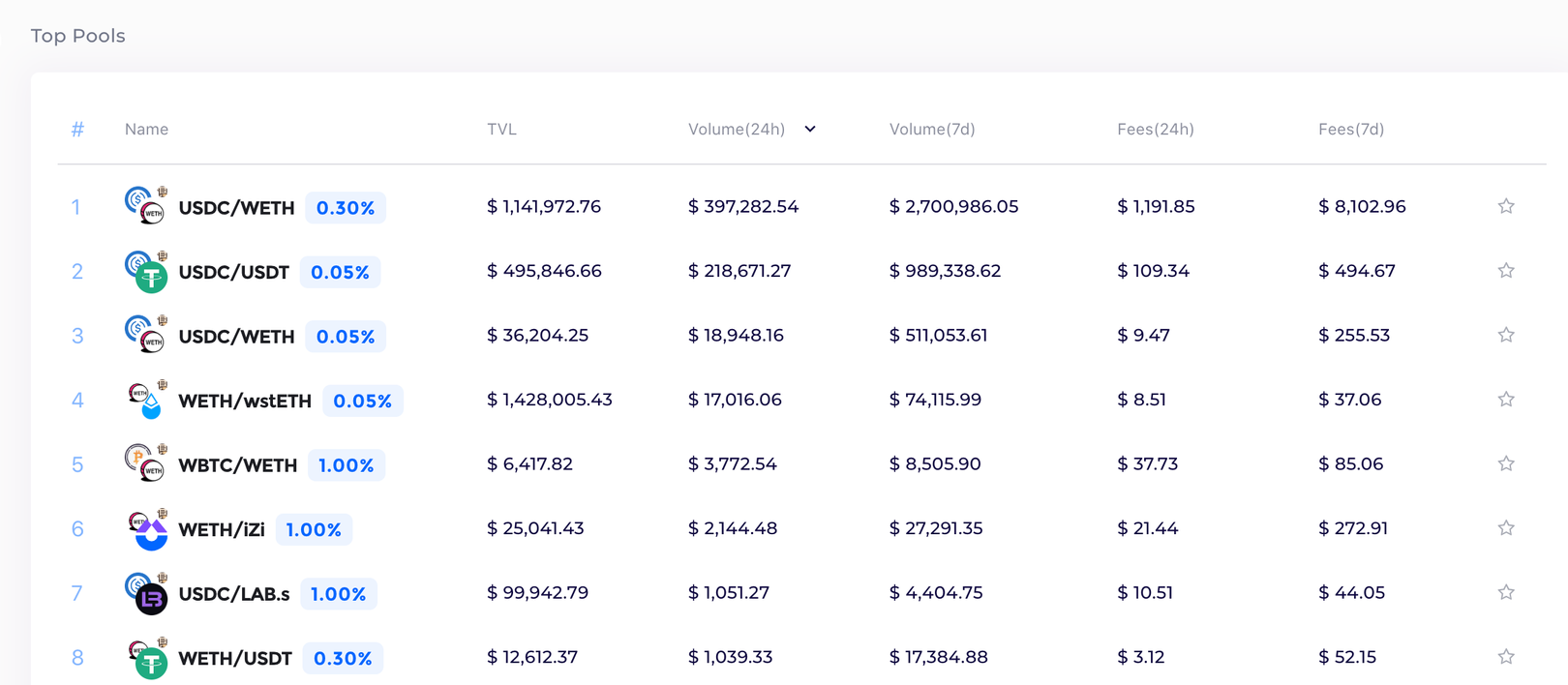

iZiSwap

SyncSwap

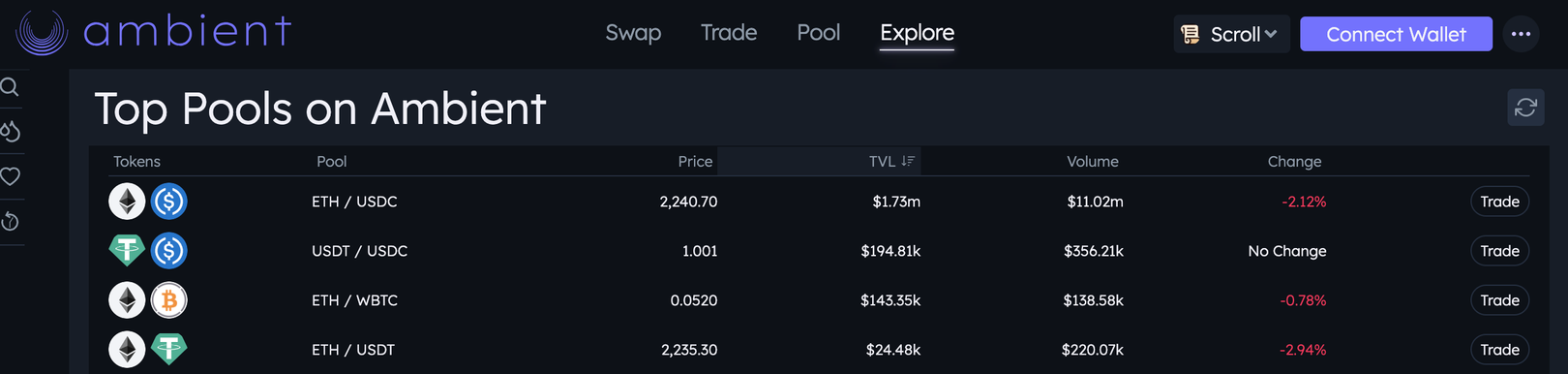

Ambient