Chaos Labs supports the proposal to onboard MAI to V3 Optimism with the following parameters:

| Risk Parameter | Value |

|---|---|

| Isolation Mode | YES |

| Enable Borrow | YES |

| Enable Collateral | YES (in isolation mode) |

| Loan To Value | 75% |

| Liquidation Threshold | 80% |

| Liquidation Bonus | 5% |

| Reserve Factor | 20% |

| Liquidation Protocol Fee | 10% |

| Borrow Cap | 1,200k |

| Supply Cap | 2,200k |

| Debt Ceiling | 2,000k |

| Base | 0% |

| Slope1 | 4% |

| Uoptimal | 80% |

| Slope2 | 75% |

Liquidity on Optimism is better than that on Arbitrum, leading us to adopt the parameters proposed by @MarcZeller, which are identical to the ones from the Polygon deployment.

We updated the reserve factor to 20% to match that of Polygon.

Overview

Chaos Labs supports listing MAI in Isolation Mode as part of an overarching strategy to increase the offering of AAVE protocol with more volatile assets. As a low market cap asset, MAI is susceptible to price manipulation, so listing it with an appropriate debt ceiling is crucial to prevent a profitable pump attack.

Liquidity and Market Cap

When analyzing market cap and trading volumes of assets for listing, we look at data from the past 180 days. The average market cap of MAI over the past 180 days was $46.6M, and the average daily trading volume was $3.8M (CeFi & DeFi). We find the market cap adequate and the trading volumes reasonable as long as they are considered when setting appropriate supply caps, a debt ceiling, and borrow caps.

Liquidation Threshold

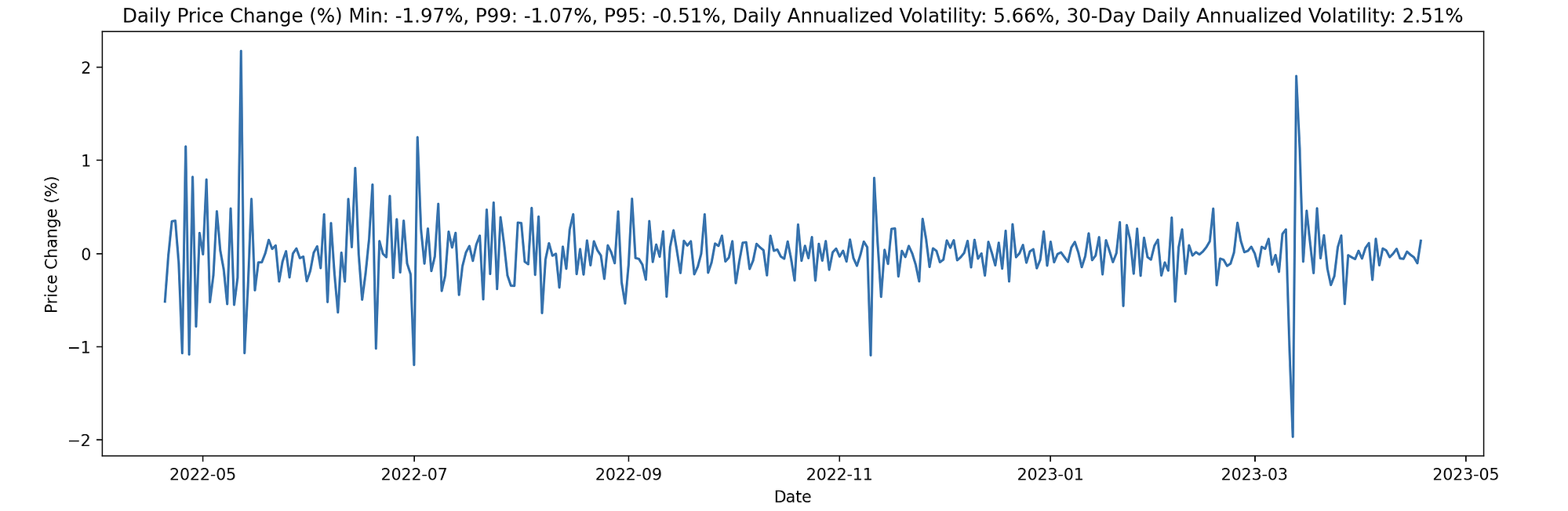

Analyzing MAI price volatility over the past, we observed daily annualized volatility of 5.66% and 30-day annualized volatility of 2.51%. Considering this volatility and the history of MAI on other networks, we support the suggested LT of 80%.

We support listing MAI as borrowable under reasonable limits of supply cap, as we do not observe a significant risk to the protocol by allowing to borrow MAI, as long as it is bound by a well-defined cap.

Debt Ceiling

Following Chaos Labs’ Isolation Mode Methodology, we support the initial debt ceiling of $2M.

Supply Cap, Borrow Cap, and Liquidation Bonus

Given the concentrated liquidity of MAI on Optimism we recommend a 5% Liquidation Bonus and support the proposed initial supply cap of 2.2M and borrow cap of 1.2M