[ARFC] Onboard tBTC to Aave v3 on Arbitrum.

Authors: @Ethan - Threshold Network Growth Coordinator & @mcitizen42 - Contributor to Threshold Network

Date: 2024-11-11

ARFC has been edited by ACI to reflect latest risk parameters provided by Risk Service Providers 2025-02-27

Summary

This proposal seeks to onboard tBTC to Aave v3 on Arbitrum following a successful launch on Mainnet (Aave - Open Source Liquidity Protocol).

Motivation/Background

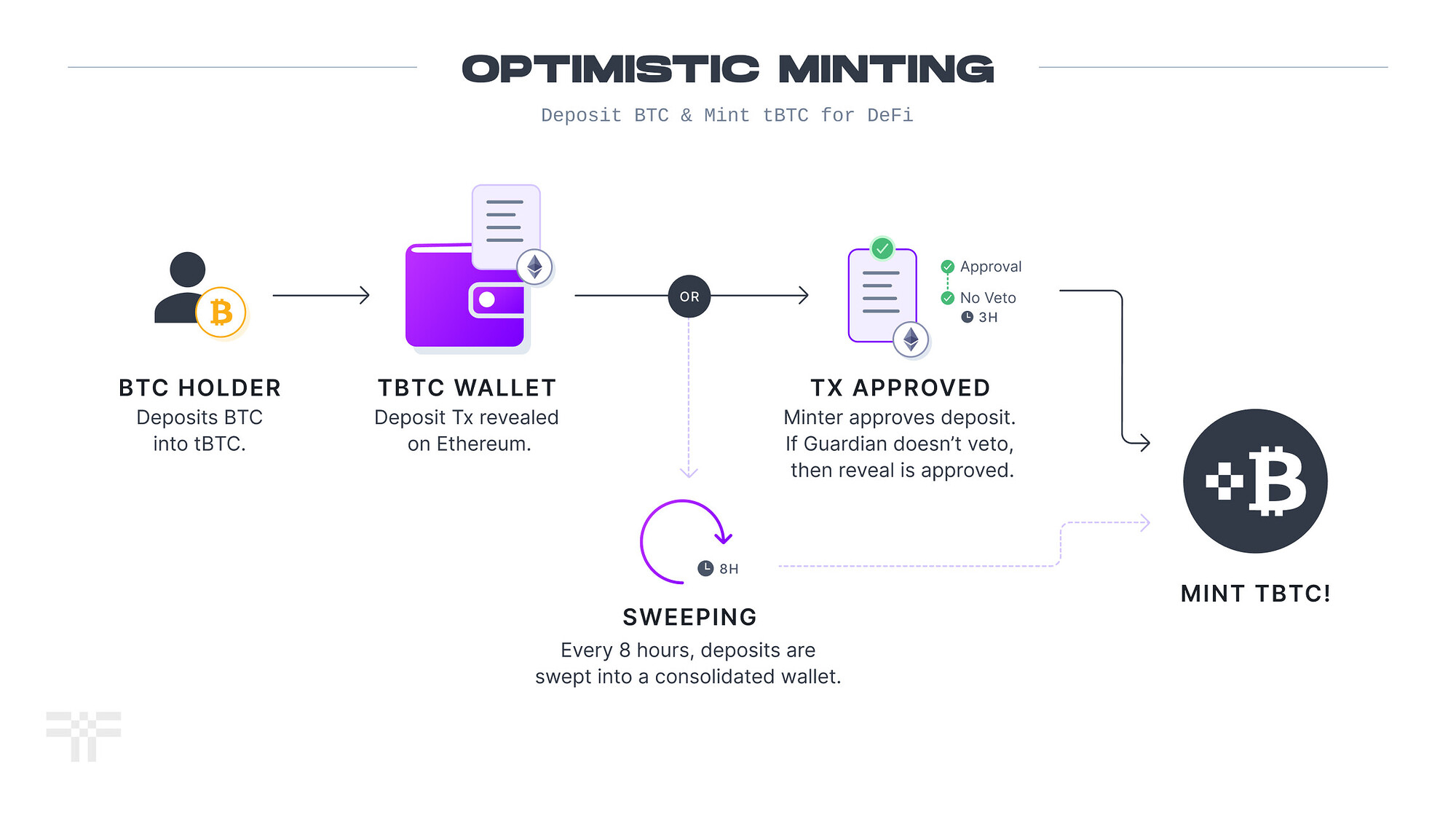

tBTC is Threshold’s decentralized and permissionless bridge to bring BTC to Ethereum, Arbitrum and 6 other chains. Users wishing to utilize their Bitcoin on Ethereum & Arbitrum can use the tBTC decentralized bridge to deposit their Bitcoin into the system and get a minted tBTC token in their EVM wallet.

Threshold Network has brought native minting of tBTC to Arbitrum, is live on GMX and has strong, sticky liquidity to support liquidations.

Following its approval on AAVE V3 Ethereum, tBTC’s initial supply cap was reached within 72 hours, prompting an increase to meet the overwhelming demand and now sits at over 1,000 BTC TVL. This rapid adoption underscores the market’s appetite for trust-minimized BTC solutions in DeFi.

Benefits for Aave

- High User Demand, since its initial deployment on Aave’s Ethereum market, tBTC reached its initial 500 BTC supply cap within the first week. The cap has been increased multiple times, now sitting at 2200 BTC, highlighting strong user interest. Something we hope to replicate on Arbitrum.

- Easy, direct onboarding of BTC capital via Threshold’s Arbitrum native minting.

- A range of lending options for those who wish to earn yield on their BTC.

- Preferable yields on tBTC through active incentive participation, boosting Aave protocol use, fees and TVL.

Specification

Ticker: TBTC

Contract Address:

Arbitrum: 0x6c84a8f1c29108f47a79964b5fe888d4f4d0de40

Chainlink Oracle:

Arbitrum: 0xE808488e8627F6531bA79a13A9E0271B39abEb1C

ARFC has been edited by ACI to reflect latest risk parameters provided by Risk Service Providers 2025-02-27

| Parameter | Value |

|---|---|

| Isolation Mode | No |

| Borrowable | No |

| Collateral Enabled | Yes |

| Supply Cap | 50 |

| Borrow Cap | 25 |

| Debt Ceiling | - |

| LTV | 73% |

| LT | 78% |

| Liquidation Bonus | 7.5% |

| Liquidation Protocol Fee | 10% |

| Variable Base | 0% |

| Variable Slope1 | 4% |

| Variable Slope2 | 300% |

| Uoptimal | 45% |

| Reserve Factor | 20% |

| Stable Borrowing | Disabled |

| Flashloanable | No |

| Siloed Borrowing | No |

| Borrowable in Isolation | No |

Useful Links:

Project: https://www.threshold.network/

Minting dashboard: https://dashboard.threshold.network/tBTC/mint

GitHub: GitHub - keep-network/tbtc-v2: Trustlessly tokenized Bitcoin everywhere, version 2

Docs: tBTC Bitcoin Bridge | Threshold Docs

Audit: About

Immunfi Bug Bounty: Threshold Network Bug Bounties | Immunefi

Llama Risk Report: Collateral Risk Assessment: Threshold BTC (tBTC) - HackMD 4

Twitter: https://twitter.com/thetnetwork

Discord: Threshold Network ✜

Dune: https://dune.com/threshold/tbtc,

https://dune.com/sensecapital/tbtc-liquidity &

https://dune.com/lrsaturnino/tbtc-on-arbitrum

What is the link between the author of the AIP and the Asset?

Threshold Network has no link and is not compensated to present this ARFC proposal.

Provide a brief high-level overview of the project and the token.

tBTC is a decentralized wrapped Bitcoin that is 1:1 backed by native BTC. Unlike other wrapped Bitcoins, the BTC that backs tBTC is not held by a central intermediary, but is instead held by a decentralized network of nodes using threshold cryptography.

tBTC is trust minimized and redeemable for native BTC without a centralized custodian. It can be used across the entire DeFi ecosystem.

tBTC can be used as collateral, liquidity, a store of value, and can be integrated with DeFi apps across all supported blockchains.

As with other BTC wrappers, tBTC provides cryptocurrency traders and general users with a BTC-pegged token, that can be used to generate yield whilst holding native BTC.

Explain the positioning of the token in the AAVE ecosystem. Why would it be a good borrow or collateral asset?

Adding support for tBTC on Aave v3 (Arbitrum) as an asset would allow tBTC holders to obtain a yield on their tBTC holdings.

tBTC is the only way to permissionlessly borrow and lend BTC in a decentralized manner. This gives Aave direct access to the 1.7 trillion market of BTC, for which centralised competitors provide limited access to.

Provide a brief history of the project and the different components: DAO (is it live?), products (are they live?). How did it overcome some of the challenges it faced?

tBTC was created by a decentralized effort of contributors at the Threshold Network DAO, and extensively utilizes the Threshold Network’s threshold cryptography to create a secure BTC asset. tBTC is a product launched on Threshold Network, on which many other decentralized applications are being built.

Threshold Network DAO was born out of the first on-chain merger between two decentralized protocols, Keep Network and NuCypher early in 2022. The DAO has successfully operated since that time, and supports an active community of contributors that work towards building tBTC liquidity and usability.

How is tBTC currently used?

tBTC is used across a variety of chains and use cases. Some key utlities include Aave, GMX, EigenLayer, Synthetix, Morpho, Symbiotic, collateral asset for crvUSD, thUSD and solvBTC.

A comprehensible list can be found here:

https://defillama.com/yields?token=TBTC 4 & Earn yield on your Bitcoin | Linktree

Emission schedule

tBTC is one-to-one backed with real Bitcoin, meaning that there isn’t an emissions schedule, but a mint and redeem function that adjusts the supply of tBTC based on native BTC coming into and out of the system.

Token (& Protocol) permissions (minting) and upgradability. Is there a multisig? What can it do? Who are the signers?

For tBTC, wallets are created periodically based on governance. In order for the wallet to move funds, it produces signatures using a Threshold Elliptic Curve Digital Signature Algorithm, requiring 51-of-100 Signers to cooperate. The 100 signers on each wallet are chosen with our Sortition Pool, and the randomness is provided by the Random Beacon. More can be found here - Wallet Generation | Threshold Docs 2

The Threshold Council multisig is a 6/9 Gnosis Safe multisig with 9 unique signers that form the Threshold Network Council. The Council has limited upgrade privileges over the smart contracts. However, those privileges do not include any custodial power over deposited BTC:

Council Multisig Ethereum Address: 0x9F6e831c8F8939DC0C830C6e492e7cEf4f9C2F5f

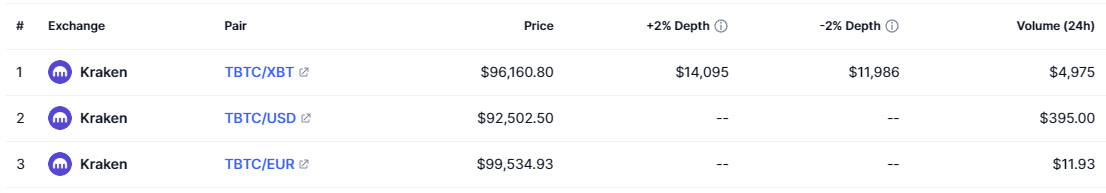

Market data (Market Cap, 24h Volume, Volatility, Exchanges, Maturity)

Market capitalisation: $350m USD / 4,286 BTC

Decentralized exchange liquidity pools: https://defillama.com/yields?token=TBTC

Dashboard on Decentralized LP liquidity: https://dune.com/sensecapital/tbtc-liquidity

&

https://dune.com/lrsaturnino/tbtc-on-arbitrum

Social channels data (Size of communities, activity on Github)

Discord: 9,191

Twitter: 37,900

Github: 4,596 commits

Contracts date of deployments, number of transactions, number of holders for tokens

Date of Deployment: February 2023

Number of transactions: 74,721

Number of token holders: 1,665

Risk parameters

We suggest waiting for the feedback from risk teams for suggested parameters.

Symbol: TBTC

Arbitrum Contract Address: 0x6c84a8f1c29108f47a79964b5fe888d4f4d0de40

Disclaimer:

This proposal is powered by Threshold Network. The authors are @Ethan (Growth Coordinator for Threshold Network) and @mcitizen42 (Contributor to Threshold Network).

Next Steps:

- If consensus is reached on this [ARFC], escalate this proposal to the Snapshot stage.

- If the Snapshot outcome is positive, this proposal will be escalated to the Aave AIP stage for final confirmation and enforcement of the proposal.

Copyright:

Copyright and related rights waived under CC0.