Gauntlet Risk Analysis - Aave V3 on GnosisChain

Summary

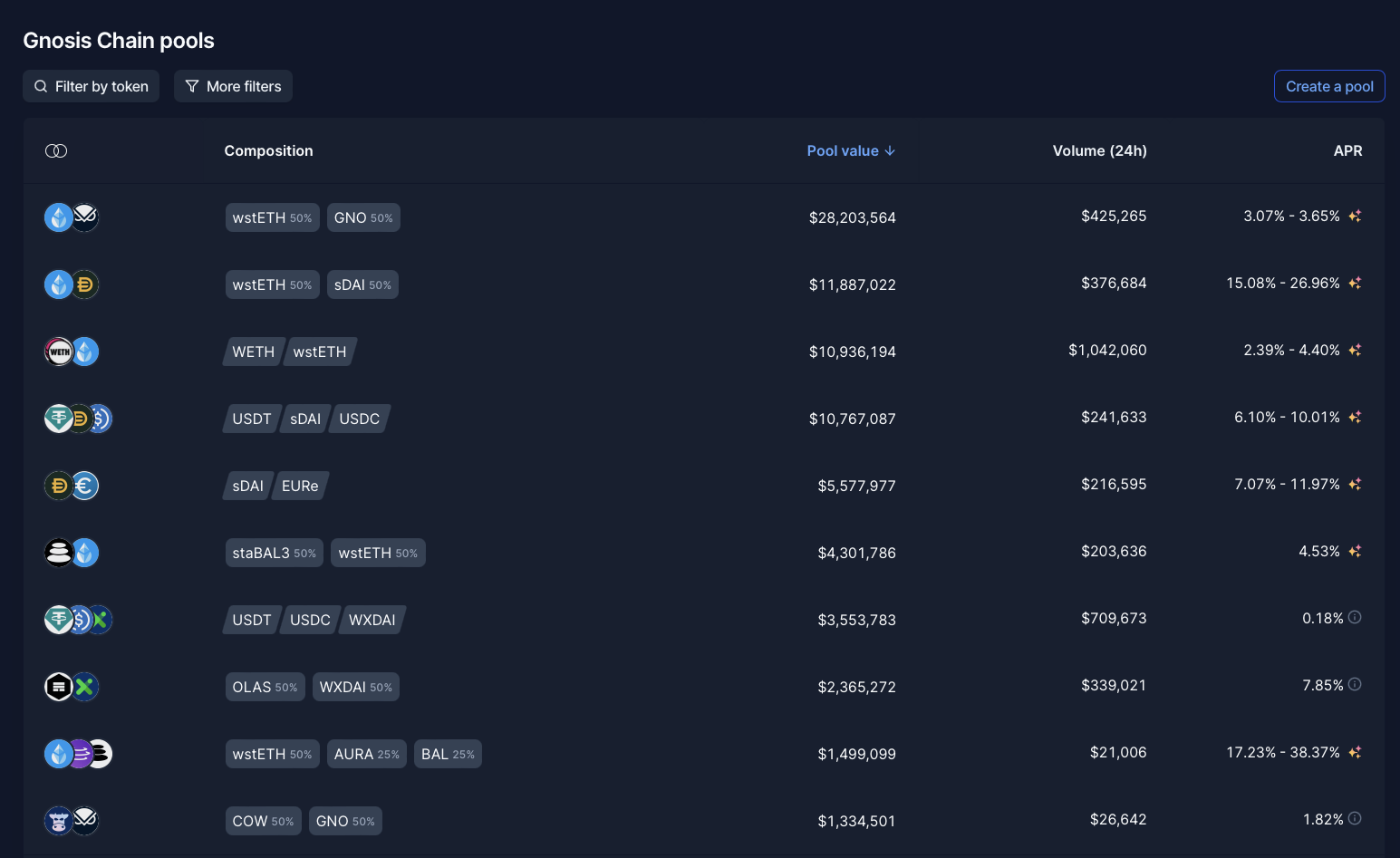

Gauntlet previously provided initial risk recommendations for Aave V3 on GnosisChain and concluded that the highest risk to Aave on GnosisChain was in limited wETH liquidity against USD stablecoins.

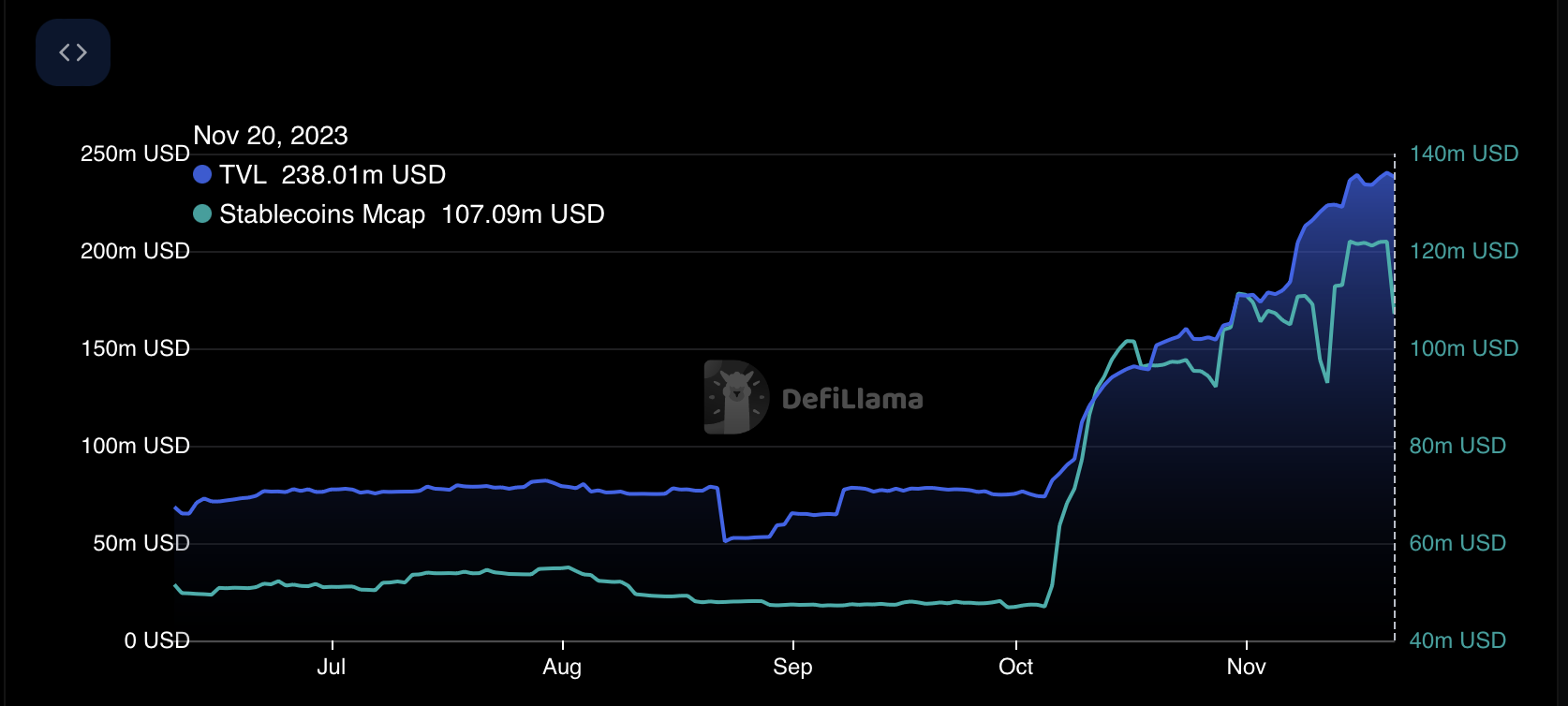

We acknowledge that the total value locked (TVL) in Gnosis Chain has almost tripled since early October, increasing from $75 million to close to $250 million, and this surge was driven by the transfer of stablecoins to Gnosis Chain.

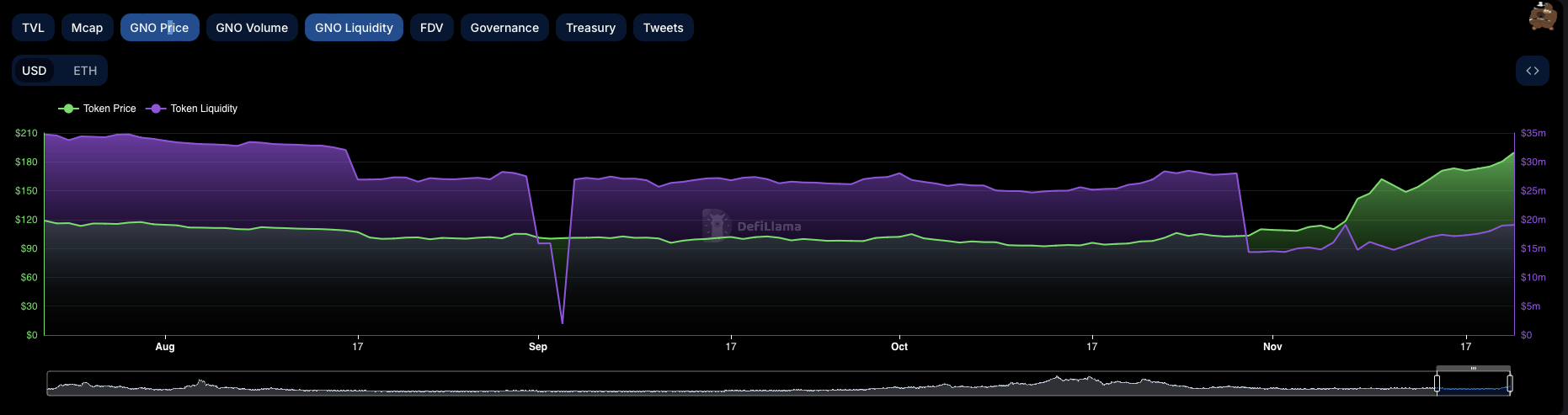

Despite this growth, the liquidity between wETH and USD stablecoins remains low, maintaining the risks identified in our initial analysis.

Gnosis Chain experienced a temporary drop in liquidity following a Balancer V2 pool hack in late August 2023. Although the liquidity has since recovered, such incidents can have lasting effects on users’ trust and willingness to provide liquidity.

Hence, we strongly recommend adopting cautious initial parameters as per our revised analysis until a more comprehensive understanding of the market dynamics and potential risks associated with GNO borrowing is achieved.

Implementing conservative measures can serve as prudent steps towards ensuring the stability and security of the platform while minimizing exposure to adverse market conditions.

Furthermore, contemplating a phased approach for the future could be a viable consideration, where the introduction of GNO borrowing is executed incrementally, facilitating ongoing scrutiny and evaluation of its effects on the platform’s liquidity and overall functionality. However, it’s crucial to note that as of now, a phased approach is not recommended. This cautious stance will afford us, at Gauntlet, the opportunity to meticulously monitor the landscape and address any emergent issues or unforeseen hurdles promptly. This methodical approach not only underscores our commitment to maintaining a tight rein on the process but also ensures a more disciplined and safer framework for potentially integrating GNO as a borrowable asset down the line. Our vigilant oversight aims to mitigate risks and foster a conducive environment for such integration when the circumstances are deemed favorable.

Specifications

We recommend against listing GNO in isolation mode to allow for wETH borrowing, since isolation mode only allows for stablecoin borrowing. GNO-wETH liquidity is much stronger than GNO - USD stablecoin liquidity. The correlation between GNO and wETH is stronger, which may provide a more predictable and coherent market behavior, aiding in maintaining a balanced lending ecosystem. The restriction of isolation mode to only allow for stablecoin borrowing further complicates the scenario, making the inclusion of GNO less beneficial in this setting.

We recommend against listing GNO as borrowable assets. The liquidity dynamics between GNO and other assets such as wETH are more favorable compared to GNO and USD stablecoins, which is a critical factor for ensuring smooth operations on lending platforms.

| Risk Parameter | Current Parameters | ACI Proposed | Gauntlet Updated Recs |

|---|---|---|---|

| Isolation Mode | YES | NO | NO |

| Enable Borrow | NO | YES | NO |

| Reserve Factor | N/A | 20% | N/A |

| Borrow Cap | N/A | 24,000 GNO | N/A |

| Isolation Mode Debt Ceiling | 1M$ | N/A | N/A |

| uOptimal | N/A | 80% | N/A |

| Base | N/A | 0% | N/A |

| Slope1 | N/A | 15% | N/A |

| Slope2 | N/A | 80% | N/A |