Gauntlet Analysis

Here is Gauntlet’s recommendation to the propose parameter adjustments:

LB Recommendation

Gauntlet supports decreasing the liquidation bonus to 1% for ETH e-Mode in Arbitrum.

Optimal Ratio Recommendation

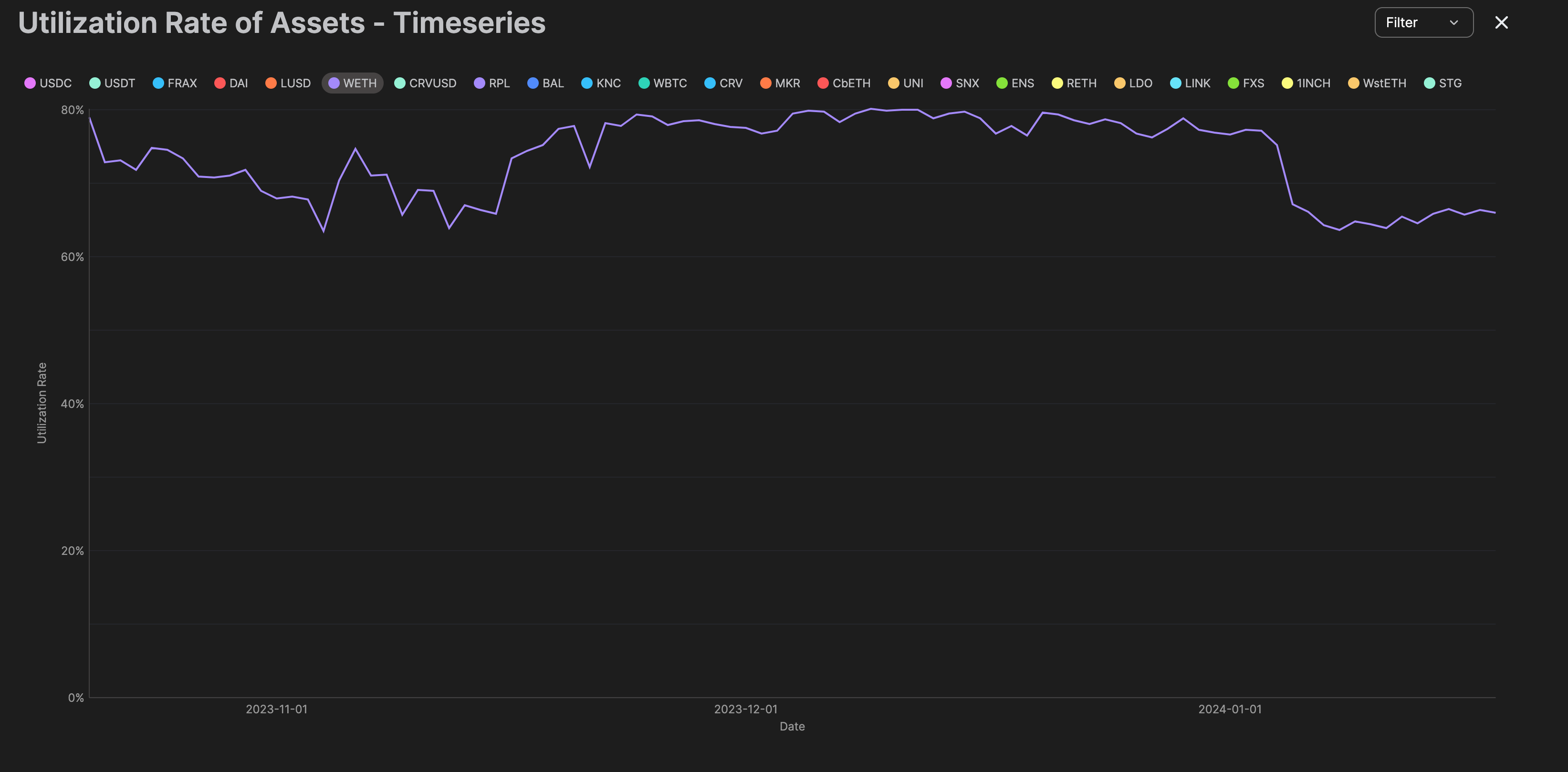

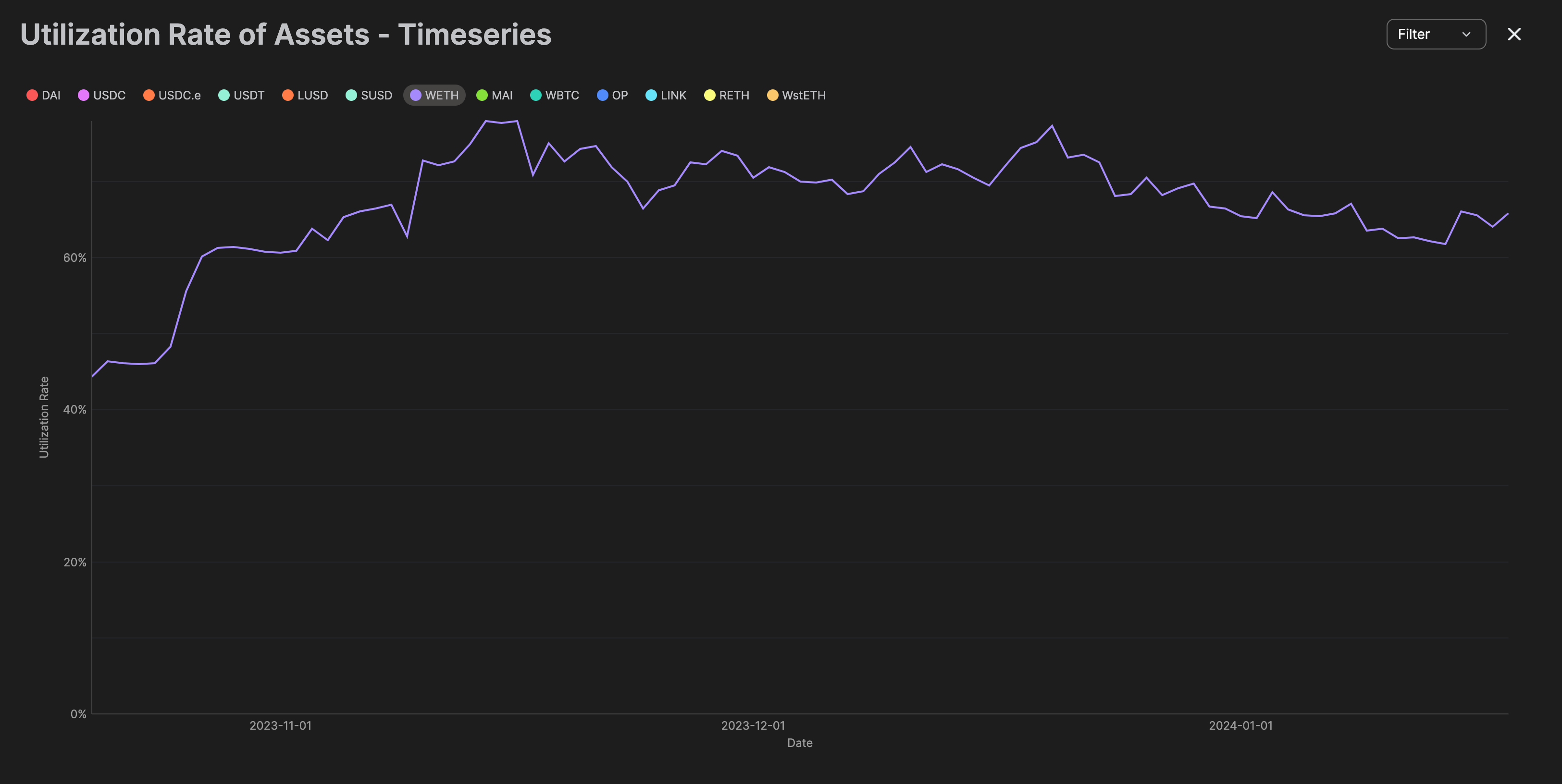

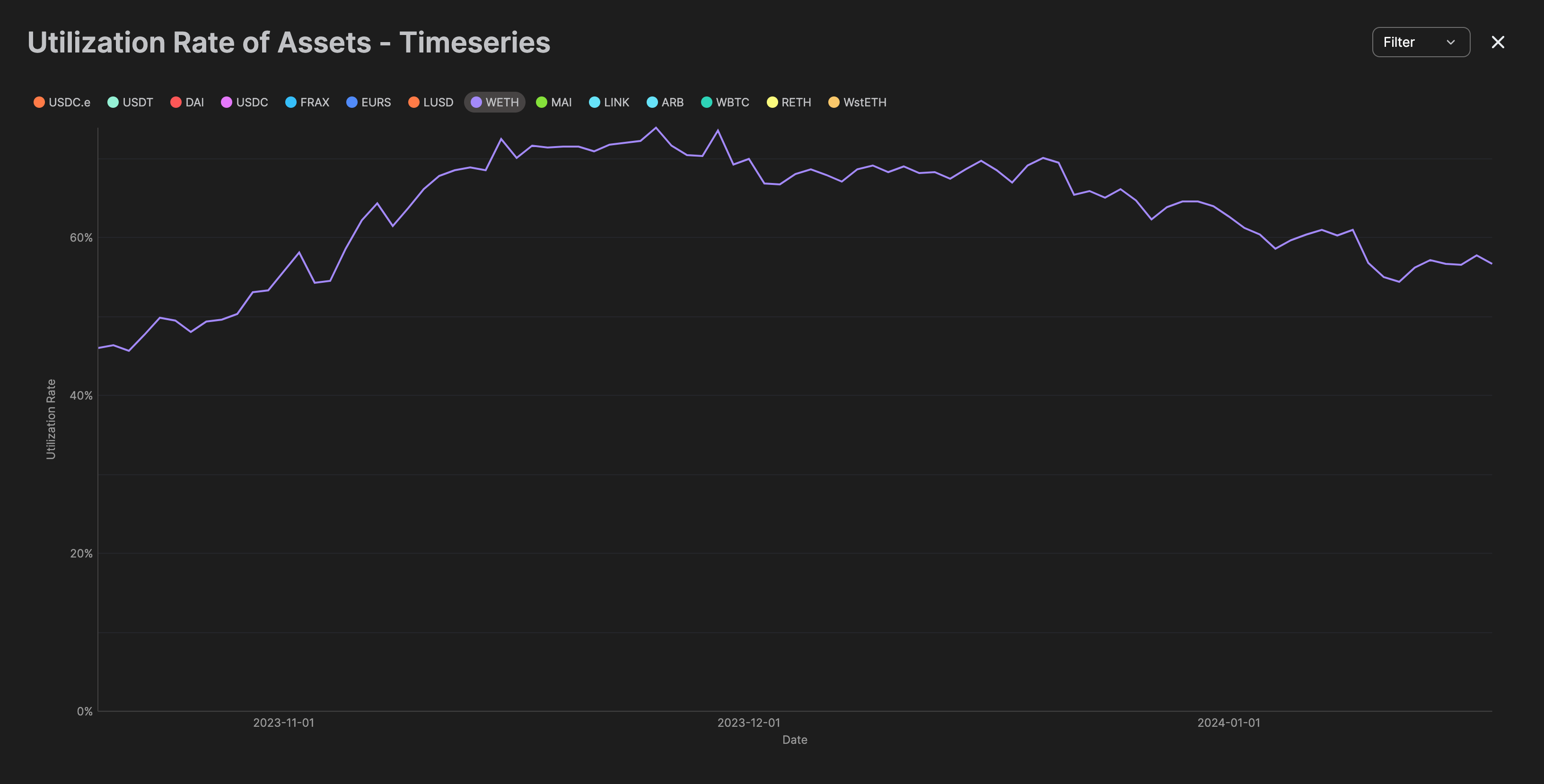

Gauntlet does not recommend increasing the Optimal Ratio to 90% as it leaves less room for liquidations during volatile market conditions. We provided a detailed analysis on this within this forum post. Furthermore, the current utilization conditions for WETH on Ethereum, Arbitrum, and Optimism do not support capital efficiency improvement to the markets with utilization less than 70% across the markets.

WETH Utilization on ETH v3

WETH Utilization on OP v3

WETH Utilization on ARB v3

LT/LTV Recommendation

Gauntlet does not recommend increasing the LT/LTV for eMode on ETH,ARB, and OP markets until the implementation of a killswitch functionality and until community has aligned on next steps with the new Correlated-asset Price Oracle functionality.

With Aave’s oracle utilizing exchange rate instead of market pricing of LSTs, we need to be aware of the inherent risk the protocol is taking in the event of a LST price dislocation. These increases to LTV/LT would reduce the collateral buffer without any mechanism to prevent the risks being address with the kill switch and correlated-asset price oracle. As such, Gauntlet recommends to hold off on any increases to the emode LT/LTV until these risk mechanisms have been implemented/decided by the community.

Reserve Factor Recommendation

Gauntlet does not recommend decreasing reserve factors based on information provided by OP. Decreasing the reserve factor by 5% has large implication to reserve generation to the protocol as shown in the below table utilizing current market utilization:

| Annualized Reserves | ETH Market | OP Market | ARB Market |

|---|---|---|---|

| Current | $3,315,425.68 | $107,552.79 | $232,253.53 |

| Projected | $2,210,283.79 | $71,701.86 | $154,835.69 |

For wETH LP on Ethereum market, we would potentially be decreasing reserve generation by a minimum of $1M.

Decreasing the reserve factor would generate a higher supply rate for WETH suppliers thus attracting more suppliers to the protocol, but with the current utilization of the WETH markets, this action does not seem necessary since utilization is not near optimal ratio.

| Supply Rate APR | ETH Market | OP Market | ARB Market |

|---|---|---|---|

| Current | 1.29% | 1.44% | 1.13% |

| Projected | 1.37% | 1.53% | 1.19% |