Summary

LlamaRisk supports these changes. The proposed risk parameter adjustments are rational, given the justifications provided by ChaosLabs. Moreover, we see minimal incremental risks associated with introducing new Liquid E-Modes. This update will allow for a fine-grained risk control for the LST yield leveraging strategy that is dominant on Aave.

weETH

LTV Adjustments

The main use case for weETH collateral on Arbitrum and Base is LST yield leverage, where WETH is mainly borrowed. On Arbitrum, 97.5% of these borrows are made in the ETH Correlated E-Mode, which has an optimized max LTV of 93%. As for Base, 99.7% of WETH borrows using weETH as collateral are made in the ETH Correlated E-Mode with a max LTV of 90%. Most loans in the ETH Correlated E-Mode are at 1-1.1 health ratios.

Arbitrum

Source: ChaosLabs Aave Risk Analytics Dashboard, March 13th, 2025

Base

Source: ChaosLabs Aave Risk Analytics Dashboard, March 13th, 2025

Notably, the proposed LTV adjustments would not impact the utility of the LST yield looping on these markets. However, increasing LTV could improve the capital efficiency of weETH price leveraging on Aave’s Arbitrum and Base markets as this strategy represents a very small portion of weETH-backed loans (~1.5%). On Aave’s Core market, where the max LTV of weETH is 77.5%, this strategy represents a slightly larger portion of the loans (2.5%). If the negative market conditions persist and stablecoin rates on Aave continue to decrease, this strategy could become more apparent.

Source: Aave Dashboard, March 13th, 2025

Considering these observations and the sustained stability of the liquidity on both Arbitrum and Base, the proposed increases in weETH LTV are rational. They would bring the utility of weETH collateral outside E-Modes closer to that of Aave’s Core market.

weETH/WETH E-Mode

The current general ETH Correlated E-Mode allows up to 93% LTV on Core and Arbitrum while offering a 90% max LTV on Base. Creating a new specialized weETH/WETH E-Mode on these 3 markets would unify the maximal LTV while offering a lower Liquidation Bonus on Base.

Source: Aave Dashboard, March 13th, 2025

Creating a weETH/WETH Liquid E-Mode allows the enactment of fine-grained risk parameter adjustments and, therefore, more collateral efficiency for specific strategies. With the introduction of Umbrella, these changes will help to set the liquidity coverage targets more efficiently and thus allow to push the LTV parameters further, as proposed in a subsequent Risk Stewards publication.

wstETH

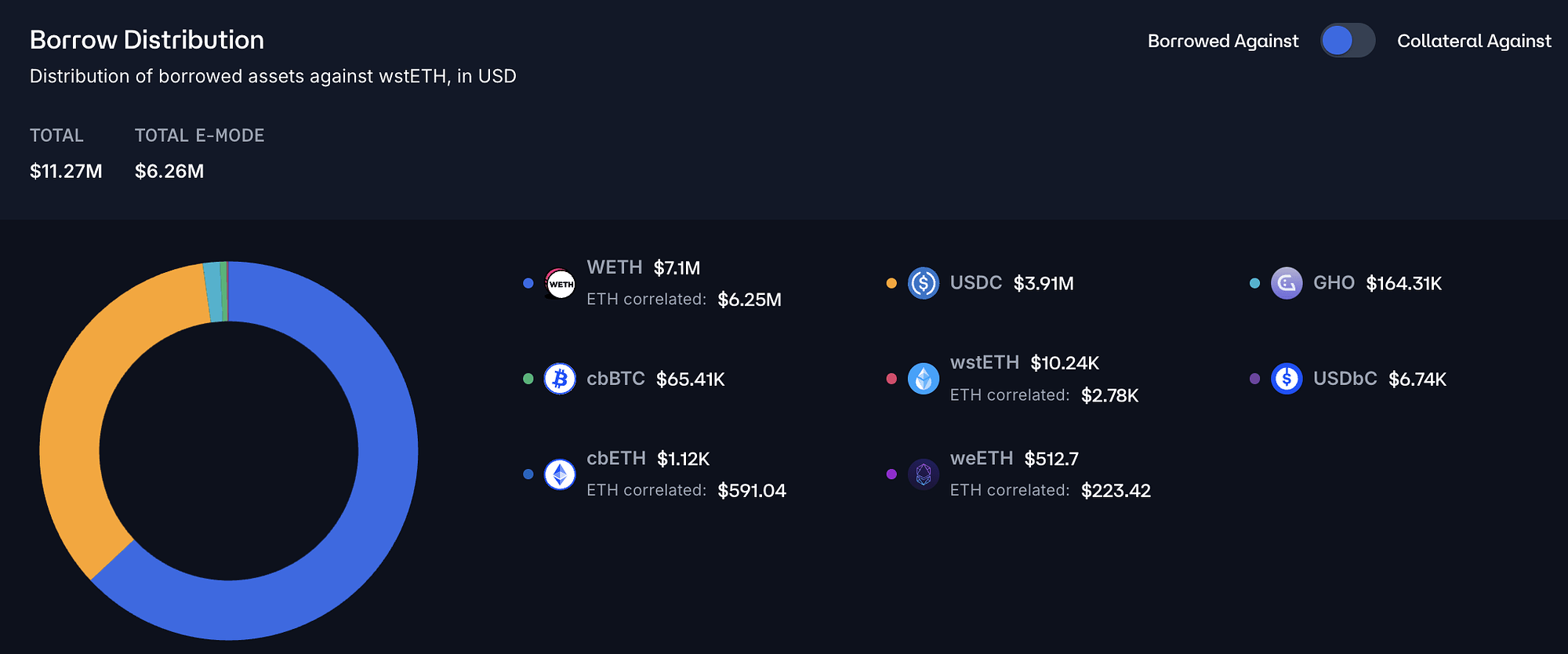

The amount of wstETH supply on Arbitrum and Base is much smaller than weETH. While most activity is LST yield looping, more diverse use cases of collateral and increased stablecoin borrowing are observed in these markets. In addition, wstETH collateral usage on Aave’s Core market is also more distributed, with the borrowing of WETH in ETH Correlated E-Mode representing 50% of all borrows. Similarly to weETH, most loans backed by wstETH in the ETH Correlated E-Mode are at 1-1.1 health ratios.

Core

Source: ChaosLabs Aave Risk Analytics Dashboard, March 14th, 2025

Arbitrum

Source: ChaosLabs Aave Risk Analytics Dashboard, March 14th, 2025

Base

Source: ChaosLabs Aave Risk Analytics Dashboard, March 14th, 2025

wstETH/WETH E-Mode

For wstETH, the ETH Correlated E-Mode is the sole setup used to borrow more efficiently. Introducing a separate Liquid E-Mode for wstETH/WETH looping would push the maximal LTV to 93.5%, which is 0.5% higher than the current max LTV on Arbitrum/Core and 3.5% higher than the current max LTV on Base. Once again, implementing this separate E-Mode would allow further optimizations, enabling more yield leverage for the users. The fine-grained setup isolates risks and pushes for more aggressive LTV levels but remains to be covered via the Umbrella.

Further Risk Considerations

This proposal sets a precedent for moving LTV for the LST yield looping strategy on Aave to higher levels than currently. This strategy’s correlated nature of collateral and borrowed assets is the underlying reason for high LTVs. This means that the sole reason for liquidations could be the unlikely event of LST slashing. The potential slashing risk is estimated in more detail as part of our Ethereum Validator Slashing Simulator.

While the loan-to-value buffer has been kept higher, introducing Umbrella’s automated risk coverage will allow growth managers to propose more utility and lower this buffer. The upcoming aim of risk providers will be to ensure that optimal insurance levels mitigating increased risks are set.

Disclaimer

This review was independently prepared by LlamaRisk, a community-led decentralized organization funded in part by the Aave DAO. LlamaRisk is not directly affiliated with the protocol(s) reviewed in this assessment and did not receive any compensation from the protocol(s) or their affiliated entities for this work.

The information provided should not be construed as legal, financial, tax, or professional advice.