My opinion on the topic:

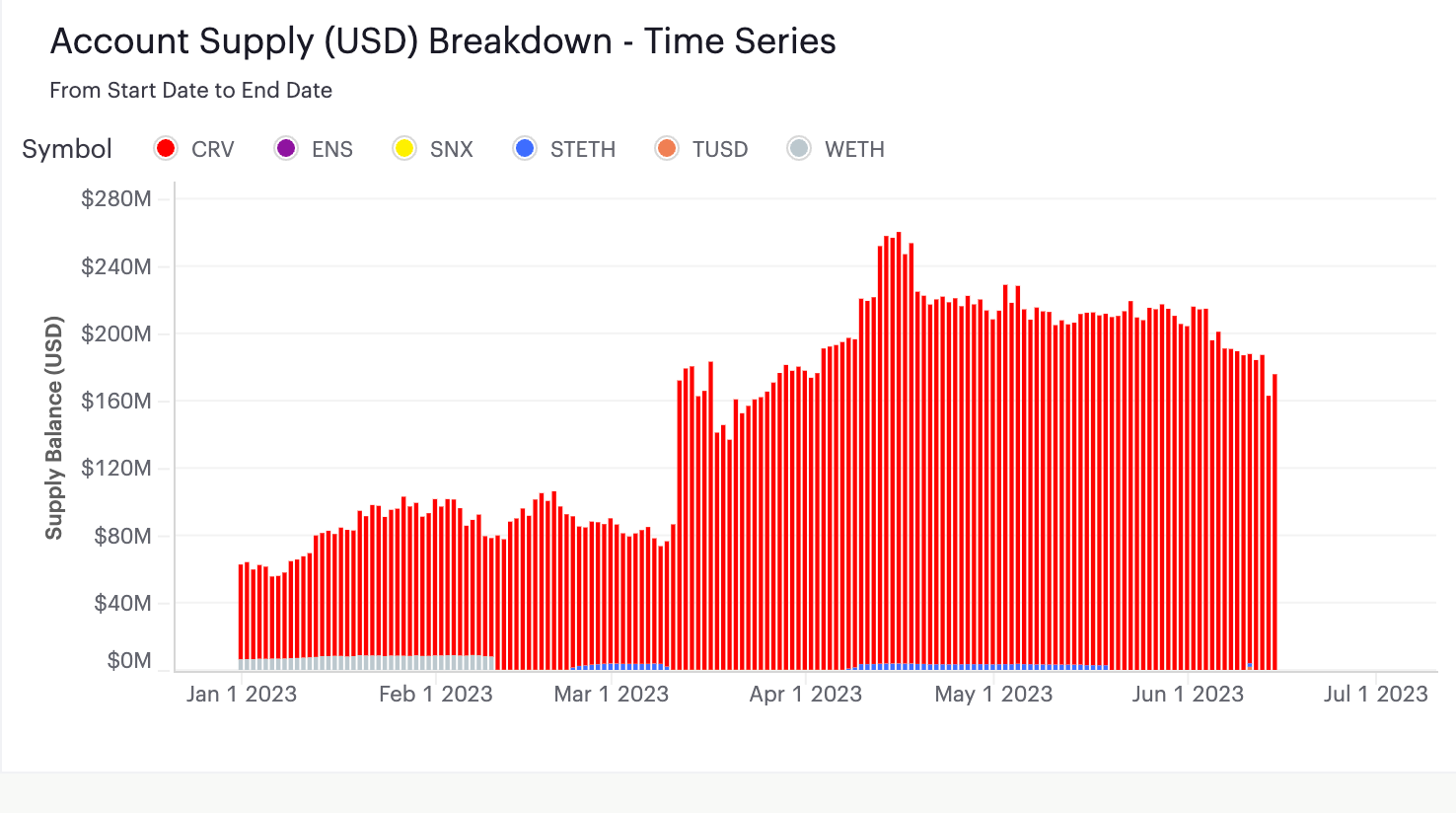

- The exposure of Aave v2 Ethereum to CRV is too big, there should not be much doubt about it.

- There is not much reason to think that the big position of CRV is trying to execute anything against Aave. It is from a long-term user, who historically has been actively maintaining his collateralization. Even these days, checking on-chain activity is clear that he is trying to de-risk positions.

Additionally, Curve is a pretty active project, with a big ecosystem around. It is not something measurable but sounds ridiculous for its founder (with huge exposure to it) to look for a liquidation. - Market is how it is at the moment, and still, the HF is at acceptable levels. Obviously, the sheer size of the position is what creates the risk, but only looking at that is simplistic.

- Talking about how risk should have been controlled before, calling out some mechanisms of Aave v2 gives close to zero value. That is a conversation to have in parallel, but the effort now should be simply de-risking if desirable.

Regarding the proposed actions (and submitted AIP from @Gauntlet):

-

Freezing CRV on v2. The exposure to CRV collateral is too high on Aave v2, that is clear. But there is not really any mechanism to reduce (fast) that without a debt ceiling.

Let’s assume the CRV position goes close to liquidation. At that point, the user can mobilize non-CRV funds to repay or refill CRV. Considering the current size of CRV in his positions, seems remote he has a meaningful % of it available to refill. That means that the additional exposure from that potential refilling will not really change much negatively to Aave, but can make a bit of difference in the user protecting his position.

But if CRV gets frozen, he will not be able to refill.

So AGAINST freezing. -

LTV to 0 on Aave v2. LTV is a soft protection on Aave v2, with only Liquidation Threshold affecting Health Factor and influencing on the liquidation price. Changing LTV to 0 will disable new borrowings by average users, but doesn’t really change anything at the core.

Fundamentally, feels just correct for CRV to not have additional borrowings associated, but in my opinion, makes not much difference.

So ABSTAIN on LTV 0.