Strongly in favor of leveraging RFs to gently migrate users to V2 (and using LT reduction where unsafe positions have manifested)

Aho,

Thanks @ChaosLabs for your comprehensive analysis. We would love to hear your thoughts regarding the analysis from @BlockAnalitica regarding these two things: Increase CRV Liquidation Penalty and Adjust v2 Interest Rate Models

Summary

The CRV LTV → 0 on Aave V2 Ethereum proposal will pass AIP on Aug 5 with over 900k votes from the community.

Given users are migrating to V3 (see data below) and other associated risk factors for CRV, we have recommended reducing CRV LT and LTV on v3 Ethereum and Polygon, as well as debt ceiling on v3 Ethereum. The associated AIP-288 was deployed earlier today.

We continue to make incremental risk mitigation recommendations and are choosing minimize bundling recommendations together, to accomodate any nuanced preferences from the community.

Below we share additional analysis and data on CRV liquidity, Aave TVL, withdrawals, migration, and thoughts on RF adjustments.

Expected Insolvency

We’ve ported some simulation results for CRV here. Results are grouped by drawdown percentages and liquidity decrease percentages. The simulation emphasizes that the current liquidity levels, as well as potential future reductions in liquidity, are unlikely to prevent insolvencies at price drops >= 80%, despite improving since the initial Vyper hack.

Liquidity Comparisons to Nov 2022

It is impossible to predict where CRV price stabilizes. A breach of 0.4 may cause more price discovery, since

- OTC bid forms a soft barrier

- Not reflected in current Binance spot orderbook

- First liquidation levels are below the OTC bid

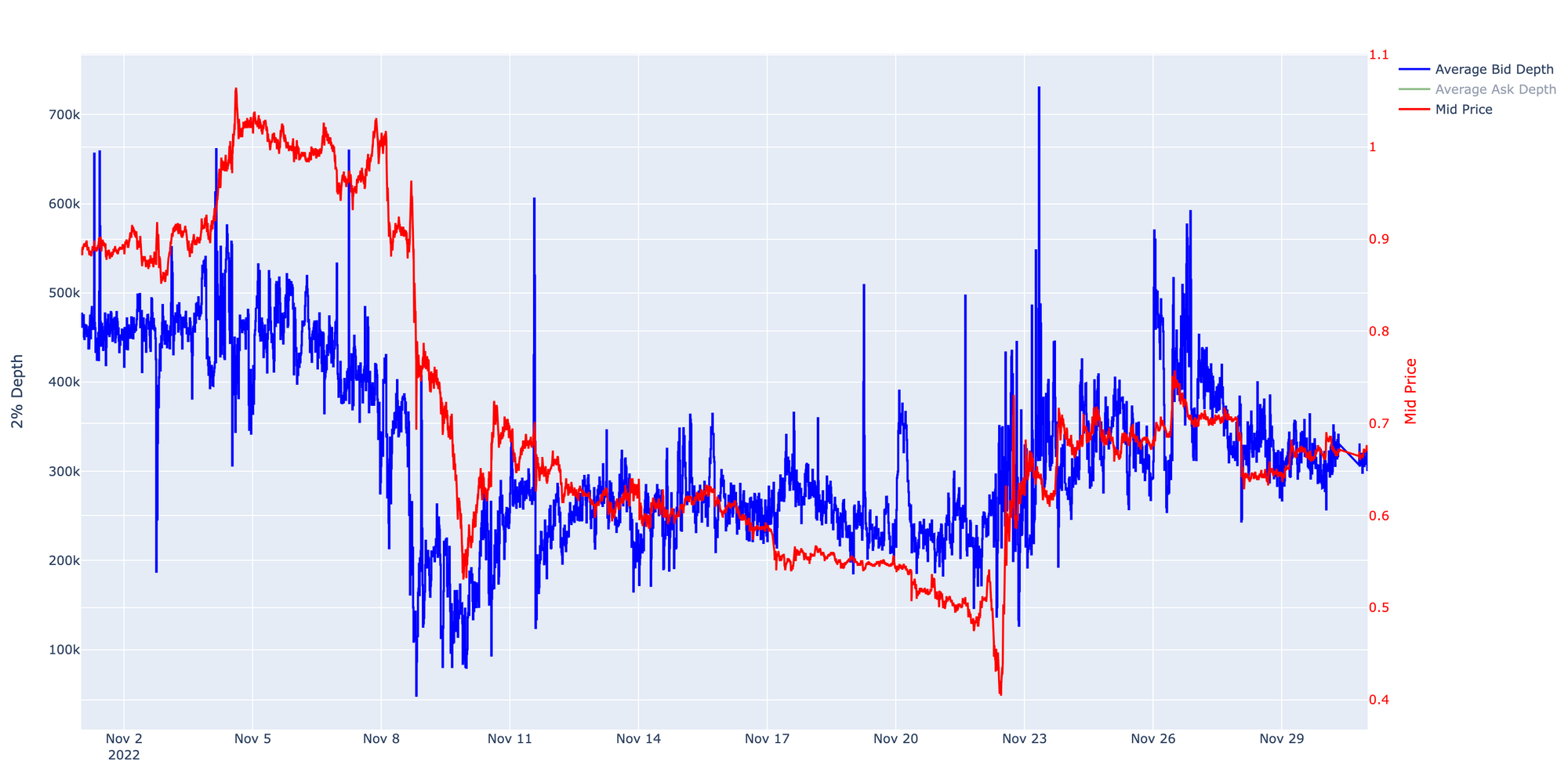

However, we aim to shed some light on how CRV liquidity behaved during the FTX crisis and the Avi Eisenberg incident. We look at how both DEX and CEX liquidity evolved back then to form a proxy for how liquidity might evolve if CRV undergoes stress today.

Currently, there is a ~50% drop to liquidation and a ~70% drop to first insolvencies. Using historical context, we estimate CEX and DEX liquidity to drop by 50% with sudden price drop to liquidation levels, and liquidity to drop by 75-80% with a sudden price drop to insolvency levels. At lower liquidity levels, CRV price is likely to be significantly more volatile. Where CRV price stabilizes will be impossible to predict.

Binance currently accounts for roughly 1/3 of the depth and the majority of the volume.

-

FTX event

- DEX liquidity roughly dropped by 50%, and CEX liquidity roughly dropped by 80% during the FTX event.

-

Avi event

- DEX liquidity dropped by ~30-40%, CEX liquidity was noisy but did not meaningfully change

-

Binance CRV/USDT spot market, November 2022

- CRVETH Curve pool liquidity

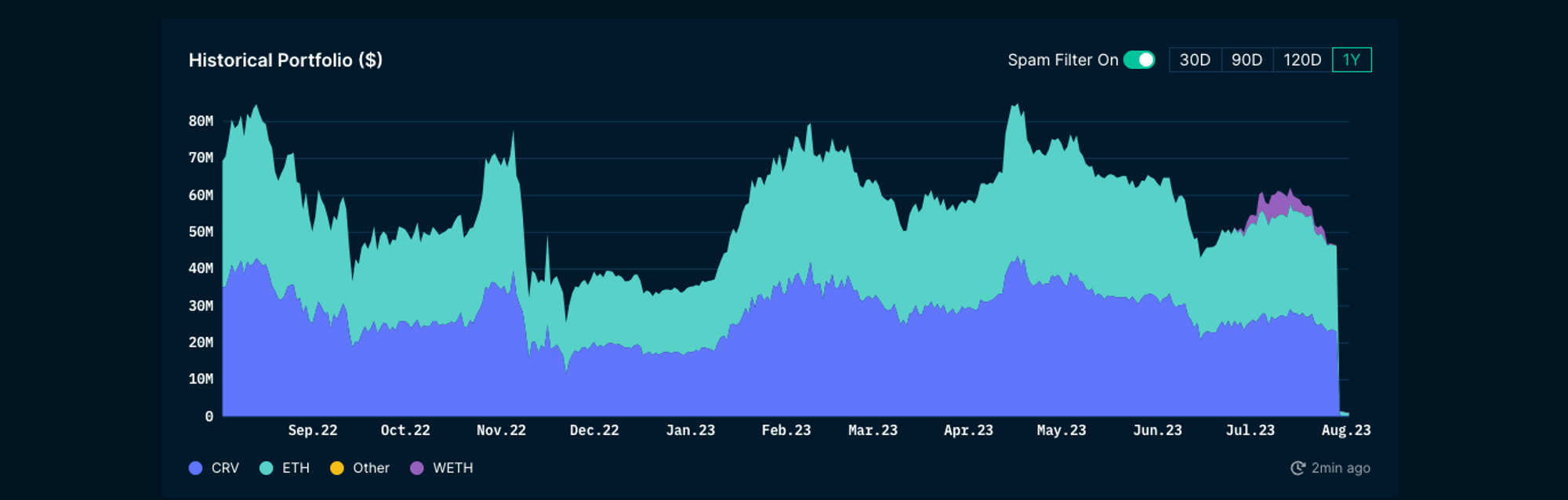

TVL Changes

Migration continues to V3 which has enhanced risk controls. To mitigate similar CRV insolvency risk in V3, we deployed AIP-288 to reduce LT, LTV, and debt ceiling on V3 Ethereum and Polygon.

v3 Ethereum

v2 Ethereum

Where did withdrawals go?

Total Withdrawals Difference: $563.327M since 7/30 from Ethereum Aave v2 accounts.

Breakdown Categories

- Unclear final destination: $64.827M

- Staked in stUSDT (Justin Sun): $52.4M

- Held in wallet: $192.3M

- Migrate to v3 Ethereum: $186.1M

- Compound: $7.3M

- Binance: $7M

- Huobi: $53.4M

Exclusions

- CRV founder: $36.5M

0x7a16ff8270133f063aab6c9977183d9e72835428 - Withdrawals from Morpho: $26.0M

0x777777c9898d384f785ee44acfe945efdff5f3e0 - Flamincome Protocol: $12.1M

0x1d0c2555a0002a54de13749af384223691bcb4d6

Details

Unclear final destination

0xa38aa9ae8953f245b44e84b6f25e0032e58b1f42: $29.9M0x1da05bce1edd2369cddcb35e747859ef6a675010: $15.8M0xccee999c040caa91e2e1e23ea99d5e154e1e94c4: $6.9M0x77fcae921e3df22810c5a1ac1d33f2586bba028f: $6M0x526d0047725d48bbc6e24c7b82a3e47c1af1f62f: $5.6M0x06185ca50a8ab43726b08d8e65c6f2173fb2b236: $0.627M

Huobi

0xbcb742aadb031de5de937108799e89a392f07df1: $53.4M

Staked in stUSDT (Justin Sun)

0x176f3dab24a159341c0509bb36b833e7fdd0a132: $52.4M

Held in wallet

0x02ed4a07431bcc26c5519ebf8473ee221f26da8b: $33.3M0x32c98a981fe7c333bd4e8e7630e8e0cf5ce20987: $30.0M0x8cc2af700d686e7e21135681511992c972dbd8ea: $30.6M0xf9b43deb017253448eea94ad790db67541487021: $24.5M0x769952be34f5f9b267e5a467149219e646968bd7: $16.5M0x817f6e501e640c5efbadbe98bf3f896a694212b5: $10.8M0x900ca99de58dc581c04f3844b3e56370654dc79e: $10.6M0x13939d994b1a27753de29adddb56d175e846608b: $7.8M0xf08600e1de0ae7294ab3e245e433f4121b93c75a: $7.1M0x29cc23660158f945942dac47a9db1c0177f31c77: $6.1M0xdc77b2c59db1b02f988e8e08a60fbe9139447cc3: $6M0xc49515cbce8a5ba7e82b46abf3401400fd94233e: $5M0xc6f69e100bbb34d3a18caa01d3e2e1ca76214e16: $5M

Migrate to Ethereum v3

0x171c53d55b1bcb725f660677d9e8bad7fd084282: $63.2M0x06e4cb4f3ba9a2916b6384acbdeaa74daaf91550: $20.8M0x05bc11f64c6515bb384b05bfd3e0d0424fa65aa4: $20.5M0x3c9ea5c4fec2a77e23dd82539f4414266fe8f757: $24.3M0xb748952c7bc638f31775245964707bcc5ddfabfc: $128M (Migration via Migration Tool)

Compound

0xdfcaf20a17521a761036af8a3a758fcdd91dfc07: $7.3M

Binance

0x0082ce7f8a3e3c69e7c5cd801760d40d55ce119c: $7M

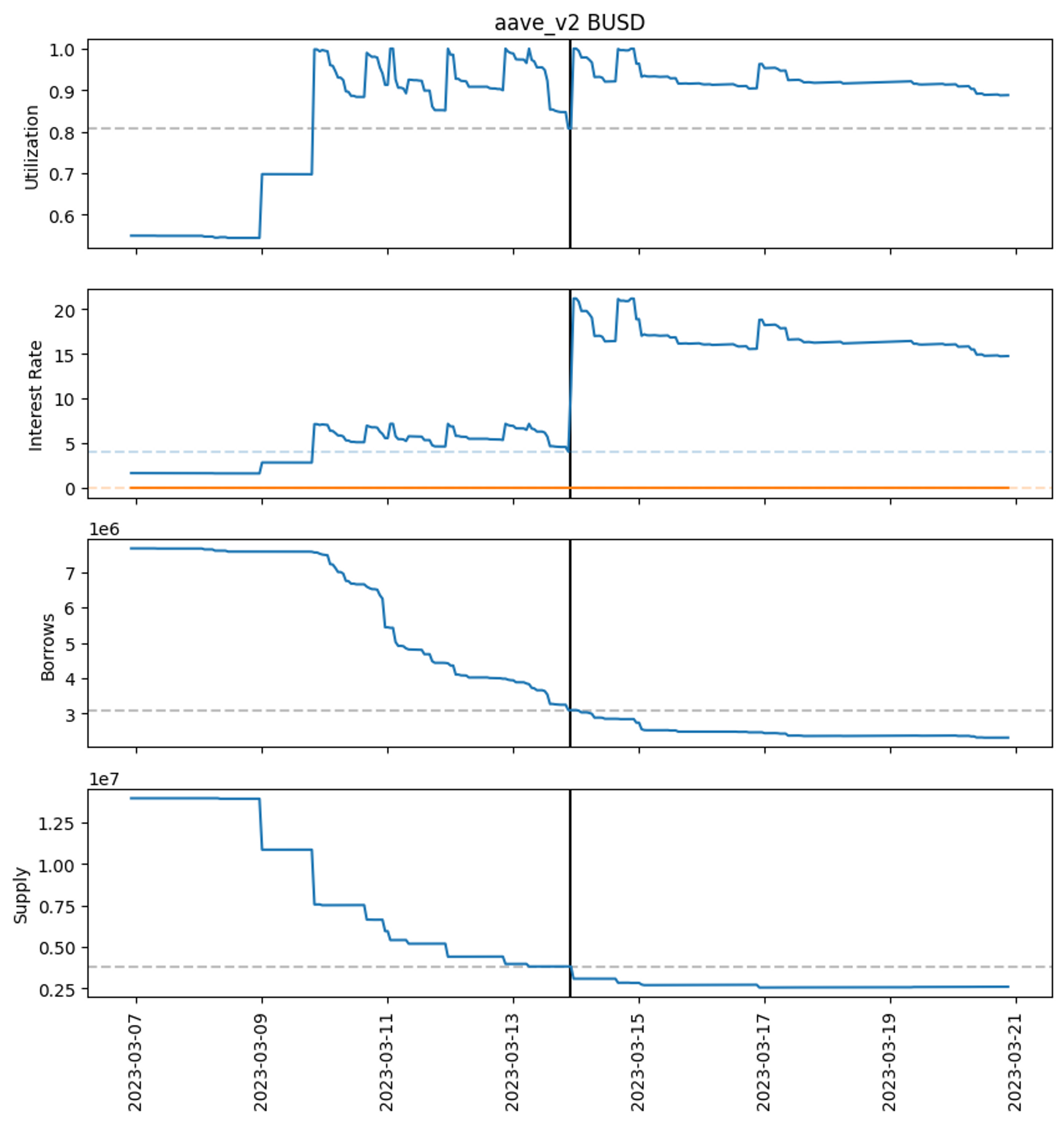

Reserve Factor Adjustments

- We agree with @Blockanalitica that Reserve Factor (RF) changes for CRV are unlikely to have a significant isolated effect on the risk level. One other consideration is to raise the RF for USDT, which we analyze below.

- RF changes historically have unclear effects on borrower and supplier behavior.

- The most significant change was BUSD deprecation (RF from 0.1 to 0.999), but was also accompanied by IR param increases.

- Deprecation reached its intended goal in reducing supply and borrow.

- RF change is unlikely to have a significant isolated effect

- Assuming RF increase incentivizes suppliers to leave and triggers 100% utilization, the max rate for USDT is 104%, which is lower than loans on Abra (130%)

- RF change directly impacts all other USDT borrower (this account is only 20% of total USDT borrowing)

- USDT suppliers are unable to exit and get lower supply reward to compensate for their added risk

Next Steps

- Queue and execute AIP-286 (LTV0 on v2)

- Gain clarity on the community preference to freeze CRV on v2 Ethereum. The first time we froze v2 CRV (Nov 2022) it was immediately rolled back. Recently we went straight to AIP, which was unanimously voted down. We are open to more discussion or Snapshot. Our AIP payload ready. Please discuss.

- Facilitate CRV v2 market unwind with LT reductions.

Over the past few days, the user has repaid ~20.75M USDT and has redeemed ~73.25M CRV bringing the account health to 2.11 at the time of this post.

We stay consistent with our recommendations to incrementally reduce LTs to wind down the CRV V2 ETH market, in addition to disabling borrows on V3 deployments.

We started a separate thread to discuss the deprecation of the CRV market on V2 Ethereum here.

Next Steps:

We have prepared two separate AIPs, which are currently under review and are planned to go live shortly:

- Disable CRV borrows on V3 Ethereum and Polygon.

- Reduce LT of CRV on V2 Ethereum by 6%. This is the same planned reduction that the community has previously voted on and was canceled during the CRV price downturn last week.

-

As of today, this LT reduction will make 3 total accounts amounting to ~$107 eligible for liquidation.

List of affected accounts:

As an update, the following AIPs have been published:

Previous changes to LT were at most 3%. Why is this limit being exceeded with this reduction by 6%?

Hi @marblemonkey,

The community was presented with two options to vote from, both with minimal impact on existing users:

- “Aggressive” option to reduce LT by 6%

- “Moderate” option to reduce LT by 3%.

In a Snapshot vote, the community voted for the “Aggressive” option. You can find the governance discussion around the proposal here.

The community discussion to freeze continues in a new thread. [ARFC] Gauntlet Recommendation on freezing CRV for Aave v2 Ethereum