I’m answering on behalf of the @ACI.

First, it is my firm belief that every service provider on Aave DAO’s payroll has a mandatory fiduciary duty towards the DAO, and by extension, to the best interests of AAVE token holders.

There has been a precedent and expectation of alignment between @AaveLabs and the Aave DAO. In this context, flash loan fees originating from UI swaps and ParaSwap positive slippage fees have always been redirected towards the Aave DAO treasury.

The tacit relationship was that the DAO lent the usage of the Aave brand and IP in exchange for the monetization of the aave.com frontend contributing to Aave DAO resources.

In this context and understanding, @ACI has contributed heavily to the @AaveLabs frontend via our engineers @MartinGbz and @Nandy.eth, making dozens and dozens of PRs because we firmly believed that contributing to this frontend was contributing to the best interest of the Aave DAO. We agreed to bend the frontiers of our paid scope to support a company that was focused on ventures other than a lending protocol at the time. It was hurtful for Aave and its users to constantly have new onboarded tokens without their token logo added, no support for incentive campaigns, and so on.

It seems we have been fooled in considering this a natural alignment, and we acknowledge the new reality. We acted in good faith and have no particular comment on this to add.

The main concern we have with the CowSwap integration over ParaSwap and the new fee schedule is the benefit for Aave users, as there is now explicitly no consideration of monetization for the Aave DAO.

- The Aave DAO lost the ParaSwap revenue.

- It is very unclear to us that ParaSwap execution was historically worse than CowSwap + frontend fees; therefore, we consider that Aave users have a worse experience now than before.

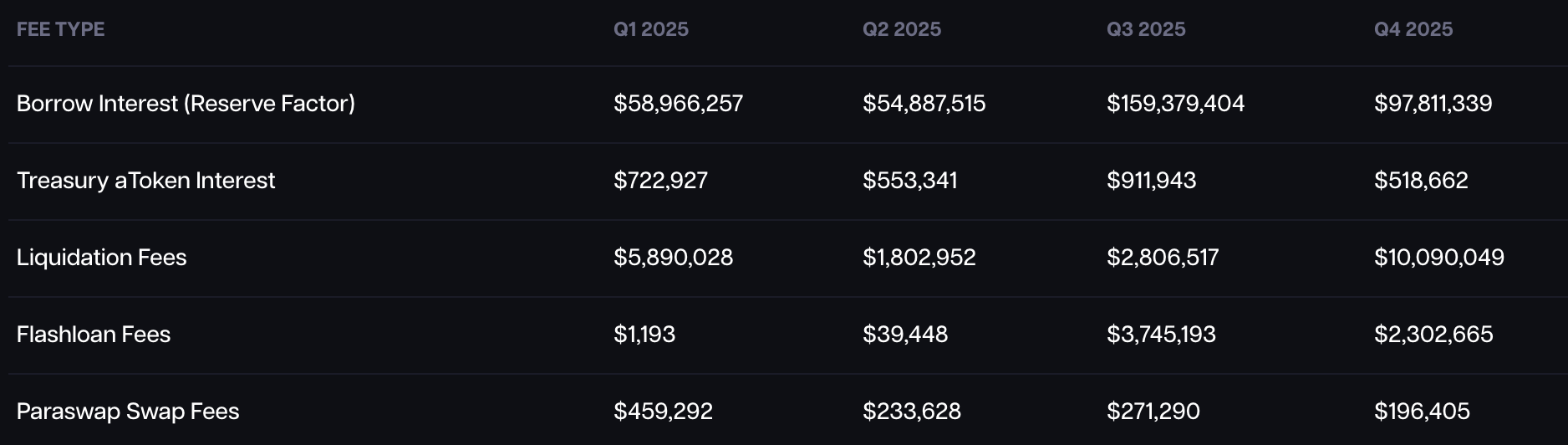

- ParaSwap leveraged flash loans, whereas CowSwap uses solvers. When analyzing volume, flash loan fees collected by the Aave DAO recently collapsed; this is because many solvers leverage Balancer flash loans (which are free) to increase their margins. What is concerning is that some of them also leverage the Morpho equivalent of flash loans (which are also free).

Aave Labs, in the pursuit of their own monetization, redirected Aave user volume towards competition. This is unacceptable.

By doing this integration, the Aave protocol lost two revenue streams that cannot be easily replaced. It is simply a factual consideration for Aave token holders.

Now, the critical part to consider is whether this integration is symptomatic of a larger trend of privatizing larger portions of protocol revenue or the DAO’s natural business for the benefit of a privately owned company.

Here is a series of questions:

- Aave Vaults, an Aave Labs product highlighted by the Aave Protocol documentation, hardcodes a fee towards Aave Labs. Is there no intention of a rev share with the Aave DAO for this product that is meant to be critical for V4?

- Did Aave Labs sign a deal and receive direct compensation in the form of a revenue advance for the integration of CowSwap, leading them to benefit from this integration directly?

- The Horizon product, which was initially proposed to have a second token that was hurtful to the Aave DAO, has yielded so far $100k of total revenue. This means that with the $500k investment from the Aave DAO in incentives, it is currently showing a visible balance sheet of -$450k. The reality is likely worse due to the tens of millions of GHO supplied there earning a yield below what it costs the DAO to maintain its peg. Did Aave Labs sign any deal or earn any integration fees to onboard assets to this instance that were until now undisclosed, and was this revenue meant to be shared with the Aave DAO?

- SVR liquidations have been a large implementation success and have yielded significant revenue for the DAO. The Aave V3 liquidations are extremely efficient, and the protocol sustained large volatility events (most recently the 10/10 event) without noticeable bad debt accrual. The promoted V4 liquidation engine will be hurtful to this revenue to the tune of 10+ millions of dollars per year. Aave Labs used Aave DAO’s brand assets and social accounts to promote their new V4 liquidation engine and issued communications suggesting that the most Lindy and safest lending protocol liquidation engine was inferior.

Is it safe to expect another large Aave DAO revenue stream will be lost in favor of V4?

- Who owns the Aave trademark, and who is entitled to benefit from the Aave IP and Aave brand? Is this @AaveLabs or is it Aave DAO?

It is important to consider the picture as a whole to define if Aave Labs breached its expected fiduciary duty towards the Aave DAO and the AAVE token holders, and what we should expect from V4 in general.

I personally have zero sunk cost bias, and as a service provider, I will stick to my duty towards the Aave DAO even if that means renouncing to the outcome of 15M$ of invested DAO funds into V4.

Our job at the ACI is to generate as much revenue as possible for the Aave DAO, with the expectation that the Aave DAO votes for buybacks and supports the token, which we own and used our own money to buy. We expect that part of our results will be converted into compensation appreciation as the protocol economy grows this natural game theory aligment make sure we sweat for aave because our success is tightly tied to the Aave DAO success.

We are ready to support what is best for the Aave protocol, regardless of how hard this journey will be and it’s short term consequences.