Ground Zero

The Aave Chan Initiative was launched almost 3 years ago in November 2022 when DeFi was in shambles. At the time, the DeFi ecosystem had been hit hard, first by fraud from CeDeFi entities resulting in the collapse of FTX, Celsius, and 3AC. Next by the failure of Anchor protocol resulting in $6B of liquidations - a quarter of Aave’s ATH TVL. In the midst of this chaos stETH depegged. In light of these failures, regulators were coming for the industry with a view to kill it.

Internally things weren’t much better. The DAO was under the influence of extractive entities with Gauntlet and Llama raiding the DAO treasury and depleting its resources. TVL had fallen to $5B. The balance sheet was showing a $35M annualized loss. In addition to all of the above, the Genesis team had experienced an exodus of their workforce, spinouts from core team members, and was under increasing pressure from hostile regulators greatly limiting their abilities.

Externally, the open-source nature of Aave was weaponized against our protocol by extractive teams. Opportunistic teams were raising funds by copying our codebase and slapping farming tokens on top with some ecosystems complicit. These clones received significant incentives and airdrops, often bigger than what Aave received in order to create a false image of growth. When these clones eventually got hacked due to incompetence and reckless behavior, the entire Aave ecosystem’s reputation suffered from their failures.

In an attempt to compete in this increasingly hostile environment, AAVE V3.0 was launched on L2s but had limited success. At the time the protocol featured a codebase that required improvement, it many good ideas and features but lacked a coherent implementation plan and vision. This was exemplified by features such as Portals or credit delegation vaults that have never been used outside of PoCs.

In this hostile environment, “DeFi is Dead” was a widely accepted statement in the ecosystem, and giving up and pivoting away while slowly draining the treasury funds seemed the most logical thing to do.

Yet we refused to give up. We left our comfortable jobs as part of the Genesis team and joined the trenches of the DAO by launching an initiative to Make Aave Great Again. It was a complete leap of faith, without support, resources, and little to no chance of success.

But it was necessary, so we did it.

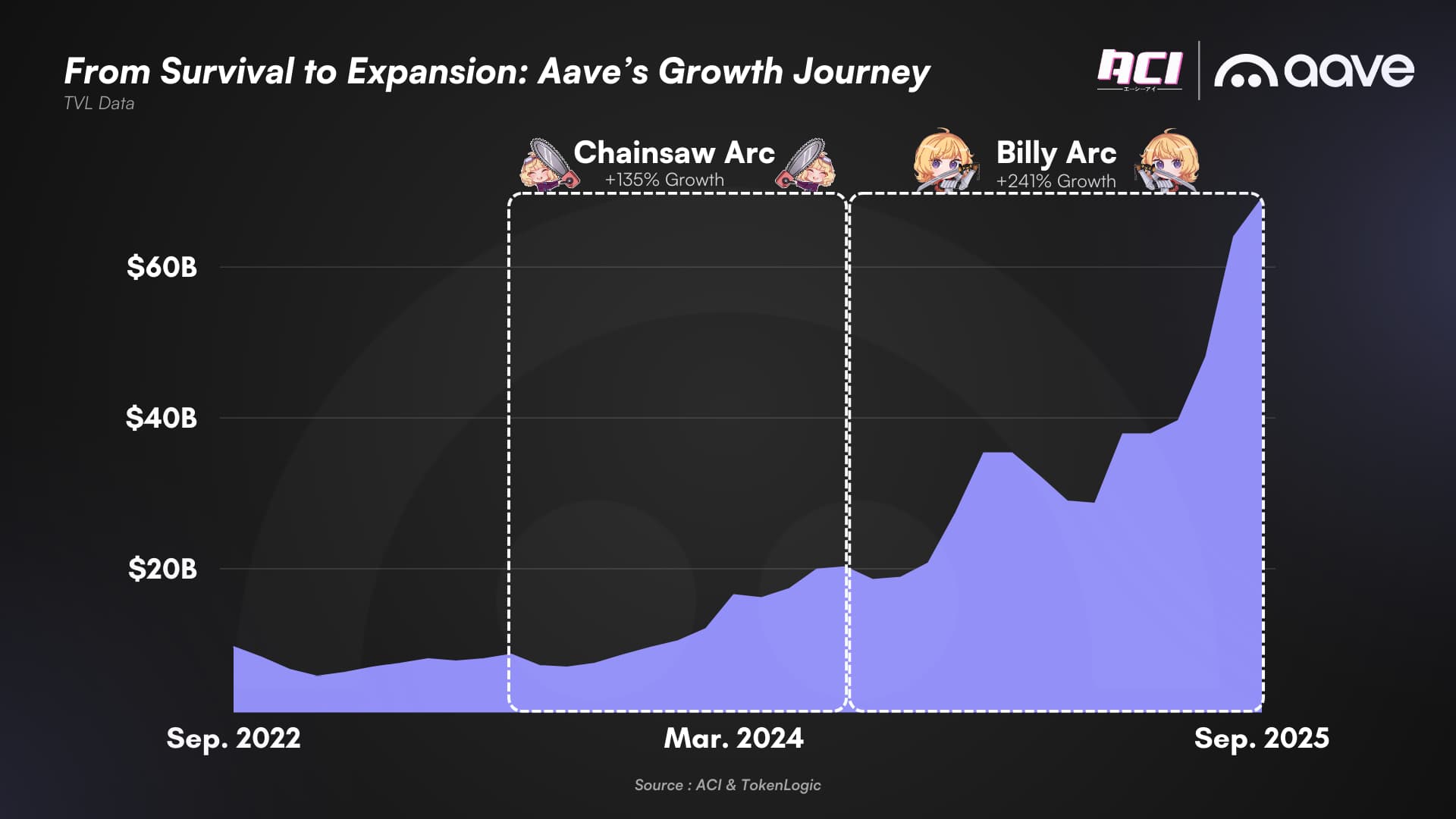

The Chainsaw Arc

18 months after the launch of the Initiative, extractors were removed, verticals wasting resources were cut, and the DAO has been professionalized with clear and efficient frameworks followed by a suite of highly skilled and focused service providers who now have explicit scopes and guardrails.

For the first time, the community had a direct impact and a voice in the future of Aave. Initiatives from ACI such as Skywards, Dolce Vita, and Orbit enshrined the efficiency of the DAO’s processes.

The Aave codebase continued to improve with the key support of former Genesis team members who spun out as BGD Labs, and the protocol emerged with a positive balance sheet and gained market share in the most competitive environment we have ever faced. At the time, the DAO was facing well-supported and well-funded competitors that had raised dozens of millions to “eat Aave”. Yet they failed to hurt Aave’s market share and dominance. This triumph was thanks to the focus and relentless work of the DAO service providers who spared no effort to ensure our success.

This period, which we call the “Chainsaw Arc,” was challenging. From our perspective, ACI was underfunded and undersupported, facing both internal and external hostility, receiving significant backlash and smear campaigns. Despite confronting these giants, in hindsight, David has prevailed against an army of Goliaths thanks to the vote delegation of hundreds of private individuals who decided to join the initiative and turn things around. Their contribution made everything possible, and while the main audience will likely never know their names, we are deeply grateful for the support of each and every one of them.

Every single achievement was hard-fought, not given. We feel immense pride seeing the remarkable results, the impressive suite of DAO service providers, and the delegate ecosystem that has built Aave’s success into what it is today.

A Comfortable Status Quo

The Aave DAO now stands on comfortable ground.

TVL, Revenue, market share, borrowing volume - every single metric is proof of the DAO’s success. Aave not only improved, but it has outperformed. We consider Aave’s dominance no longer threatened by alternatives in our vertical. The revenue-generating verticals of onchain lending: leverage (re)staking, borrowing stablecoins against BTC & ETH collateral, and yield-generating collateral carry trades are now comfortably dominated by Aave.

Our competitors are often stuck with TVL renting, long-tail asset collateral TVL growth schemes, and unprofitable distribution deals that increase their TVL but contribute little to no revenue whilst diluting their users’ yield at the expense of their native tokens’ costly incentives.

Aave’s current net annual revenue is now above the combined cash reserves of our competitors. They are now in need of new fundraising to keep up, stuck and depleting their reserves whilst we have a comfortable flow of resources to deploy towards further growth. If the market trend reverses, it will hurt the valuation of their primary source of incentives, while our cash will remain cash, and cash is king.

Furthermore, one of the key promises at the launch of the ACI - to upgrade the tokenomics of Aave and bring value to our native assets - has started materializing. Buybacks have already absorbed more than 50 bps of our total supply whilst the current revenue of Aave allows the DAO to enshrine the program, giving confidence to the market about the enduring value of our ecosystem.

Yet resting on our laurels has never been part of Aave’s DNA.

Improve, Focus, Accelerate

Now is the time to shift focus from external threats to an internal reorganization, allowing for further growth and increased dominance. The first step towards this is to make an introspective effort to assess what works and what doesn’t, allowing us to focus efforts moving forward.

Current L2 landscape

Aave’s L2 strategy at the dawn of V2 was a key factor in our success. Our early launch (2021) in the Polygon and Avalanche ecosystems allowed us to grow in uncharted territories with significant support from these ecosystems. This resulted in a mutually beneficial relationship that propelled everyone involved to the top. In 2025 the landscape is different.

While in previous cycles ecosystems were focused, in more recent times influence from VCs, opportunistic investors, captured DAOs and foundations eroded a winning recipe, resulting in L2 fatigue and dilution of success by distributing efforts in spray-and-pray schemes that prioritised short-term gains for an audience of farmers over the long-term gains that come from building sustainable onchain economies.

The lifecycle of L2s between the points of TGE and TVL-death is getting shorter and shorter. Aave has made the mistake of being attracted to these L2s by incentives that appeared attractive but appear less so once the native token is diluted by an order of magnitude or more in a short timeframe.

At this point in time more than half of the Aave instances across L2s and alt-L1s are not economically viable. Based on YTD data, more than 86.6% of Aave revenue is made on Mainnet; it is now increasingly clear that everything else is a side quest.

In light of this, the ACI has updated our doctrine toward new network deployments and is now happy to allow competitors to dilute their efforts and resources on chains that we believe present future dead ends. Our service providers’ bandwidth is not infinite, and every marginal increase in workload leads to inevitable compensation inflation.

Instead, the DAO should invest in key networks with significant differentiators such as a CeDeFi relationship allowing large-scale distribution deals as exemplified by Kraken/Ink as well as others in the pipeline, or alternatively those with a critical native element as exemplified by Plasma/USDT.

Therefore, we will publish proposals in the near future, aiming to close down shop on underperforming networks.

Friendly Fork Failure

The Friendly fork framework was a reaction to our competitor’s approach of commodifying the lending business and turning themselves into neutral infrastructure. With the benefit of hindsight, there’s little to no benefit of following a race-to-zero doctrine.

Most friendly forks of Aave have shown underwhelming results in respect of TVL and revenue, and at some times have even been weaponized by non-aligned actors to apply a very liberal interpretation of terms in order to benefit themselves at the expense of Aave.

The standout example of this is Spark, which in hindsight has been extremely damaging to Aave. On top of having very creative accounting which led to a fraction of expected revenue for our DAO, they have been and remain the strongest ally and a large liquidity provider to our competition.

Spark is currently enabling the success of the Base Coinbase distribution deal by providing approximately $600M of USDC liquidity to our competition. In addition to this they contributed to saving the same competitor from being eliminated by our Merit initiative by providing 10-figure liquidity as a counterparty to Ethena last year. Mitigating Spark damage has a cost which continues to be in the millions of dollars per year in incentives, with this cost borne by the DAO.

The other “friendly” forks have either been irrelevant in terms of revenue generated (less than 1% of our revenue) or have added friction to deploy on promising networks. It is essential to reflect on past mistakes, draw conclusions, and adapt from what doesn’t work so that we can evolve and improve.

According to DefiLlama, the top 10 Aave V3 forks account for 3.81% of Aave’s total TVL, and generate revenues equal to 9.59% of Aave’s total revenue. Importantly, these figures reflect their own revenue, not any portion contributed back to the DAO.

On this basis, the ACI is now formally against any friendly fork operated by third-party actors. Some forks might make sense when operated by service providers willing to work in ecosystems that are not a natural fit for the DAO (non-EVM or EVM-equivalent requiring custom work) or for assets outside of our current comfort zone (Horizon for RWA, Emergence market). These forks, supported as side quests for our internal service providers, must provide a larger revenue share and should never issue new protocol tokens so as not to dilute the value of Aave.

The DAO should accept that the Aave codebase will focus on quality and curation as it’s part of our brand, and allow some areas with less potential to be an opportunity for our competitors to dilute their focus.

Therefore, the ACI will actively push for a complete overhaul of the friendly fork framework in the near future.

Irrelevance of Instances

Instances were a smart innovation in early versions of the Aave V3.x codebase as they allowed to bypass eMode limitations and enable segregation of risk. They also served as an effective narrative selling point by offering focused instances with curated asset subsets as an alternative to competitors.

However, this came at a significant cost: liquidity segregation that reduced overall efficiency. While we consider the Prime instance successful, the introduction of liquid eModes now provides all the benefits of segregated instances with none of the drawbacks.

We must acknowledge that the instances paradigm has become obsolete in newer versions of the Aave V3 codebase. No development or growth efforts should be allocated towards it going forward.

The Prime instance will remain and continue to thrive.

Service Provider Alignment

The “Chainsaw Arc” was a necessary pain for the DAO to regain its financial health after a period of extraction and dominance of non-aligned actors.

This led to a culture that the ACI largely contributed to creating, characterized by an overly conservative approach to management of our resources and compensation. We fully confess to having pressured most service providers to give the best of themselves with limited resources and imposed a constant 3-year work “crunch” on them.

This was necessary, and the ACI walked the hard path alongside them, leading by example.

The situation is now more comfortable as explained in this post. We believe it’s now time to reward and secure the long-term alignment of the service providers that are undeniably the best in the industry within their verticals.

The industry has changed, and standard compensation is now offering a mix of native tokens and cash in addition to revenue sharing with service providers/curators linked to their own growth. Alongside this, our industry’s growth is now heavily linked to partnerships and institutional deals which are easily traceable in terms of success and impact.

Our current internal doctrine typically offers fixed, cash-only compensation, regardless of KPIs, with strict oversight by a highly attentive ecosystem of delegates that sets a high bar for what is expected from service providers. They are not shy about denying renewal of engagements if performance falls short of expectations.

We believe it’s time to introduce a performance linked element to some of the service provider’s compensation which is linked to measurable success metrics.

It is also important that service providers who contributed to making Aave what it is, and who are key to the future success of the Aave DAO have a vested interest in the success of the AAVE token.

This is why we believe we should explore AAVE vesting schemes tied to KPIs for some service providers that have made AAVE a centerpiece of their business.

We believe the only desirable way to do this is to have growth or growth-adjacent service providers (Tokenlogic, ACI, Aave Labs) lead deals and partnership inbound leads in a framework that empowers them to do so and in return share measurable revenue directly linked to these initiatives.

That being said, growth can only exist sustainably if risk and technical analysis work is done correctly, which is why we are in favor of also enforcing growth variable revenue sharing with risk and technical analysis service providers (Chaos Labs, Llamarisk, BGD Labs).

Introduction of this new model, additive to current fixed compensation, will likely increase our service providers’ motivation, empower them to find new growth verticals, and retain top talent in the Aave ecosystem.

The ACI will soon propose a new framework to reform service provider compensation.

From a Low-Margin Business to a High-Margin Business

Aave is now the undisputed leader of the onchain lending vertical. As previously mentioned, we have near total dominance of the industry’s cash cows.

Yet, despite this success, onchain lending is a remarkably low-margin business. 80% to 95% of all revenue created by the Aave protocol in the form of borrowing volume is returned to our LPs. Even with 70% market share and a borrowing volume that has tripled from the previous ATH, the net revenue of the DAO still stands at only $130M/year.

It is now clear that the pure lending business will not allow us to reach a billion or more in revenue in the short term, particularly in an environment where yields are compressing and arbitrage gaps in borrowing costs are shrinking.

Borrowing stablecoins in previous market conditions used to sit in an 8-12% range with peaks at 16-20% during phases of euphoria. We are now likely locked into a 6-8% range long term. As we grow and mature, rates will converge toward TradFi levels as the market becomes less willing to apply a risk premium to onchain borrowing, this will hurt our profit margins over the longer term.

GHO represents a paradigm shift because the protocol itself is GHO’s main LP. Instead of paying LPs, the protocol must focus on paying liquidity sinks, maintaining secondary liquidity, and ensuring peg strength. Even if 50% or 60% of all GHO revenue is dedicated to that goal long-term, this would effectively 4x the DAO’s profit margin compared to USDC borrowing volume.

Aave’s unfair advantage over everyone else is that the DAO built a very successful lending business before building a successful stablecoin CDP business. This allowed the DAO to leverage lending business revenue to invest in GHO’s growth.

While GHO in its initial state as delivered was a poor vehicle for growth and stability, we must acknowledge the relentless work and significant achievements of key service providers led by Tokenlogic to complete an overhaul and drive growth of the GHO product. Thanks to this work, we have now achieved a critical mass of GHO, recently enabling our first CeFi integration. Going forward GHO will continue to be strategically bundled in key CeDeFi distribution deals to increase adoption. Additionally, this critical mass of GHO provides more buffer for profitable and strategic credit line strategies, boosting revenue in line with Spark’s doctrine with USDS.

Now that GHO is 2 years old, after spending the first year upgrading it to a functional state, we believe we should continue investing in this product for at least another year, regardless of its current profitability, given its potential.

The ACI will continue to support the growth of GHO as best we can alongside the tireless work of Tokenlogic leading GHO’s success.

Growth, Growth, Growth

The current market cycle is not retail-driven; we are currently experiencing an unprecedented combination of regulatory tailwinds and institutional mass adoption of our industry. This is new, uncharted territory with new rules, new approaches, and strategies needed to win.

A noticeable and significant part of our growth over the past 18 months has been driven by key exclusivity partnerships, adoption of the right collateral, and investment in key networks.

As already outlined, Aave is in a comfortable position, and based on this the ACI’s current doctrine is to leverage our healthy finances to invest in growth and solidification of our dominance as much as we possibly can in the short term. If we play our cards aggressively enough, none of our current competitors will survive, and our head start will secure our position in the mid and long term.

The ACI has been extremely conservative with our approach to our cash reserves as we were dedicated to building a large war chest for the DAO. Thanks to this approach the DAO is now sitting on $130M of cash and cash-equivalent assets with an ever-growing treasury even with buybacks activated.

Our suggestion to the DAO is to enshrine buybacks at, or close to, current levels ($500K-$1M/week) to maintain a public signal to the market of confidence in our native token and alongside this to start spending aggressively on distribution and growth deals using our reserves over the next 18 months.

On top of this, buybacks created a large reserve of Aave tokens that can be mobilized alongside our significant BTC and ETH reserves to generate a GHO credit line with a high HF (2/2.5 minimum) made available to spend on growth deals. The ROI of these deals can be used to repay the credit line mid-term. Constant buybacks and revenue will naturally increase position collateralization, avoiding unwanted outcomes. This, in addition to our current cash reserves, would give the DAO above $100M of firepower to accelerate our growth and dominance.

A plan this ambitious calls for strict guardrails and close oversight. The DAO should carefully debate and consider this strategic vision and define via vote a suitable framework to define, limit, allocate, and follow up on investments.

No single service provider should be allowed free rein with such a large budget. A suitable option is to have several related service providers in an ad-hoc committee, akin to the current AFC, under the supervision and control of independent key delegates and service providers.

The ACI will soon propose to the DAO a framework for our growth investment doctrine.

Closing Thoughts

At the ACI, we feel proud of what we’ve accomplished at Aave over the past 3 years. We believe the industry stands at an important crossroads. Thanks to our previous success, we now hold all the cards needed to expand our dominance and grow our protocol to new heights.

If we play these cards right and sharpen our focus on what works best while letting go of what doesn’t, we will remember this period as the foundation upon which Aave built its lasting dominance in DeFi. With strategic growth investments, aligned service providers, and focused product development, we are positioned to cement Aave’s legacy as the definitive leader in decentralized finance for years to come.

Just Use Aave.