Given that I really have 100% visibility on some of the topics, I would like to leave some comments:

The conversation in some places has degenerated into “how much the Aave DAO received from the Paraswap integration” and pointing out that it was not the $10m or $15m floating around. That’s true, it was (@TokenLogic can confirm numbers) lower previously. And even the type of revenue was not a “fee”, but a kind of referral program introduced by ParaSwap.

But that is totally irrelevant, not even the core problem here; the problem is the fact of having the app.aave.com orderflow and privately monetising it.

Some clarifications:

-

On the ParaSwap integration, sure, it was kind of a referral, an initiative from the ParaSwap DAO/org. But that was the way of ParaSwap of keeping integrations bringing from tens to up to $200m volume per day to their DEX. Everything is public, can be checked on the Paraswap side HERE.

-

This volume is called orderflow, the orderflow that comes due to the application being hosted on app.aave.com; brand recognition. This is totally evident, akin to a website with high traffic, adding a widget to swap assets in, let’s say Uniswap.

-

The numbers of the OP of estimated revenue for Labs seem to be based on data from last weeks/months. Once again, I think @TokenLogic should check more in detail, but for what I see in the final wallet recipient, this is for example the last payment

https://debank.com/profile/0xf38b417b8c1bf2a0b81a356fe2014da8dbb44306/history?mode=analysis

Considering that seemingly only now are all features “migrated” to CowSwap, that seems like a good ballpark number, sometimes higher, sometimes lower. Then it is just a matter of checking historic volume before with ParaSwap, applying some weighting to the current market, and estimating. Definitely, the number seems to be in the ballpark of $10-20m/year. -

This traffic/integration on app.aave.com is extremely high value. Because it is not only that users can swap there, it is that users have funds on the biggest DeFi protocol, and obviously for it is better to do swaps or modification of their Aave position in the same place.

-

It is not really serious that we are discussing that in all senses, the protocol and the “product” have totally “in substance” different ownership. Even if that were the case (which is highly dubious), the brand should be on the final stakeholders, which are the AAVE token holders. Defending a position of the Aave Labs legal entity owning, in practice, the trademark, domain, and communication channels, and monetising directly/indirectly privately, is nonsense, first, second, lack of good faith.

I mean that it is perfectly possible to have a feature like swaps benefiting the DAO solely even if the DAO can’t hold a domain at the moment. I mean that it is possible to just not use aave.com and aave social handles for advertisement of private products, even if the DAO can’t neither hold a social handle.

I mean, let’s try not to be disingenuous or make fools out of readers. -

Again, it is not even too relevant with the core problem being redirection-ownership of the orderflow, but the majority of the features were part of Aave as a whole. It is disingenuous and misleading not to say that, and very simple to check:

https://medium.com/aave/the-aave-protocol-v2-f06f299cee04

In the previous picture, we can see how they are announced as part of the v2 release, where the initial features were introduced. Yield & Collateral swap are currently called aToken/liquidity swap and collateral swap. Repayment with Collateral is the same. And Debt Swap was introduced later, with the contracts developed by the team I’m part of (BGD Labs), and plugged of course into the UI by Aave Labs.

Then the additional features added (Withdraw and Swap, and “plain” token swap), were introduced later, and I think there should not be any doubt that a “plain” token swap not involving Aave at all and using an external swap provider is valuable because of the orderflow.

And to be very precise about the swap features: they are not part of the core protocol, more of the so-called “periphery”. But we have been building for years on the DAO, maybe 60% of what can be defined as “periphery”, and that doesn’t mean that they are not products/sub-systems of the DAO. There is an endless list; I will not share it here. -

Another point, which, even if not so relevant, needs to be clarified because there is quite a lot of misleading information. I think not assuming that ETHLend, Aave v1 and v2 were “compensated” with the proceeds of the ICO end of 2017, is ridiculous. I’m not saying that @stani didn’t do a good job leading the team and developing the best product for the LEND (later AAVE) token holders, but there was funding directly.

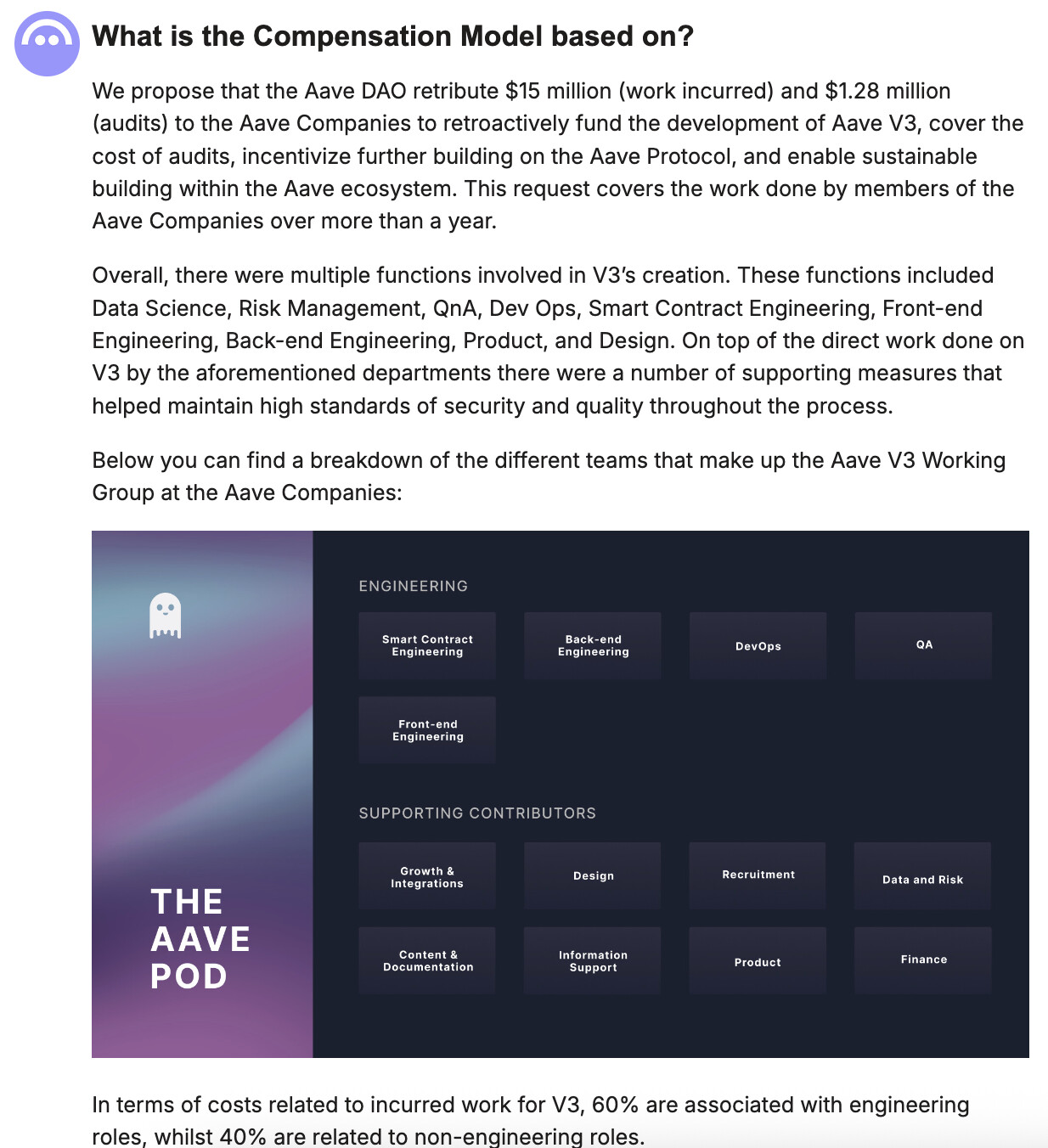

Then, v2 started to be a self-sustainable product, and Aave Labs (in my opinion, totally legitimately) asked for retroactive funding for Aave v3. And even if again, not so relevant, the v3 UI was compensated by the Aave DAO on the retroactive funding. This is not even my interpretation; it is here on the forum and has been voted on

https://governance.aave.com/t/arc-aave-v3-retroactive-funding/9250?u=aavecompanies#p-21219-what-is-the-compensation-model-based-on-6

I mean, we can start discussing semantics, but to not understand that for a new product, with the development entity mentioning as the cost to cover, the interface is not part of the “package”, it is ridiculous. -

A good representation of this situation, being pretty evidently not good, is what there is when simply opening aave.com. The following.

From aave.comThe “Aave App” is a private product of Aave Labs.

Really, does anybody think that it is legitimate to at the beginning of the main point of access to see anything about Aave, a private product not owned at all by the DAO, is linked/advertised? Should a long-term integrator of the protocol, like let’s say DefiSaver, have that type of crazy high visibility and advertisement? Or anybody else?