Hello Aave DAO,

This post is not a proposal, but more of an open letter with questions towards @AaveLabs from me as an Orbit delegate & Aave tokenholder.

On the 4th of Dec 2025 Aave Labs made a public announcement on X, that a new partnership with CoWSwap has been established to provide “an improved swap experience across aave.com” (https://x.com/aave/status/1996591393817473247)

This integration essentially means that “cow swap adapters have been deployed on several chains, improved incentives tooling via Merkl and introduced a Balancer v3-based flash loan factory. (AL Development Update | November 2025)

Essentially replacing the existing Paraswap adapters that have been introduced with Aave v2 and v3.

All these adapters allowed Aave to gain advantage in terms of, that a user did not have to leave Aave (the protocol) to do any kind of swaps. This helped to increase user retention and resulted in an additional revenue source for the Aave DAO, as Paraswap introduced in June 2022 a referral program that had no impact on users but redirected revenue to the Aave DAO treasury.

It’s important to mention to anyone reading this, that no fees were enforced on users, to be received by the DAO or anyone else within or outside the DAO. The goal was simply to introduce a great feature to the Aave core protocol.

Then Aave Labs communicated that the Aave UI now allowed to swap directly with CoWSwap (https://x.com/aave/status/1929538754189963350). Adding great features for Aave users.

Now we are coming to the tricky part of this implementation.

According to the Aave docs provided by Aave Labs, extra fees were introduced which are ranging from 15 to 25 bps. This is generally speaking fine, but has multiple layers that need to be broken down and asked.

- Is the Aave DAO receiving those fees, similar to the Paraswap referral fee?

- Are the fees competitive and user friendly enough, or could this result in users migrating to other protocols, thus reducing Aave DAO revenue?

- Charging this fee is only possible due to the nature that the Aave brand is widely known and accepted in the ecosystem. A brand that the Aave DAO has paid for.

So what is the answer to these questions?

I did some research with the help of AI, on-chain explorer and test transactions.

- The Aave DAO is not receiving the fees from the different swap adapter anymore.

How do I know this?

I have been doing some test transactions to see where the collected fees are going to, for example to the official Aave DAO treasury address. The result is that all fees collected are going to this address 0xC542C2F197c4939154017c802B0583C596438380.

In addition you can see that the appCode clearly indicates the Aave v3 interface widget and the recipient address mentioned above.

{

"appCode": "aave-v3-interface-widget",

"metadata": {

"orderClass": {

"orderClass": "market"

},

"partnerFee": {

"recipient": "0xC542C2F197c4939154017c802B0583C596438380",

"volumeBps": 25

},

"quote": {

"slippageBips": 426,

"smartSlippage": true

}

},

"version": "1.4.0"

}

In the docs of CoWSwap one can read that the partnerfee is defined in the appData and weekly distributed (Partner fee | CoW Protocol Documentation).

Which perfectly matches this address Address: 0xc542c2f1...596438380 | Etherscan.

Where each week or every 7 days big amounts of ETH are being transferred. For example on the 4th Dec, the last transfer day, 45.99 ETH have been transferred, with a value of approx. 152k$ at the time of writing this post. It’s worth mentioning that this is only the partnerFee received on Ethereum Mainnet. I also did another test on Arbitrum with the same address receiving this fee. Which simply means that on every chain, where there is CoWSwap support on the Aave frontend, another entity rather than the Aave DAO is at least receiving 200k$ per week worth of ETH.

A loss to the DAO over 365 days seen by at least over 10m$, assuming a transfer of only 200k$ each week.

Again, this only translates to my test transactions on two networks, so likely numbers are higher.

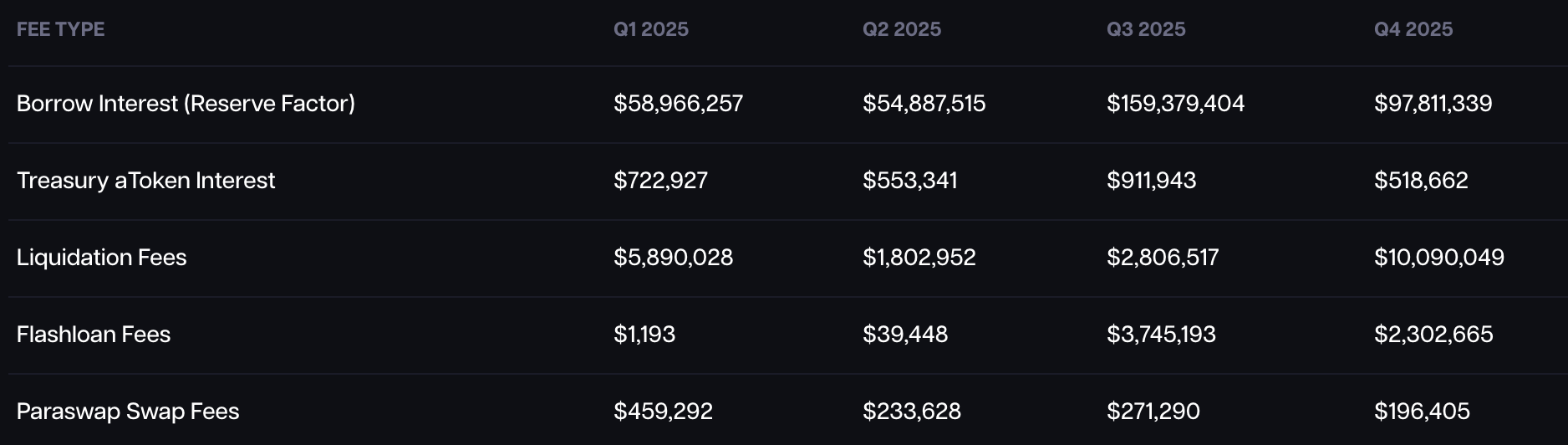

For comparison, here are the fees going to the Aave DAO treasury from the Paraswap referral program. Thanks to @TokenLogic for creating these amazing dashboards.

2024

2025

What is interesting to observe here is that the revenue for these swaps have been going down a lot since Q2 2025. This is likely due to the fact that in June this year Aave’s swap widget was powered by CoWSwap (https://x.com/CoWSwap/status/1929538997782806648).

Also interesting to mention is that the flashloan used for these swaps is based on Balancer v3 based flashloan factory. Which do have 0 fees, unlike Aave flashloans. These can be waived, if the Aave DAO approves it.

- This is something that can be argued within the DAO. Based on AI research the fees are the highest among other lending protocols, but also match Uniswaps frontend fee as comparison. Below a table of the biggest lending protocols and their fees.

- The Aave visuals are owned by the Aave DAO. ([TEMP CHECK] Aave 2030)

Quote: “The proposed new Aave Visual Identity will be irrevocably licensed to the Aave DAO. This license will grant the community the broad rights to reproduce, distribute, perform, display, and communicate the visual identity for the benefit of the Aave Protocol, the Aave ecosystem, the Aave DAO, and related activities. The use of the visual identity will be strictly prohibited for malicious activities, including but not limited to phishing scams and impersonation. This identity will be separate from that of Aave Labs, which will have its own distinct identity. For the purposes of this proposal, we are using the newly proposed visual identity in an effort to showcase the vision for the brand.”

Looking at the bold highlighted parts, we can essentially come to the conclusion that the DAOs treasury could and should benefit from the visual identity, which is famous in the cryptospace, as it is the core and heart of the DAO and all Aave tokenholder.

Users of the protocol tend to use aave.com/app.aave.com because of the brand identity, and there is a case to be made that they belong to the DAO or at least the DAO should have some decision power to avoid conflict of interest.

After presenting all this information, as a delegate and Aave tokenholder I have the following questions and I invite the DAO to comment.

- Can Aave Labs confirm it decided unilaterally to cut the referral revenue stream of the Aave DAO?

- Aave DAO members are supposed to be working for the DAO. So, how does it fit that picture when Labs unilaterally decides to slap a fee on a feature that used to be free? Especially without asking the DAO (who used to get the fees) and now that money is going straight to a private company.

- The DAO already paid Aave Labs to build the interface and funded others for the advanced features. People use the site because of the protocol, which the DAO owns. So, where’s the alignment? It feels like Labs is just leveraging the aave.com domain to extract value that should rightfully go to the DAO.

- Is the swap of provider to CowSwap exclusively because Cowswap is better for users? Or is there any type of agreement between Aave Labs and CowSwap leading to that decision?

- Why is Aave Labs posting updates on the forum about features that have never been mentioned in the scope of the DAOs mandate?

- What does this mean for the new Aave v4 pro interface? What assurance does the DAO have, that it will not be done with similar features? Considering the DAO paid for the development of V4 and its benefitting from the Aave brands reputation, also built at the cost of the DAO.

All my research and results presented here, have been done via on-chain investigation, AI research and other tools. I have not been compensated by anyone creating this post except the Orbit program, nor is it the intention to harm anyone. I am just a delegate that many people put their trust into and an Aave tokenholder myself. As a delegate my main goal is to grow the Aave protocol and work for the DAO and its treasury.

Just use Aave.