Wanted to highlighted our crosschain mechanisms for added info.

No bridge has the ability to mint MAI on other chains. We saw the issue some tokens have come across with fungibility, so we decided to control minting on each chain. Bridging is done through liquidity on routers. That means users exchange MAI on one chain for other one that we provide on the destination chain. If a bridge is deprecated or exploited, we have the ability to remove the liquidity from that bridge. This process is often referred to as canonical bridging, and is a type of bridging that QiDao pioneered.

Let me know if you have any questions about this.

3 Likes

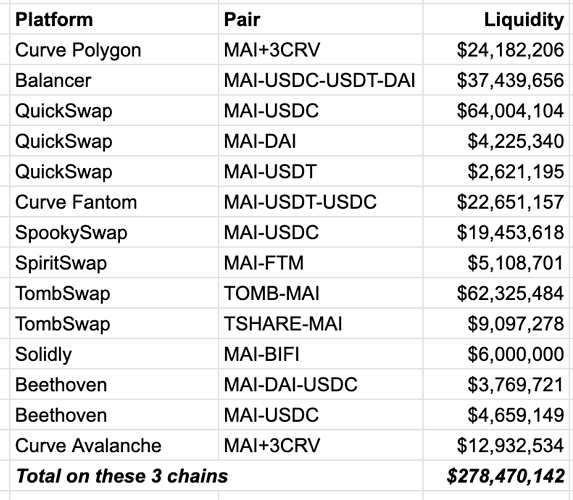

Here is a breakdown of our liquidity on those chains.

As you can see, we have significant liquidity on these chains. Having a chainlink oracle, MAI had to overcome liquidity fragmentation and liquidity centralization hurdles. There is no native stablecoin on these chains that has gotten a chainlink oracle other than MAI.

You can also see in the chart that MAI has been integrated with the major players in each of these chains. The level of collaboration and integration MAI has achieved in these chains is unparalleled by any native stablecoin. I think that is a testament to the strength of the token and the trust these communities have in MAI.

1 Like

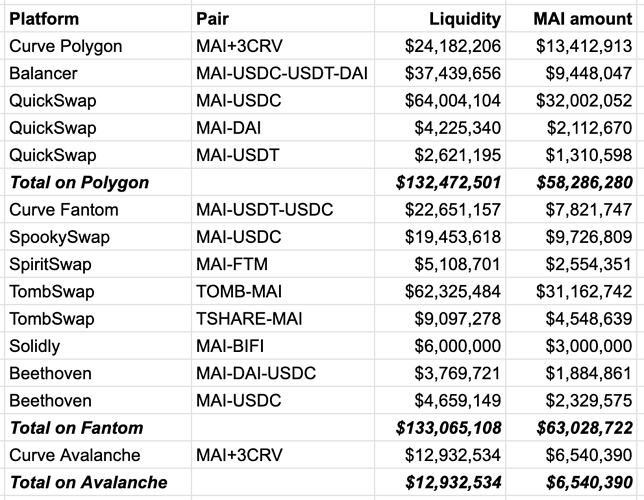

Here is the liquidity breakdown by chain:

3 Likes

Thanks for providing all these details