Sentence Rational

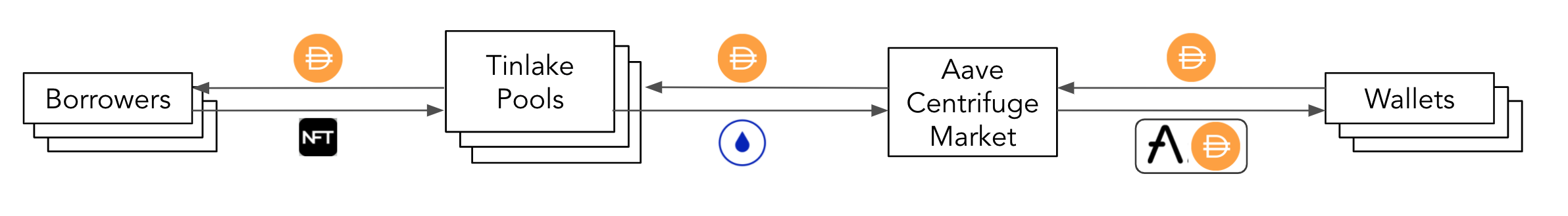

END_Bridge with the support of Centrifuge is proposing to add a Real World Assets (“RWA”) permissioned market on Aave to enable businesses to finance their tokenized financial assets using crypto and allow investors to diversify their portfolio with uncorrelated, stable assets.

References

- Homepage: https://centrifuge.io/

- Tinlake app: https://tinlake.centrifuge.io/

- Documentation: https://docs.centrifuge.io/

- Source code: GitHub - centrifuge/tinlake: Smart contracts for Tinlake, the on-chain securitization protocol for real-world assets,

- Audits: security/audits at main · centrifuge/security · GitHub

- Communities: https://discourse.centrifuge.io/

Paragraph Summary

Our goal is to launch the first (permissioned) market for Real World Assets (RWA) on the Aave protocol. This will allow Aave depositors to earn yield against stable, uncorrelated real world collateral while Centrifuge asset originators can borrow money from Aave, automatically balance capital needs and provide an alternative collateral to volatile crypto assets. Currently, there are 10 pools live on the Tinlake protocol, ranging from real estate, to supply chain financings, to music streaming invoices.

Motivation

RWA bear monumental potential for DeFi in regards to volume, adoption and risk diversification. Pioneering lending in DeFi, Aave could be the game changer for millions of businesses by providing instant, bankless liquidity. When bridging the regulated world of Tradfi to trustless DeFi you encounter challenges that only few in DeFi have taken on so far. Centrifuge is planning to make use of the new permissioned pool feature on Aave which is designed to be compliant with AML regulations and US securities guidelines. The pool itself will be public on Ethereum but only accessible to those that undergo KYC verification.

Each Tinlake pool has two tokens: DROP and TIN. DROP is the senior tranche token, protected by the TIN token, which takes first losses. We want to use these DROP tokens as collateral, for borrowing DAI. Please note that there is one DROP token per Tinlake pool (e.g. NewSilver: real estate backed loans, NS2-DROP; ConsolFreight: trade finance txs, CF4-DROP). Currently the majority of Tinlake pools are denominated in Dai, meaning liquidity providers investing in a pool deposit Dai and receive interest bearing DROP tokens in return. On the permissioned RWA Market on Aave investors will be able to provide liquidity for a blended portfolio of DROP tokens. The design of the Tinlake infrastructure is focused on composability and allows for different types of investors to invest in a single pool. Some of our partners we work with are already onboarded to MakerDAO’s MCD. This means individual pools have a corresponding vault on Maker and mint new DAI against their DROP collateral token. With the launch of the Centrifuge market on Aave our asset originators will gain additional liquidity sources and will be able to move their collateral freely between platforms following the best conditions instead of being siloed. To make beginnings easier for our asset originators they will only accept DAI and branch out to other stable coins long term.

Specifications

- What is the link between the author of the AIP and the Asset?

The permissioned RWA market will be operated and managed by a Series of END_Bridge LLC, an independent and bankruptcy remote Delaware series limited liability company. Independent means that END_Bridge is not owned, not operated by, and not managed by Centrifuge. END_Bridge stands for being an Early New and Different Bridge to DeFi. LPs will need to go through KYC and sign a subscription agreement with END_Bridge. They get then whitelisted for the permissioned RWA market and will receive aDROP in turn for providing DAI. The main contact on END_Bridge for this proposal will be @thedoctor_j

Centrifuge is the infrastructure provider that enables asset originators to create an on-chain asset fund via Tinlake to finance loans. The asset originators provide the collateral assets to the permissioned RWA market by adding their DROP token to the pool in exchange for DAI. The main contacts on Centrifuge for this proposal will be @jeroen_0 and @lea

- Provide a brief high-level overview of the project and the token

Tinlake is an open, smart-contract based marketplace of asset pools bringing together Asset Originators and Investors, which seek to utilize the full potential of DeFi. They do this by tokenizing their financial assets into Non-Fungible Tokens (“NFTs”) and use these NFTs as collateral in their Tinlake pool to finance their assets. For every Tinlake pool, investors can invest in two different tokens: TIN and DROP. TIN, known as the “risk token,” takes the risk of defaults first but also receives higher returns. DROP, known as the “yield token,” is protected against defaults by the TIN token and receives stable (but usually lower) returns. This is similar to Junior/Senior investment structures common in traditional finance. Every Asset Originator creates one pool for their assets and issues their own DROP and TIN tokens.

For the detailed documentation click here

- Explain positioning of token in the AAVE ecosystem. Why would it be a good borrow or collateral asset?

Both Tradfi and DeFi is undergoing innovation and learning processes. Aave is one of the trailblazers in the community bringing both worlds together. Accepting RWA in a closed environment in the form of a permissioned pool is a first step for Aave towards a wider adoption in traditional finance. The Centrifuge market will be seperated from other Aave markets to guarantuee a safe environment with minimal risks to the protocol. Onboarding real businesses on one side and institutions on the other side will allow the next iteration of DeFi.

- Provide a brief history of the project and the different components: DAO (is it live?), products (are the live?). How did it overcome some of the challenges it faced?

Centrifuge has been working on enabling businesses to borrow money using their assets in DeFi since the project was founded in 2017. The DApp Tinlake has been in development since early 2018 and is evolving rapidly. We are currently live with Tinlake v3 and host 10 live pools with different RWA collateral types on our network. The biggest challenge has been to bridge the regulated world of Tradfi to the trustless world of DeFi. Creating an infrastructure to securely onboard RWA that is able to scale has been demanding. With our recent onboarding to MakerDAO we deem our initial approach validated and are looking to further expand RWA within DeFi while improving the setup continuously.

- Token (& Protocol) permissions (minting) and upgradability

Our smart contracts are controlled by a multisig with 8 signers and 3 signers required per transaction. The contracts are non-upgradeable, based on the MakerDAO coding patterns. DROP tokens are only minted by the Tinlake smart contracts. For the Aave Centrifuge market, a custom adapter will be developed, similar to the existing Maker adapter.

- Market data

Current TVL on Tinlake: 22M

- Social channels data

- Twitter: https://twitter.com/centrifuge

- YouTube: https://www.youtube.com/channel/UCfNkoq7YLrr8MeSJ3a6jVcA

- Forum: https://gov.centrifuge.io/

- Discord: http://centrifuge.io/discord

Risk Considerations

Whereas it is a quite common occurrence that highly volatile crypto assets can quickly decrease in value and borrowers get liquidated from one hour to the next, RWA are different. Tinlake pools securitize balanced portfolios of real world assets, making the DROP tokens very stable assets.

Tinlake’s RWA have a maturity date that indicates when a loan needs to be repaid (maturity ranges from 60-90 days for invoices, to 12-24 months for mortgages). If an asset has not been paid back upon maturity an asset originator usually starts a collection process to recoup funds. The worst case scenario is the default of an asset. Asset originators factor in expected defaults into their interest rate calculation and asset specific advance rates (E.g. it is common practice to finance only 80-90% of the face value of an invoice).

Besides accounting for expected default via interest rates, all Tinlake pools have downside protection through the (Junior) TIN tranche. If for instance a single invoice of a balanced invoice portfolio defaults, TIN investors take first loss without impacting the DROP investors. Only if defaults exceed the pool specific TIN ratio the price of the DROP token is compromised. If this happens the pool is frozen which means that the asset originator cannot originate more loans until funds are recouped to pay out DROP investors (see an overview of our revolving pool mechanics here).

Asset parameters

All Tinlake pools have existing risk parameters, most importantly the DROP APR. This is the interest rate that senior (DROP) investors receive on their capital (excluding any cash drag). This parameter reflects the risk of the underlying asset and the senior tranche investment. We propose to use the DROP APR as one of the main drivers to determine the Aave risk parameters while taking maturity, the asset class, the size of the pool and the diversification within the pool into consideration.

In the table below we are proposing the following Aave risk parameters for our current live pools:

| Name | Collateral Type | Maturity | Token Address | DROP APR | Loan To Value (Aave) | Liquidation Threshold | Liquidation Bonus | Reserve Factor |

|---|---|---|---|---|---|---|---|---|

| New Silver | Real Estate Bridge Loans | 12-24 months | NS2DRP | 4% | 94.1% | 97% | 3% | 5.9% |

| Fortunafi | Revenue Based Financing | 24 months | FF1DRP | 5% | 94.1% | 97% | 3% | 5.9% |

| ConsolFreight | Cargo & Freight Forwarding Invoices | 60-120 days | CF4DRP | 6% | 92.2% | 96% | 4% | 6.8% |

| Harbor Trade Credit | Trade Receivables | 60-120 days | HT2DRP | 7% | 90.3% | 93.7% | 4.9% | 7.7% |

| Bling (1754 Factory) | Payment Advances | 30-90 days | BL1DRP | 7.5% | 90.3% | 93.7% | 4.9% | 7.7% |

| Branch | Emerging Market Consumer Loans | 3 years | BR3DRP | 10% | 84.5% | 87.5% | 6.8% | 10.5% |

We are exploring whether we can use some of the upcoming new features coming in the Aave V2.5 protocol, like the Exposure Ceiling and Borrow/Supply Caps, to ensure proper diversification and risk management in the market.

Every new pool that will be added to the permissioned pool will go through Aave governance and put up for vote.

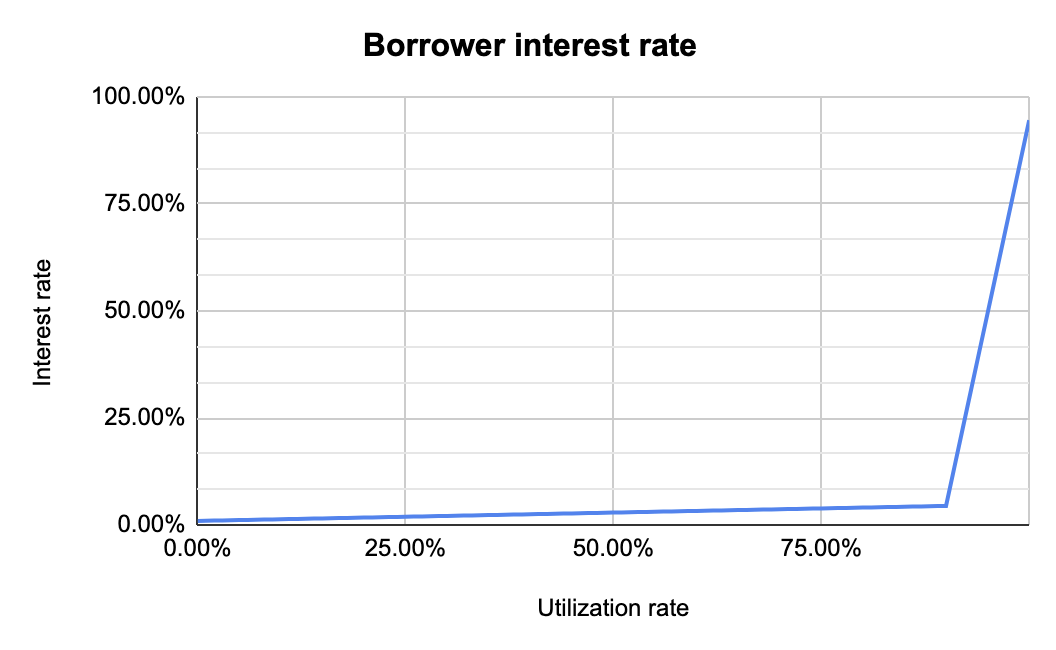

As for DAI, the currency which investors can use to participate in the market, we plan to only support variable rates in this market. Therefore, we propose the following Borrow Interest Rate for variable borrowing DAI:

| DAI Borrow Interest Rate | |

|---|---|

| U_optimal | 90.00% |

| Base | 1.00% |

| Slope 1 | 3.50% |

| Slope 2 | 90% |

These are similar to the DAI parameters in the Aave V2 market, with a few exceptions. The optimal utilization rate was set to 90.00% to encourage high utilization of the market, to maximize capital efficiency and investor returns. The slope is slightly lower before the optimal utilization rate, to even out interest rates. Above the optimal utilization rate, the slope is even higher than in the Aave V2 market for DAI, as the optimal utilization rate is higher and thus this will lead to more incentive for repayments when liquidity runs out. The associated interest rate curve has been visualized below.

Technical Specifications

The Centrifuge market will be a new deployment of the Aave V2 protocol, using the permissioned market implementation. We have been working closely with Aave developers and are close to deploying a test version of this market to Kovan. This market differs in a few ways from the existing markets. For regulatory compliance, in order to provide liquidity for the Centrifuge market, investors will need to:

- Pass KYC/AML checks.

- Sign a Subscription Agreement for the Aave Centrifuge market.

For Tinlake, we have implemented an onboarding UI which facilitates these steps for each specific pool. We plan to re-use this existing UI, which in practice will mean that users will need to go to a webpage like Centrifuge App, where they can follow these steps. Our system will then add these addresses as depositors in the lending pool. After this, they can use the Aave UI to use the Aave Centrifuge market.

Price feed

Each DROP token is linked to a Tinlake pool, which is a set of contracts. There is no secondary market for DROP tokens. The price of the token is based on a NAV (Net Asset Value) calculation, which updates each second. The DROP token price can be calculated from the Assessor contract.

The Aave V2 protocol uses a Chainlink Aggregator by default as a price feed, and can use a fallback oracle if that doesn’t exist. For DAI, we want to use the same oracle setup as DAI on the Aave V2 market. For our DROP tokens, we want to implement a fallback oracle contract, which retrieves the DROP token price from our Assessor contract.

Liquidations

Liquidations can be done by investors who have passed KYC and have signed the Subscription Agreement for specific Tinlake pools. These investors can participate in liquidations to receive DROP at a discount over investing directly into the pool. These DROP tokens can be used to place redemption requests on a specific Tinlake pool.

Each DROP token is already restricted by a memberlist contract. To avoid having to modify the Aave V2 core contracts, we will use a new proxy contract. This contract will be the only address with the liquidator role in the Centrifuge market.

Poll:

- I support a Permissioned “RWA” Market

- I do not support a Permissioned “RWA” Market

Internet of Value

Internet of Value