Title: [ARFC] Aave V3 Deployment on Aptos Mainnet

Author: @AptosFoundation

Date: 2025-04-16

ARFC updated with latest Risk Parameters by Risk Service Providers 2025-04-30

Summary

This proposal aims to deploy Aave V3 on the Aptos Mainnet, expanding beyond Ethereum to tap into a next-generation blockchain that offers high throughput, ultra-low transaction fees, and enhanced security. By leveraging Aptos’s innovative features—especially its use of the Move programming language—this move seeks to make the protocol more efficient, accessible, and resilient, positioning Aave to serve a broader audience and adapt to the evolving DeFi landscape.

If approved by the Aave community, Aave V3 will launch on Aptos Mainnet with a carefully chosen selection of assets, guided by community input and curated by Chaos Labs and Llama Risk.

This initiative aims to extend Aave into the thriving Aptos ecosystem—unlocking innovative growth opportunities and enhancing the value for both communities.

Background

The Aave Protocol has been EVM-native for over 6 years, ensuring widespread cross compatibility, a robust developer ecosystem, and significant network effects over the years both in terms of user base and liquidity. However, it also brings limitations, especially considering the existence of many non-EVM blockchains that offer different advantages such as lower transaction fees, higher throughput, and more advanced consensus mechanisms. In addition to purely technical advantages, many non-EVM blockchains can allow the Aave community to expand to an entirely new ecosystem, previously inaccessible user groups, and introduce new product possibilities.

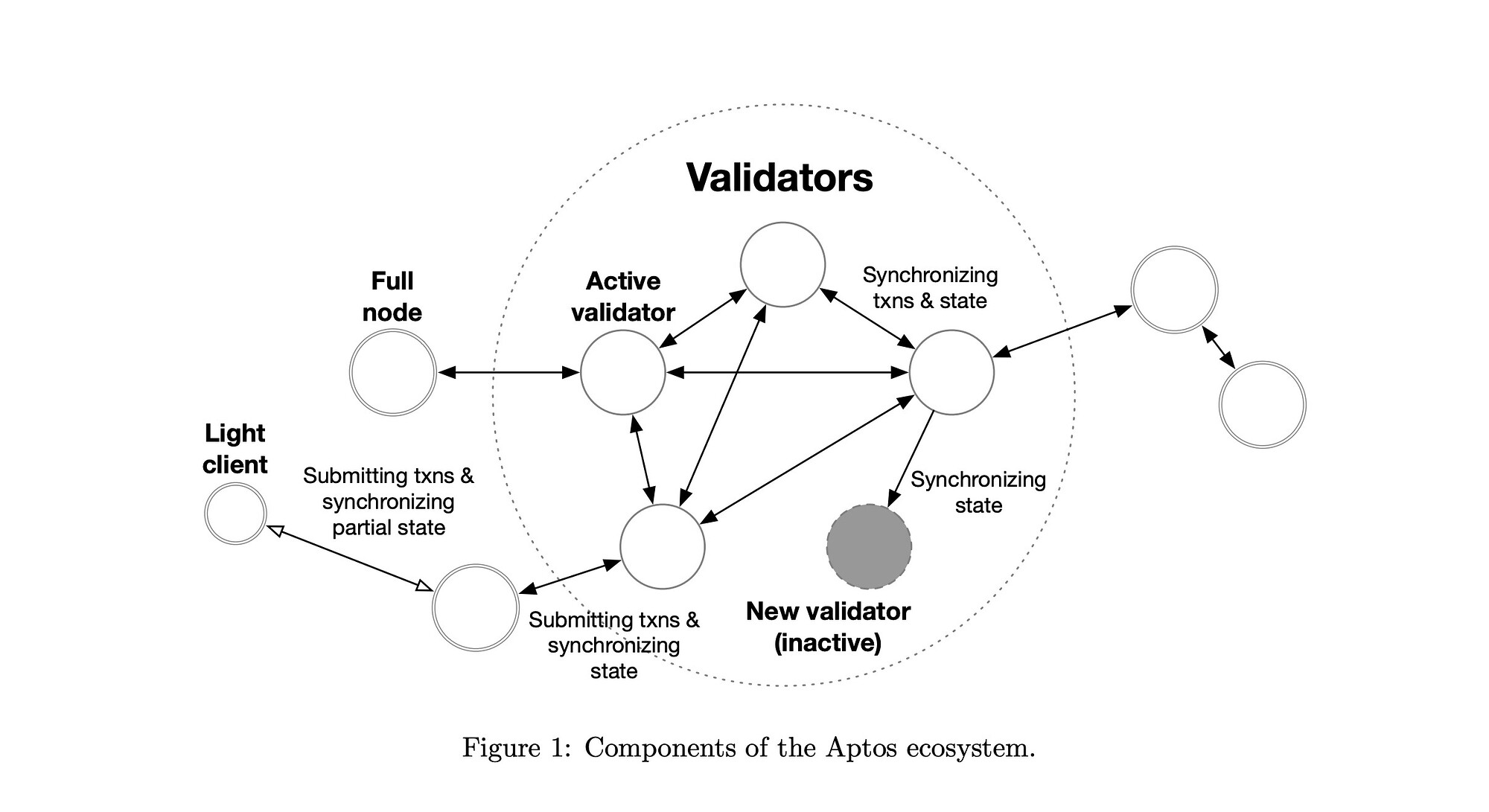

Aptos is a blockchain designed for building scalable and secure dApps. Developed by former leaders of Meta’s Diem blockchain project, it aims to address some of the limitations in existing blockchain systems such as throughput, scalability, and security. With a TVL of approximately $958.64M and growing rapidly, Aptos is the 11th largest chain by TVL (source:DeFiLlama). Its robust infrastructure offers high transaction throughput, low, predictable fees, and advanced security through the Move programming language that make Aptos an ideal platform for DeFi applications.

Motivation

Deploying Aave V3 on Aptos represents a groundbreaking expansion as it marks Aave’s first deployment on a non-EVM blockchain. This strategic move is significant as it opens up new technological frontiers, diversifies Aave’s ecosystem, and underscores its commitment to innovation.

By leveraging Aptos’ innovative technology and developer community, Aave can address diverse financial needs, attract new users, and drive greater innovation in the DeFi sector. This deployment aligns with the Aave community’s strategic goal to explore new technological possibilities and tap into a wider pool of talent and resources.

Key benefits of deploying Aave V3 on Aptos include:

1. First Non-EVM Deployment:

- This deployment is a significant milestone as Aave’s first move beyond EVM-compatible blockchains. It positions Aave to explore and integrate with new blockchain ecosystems, enhancing its resilience and broadening its reach.

2. Early Mover Advantage and Strong Brand:

- Aave is a leading brand in the DeFi space, with a strong reputation and market share. By deploying on Aptos, Aave captures early mover advantages on a high-performance blockchain, similar to its strategic expansions to Avalanche and other L2s. This can attract both seasoned DeFi users and new participants exploring Aptos.

3. Aptos’ Strategic Position:

- The Aptos team, with their background from Meta’s Diem project, has strong connections and expertise in finance, social and gaming sectors. Integrating Aave into Aptos complements these areas by adding a mature financial layer, essential for a complete blockchain ecosystem.

4. High Transaction Throughput:

- Aptos supports up to 30,000 transactions per second (TPS), crucial for DeFi protocols like Aave that handle a high volume of transactions, including loans, repayments, and interest accruals. This high throughput can significantly enhance user experience and enable new use cases that require high-frequency transactions.

5. Enhanced Security with Move Language:

- Aave v3 introduces sophisticated risk management tools and improved security protocols. The Move programming language used by Aptos has inherent security advantages, such as preventing reentrancy attacks. This alignment can lead to a more secure DeFi lending environment, leveraging Move’s safety features and formal verification.

6. Transaction Cost Efficiency:

- Aave v3 focuses on gas efficiency, critical for reducing transaction costs. Aptos’ efficient processing capabilities further complement this by potentially lowering transaction fees even more. This makes Aave more accessible and attractive to a broader range of users, from retail participants to institutional players.

7. Modular and Flexible Architecture:

- Aave v3’s modular and flexible architecture facilitates easier upgrades and expansions. Aptos supports upgradable smart contracts and a flexible account model, enhancing this aspect. This allows for seamless implementation of updates and improvements without significant disruptions or migrations.

8. Economic Benefits for the Aave DAO:

-

Market Share Growth: Access to new markets and user bases, specifically in APAC and Korea where Aptos has a strong presence.

-

Revenue Growth: New markets and user bases can significantly increase transaction volumes and generate additional revenue streams.

-

Incentives: Aptos Foundation has committed to provide up to 2M APT in liquidity mining incentives and rewards depending on performance in order to attract users and liquidity providers, increase adoption and boost the ecosystem’s growth. Aptos Foundation will work closely with Chaos Labs on determining the appropriate level of incentives relative to caps set.

By deploying Aave V3 on Aptos, we will have the first non-EVM deployment through which we can reach new user bases and tap into an ecosystem primed for high-demand DeFi applications, ensuring our protocol remains at the forefront of innovation.

Specification

Risk Parameters

ARFC has been updated by ACI to reflect latest Risk Parameters provided by Risk Service Providers 2025-04-30

We recommend using Chainlink data feeds for each asset, with the same setup for sUSDe as on Ethereum Core.

Specification

| Parameter | Value | Value | Value | Value |

|---|---|---|---|---|

| Asset | APT | USDC | USDT | sUSDe |

| Isolation Mode | No | No | No | No |

| Enable Borrow | Yes | Yes | Yes | Yes |

| Enable Collateral | Yes | Yes | Yes | Yes |

| Loan To Value | 58% | 75% | 75% | 65% |

| Liquidation Threshold | 63% | 78% | 78% | 75% |

| Liquidation Penalty | 10% | 5% | 5% | 8.5% |

| Reserve Factor | 20% | 10% | 10% | 20% |

| Liquidation Protocol Fee | 10% | 10% | 10% | 10% |

| Supply Cap | 1,000,000 | 25,000,000 | 40,000,000 | 14,000,000 |

| Borrow Cap | 500,000 | 23,000,000 | 37,000,000 | - |

| Debt Ceiling | - | - | - | - |

| UOptimal | 45% | 90% | 90% | - |

| Base | 0% | 0% | 0% | - |

| Slope1 | 7% | 6% | 6% | - |

| Slope2 | 300% | 40% | 40% | - |

| Stable Borrowing | No | No | No | No |

| Flashloanable | Yes | Yes | Yes | Yes |

| Siloed Borrowing | No | No | No | No |

| Borrowable in Isolation | No | Yes | Yes | No |

| E-Mode Category | N/A | sUSDe/Stablecoin | sUSDe/Stablecoin | sUSDe/Stablecoin |

sUSDe/Stablecoin

| Asset | sUSDe | USDC | USDT |

|---|---|---|---|

| Collateral | Yes | No | No |

| Borrowable | No | Yes | Yes |

| LTV | 90.00% | - | - |

| LT | 92.00% | - | - |

| Liquidation Bonus | 4.00% | - | - |

Technical Adaptation of Aave V3 to Aptos

Since our last update—and following the successful TEMP CHECK snapshot vote—we have made significant progress in tailoring Aave V3 for Aptos. We have been actively engaging with the community through regular development updates and rigorous testing on the Aptos testnet while involving security auditors at every step. Our extensive efforts have ensured that Aptos is now fully prepared to host Aave’s next-generation protocol.

Key areas of effort included:

1. Deep Protocol Understanding:

- Comprehensive study of the intricate financial models and smart contract design of Aave V3, ensuring that the full complexity of the protocol is faithfully reimagined on Aptos.

2. Mastering Move and the Aptos Ecosystem:

- Immersion into the Move language, its ecosystem, and best coding practices. This included analyzing standard native libraries, thoroughly understanding the Aptos VM architecture, and evaluating reference projects to inform our design choices.

3. Architectural Innovation:

- Addressing Solidity limitations by rethinking architectural decisions in Move, with careful consideration given to gas optimization, safety, and security. This process ensured we employed best practices tailored to the Aptos environment.

4. Robust Development Process:

- Building an MVP to evaluate model robustness, deployability, upgradability, scalability, and security. We re-implemented end-to-end, unit, and integration tests (including backward compatibility tests) and set up comprehensive pipelines for testing, compilation, deployment, audits, and documentation.

5. Tooling and Infrastructure:

- Developing a complete front-end interface, a TypeScript SDK, and a custom fuzzer to stress-test our implementation. Additionally, we prepared the monitoring services, indexers, Rust-based services, and all necessary infrastructure to support a seamless go-live, including initial configuration, tokens, and faucets.

6. Governance Considerations:

- Special attention was given to designing a governance strategy that aligns with the needs of a protocol on a new chain—starting with community guardians after launch, with future plans to integrate a full governance solution if market conditions warrant.

The UI is live and fully integrated with the TS SDK ensuring that developers can interact with the protocol and provide valuable feedback during the testnet phase. This level of preparation reflects our commitment to delivering a secure, efficient, and maintainable version of Aave V3 on Aptos.

Architectural Changes

This section outlines how the modern architecture and unique benefits of Aptos were capitalized in building this while ensuring the protocol retains its core functionality and top notch security.

1. Modular Conversion:

- Ethereum Approach: Aave V3 is composed of multiple interrelated Solidity contracts (e.g., LendingPool, Token Manager, Risk Engine).

- Aptos Adaptation: Each contract is restructured as a separate Move module. Move’s native module system enforces clear boundaries, enabling better separation of concerns, enhanced security and simplifying future upgrades.

2. Data & State Management:

- Solidity: State variables are stored in contracts and accessed via delegatable external calls, which can sometimes lead to state inconsistencies.

- Move: The use of resources in Move ensures that each asset is uniquely tracked and can’t be duplicated or lost. This strict management helps maintain consistency across the protocol’s state, avoiding re-entrances, double spending and other attack vectors. Also, Aptos has a uniquely defined global storage whose resources can only be modified by the owner of the resources thus preventing the storage from being maliciously modified in a transaction.

3. Control Access:

- Solidity: By design solidity allows external contracts to modify our own contract state which makes it hard to control and avoid unexpected 3rd party breaches.

- Move: Move modules have full control over their apis and do not allow by design delegate-calls (callbacks) to other contracts which prevents unexpected state-changes, re-entrances and other unwanted effects. On top of that, Aptos has a very secure system of allowing external modules to be friends and only scoping them to a particular scope of methods without ever giving control over its own resources.

4. Dispatch Mechanisms:

-

Solidity: Supports dynamic dispatch mechanism which enables a contract to call any other contract as long as a given interface is implemented. This can be however dangerous and the underlying implementation could often be replaced with a malicious one

-

Move: On the contrary supports only static dispatch which introduces a high degree of security as an external call to a module can only succeed at static compilation at which point contract address and implementation are known and immutable.

Security Enhancements

1. Formal Verification & Type Safety:

-

Move’s Built-in Features: Move was designed from the ground up to support formal verification. We have engaged with Certora to leverage its built-in verifier for mathematically proving smart contract properties, significantly reducing risks like re-entrancy attacks, integer overflows, and other vulnerabilities common in Solidity.

-

Resource-Oriented Programming: Resources in Move can only be created, moved, or destroyed in prescribed ways. This model ensures that token balances and collateral remain consistent and secure throughout all operations.

Performance and Gas Efficiency

1. Optimized Transaction Costs:

- Gas Model Comparison: Whereas Solidity requires significant manual optimization to reduce gas consumption, Move’s design inherently minimizes resource usage. This results in lower fees and more predictable transaction costs on Aptos.

2. Parallel Execution with Block-STM:

- Enhanced Throughput: Aptos’s Block-STM consensus allows for parallel transaction processing. This means that high-frequency operations (like loan issuance, repayments, and interest accruals) can be handled simultaneously, reducing bottlenecks and improving overall performance.

3. Atomic Transactions:

- Consistency: All operations in Move are executed as part of an atomic transaction. This guarantees that either every part of an operation completes successfully or none do, preventing partial state changes and enhancing reliability. Transactions modifying the same state are executed atomically and linearized.

Developer Experience and Future-Proofing

1. Improved Modularity & Maintainability:

- Move’s Module System: The modular architecture in Move not only organizes code in a logical manner but also facilitates isolated testing, easier upgrades, and reusability of code components.

2. Enhanced Tooling:

- Ecosystem Maturity: The Move ecosystem is evolving rapidly, building improved IDE plugins, debugging tools, and testing frameworks. These tools will aid developers in writing, testing, and deploying smart contracts with greater confidence.

3. Future Integrations:

- Adaptability: The structured approach of Move allows for easier integration of new features or protocol improvements in the future. As the Aptos ecosystem grows, Aave V3 can seamlessly evolve to incorporate emerging trends and requirements.

4. Governance Strategy:

- Phased Approach to Governance: Initially, Aave Labs will retain control of the critical protocol keys while the market is in its early stages. Over the coming months—as the market matures, operates smoothly, and undergoes rigorous verification—we will gradually transition key management to trusted community guardians who will provide oversight and help manage early protocol decisions. In parallel, we will engage with relevant service providers to evaluate the feasibility of integrating the Aave Governance V3 system alongside a.DI, ensuring that future governance processes remain robust and fully aligned with community interests.

Development & Testing

1. Testnet Deployment:

- A fully functional testnet for Aave V3 on Aptos is already live). This environment is used for rigorous testing of Move modules, simulating real-world scenarios.

2. Audit & Security Reviews:

- Comprehensive internal and external audits are done and ongoing with companies like: SpearBit/Cantina, Certora and OtterSec. These will focus on ensuring that the Move modules adhere to Aave’s strict security and performance standards.

- After the audits are complete, a Security Contest will go live followed by a comprehensive Bug Bounty program when we go live. This initiative, funded by Aave Labs, the Security Contest will offer a total reward pool of $150,000 paid in GHO stablecoin. The contest is designed to incentivize thorough testing and uncover any potential vulnerabilities, ensuring that our protocol meets the highest security standards prior to the mainnet launch.

3. Audit Reports: aptos-aave-v3/audits at main · aave/aptos-aave-v3 · GitHub

4. Developer & Community Feedback:

- Continuous feedback will be solicited from our developer community to ensure that the transition to Move is smooth and that any issues are promptly addressed.

Conclusion

Deploying Aave V3 on Aptos presents a significant opportunity to drive Aave’s growth and expansion. By leveraging Aptos’s innovative capabilities and the power of the Move programming language, we can build a protocol that not only enhances efficiency and security but also broadens our reach into new markets and developer communities. This strategic initiative positions Aave at the forefront of DeFi innovation, enabling us to tap into emerging opportunities and accelerate ecosystem-wide growth.

Next Steps

- Integrate Chaos Labs and LamaRisk suggested assets and risk parameters report once available.

- Refine the ARFC based on community feedback and risk providers recommendations.

- Submit the ARFC for a Snapshot vote for final approval.

- If consensus is reached, submit an onchain AIP Vote for Aave V3 on Aptos (upon Mainnet launch)