Overview

Chaos Labs supports listing mUSD on Aave’s v3 Ethereum Core and Linea instances. Below is our analysis and initial risk parameter recommendations.

Metamask (Wallet Layer & Brand)

MetaMask is one of the most widely adopted self-custodial crypto wallets, developed by Consensys, a leading Ethereum software company. Since its launch in 2016, MetaMask has played a central role in enabling access to the Ethereum ecosystem and broader Web3 landscape, offering tools for interacting with dApps, managing assets across multiple chains, and signing on-chain transactions.

Consensys, founded by Ethereum co-founder Joseph Lubin, is behind a suite of infrastructure and developer tools including Infura, Linea, Truffle, and Ethereum clients Teku and Besu. It remains one of the most active software firms building atop Ethereum.

In 2025, MetaMask introduced MetaMask USD (mUSD), a non-rebasing stablecoin native to its wallet ecosystem. The launch follows increased regulatory clarity brought by the Genius Act, allowing Consensys to move forward with a compliant, wallet-native stablecoin offering.

While MetaMask does not directly issue mUSD, it acts as the front-facing distribution and utility layer. This integration allows users to hold and transact with mUSD directly inside the MetaMask wallet. Additionally, on- and off-ramp functionality is available through MetaMask’s integration with Transak, enabling users to seamlessly convert between fiat and mUSD. The actual issuance and redemption of mUSD is handled by Bridge, a regulated stablecoin platform that operates behind the scenes to ensure full collateral backing and compliance.

Bridge (Issuer – Stripe Subsidiary)

Bridge is the official issuer of mUSD. It operates as a regulated stablecoin orchestration platform, offering licensing, compliance, reserve management, and monitoring infrastructure to support the issuance and redemption of fiat-backed stablecoins.

Bridge abstracts away the complexity of blockchain infrastructure, enabling trusted brands like MetaMask to offer stablecoins without directly managing custody or compliance. While MetaMask serves as the wallet and distribution layer.

In February 2025, Bridge was acquired by Stripe, a global payments company, signaling a broader convergence between fintech and stablecoin infrastructure. Post-acquisition, Bridge continues to operate independently but benefits from Stripe’s regulatory reach and institutional credibility, especially relevant in light of the Genius Act, which established a regulatory framework for stablecoin issuance in the U.S.

Bridge utilizes the M0 protocol as the backend infrastructure for mUSD issuance, enabling programmability and cross-chain operability while maintaining full compliance and transparency.

M0 Protocol (Infrastructure Layer)

M0 is a stablecoin infrastructure platform purpose built for issuing application specific stablecoins. At its core, M0 manages the issuance and redemption of $M, a fully collateralized digital dollar that acts as the foundation for custom stablecoin implementations known as M0 Extensions.

The protocol breaks down the concept of a stablecoin into two modular layers:

- A value layer: represented by the $M token, backed 1:1 by eligible collateral (primarily short-duration U.S. Treasuries).

- An application layer: represented by Extension tokens, which wrap $M to inherit its collateral and yield properties, while adding custom logic, branding and functionality.

M0 operates as an open and federated system, where Minters, Validators, and Governance participants interact to ensure the security, transparency, and compliance of the system. M0 is designed to be cross-chain interoperable, with Ethereum as the canonical hub for minting and governance and extensions like mUSD operable across L2s such as Linea.

M Token

The $M token is the core collateral-backed asset of the M0 Protocol. It is an immutable, ERC-20 compliant token, fully backed 1:1 by eligible collateral such as short-duration U.S. Treasuries or on-chain options like USTB, a tokenized short-duration U.S. government securities fund.

While not designed for end users, $M serves as the foundation for all M0 Extension tokens, like mUSD, which wrap $M to inherit its composability, compliance and yield properties.

Minting and burning of $M is exclusively controlled by the protocol’s MinterGateway contract, with supply changes initiated by governance approved Minters and validated by governance approved Validators, ensuring all operations are fully collateral-backed and compliant with protocol rules.

$M token can be wrapped into any M0 Extension token or unwrapped back to $M at a fixed 1:1 rate, with no slippage or fees. This mechanism ensures seamless interoperability between custom stablecoins and the underlying collateral layer.

Extension Tokens

Extension Tokens represent the application layer of the M0 Protocol. Built on top of the foundational $M token, they enable developers to issue custom ERC-20 stablecoins with their own branding, logic and distribution mechanics, while inheriting the full collateral backing, compliance guarantees and infrastructure of $M.

Your Custom Stablecoin e.g mUSD (Extension)

↓ wraps/unwraps

$M Token (Foundation)

↓ backed by

US Treasury Collateral

These tokens inherit the cross-chain interoperability features of the M0 Protocol, allowing them to exist across ecosystems via Portals built on protocols like Wormhole and Hyperlane. This enables native functionality on chains like Linea, while maintaining Ethereum as the canonical source of truth.

Wrapping and unwrapping between an Extension token and $M occurs at a fixed 1:1 rate and can be performed by permissioned users as defined by each Extension’s governance or configuration.

In addition, the M0 architecture supports Extension-to-Extension swaps, enabling users to directly convert one Extension token into another. These swaps require both Extension contracts to grant permission to approved entities to facilitate the operation and by default this functionality is also permissioned for security and control.

Mint and Redemption of M Token

The minting and redemption of $M tokens are governed by a permissioned and highly controlled process designed to ensure full collateralization and compliance at all times. These operations are facilitated by a set of trusted roles: Minters, Validators, SPV Operators, and underlying custody structures.

The M0 Protocol operates under a hub-and-spoke architecture, where Ethereum serves as the canonical hub, the only chain where $M can be natively minted and redeemed. Spoke chains include Ethereum Layer 2s (e.g., Linea, Arbitrum) and other EVM or non-EVM L1s.

While users can freely access and use $M on spoke chains via bridging mechanisms, minting and redemption of the underlying collateral is strictly restricted to the Ethereum hub. Both hub-to-spoke and spoke-to-spoke bridging are supported, enabling interoperability across the multichain M0 ecosystem while preserving central control over issuance and collateral flows.

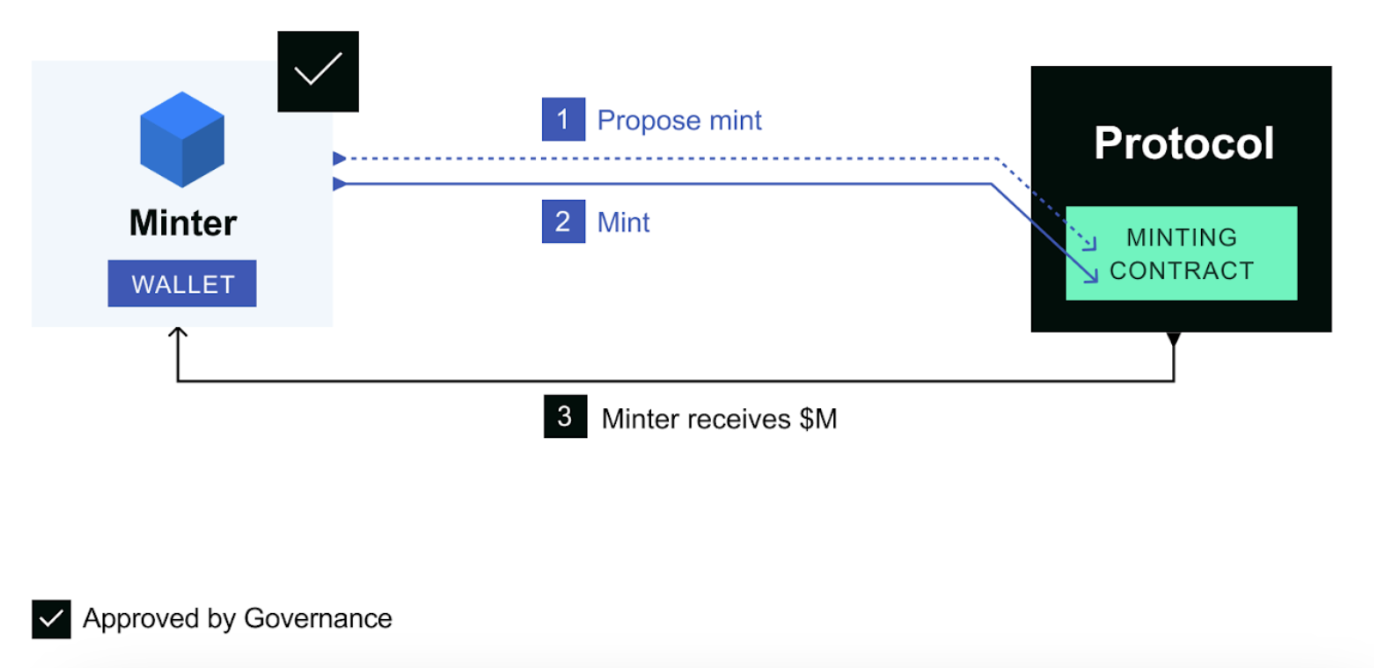

Mint

To mint $M, a governance approved Minter deposits eligible collateral (e.g., short-duration U.S. Treasuries or tokenized equivalents like USTB) into an SPV controlled custody account. The Minter then submits a proposeMint() request through the protocol’s MinterGateway contract.

This request is subject to a Mint Delay period, during which any Validator may cancel the transaction if the collateral conditions are not met. Once the delay has passed and all Core Operating Conditions are validated, the Minter can execute the mint and $M is issued to the designated address.

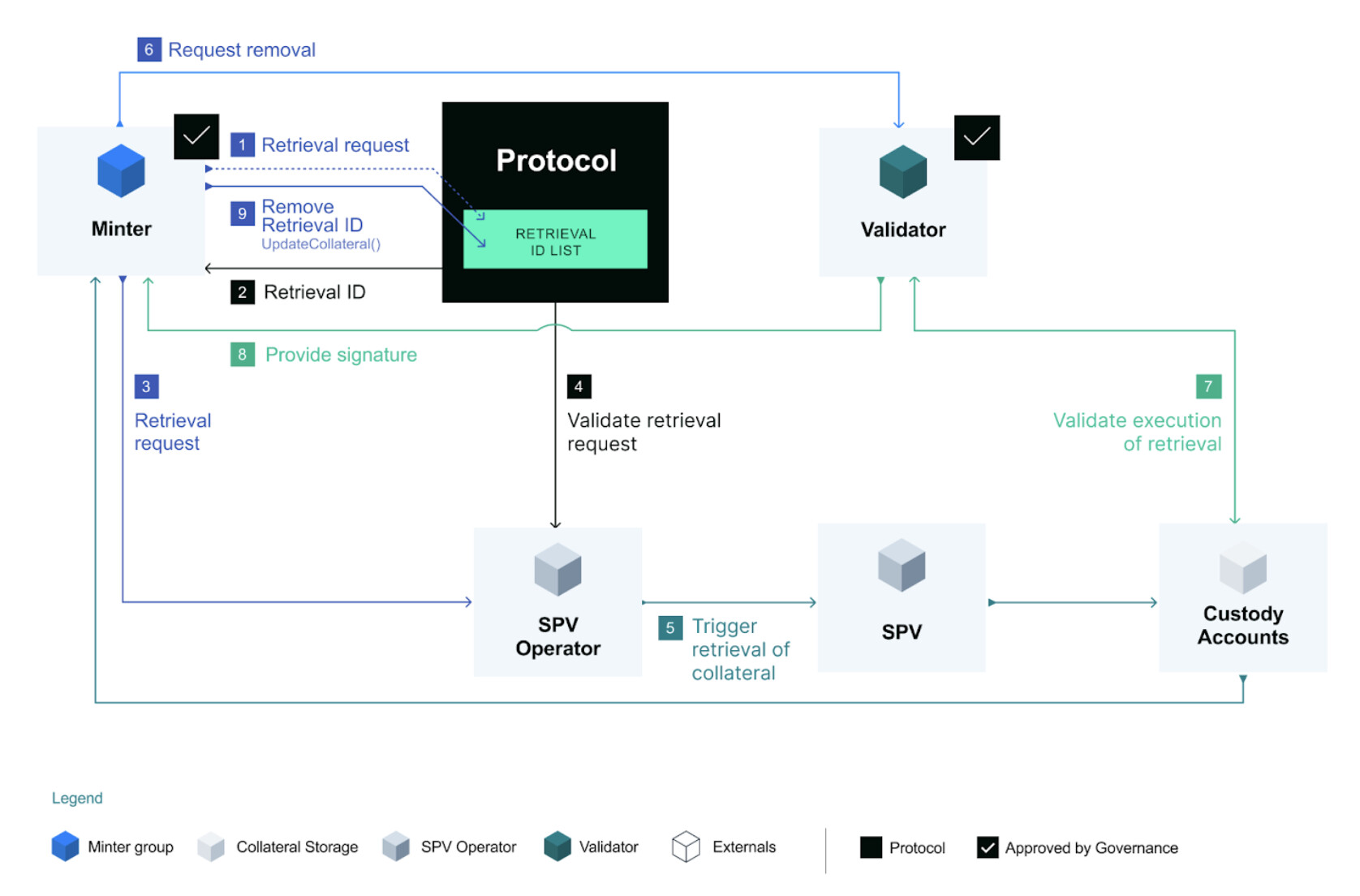

Redemption

To redeem the underlying collateral, the Minter initiates a proposeRetrieval() request. If the request passes validation, a RetrievalID is generated and the protocol subtracts the corresponding amount from the Minter’s on-chain collateral balance.

An SPV Operator then facilitates the liquidation of the collateral held in custody and transfers the funds to the Minter. Once confirmed, a Validator signs off on the removal of the RetrievalID, and the collateral is officially released from the system.

Trusted Entities Involved in Mint and Redemption

- Minters: Permissioned institutions authorized to mint and redeem $M against real-world collateral.

- Validators: Independent parties who verify collateral backing, enforce protocol rules, and approve or cancel mint/redeem operations.

- SPV (Special Purpose Vehicle): A legally isolated entity that holds custody of the collateral, designed to be insolvency remote and compliant with regulatory standards.

- SPV Operators: Entities authorized to access custody accounts.

- Custody Accounts: Regulated accounts where collateral is stored, segregated, and independently audited to meet the protocol’s collateral eligibility criteria.

M Token Backing

Each $M token is fully backed by eligible collateral, with all collateral types and requirements approved by M0 Governance. Currently, the backing consists of:

- Off-chain short-duration U.S. Treasuries, held via regulated custodians in insolvency-remote structures (via SPVs), and

- On-chain tokenized equivalents, such as UST, a tokenized U.S. Treasury fund.

The protocol maintains a 102% collateralization ratio. This buffer provides additional security in the event of operational delays or yield volatility in the bond market.

As of now, the total value of collateral backing the system is approaching $500 million, which supports approximately 487 million $M tokens currently issued onchain. These $M tokens are wrapped into various M0 Extension tokens, including mUSD, USDai and other application specific stablecoins launched by third-party developers and institutions.

Collateral Storage

The collateral backing $M tokens is held in carefully designed custody structures to ensure security, transparency and legal separation. All assets must be stored in entities and accounts that meet the standards defined by M0 Governance and must be verifiable by approved Validators.

Collateral is held by SPVs. These SPVs:

- Are orphaned legal entities with no direct control or affiliation with Minters or Validators,

- Do not conduct any other business beyond the storage of collateral for Minters and the issuance of notes representing that collateral,

- Are restricted in purpose, with no ability to incur liabilities outside of collateral management.

To interact with the on-chain protocol, each SPV works with an authorized SPV Operator responsible for executing real-world asset transfers during redemption flows. All asset movements are subject to verification by Validators and must comply with the protocol’s collateral rules.

Additionally, SPV-held collateral must meet strict criteria, including:

- Full asset segregation: not just between Minters, but also at the level of each individual wallet address,

- Limited recourse: Minter claims are strictly limited to their own pledged collateral.

mUSD

mUSD is a non-rebasing ERC-20 stablecoin issued by Bridge and distributed through the MetaMask. It is live on both Ethereum and Linea, with deployments completed in mid-August 2025.

mUSD is built as an M0 Extension and inherits its core infrastructure, collateral backing, and cross-chain interoperability from the M0 Protocol. Specifically, mUSD is a MYieldToOne-type Extension, meaning it wraps $M tokens 1:1 but does not distribute yield to users. Instead, all rewards accrued from the underlying collateral are directed to a single designated address. This makes mUSD functionally similar to a zero-yield, US treasury backed stablecoin.

To ensure security, mUSD underwent a 4-audit process in August 2025, covering both the Extension contract and underlying issuance mechanics.

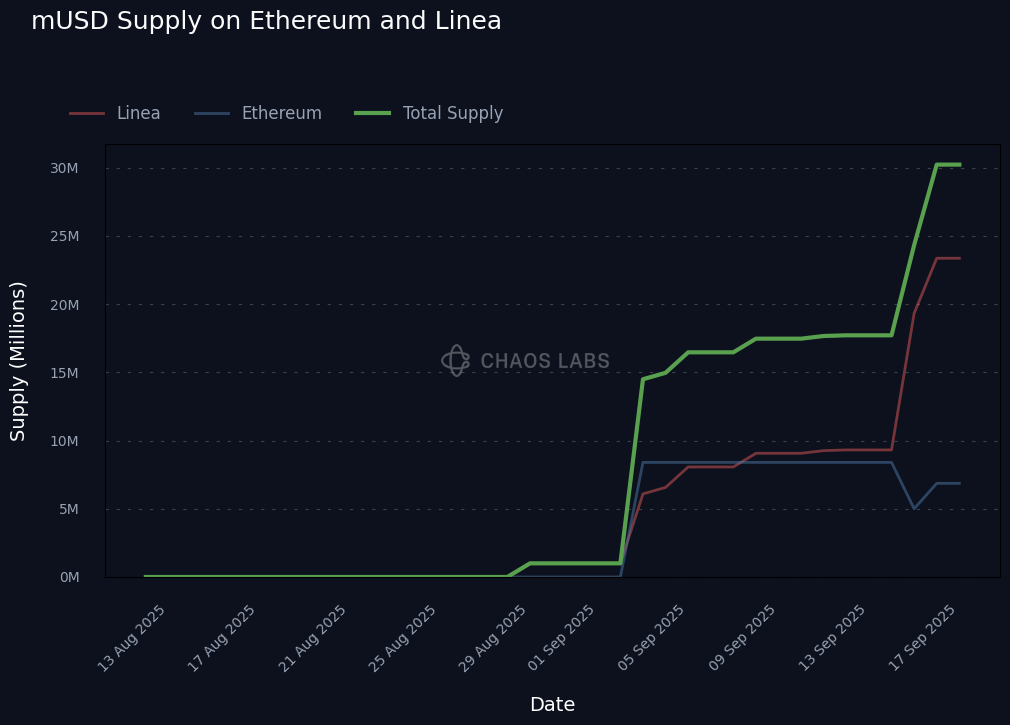

Market Capitalization

As of mid-September 2025, mUSD has reached a total supply of over 30 million, with most of the growth occurring since the beginning of the month. The supply is split across two chains:

- Linea: ~23.3 million

- Ethereum Mainnet: ~6.8 million

The majority of mUSD growth is currently concentrated on Linea, where it benefits from deep liquidity and active ecosystem incentives. Over 77% of mUSD supply on Linea is deployed in various Etherex DEX pools, primarily paired against USDC, ETH and USDT making it a highly liquid stablecoin relative to its current size.

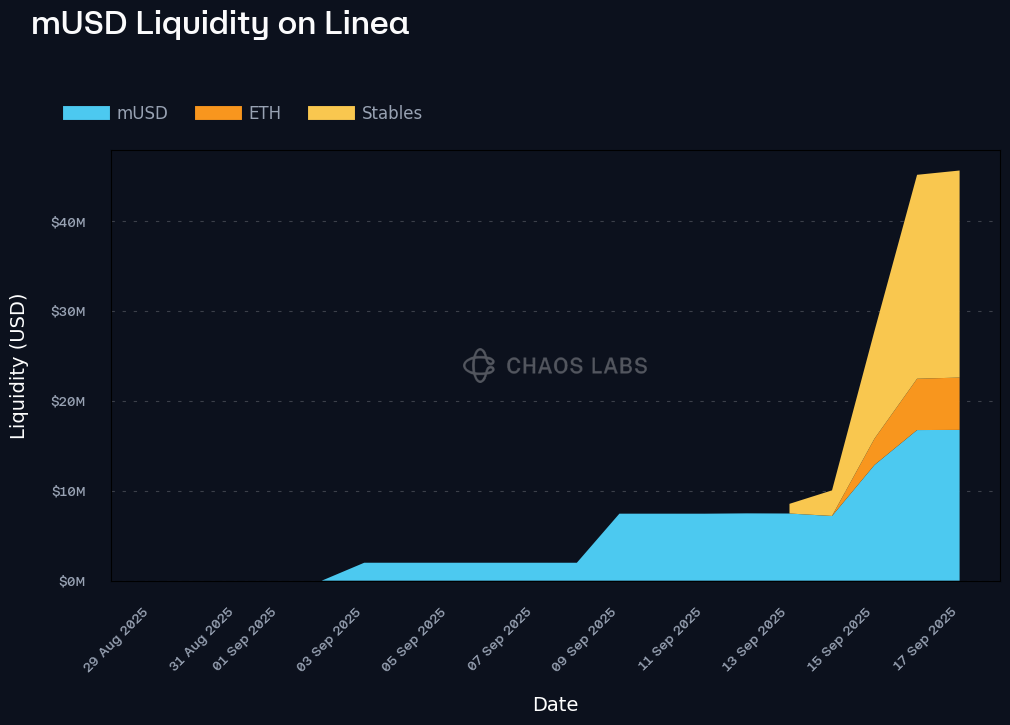

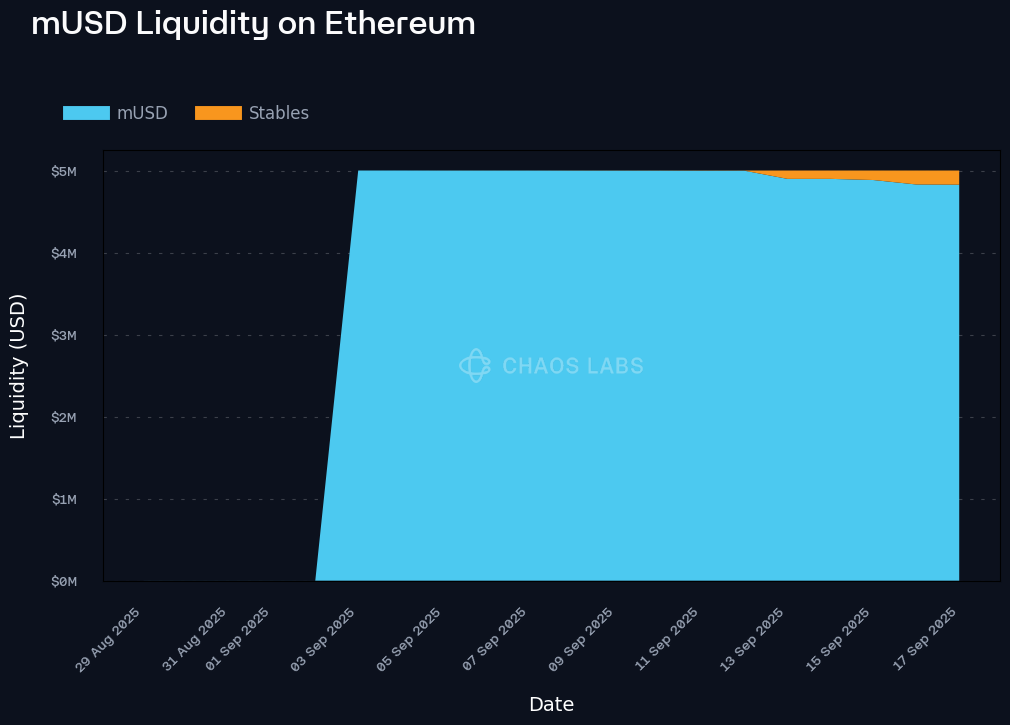

Liquidity

mUSD has over $45 million in total liquidity on Linea, primarily paired against USDC, USDT and ETH across various Etherex DEX pools. This makes mUSD one of the most liquid stablecoins on Linea relative to its circulating supply.

This rapid growth in liquidity has been driven in part by the Linea Ignition program, which began on September 15th and is scheduled to run until October 27th. The program incentivizes liquidity provisioning and has significantly deepened liquidity for mUSD. The duration and reward allocation of the program may be extended or adjusted.

Importantly, over $27 million of the $45 million in liquidity is on the buy side, held in USDC, USDT and WETH. This allows:

- Up to $24 million in mUSD to be swapped into stablecoins with <5% price impact

- Up to $21 million into ETH with <5% price impact

This depth supports both trading and lending protocol integrations, positioning mUSD as a highly liquid token on Linea, especially when viewed relative to its 24 million circulating supply on the chain.

However, this liquidity profile is currently incentive driven and should be re-evaluated once the Linea Ignition program ends, as a portion of the capital may be yield seeking.

On Ethereum Mainnet, token supply concentration patterns are similar to Linea, with a large portion of the mUSD circulating supply deployed into a DEX pool on Uniswap v4. Out of the current ~6.8 million mUSD circulating on Ethereum, approximately 4.8 million mUSD (over 70%) is deposited into a USDC/mUSD pool.

Unlike on Linea, this does not necessarily make mUSD a liquid token on Ethereum, as the buy-side depth is significantly limited. Only around $359,000 in USDC liquidity is available on the buy side, meaning that large-scale mUSD liquidations would likely incur substantial slippage if mUSD were to be listed as collateral.

This low buy-side liquidity poses challenges for atomic liquidations and large trades. However, it is reasonable to expect that the peg of mUSD on Ethereum will remain stable, as arbitrageurs can bridge between Ethereum and Linea to take advantage of price discrepancies, facilitated by M0’s native cross-chain interoperability design.

Mint and Redemption

While the minting and redemption of $M tokens have been detailed in the M0 Protocol section, the process for mUSD builds on that flow by introducing an additional wrapping layer through the SwapFacility, a core interoperability contract within the M0 ecosystem.

Mint Flow

The issuance of mUSD follows a permissioned, multi-step process involving collateralization, token minting, and wrapping.

First, a governance approved Minter deposits eligible collateral into an SPV controlled custody account. Once the collateral is validated by Validators, the Minter mints $M through the protocol’s MinterGateway contract.

To convert $M into mUSD, the Minter interacts with the mUSD Extension contract, first calling the wrap function on the MYieldToOne MUSD contract, which then triggers the swapInM function on the SwapFacility contract. This flow results in the issuance of non-rebasing mUSD tokens atomically, fully backed by overcollateralized reserves via the M0 Protocol.

Redemption Flow

The redemption of mUSD similarly follows a permissioned, structured process in reverse.

A whitelisted Minter first calls the unwrap function on the MYieldToOne MUSD contract to convert mUSD back into its underlying $M tokens. This triggers a call to the swapOutM function on the SwapFacility, executing a atomic 1:1 transaction, fee-free conversion from mUSD to $M.

Once the Minter holds the unwrapped $M, they initiate a proposeRetrieval() through the MinterGateway, signaling intent to redeem the underlying collateral. After passing validation and final checks by Validators, the associated SPV Operator liquidates the collateral held in custody and transfers the proceeds to the Minter.

SwapFacility

The SwapFacility is the central hub that powers 1:1 atomic conversions between $M and any M0 Extension, including mUSD. It ensures value preservation across the M0 ecosystem and serves as the exclusive gateway for wrapping and unwrapping operations.

Because all Extensions wrap $M, the SwapFacility also enables Extension-to-Extension swaps without the need for separate AMM pools. For example, a user could technically convert mUSD to USDai through atomic process (e.g mUSD ⇄ $M ⇄ USDai), maintaining full parity throughout. However, this feature is disabled by default and requires explicit permission from both Extension contracts to be activated. The ability to use SwapFacility is currently not enabled within mUSD.

This design concentrates liquidity, simplifying liquidity provisioning and enabling composable interoperability between all M0-based stablecoins.

Bridging

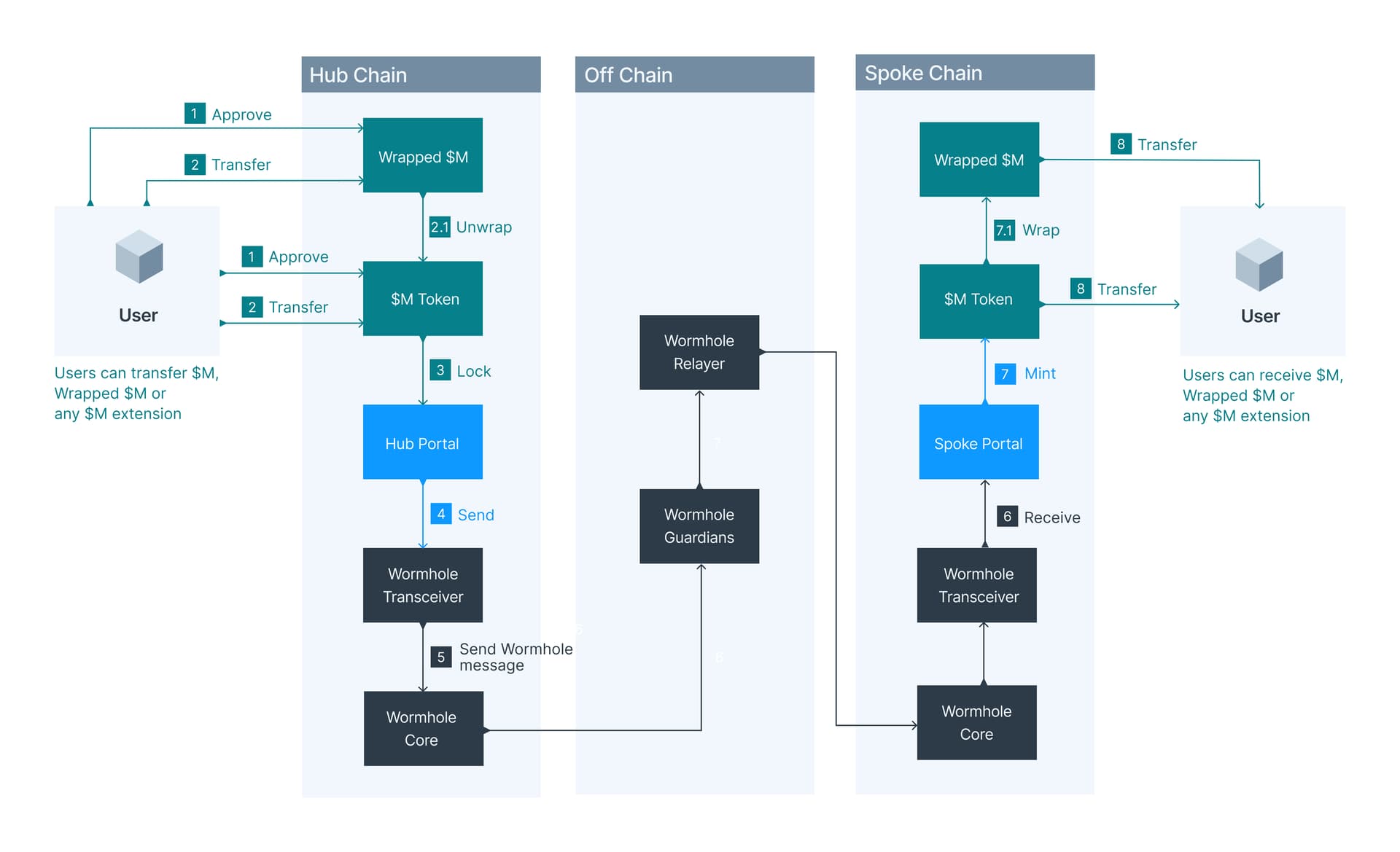

The M0 Protocol uses a Hub-and-Spoke architecture to support secure and consistent multichain deployment of the $M token and its Extensions. This model preserves Ethereum as the canonical source of truth while enabling fast and composable access to $M across Layer 2s and other chains.

Ethereum acts as hub for the native $M token. All $M minting, burning and governance operations (including collateral verification, validator attestations and yield index propagation) originate from this hub.

The HubPortal contract on Ethereum manages the core bridging logic using a lock and release mechanism. When bridging from Ethereum to a spoke chain, $M tokens are locked in the HubPortal, when bridging back, the corresponding amount is unlocked and released to the user. The HubPortal also propagates global system variables such as the $M earning index to all connected chains, ensuring consistency across the ecosystem. HubPortal additionally tracks the principal amount of $M bridged to each spoke, ensuring that no spoke can release more tokens than were originally locked on Ethereum.

Spoke chains host representations of the $M token and its Extensions, allowing users to interact with M0-based assets in fast, low-cost environments.

Spoke chains host SpokePortal contracts and operate using a mint and burn mechanism. When bridging to a spoke chain, a representation of $M is minted on the destination chain. Conversely, when bridging back to Ethereum, the representation is burned on the spoke chain before the underlying $M is released from the HubPortal. Additionally, spoke chains receive and apply updates to the $M earning index propagated from the Ethereum hub, ensuring consistent protocol logic and state across all supported networks.

This bridging system is built on top of Wormhole’s cross-chain messaging infrastructure, leveraging its Native Token Transfers (NTT) and general message passing framework to ensure security and protocol wide synchronization.

Overall, this architecture enables hub-to-spoke, spoke-to-hub and even spoke-to-spoke bridging, while maintaining full supply integrity across the M0 ecosystem.

Oracle/Pricing

We recommend using Chainlink USD price feeds for mUSD on both Ethereum and Linea:

- Ethereum:

0xc90E3460424fb8ea79775089E9053113FEE34Ed0 - Linea:

0xc834a55fb78dEa866E9cd86047Df0F584B9da339

In line with Aave’s approach for stablecoins, we recommend applying a 1.04 USD price cap to guard against oracle anomalies or low-liquidity price spikes.

LT, LTV and Liquidation Bonus

We do not recommend enabling mUSD as collateral on Aave at this time.

mUSD is a newly launched stablecoin (12 August 2025) with a relatively short track record and permissioned mint/redeem flows.

As such, we recommend listing mUSD as a borrowable asset only, without collateral usage, to avoid introducing liquidation risk.

Specification

| Parameter | Value | Value |

|---|---|---|

| Asset | mUSD | mUSD |

| Chain | Ethereum | Linea |

| Isolation Mode | No | No |

| Borrowable | Yes | Yes |

| Collateral Enabled | No | No |

| Supply Cap | 10,000,000 | 70,000,000 |

| Borrow Cap | 8,000,000 | 60,000,000 |

| Debt Ceiling | - | - |

| LTV | N/A | N/A |

| LT | N/A | N/A |

| Liquidation Penalty | N/A | N/A |

| Liquidation Protocol Fee | N/A | N/A |

| Variable Base | 0% | 0% |

| Variable Slope1 | 6.5% | 6.5% |

| Variable Slope2 | 60% | 60% |

| Uoptimal | 80% | 80% |

| Reserve Factor | 20% | 20% |

| Stable Borrowing | Disabled | Disabled |

| Flashloanable | Yes | Yes |

| Siloed Borrowing | No | No |

| Borrowable in Isolation | No | No |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0