September 2025

This update highlights Chaos Labs’ activities and proposals in September.

Highlights

Introduction of cbBTC Stablecoin E-Mode on Base

The initiative aimed to enhance capital efficiency for cbBTC collateral, enabling users to borrow USDC and GHO at higher LTV ratios while maintaining a controlled risk framework.

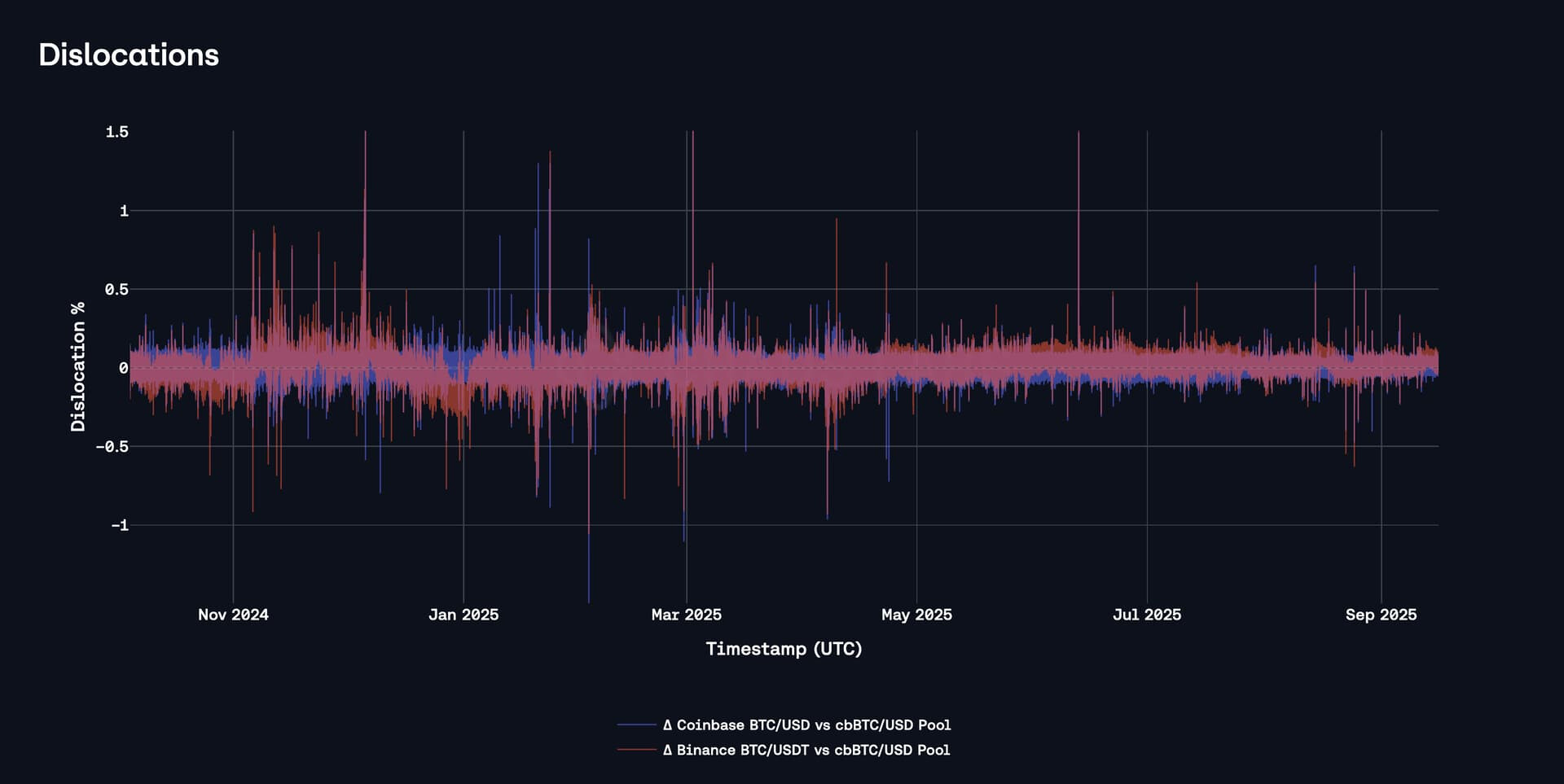

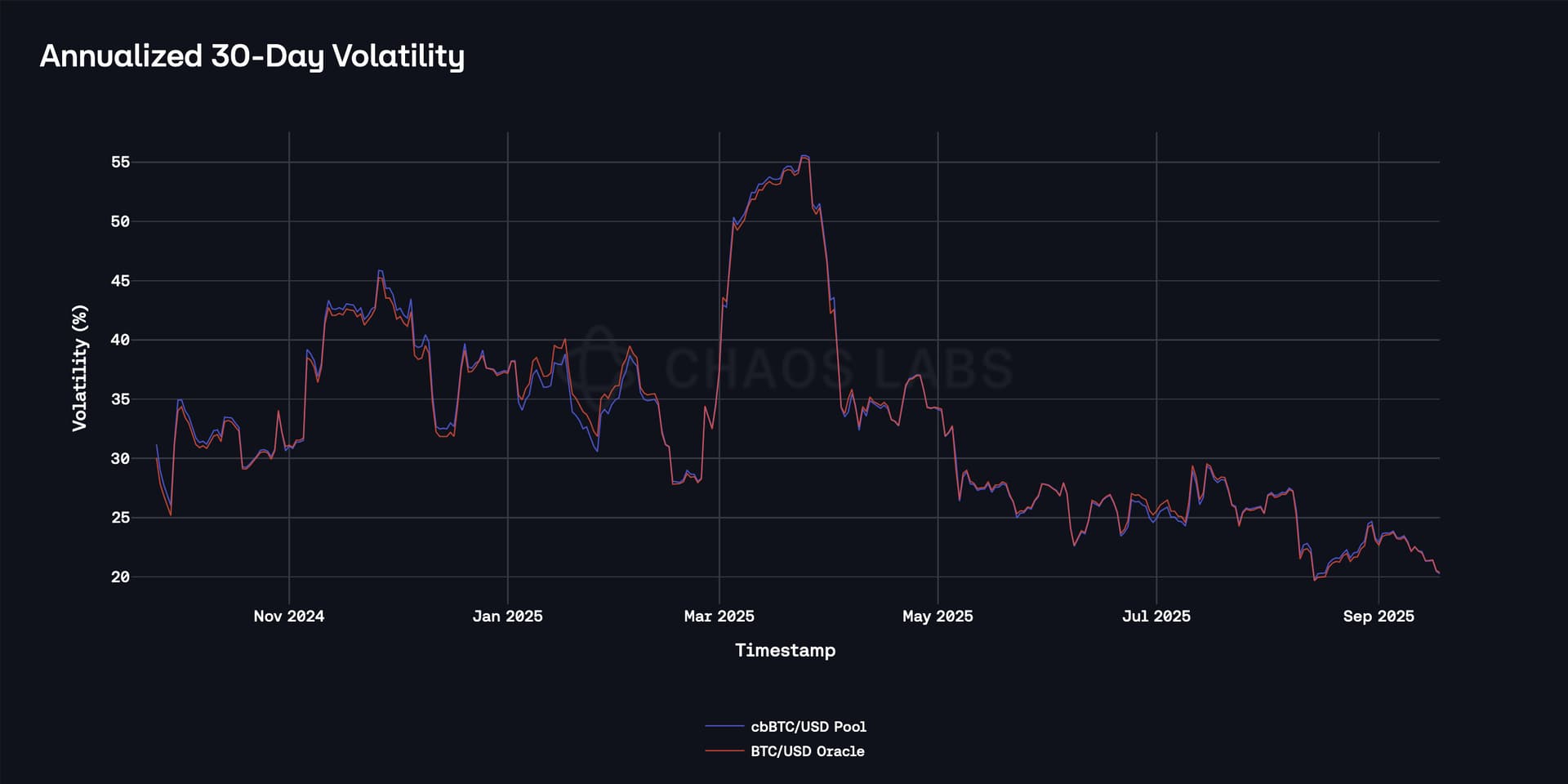

Thanks to our coverage of cbBTC stability and liquidity, compared to its exchange counterparts, Chaos Labs identified the ability to improve the asset’s risk parameters, ensuring a highly competitive environment on the Base Instance.

cbBTC’s rapid redemption mechanisms and institutional-grade custody significantly reduce wrapper-specific risks. These characteristics, combined with deep liquidity on both decentralized and centralized venues, make cbBTC a suitable candidate for an isolated Stablecoin E-Mode.

This change is expected to increase stablecoin borrowing demand and generate growth of protocol revenue, reinforcing Aave’s position in the growing Bitcoin-collateral market.

Management of the Plasma Deployment

As a key Aave deployment, Chaos Labs conducted a pre-deployment analysis on Plasma to identify optimal launch assets and parameters, and followed with active collaboration with the Plasma team in order to maximize the success of the launch.

Our collaboration focused on targeted asset listings to stimulate growth of the market and organic usage, while maintaining safe parameters and helping the coordination of LPs and DEX liquidity. This support led to a highly successful launch of the instance.

The Plasma Aave Instance has grown to $6.8B of supplied assets and $2B of borrow demand within the first week of launch. With its record growth, it currently represents the second biggest Aave instance.

Risk Oracles

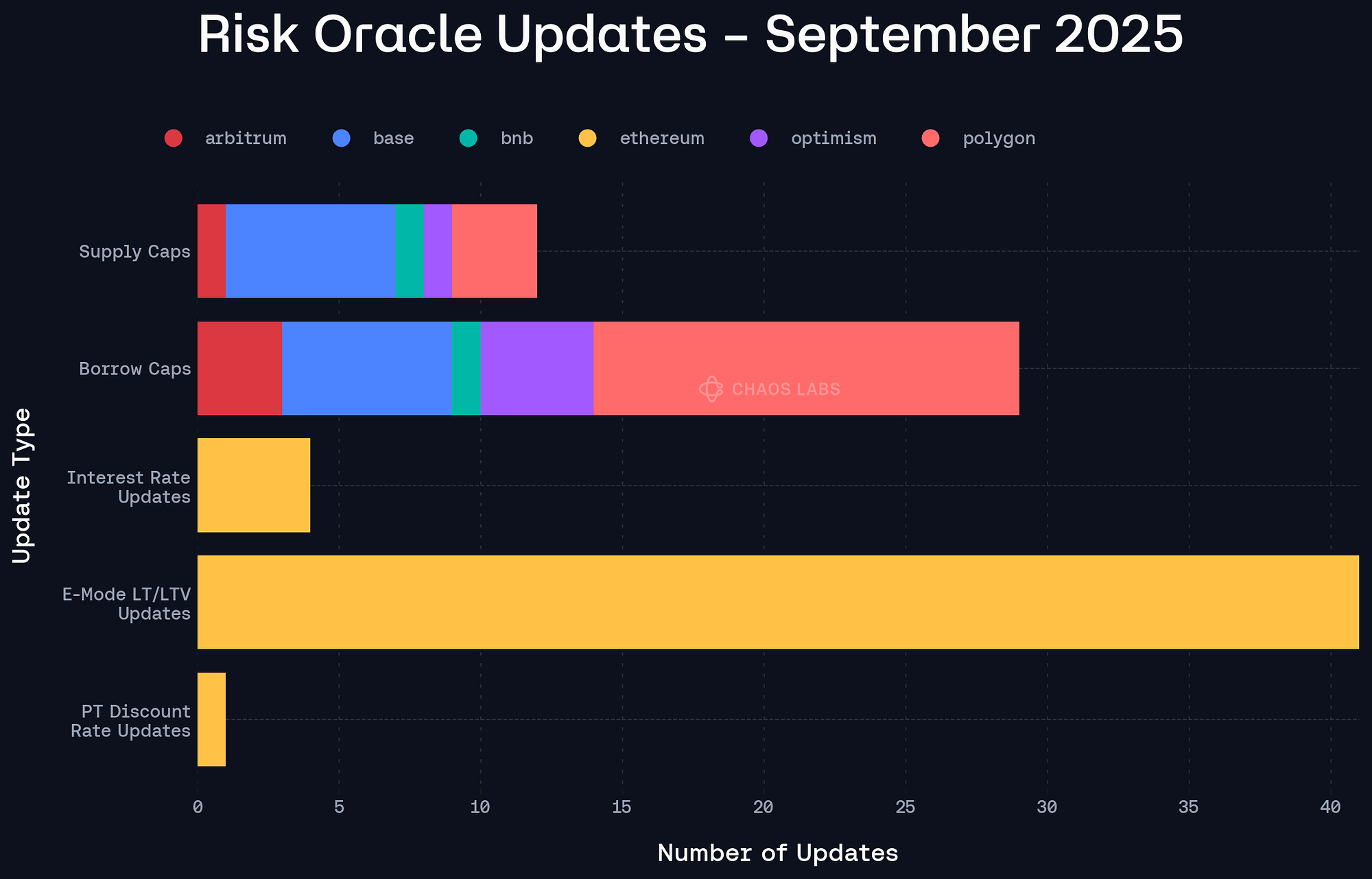

Supply and Borrow Cap Oracles

Throughout September, the Supply and Borrow Cap Risk Oracles continued to operate efficiently across all active markets.

The majority of updates occurred on Base, Optimism, and Polygon, where utilization patterns prompted dynamic cap adjustments to maintain optimal liquidity.

Borrow cap updates remained the most frequent, reflecting responsive calibration to real-time demand changes, particularly across stablecoin and liquid staking asset markets.

PT Risk Oracle

The September maturity PTs reached full maturity, triggering a scheduled migration of positions to the November-maturity PTs.

Specifically, part of the liquidity transitioned from PT-USDe-25SEP2025 and PT-sUSDe-25SEP2025 into their November counterparts, with total migrated amounts of approximately $210 million and $1.64 billion, respectively.

The drop, visible in the previous plot, stems from the significantly lower implied of the PT-USDe November compared to its September counterpart.

As these PTs approach shorter remaining durations, the oracle dynamically adjusted LT and LTV parameters to reflect their decreasing time to maturity risk.

This adaptive mechanism continues to facilitate sustainable growth in the PT ecosystem while ensuring smooth rollovers between maturities.

Forum Activity

We published the following proposals, updates, and analyses, including risk parameter updates:

- Chaos Labs Risk Stewards - Increase Supply and Borrow Caps on Aave V3 Linea Instance- 09.01.25

- Chaos Labs Risk Stewards - Increase USDe uOptimal on Ethereum Core - 08.12.25

- Chaos Labs Risk Stewards - Increase Supply and Borrow Caps on Aave V3 Linea Instance- 09.04.25

- [ARFC] sAVAX LTV & LT Adjustment

- Chaos Labs Risk Stewards - Increase Supply and Borrow Caps on Aave V3 Instance- 09.08.25

- Chaos Labs Risk Stewards - Increase Supply Caps on Aave V3 Instance- 09.10.25

- Chaos Labs Risk Stewards - Increase Supply Caps on Aave V3 Instance- 09.11.25

- Chaos Labs Risk Stewards - Increase Supply Caps on Aave V3 Instance- 09.13.25

- Chaos Labs Risk Stewards - Increase Supply Caps and Borrow Caps on Aave V3 Instance- 09.15.25

- Chaos Labs Risk Stewards - Increase Supply Caps and Borrow Caps on Aave V3 Instance- 09.17.25

- Chaos Labs Risk Stewards - Adjust Supply Caps on Aave V3 Instance - 09.20.25

- Chaos Labs Risk Stewards - Increase Supply and Borrow Caps on Aave V3 Instance - 09.22.25

- Chaos Labs Risk Stewards - Increase Supply Caps on Aave V3 Instance - 09.24.25

- Chaos Labs Risk Stewards - Adjust Supply Caps and Borrow Caps on Aave V3 Instance - 09.25.25

- Chaos Labs Risk Stewards - Adjust Supply Caps and Borrow Caps on Aave V3 Plasma Instance - 09.26.25

- Chaos Labs Risk Stewards - Adjust Supply Caps, Borrow Caps and Interest Rate Curves on Aave V3 Instance - 09.28.25

- Chaos Labs Risk Stewards - Adjust Supply and Borrow Caps on Aave V3 Instance - 09.29.25

Additionally, we provided analysis regarding the following proposals and discussions:

- [ARFC] Onboard LsETH to Aave V3 Core Instance

- [Direct to AIP] Increase rsETH Supply Cap on Aave V3 Linea Instance

- [ARFC] Launch GHO on Linea & Set ACI as Emissions Manager for Rewards

- [ARFC] Launch GHO on Plasma & Set ACI as Emissions Manager for Rewards

- [Direct to AIP] Risk Parameter Adjustments for Aave V3 Scroll Instance

- [Direct to AIP] Raise sUSDe and USDe November expiry PT tokens caps on Aave V3 Core Instance

- [Risk Stewards] WETH Borrow Rate Update

- [ARFC] Endorse the Asset Classification Framework (AAcA)

- [ARFC] Add MetaMask USD (mUSD) to Aave v3 Core Instance on Ethereum and Linea

- [Direct to AIP] Onboard sUSDe and USDe to Aave V3 Avalanche Instance

- [Direct-to-AIP] pyUSD Parameters Optimization

What’s Next

In the coming months, the Chaos team will continue its focus on the following areas:

- Supply and Borrow Cap Risk Oracle integration on additional Chains leveraging Edge infrastructure.

- Continuous monitoring of SVR and associated parameterization

- Pendle Dynamic Risk Oracle for each PT asset deployment

- Risk Oracle integration for automated Slope 2 adjustments to minimize rate volatility

- CAPO Risk Oracle integration

- Preparation for the launch of Aave V4