Gauntlet Analysis

Summary

Gauntlet recommends adding sFRAX to the Ethereum Aave V3 Liquidity Pool, conditioned on the price feed being addressed properly in final AIP.

Assessment

Market Cap

Current supply of sFRAX is ~28M.

Staking Yield

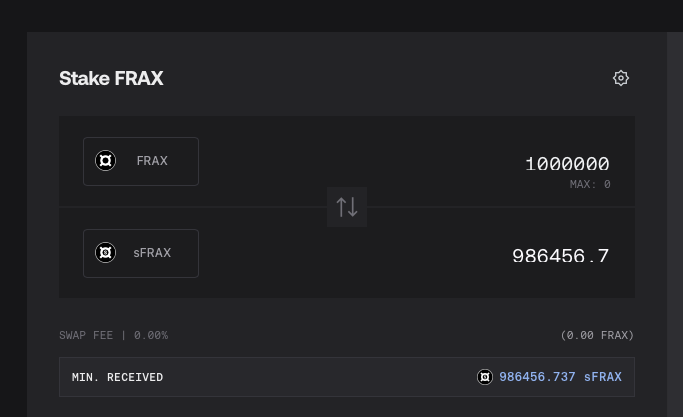

sFRAX is designed to allow holders of the protocol’s partially collateralized fractional-algorithmic stablecoin FRAX to earn yields matching the U.S. Federal Reserve’s (Fed) interest rate on reserve balances (IORB), currently around 5.4%.

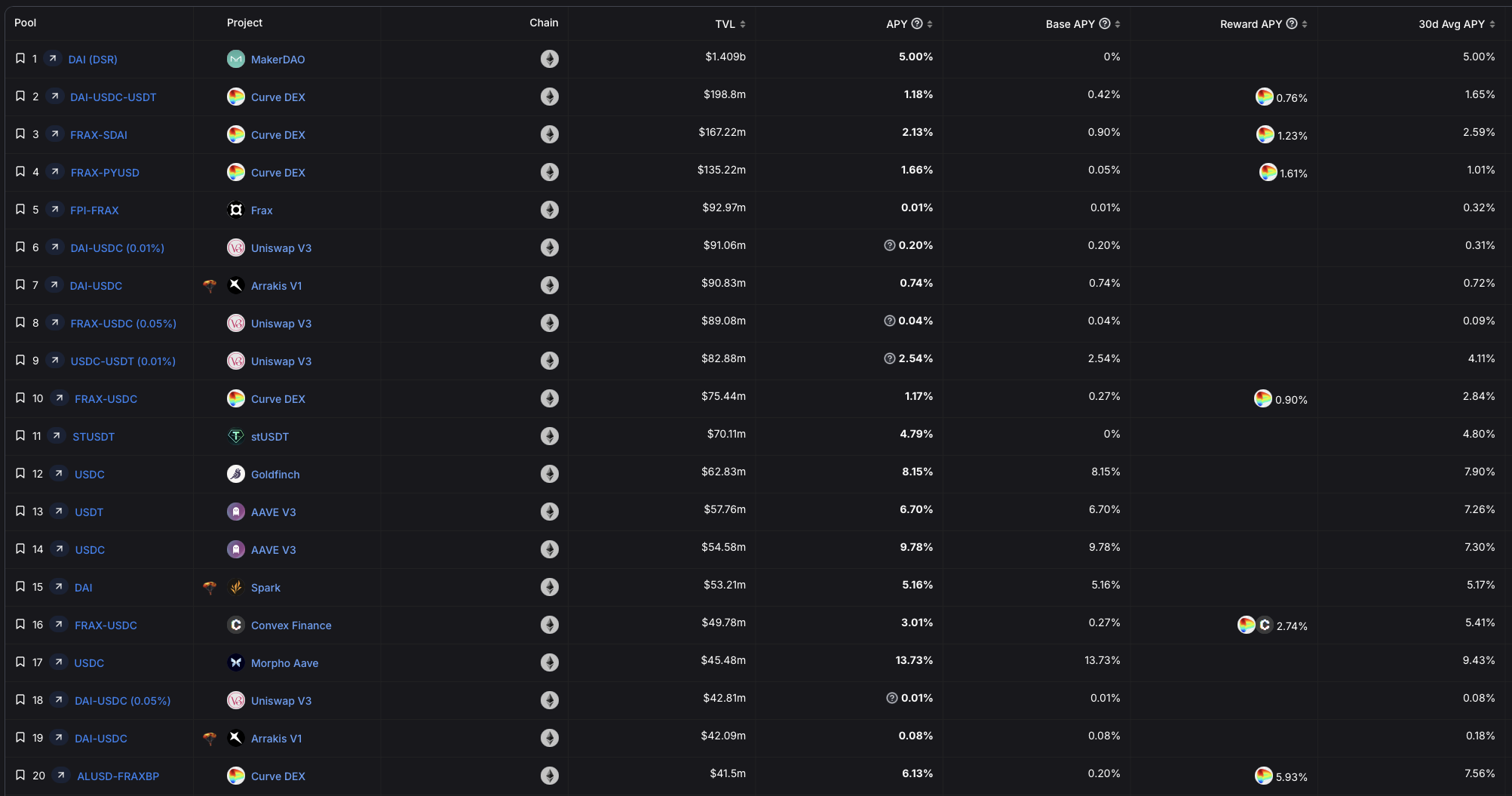

Below shows yield rankings of stablecoin LSD on Ethereum, ordered by TVL.

Slippage and Liquidity

- sFRAX liquidity creates ~2.5% slippage on trade over $2M sFRAX to FRAX (see here)

- The primary liquidity venues for sFRAX include the sFRAX - crvUSD (~$165M TVL) on Curve (see here)

Counterparty Risk

In the sFRAX model, users deposit FRAX, and the DAO invests their own equivalent funds in short-term assets via Finres. Thus sFRAX is able to be atomically exchanged for FRAX without any liquidity concerns funds invested in RWAs.

Recommendations

Given the market cap, liquidity and risk profile analyzed above, Gauntlet recommend parameters as below.

| Parameter | Recommendation |

|---|---|

| Isolation Mode | NO |

| Borrowable | NO |

| Borrowable in Isolation | NO |

| Collateral Enabled | YES |

| Stable Borrowing | NO |

| Supply Cap | 10M |

| Borrow Cap | N/A |

| Debt Ceiling | N/A |

| LTV | 70% |

| LT | 75% |

| Liquidation Bonus | 6% |

| Reserve Factor | 10% |

| Base Variable Borrow Rate | N/A |

| Variable Slope 1 | N/A |

| Variable Slope 2 | N/A |

| Uoptimal | N/A |