LlamaRisk supports exploring this solution to help stabilize interest rate shocks for specific, highly utilized assets on Aave’s Core market. The current mechanism leads to periods of extreme volatility and liquidity constraints, and a more dynamic, responsive model is a rational development for the long-term health of the protocol.

We appreciate the detailed presentation and thorough research executed by @ChaosLabs. To contribute to this effort, we have performed additional analysis to help identify potential fine-tuning opportunities and have complementary findings to help guide the parameterization of this new rate-managing approach.

Discontinuous Borrower Behavior

Our analysis focused on understanding the discrete repayment behavior of borrowers for two of the most rate-sensitive assets over the past several months: WETH and USDT. The observations were made from June 1st, 2025, to August 21st, 2025.

The “Ladders of Tolerance” Hypothesis

The Chaos Labs proposal is built on the observation that borrower stickiness can prolong periods of high utilization. The time-aware model addresses this by gradually increasing pressure. This implicitly assumes that borrower response is relatively continuous. Our hypothesis is slightly different: we believe borrowers operate on a “ladder of tolerance,” where they will absorb rising costs without repaying until a specific borrow rate threshold is breached, at which point their strategy becomes unprofitable, triggering a sudden wave of deleveraging.

This suggests that repayments happen in discrete, sharp increments, not continuously. For example, ETH-backed looping strategies may remain profitable as long as the borrow rate is below 4%, while various stablecoin strategies may have different thresholds at 5%, 7%, or higher. The Chaos Labs model suggests borrowers will begin to repay as rates slowly rise from 3% to 3.9%. In contrast, our intuition is that little deleveraging will occur until a specific rate threshold is decisively crossed. We have employed empirical tests focusing on the loan repayment events to test our hypothesis.

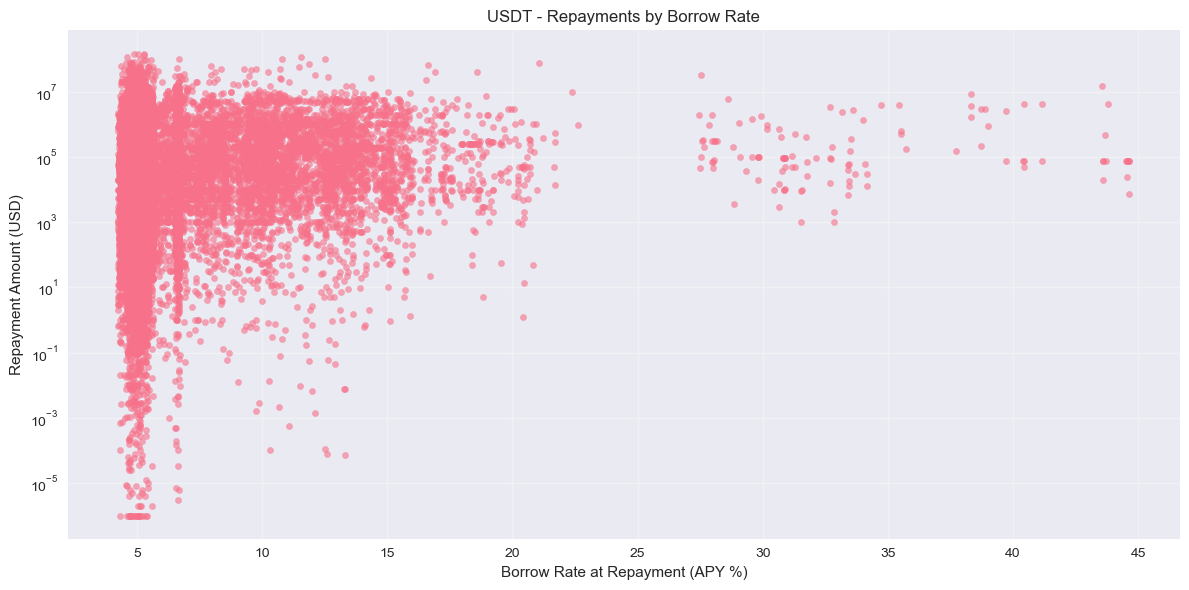

Evidence from USDT Repayments

For USDT, we observed that repayment events are not evenly distributed across all borrow rates. Instead, they cluster, with significant activity occurring at specific rate levels. The scatter plot of individual repayment events illustrates this pattern, showing dense vertical bands of activity rather than a smooth distribution.

Source: LlamaRisk, August 21st, 2025

When we aggregate this data and analyze it statistically, the “ladder” becomes clear. Regression analysis shows statistically significant jumps in hourly repayment volume when certain rate thresholds are crossed. For instance, crossing the 7% APY threshold is associated with an additional $12.1 million in hourly repayments, and crossing 15% is associated with an additional $17.5 million. This proves that borrowers are reacting in waves at these specific price points.

Source: LlamaRisk, August 21st, 2025

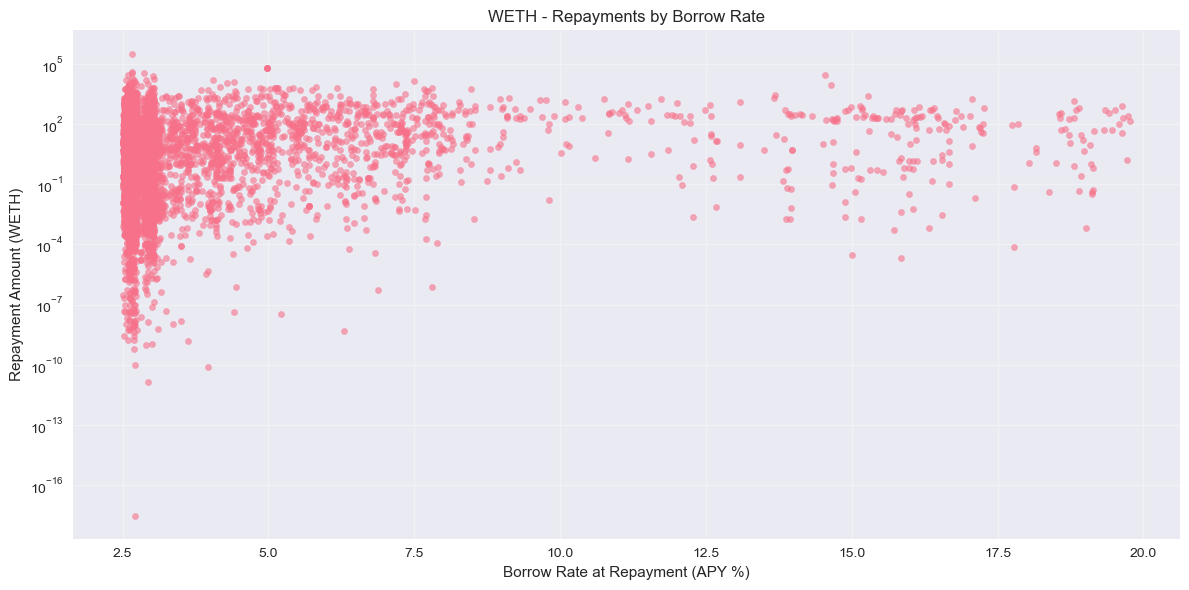

Evidence from WETH Repayments

The behavior in the WETH market is slightly different; however, it still supports our hypothesis. The scatter plot shows that most repayment activity is concentrated at the lower end of the rate spectrum. This is due to the primary WETH borrowing strategy being related to LST/LRT looping, which is highly sensitive to one particular profitability threshold, as also explained by Chaos Labs.

Source: LlamaRisk, August 21st, 2025

The statistical analysis for WETH reveals a particularly sharp and significant threshold. While there is a small, considerable effect at 3%, the primary behavioral shift occurs at 4% APY. Crossing this single threshold is associated with an additional 4,013 WETH in hourly repayments. This suggests a large, homogenous group of borrowers, likely ETH loopers, whose profitability is acutely sensitive to this specific rate. Interestingly, the effect at 6.5% was not statistically significant in our sample, indicating that point has already flushed out the most elastic borrowers.

Source: LlamaRisk, August 21st, 2025

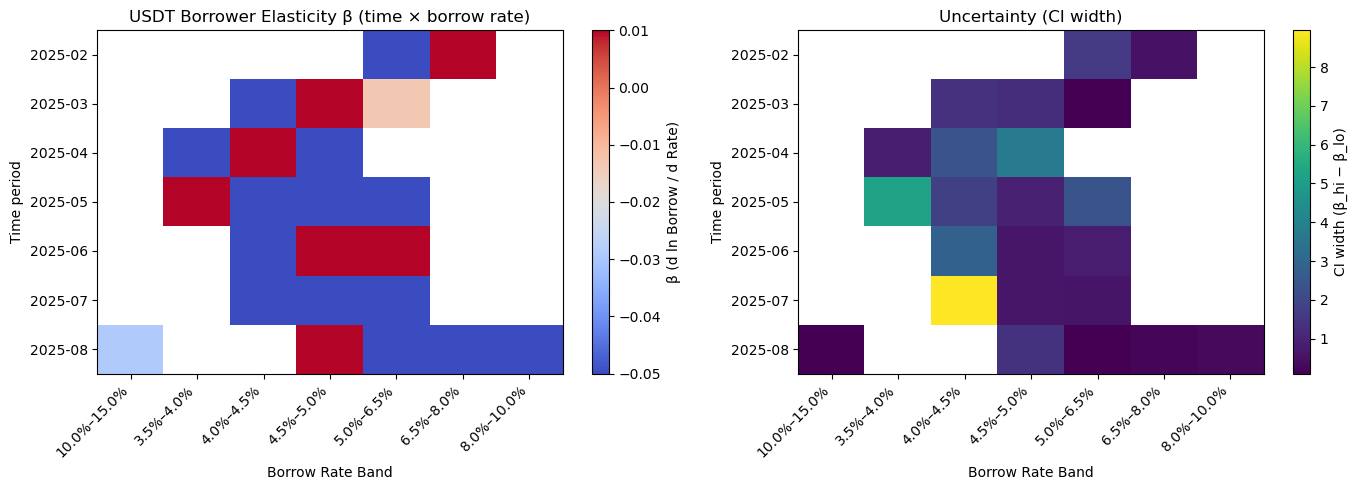

The Time-Varying Nature of Elasticity

Another crucial layer of complexity is that these borrower sensitivities are not static. The profitability of any given borrowing strategy is dependent on broader market conditions, such as staking yields, trading opportunities, or farming rewards. As these external factors change, the rate thresholds at which borrowers deleverage will also shift.

Source: LlamaRisk, August 21st, 2025

Our analysis of borrower elasticity (the sensitivity of borrowing to rate changes) over time confirms this. The heatmap for USDT shows that in certain months, borrowers were sensitive to a range of borrow rates, while in other periods, they were indifferent or even inelastic. This dynamic nature presents the challenge of a fixed-parameter system and reinforces the need for a model that can adapt to changing market regimes.

Source: LlamaRisk, August 21st, 2025

Implications for Parameter Tuning

These findings suggest that the effectiveness of the proposed mechanism will depend heavily on its tuning. A purely time-weighted policy automatically adapts - if high utilization persists, the slope escalates until deleveraging is forced, offering robustness when borrower sensitivity is low or unknown.

However, this approach has a trade-off. In regimes where borrower sensitivity is high and predictable, as we’ve identified for WETH at ~4%, a slow time-weighted escalation could “overshoot.” It may lead to unnecessarily high rates for all borrowers simply because the mechanism waits for a time-based trigger instead of directly targeting the known rate threshold. This makes the approach robust for safety but potentially less efficient and more costly for borrowers. Our analysis suggests that targeting rate increments just above these identified thresholds could trigger the desired deleveraging more quickly and efficiently.

This same principle of avoiding overshoots applies symmetrically to reversing rate increases. Once a key threshold is crossed and the desired wave of repayments commences, utilization will fall. If the elevated slope decays too slowly (meaning the time-weighted component for recovery is too high), rates will remain punitive for longer than necessary. This risks flushing out more borrowers than required to bring utilization back to a healthy level, potentially causing an over-correction. Therefore, a finely-tuned decay parameter is crucial, allowing the slope to decrease swiftly once the stress subsides. This would ensure the mechanism only displaces the marginal borrowers necessary to restore liquidity, rather than causing a broader, more disruptive deleveraging event.

Conclusion

The path toward a perfectly tuned dynamic rate model involves navigating multiple sensitivities and trade-offs. The evidence for discontinuous, threshold-based borrower behavior is strong and presents a valuable consideration for implementing this new oracle. A model that can incorporate these data-driven thresholds may prove more capital-efficient than one based purely on the duration of stress.

We appreciate the continued efforts from Chaos Labs on this front and look forward to further reports on the progress and findings from the initial tests of this important mechanism.

Disclaimer

This review was independently prepared by LlamaRisk, a community-led decentralized organization funded partly by the Aave DAO. LlamaRisk is not directly affiliated with the protocol(s) reviewed in this assessment and did not receive any compensation from the protocol(s) or their affiliated entities for this work.

The information provided should not be construed as legal, financial, tax, or professional advice.