Summary

A proposal to increase:

Arbitrum

- Increase the weETH supply and borrow caps

Polygon

- Increase the LINK supply cap

- Increase the MaticX supply cap

Scroll

- Increase the USDC supply and borrow caps

- Increase the wstETH supply cap

Motivation

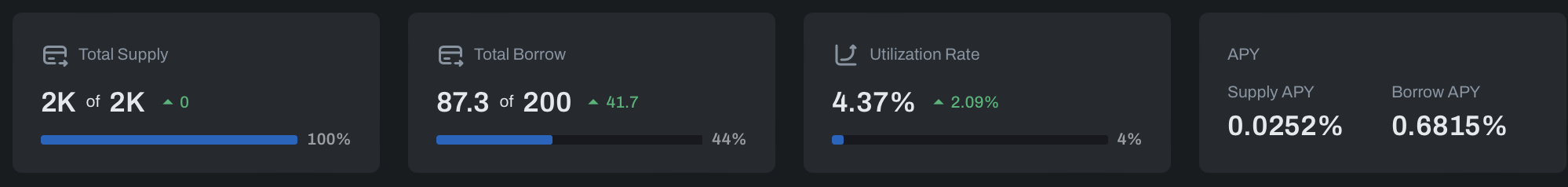

weETH (Arbitrum)

weETH on Arbitrum has reached its supply cap with 44% borrow utilization.

Supply Distribution

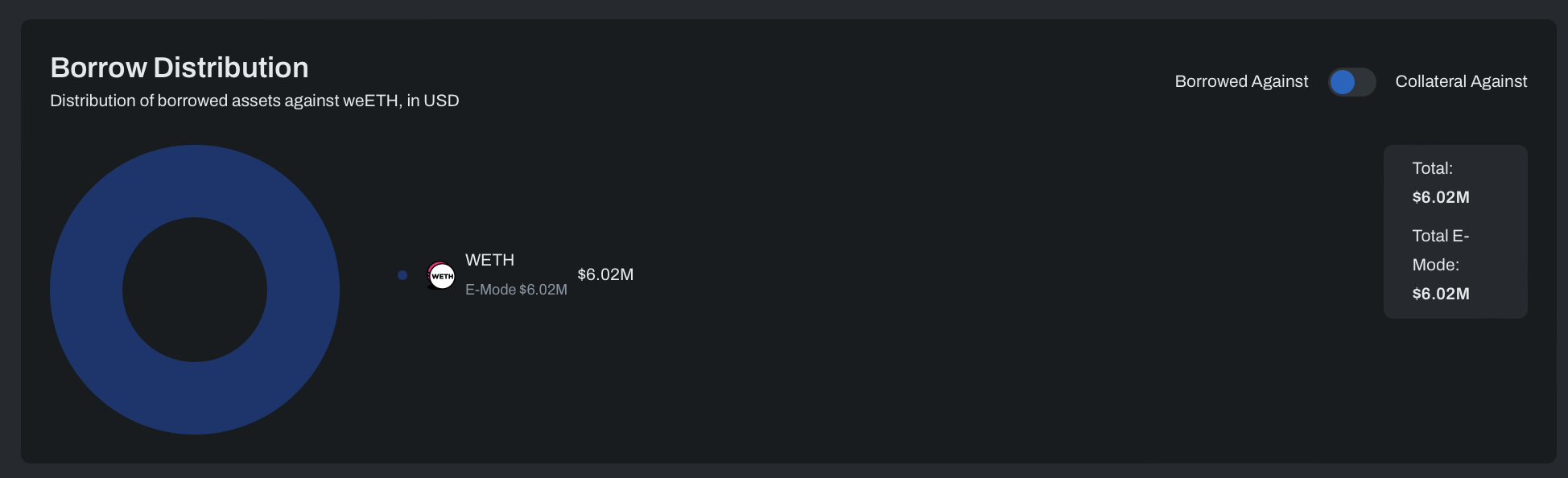

The three largest suppliers are borrowing WETH against their collateral, putting these positions at little risk of liquidation, with WETH the only asset borrowed against weETH.

Borrow Distribution

Borrows are limited, with the largest user borrowing against WETH, again at little risk of liquidation.

Recommendation

Based on on-chain liquidity and user distribution, we recommend doubling the supply and borrow caps.

LINK (Polygon)

Motivation

LINK’s supply and borrow caps have utilization rates of 91% and 24%, respectively.

Supply Distribution

Supply is well distributed, with the top supplier responsible for just 3.3% of the total.

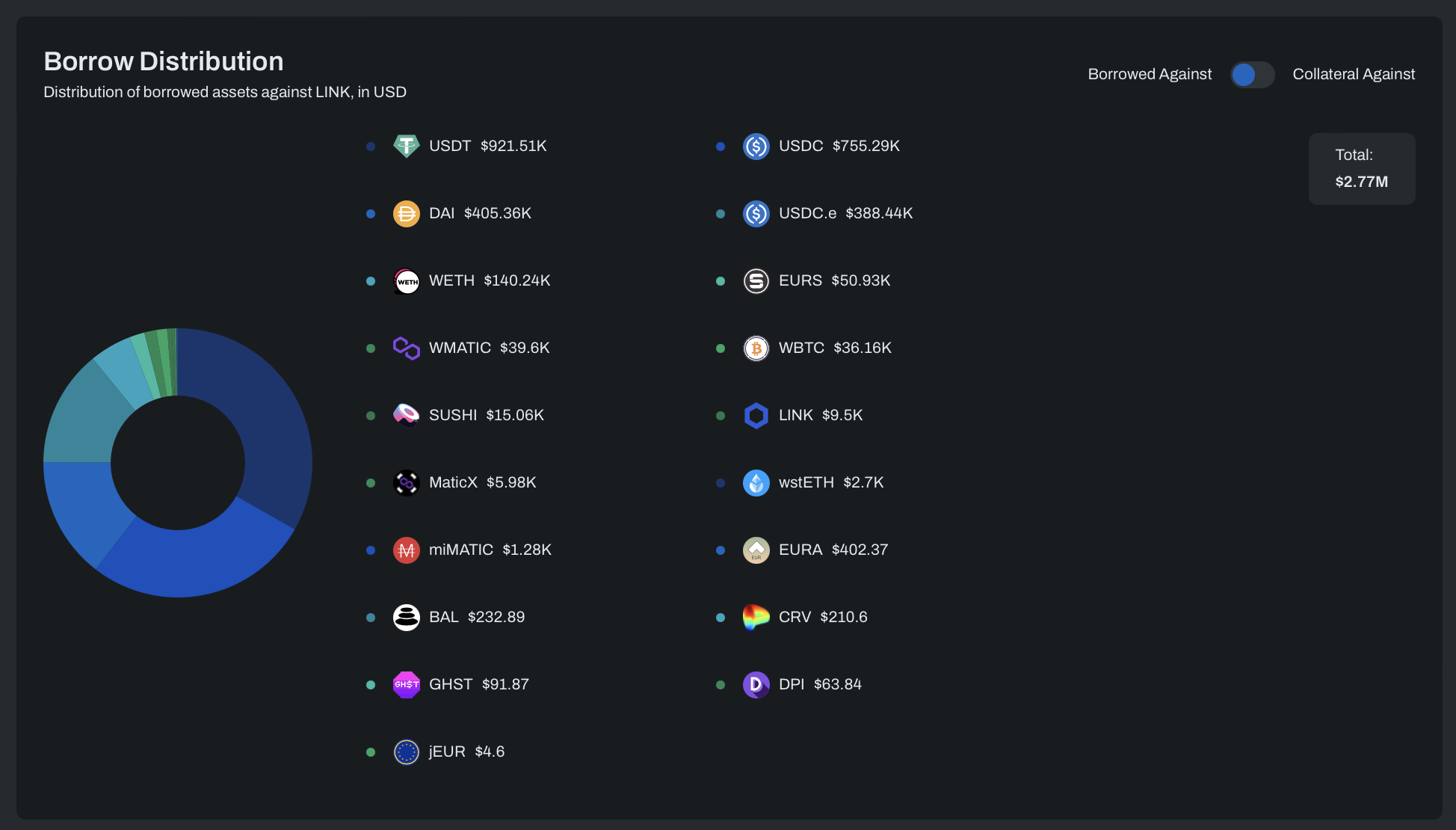

USDT and USDC are the most popular assets borrowed against LINK collateral.

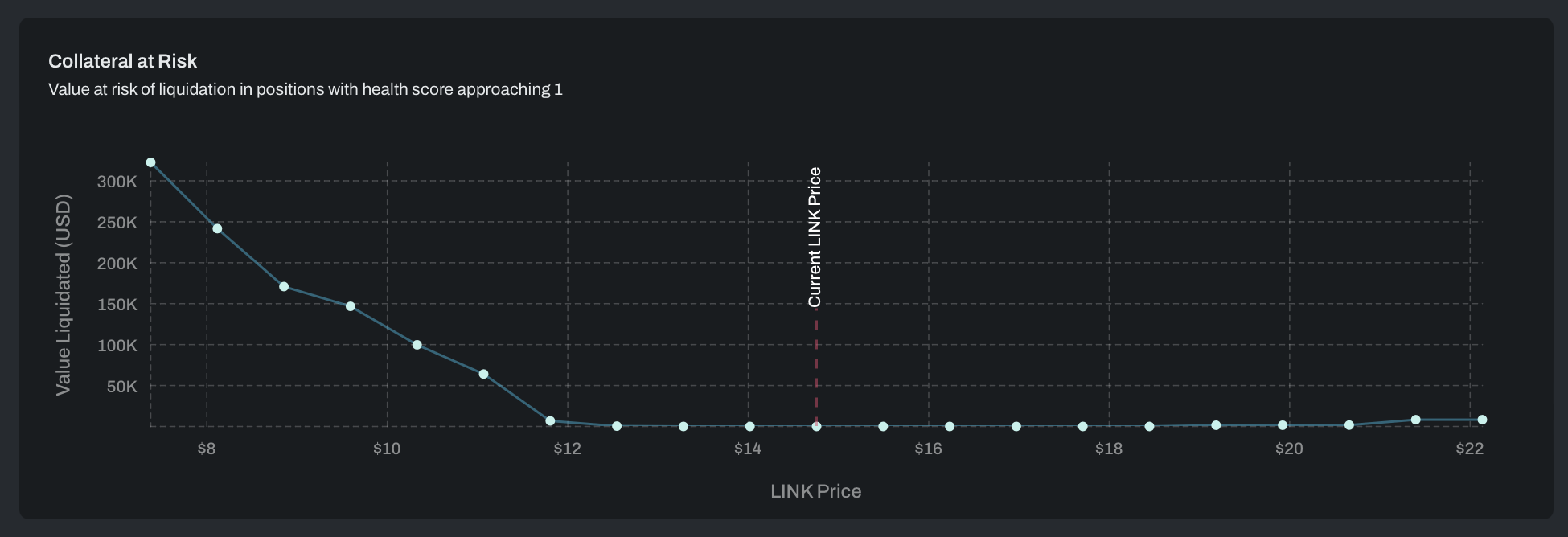

There is little collateral at risk until LINK’s price drops below $12.00

Borrow Distribution

There is limited borrowing of LINK, though WBTC is the most popular collateral asset.

Recommendation

Given on-chain liquidity and user distribution, we recommend increasing the supply cap to 800K and making no changes to the borrow cap.

MaticX (Polygon)

Motivation

MaticX’s supply and borrow cap utilization has reached 93% and 4%, respectively.

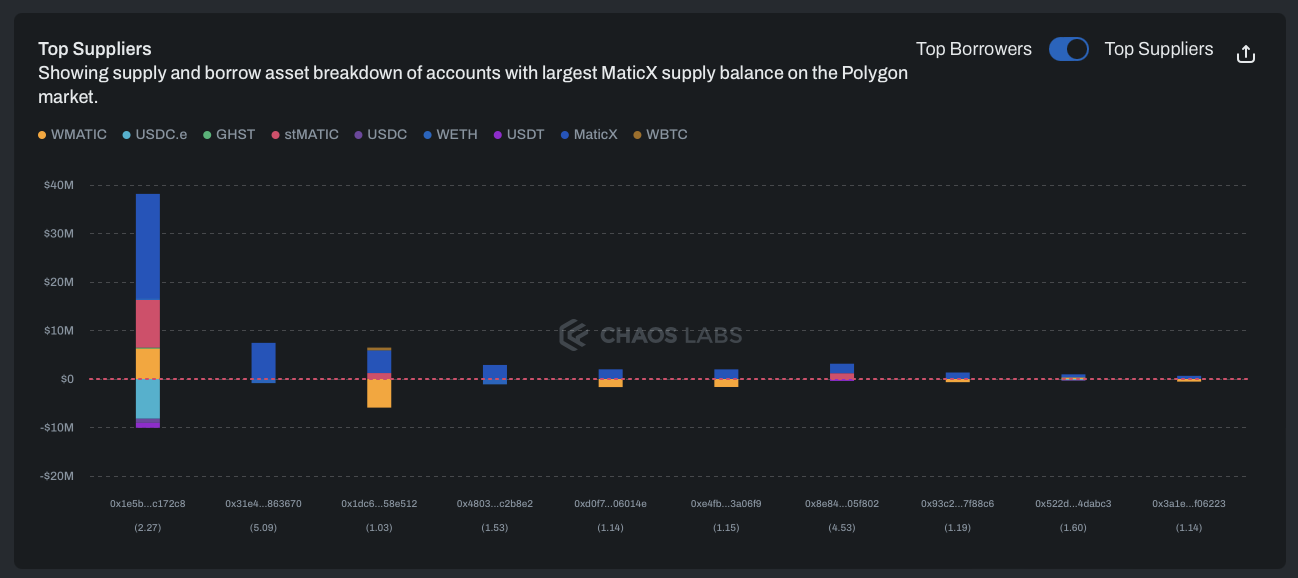

Supply Distribution

A single wallet is responsible for 35.5% of total supply; this user is also supplying WMATIC, STMATIC, and WETH while borrowing USDC.e, USDC, and USDT, maintaining a health score of 2.27. This position would be at risk of liquidation if MATIC’s price falls.

While the position is large, on-chain liquidity is sufficient to support liquidations.

Overall, 70% of the value borrowed against MaticX is WMATIC, putting these positions at little risk of liquidation.

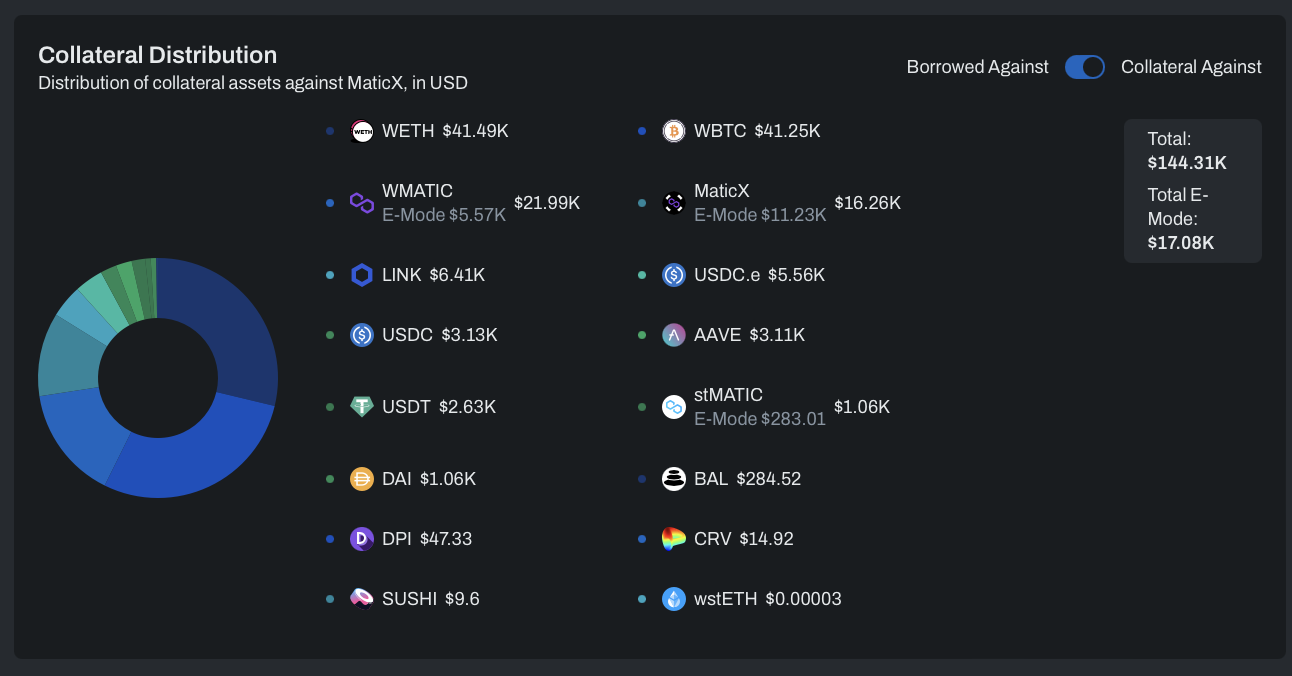

Borrow Distribution

Borrow demand for MaticX is low; WETH and WBTC are the most popular collateral assets.

Recommendation

As per community decision, the upper bound on LST supply caps is 75% of circulating supply on a given chain. This does limit us in this instance, and thus we recommend a cap that meets this criterion.

wstETH (Scroll)

wstETH has nearly reached its supply cap following new deposits.

Supply Distribution

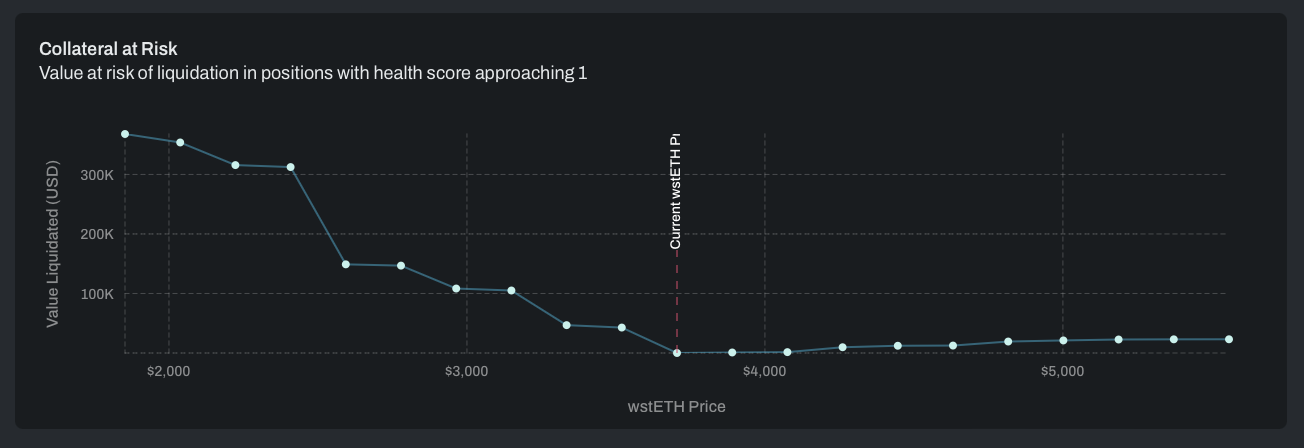

Most of the top suppliers in this market are borrowing USDC against wstETH collateral, not employing looping strategies as is common on other chains. The largest maintains a health score of 2.26.

Collateral at risk does not breach $100k until wstETH’s price drops to $3,150.

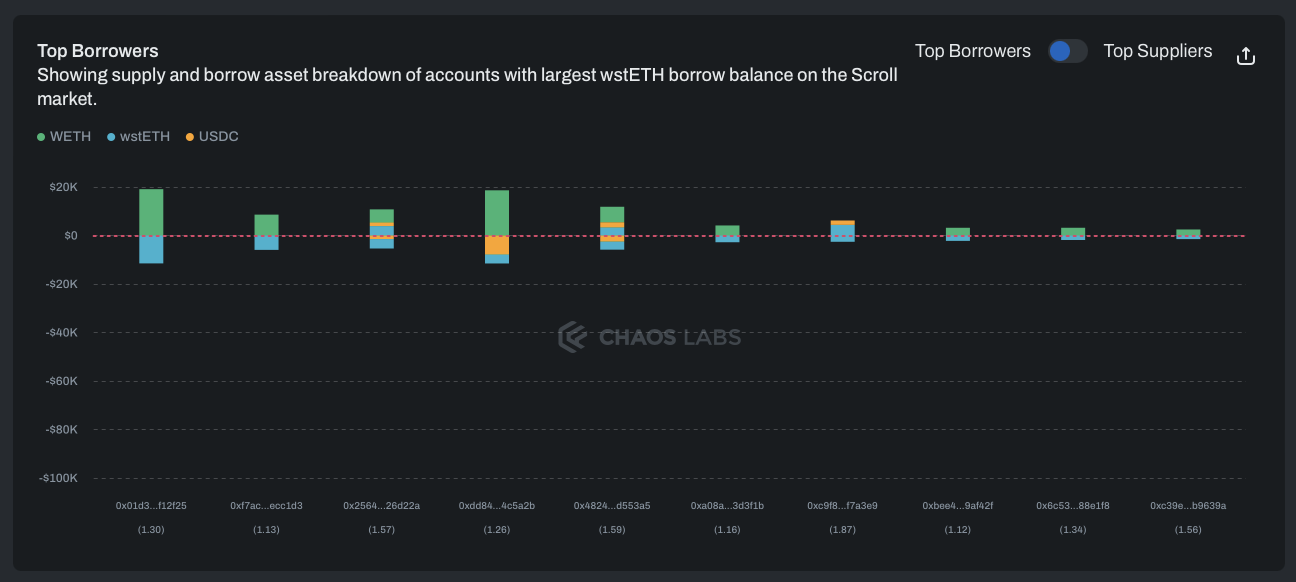

Borrow Distribution

The top borrowers of wstETH are borrowing against WETH collateral; a fairly unusual position for LSTs. However, they are at limited risk of liquidation.

Recommendation

Given that this market does not primarily facilitate looping, we rely on our stress-testing simulation methodology to provide a recommendation. Utilizing this, we recommend increasing the supply cap to 1000, with no impact on VAR.

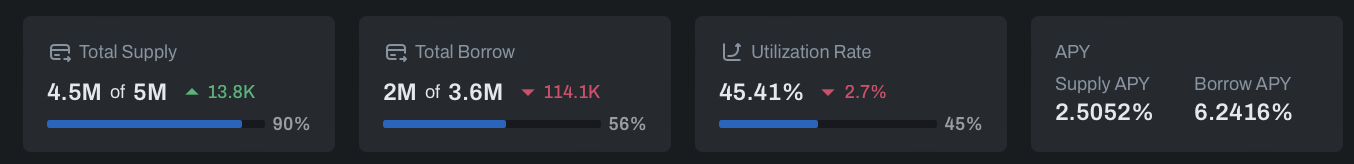

USDC (Scroll)

USDC has nearly reached its supply cap following new deposits.

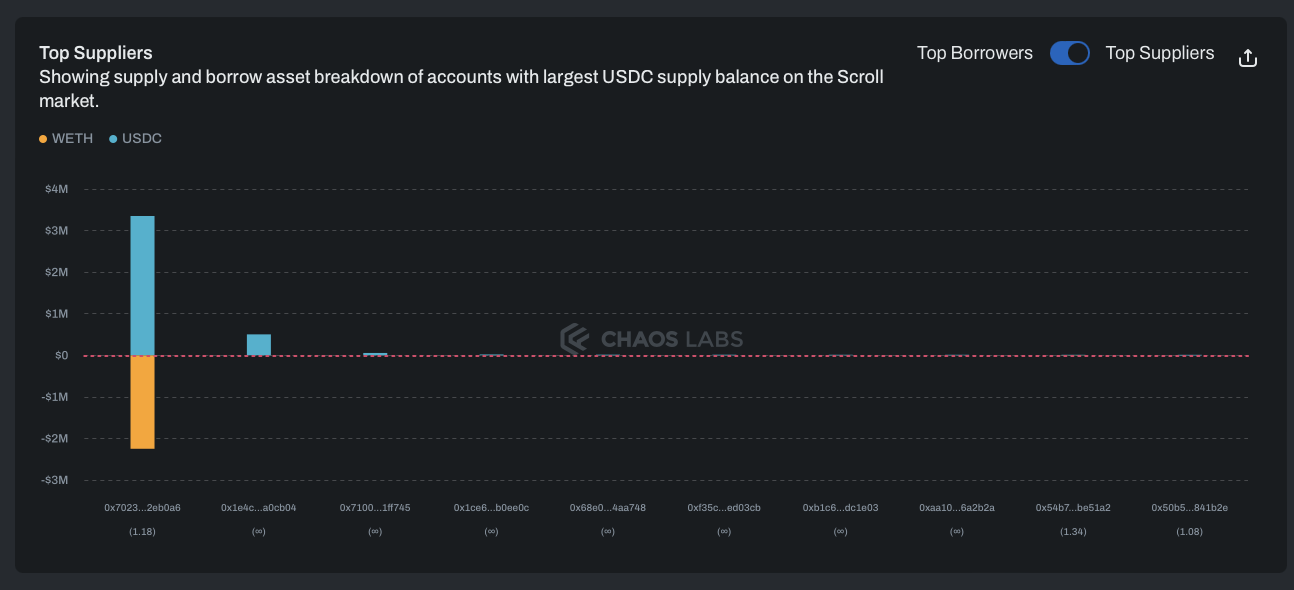

Supply Distribution

Nearly 75% of the market is supplied by a single user who is borrowing WETH against their USDC collateral, with a health score of 1.18. This user has repaid $520K WETH since April 18 and is actively managing his position

This position represents 96% of the total value borrowed against USDC.

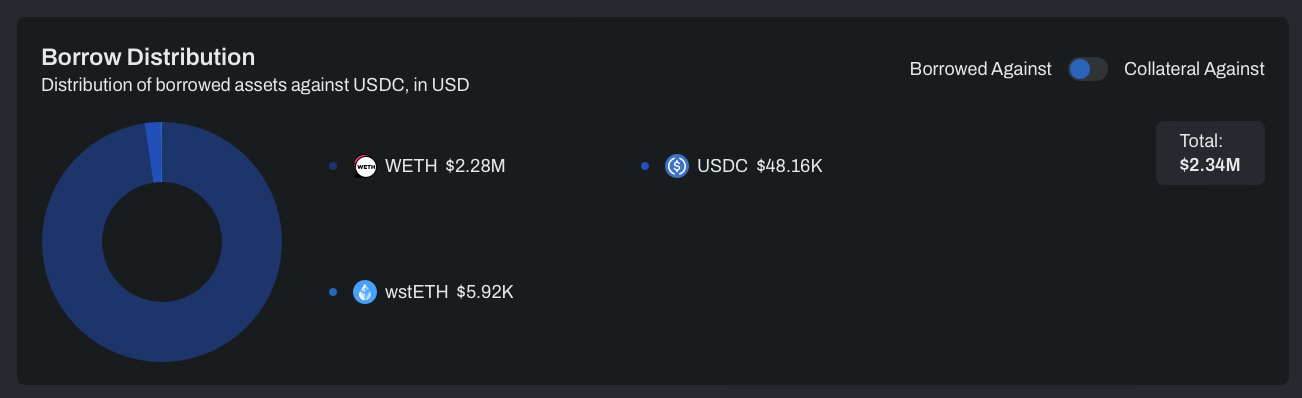

Borrow Distribution

The top borrowers of USDC are borrowing against WETH and wstETH collateral, putting them at risk of liquidation should ETH’s price fall.

Recommendation

Given the on-chain liquidity and user distribution, we recommend increasing the supply and borrow caps.

Specification

| Chain | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Arbitrum | weETH | 2,000 | 4,000 | 200 | 400 |

| Polygon | MaticX | 82,500,000 | 90,000,000 | 5,200,000 | No Change |

| Polygon | LINK | 668,000 | 800,000 | 163,700 | No Change |

| Scroll | wstETH | 700 | 1,000 | 45 | No Change |

| Scroll | USDC | 5,000,000 | 7,500,000 | 3,600,000 | 6,500,000 |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this ARFC.

Copyright

Copyright and related rights waived via CC0