Simple Summary

Decrease slope1 on Arbitrum and Optimism from 3.3% to 3%.

Motivation

Over the last eight months, we have observed a drop-off in WETH interest rates on Ethereum and, thus, relative demand for ETH borrowing.

Time series of WETH borrow APY on Ethereum, Arbitrum and Optimism, in addition to stETH APY.

Note that the red dotted line indicates the point when the base_fee decreased from 1% to 0% on Arbitrum and Optimism. This phenomenon can be explained by the drop-off in ETH staking yield, as we can deduce through the relatively strong correlation between WETH borrow APY and stETH staking APY on Ethereum due to profitable looping strategies. Additionally, given Aave prices stETH:ETH 1:1 with the underlying exchange rate, minimal liquidation risk exists in potential wstETH market price movements.

Correlation Between stETH APY and WETH APY

Correlation between stETH APY and WETH borrow APY.

Cross-correlation between stETH APY and WETH borrow APY, plotting the correlation coefficient with respect to time lag.

Computing the cross-correlation between the three markets, we notice an approximately 1-week lag when this hits the maximum value, implying the speed at which the borrow rates are maximally reflected in the staking APY.

This is statistically significant, as we can see below, where 85%-90% of all WETH debt is backed by ETH LSTs on the respective chain.

Arbitrum

Optimism

Ethereum

stETH APY Differential vs. WETH Borrow APY

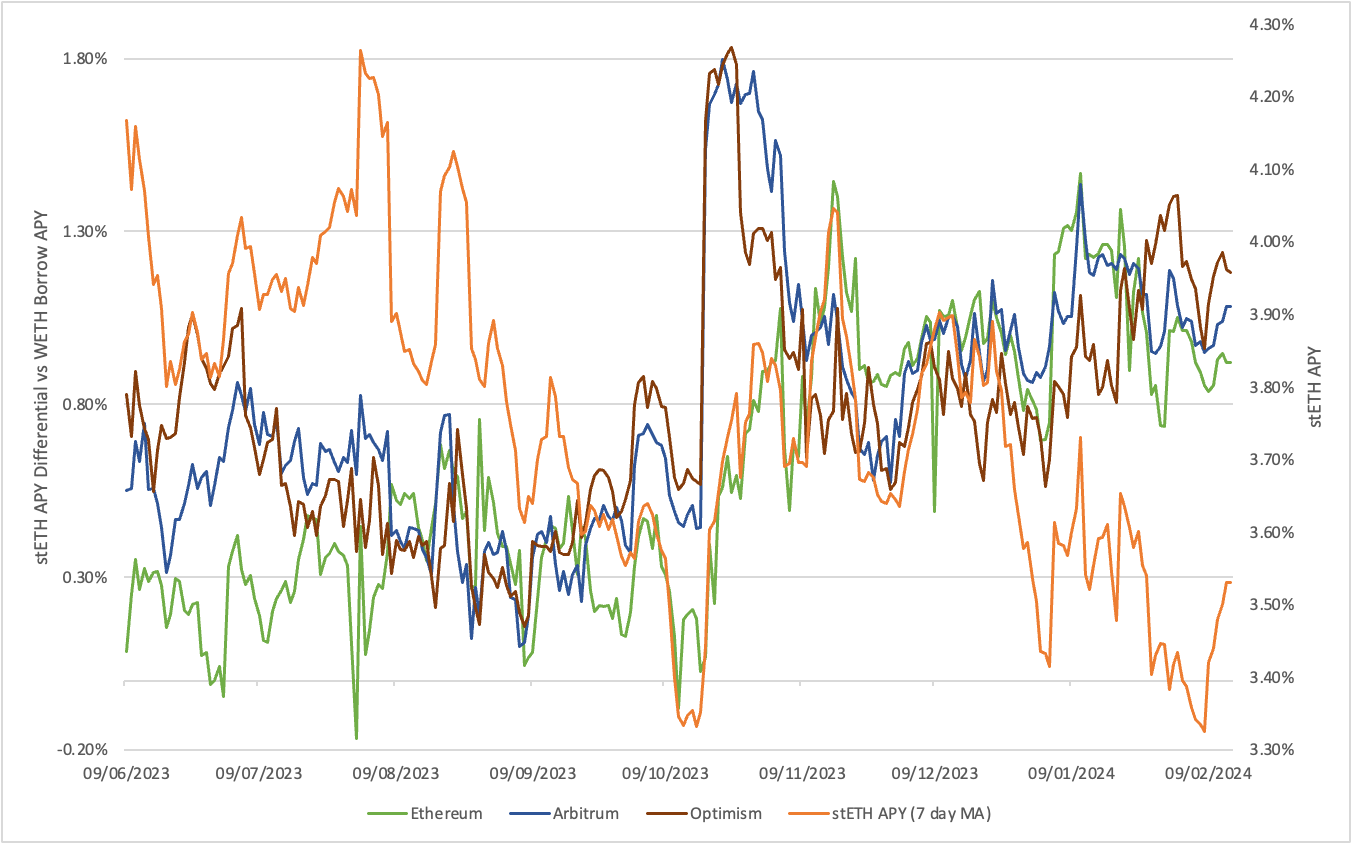

Interestingly enough, one might think that as stETH yields decrease, looping strategies would become less profitable. However, upon analyzing the difference between the stETH APY and WETH borrow APY (stETH APY - WETH APY) alongside the stETH APY itself at a given time t, a negative correlation emerges, with the peak occurring at a 2-week lag. Essentially, this means that the rate of decrease in borrow APY over time outpaces that of the stETH APY. Thus, we can conclude that when stETH APYs are high, borrowers attempt to extract as much revenue as possible, leading to convergence at lower yields. On the contrary, when stETH APYs are low, borrowers and ETH borrow APYs tend to be less aggressive with looping, perhaps due to theoretical scaling in the interest rate requiring smaller growth to become unprofitable, leading to the effective yield scaling higher than instances when stETH APYs are high. This in turn leads to less efficient markets and larger spreads when ETH staking yields are low.

stETH APY Differential vs. WETH Borrow APY

Time series of stETH APY - WETH APY. stETH APY plotted on secondary axis.

Cross-correlation between (stETH - WETH borrow APY) and stETH APY, plotting the correlation coefficient with respect to time lag.

WETH Utilization Rates

WETH Utilization rate time series.

Based on the observed trend, it’s evident that Arbitrum and Optimism could benefit from a reduction in slope1 to enhance utilization rates and consequently increase revenues. While the decrease in base_rate on both chains did positively impact utilization, it remains suboptimal. Thus, we simply take the P95 of the stETH APY differential vs WETH borrow APY since the base_rate decrease, which returned 0.6%, to derive the decrease in slope1. Considering the Uoptimal rate is projected to be below the current stETH APY with a 0.6% variance, any prolonged convergence above Uoptimal could lead to interest rate volatility. In such a scenario, it would be prudent to revert slope1. However, given the current trend and staking APY, this adjustment would likely result in higher utilization rates and greater profits for the Aave DAO.

Assuming convergence at today’s WETH interest rates:

| Arbitrum | Optimism | |

|---|---|---|

| Old Utilization Rate | 68.69% | 65% |

| New Utilization Rate | 76.5% | 72% |

| Projected Revenue Increase | 13.62 ETH $38.5k year | 4 ETH $11.3k year |

We note that adjusting WETH slope1 on other non-Ethereum chains with this intuition is seen as irrelevant, as either the market itself portrays too small a sample size with minimal relative demand for ETH LSTs as collateral, there does not exist ETH LSTs on the chain or ETH LST supply caps have been at max capacity for months.

Specification

| Chain | Asset | Parameter | Currebt | Recommended |

|---|---|---|---|---|

| Arbitrum | WETH | Slope1 | 3.3% | 3% |

| Optimism | WETH | Slope1 | 3.3% | 3% |

Next Steps

- Following community feedback, submit the ARFC for a snapshot vote for final approval.

- If consensus is reached, submit an Aave Improvement Proposal (AIP) to implement the proposed updates.

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this ARFC.

Copyright

Copyright and related rights waived via CC0