Gauntlet is supportive of the recommended LT and LTV changes to the v3 markets. The increase of LT from 76% to 80% should have minimum risk impact to the protocol with USDT borrow usage at 3.5%. The removal of USDT in isolation mode across Polygon, Arbitrum, and OP v3 markets should have little impact on capital efficiency with USDT having low usage within the non-isolated markets. Should the community wish to remove USDT from isolation on all markets, Gauntlet would like to reassert the centralization risk associated with USDT. Our risk evaluation remains consistent with those articulated in our previous USDT recommendation.

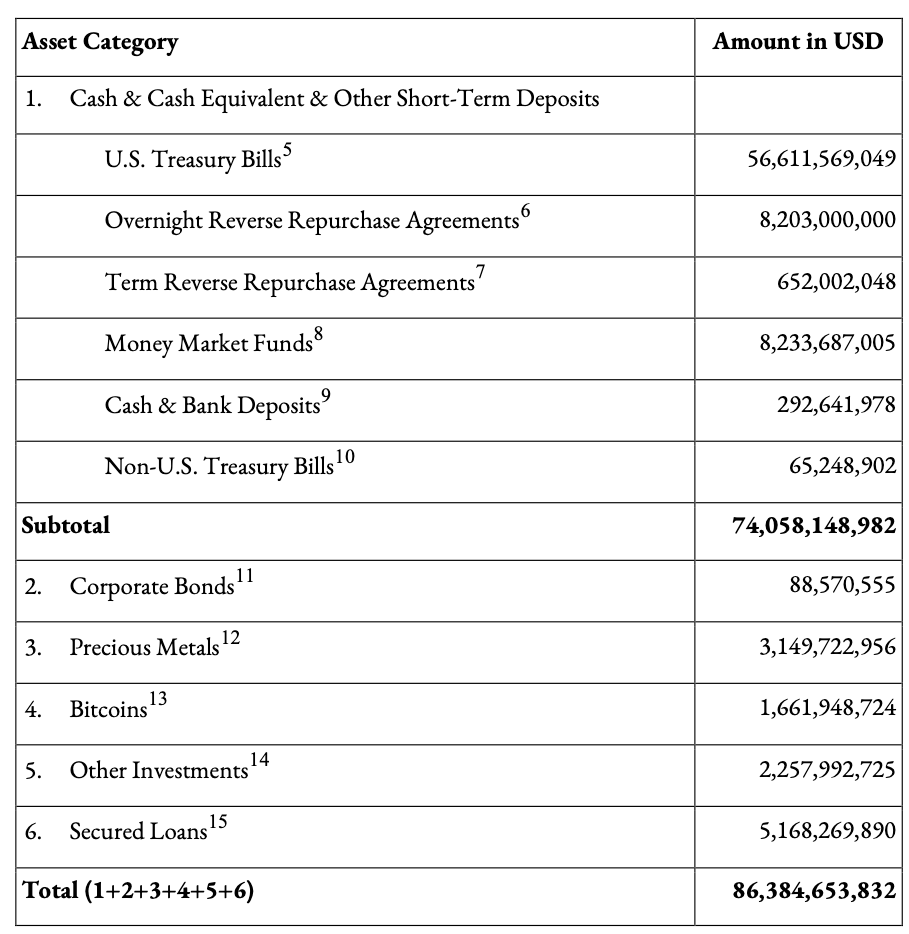

Accoding to Tether Q3 Attestation, USDT is not financially backed 1:1 by cash and cash equivalents but more like 0.86:1.