Summary

LlamaRisk supports the deployment of GHO on Ink. With GHO successfully scaling across L2s, further expansion of its availability is a logical next step. Our analysis indicates that GHO is well-positioned for additional cross-chain deployments, particularly on Ink, where it has the potential to become the primary stablecoin under current market conditions. As for GSMs supporting GHO peg stability, we do not recommend deploying the (stata)USDC.e GSM due to the limited USDC.e market supply of 2.43M on Ink.

Current GHO Scale

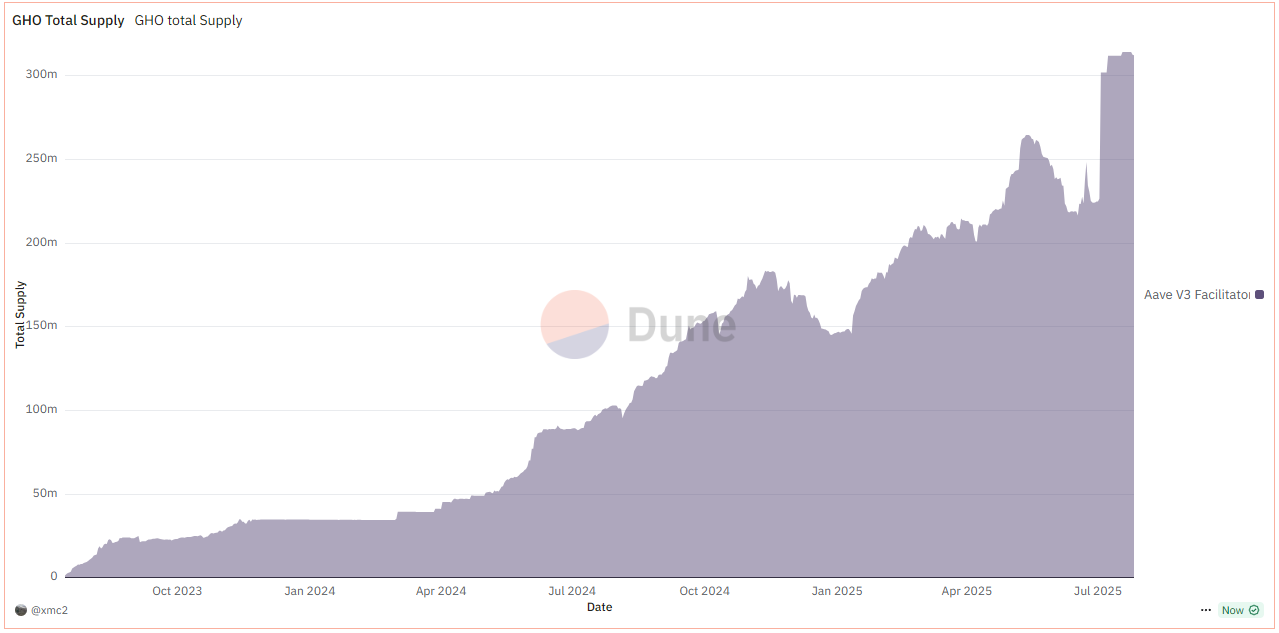

Source: GHO Total Supply, Dune, July 26, 2025

GHO is available on Ethereum Mainnet, Arbitrum, Base, Lens, and most recently, Avalanche. Its total supply now fluctuates around 315M, marking an all-time high. This represents a YTD growth of over 115% from a supply of 146.7M at the beginning of the year.

Network-specific Considerations

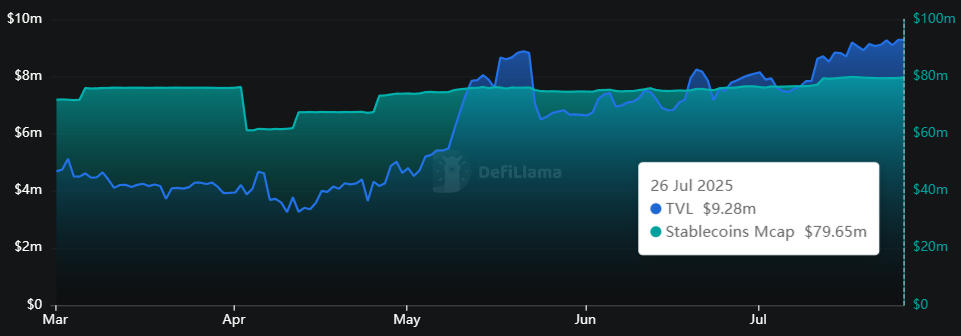

Ink is an L2 built on Optimism’s OP Stack and launched by Kraken. As part of the Superchain, it inherits Ethereum’s security and complies with the SuperchainERC20 standard, enhancing cross-chain interoperability. However, Ink’s DeFi ecosystem remains nascent, as reflected by its relatively low TVL of $9.28M compared to a total value secured (TVS) of $103.5M. This disparity suggests that most bridged assets remain idle, with limited participation in DeFi protocols on Ink.

Source: Ink TVL and Stablecoin Marketcap, DeFiLlama, July 26, 2025

Ink’s stablecoin ecosystem is in its early stages, currently dominated by USDT0, with a market supply of $75M, while the Stargate-bridged USDC.e lags behind with a market cap of $2.43M. This presents a significant growth opportunity for GHO on Ink. The upcoming launch of a whitelabel Aave instance (approved at the ARFC stage, pending AIP) is expected by the team to drive a targeted $1B in TVL to Ink, potentially serving as a strong catalyst for GHO adoption and growth on the network.

Liquidity Venues

Source: Top 5 Velodrome Liquidity Pools on Ink, Velodrome, July 26, 2025

As of July 26, 2025, the total TVL across DEXs on Ink is approximately $9M, with Velodrome and InkySwap accounting for the majority with $6M and $2M TVLs, respectively. The current liquidity is insufficient to support large trades with low price impact, and most transaction volume is concentrated on Velodrome. Therefore, securing initial GHO liquidity on Velodrome will be critical in driving early growth. This foundational liquidity can later support further increases in GHO supply and borrow caps on Ink.

Yield Venues

Source: DeFi Projects on Ink by TVL, DeFiLlama, July 26, 2025

As seen from the current protocol landscape, stablecoin yield opportunities on Ink are limited. Shroomy Protocol, an Aave V3 fork, is the only lending market, with just $67K in TVL. Yield aggregators vfat.io and TheDeep have a combined TVL of $230K. Dinero, an ETH liquid staking platform on Ink, issues iETH and currently offers a 4% staking APR. However, the yield environment is expected to improve with the upcoming launch of Ink’s whitelabeled Aave instance. The team is optimistic, projecting $1B in TVL within 90 days of launch. Additionally, Ink’s backing by Kraken could attract significant capital and users, similar to Coinbase’s impact on Base, leveraging Kraken’s existing exchange user base to drive a broader range of assets and yield opportunities over time.

Facilitators

GHO will be first minted on Mainnet and then bridged to Ink using the CCIP Bridge Facilitator. The initial configuration for the Ink GhoDirectMinter facilitator is set to have a mint cap of 15M GHO.

GSM

Deploying GSM modules and expanding to new chains is a robust and welcome approach to enhancing GHO stability. However, the current USDC.e supply on Ink is limited to just 2.43M, making it vulnerable to significant borrow and supply rate fluctuations if a (stata)USDC.e GSM were deployed. This low supply would also limit the GSM’s effectiveness in stabilizing the GHO peg. Therefore, we recommend holding off on deploying a GSM until the market matures further.

Recommended Parameters

LlamaRisk supports the parameter specification provided by TokenLogic for GHO, including facilitator mint cap, CCIP configuration, and GHO market parameters.

Disclaimer

This review was independently prepared by LlamaRisk, a community-led decentralized organization funded in part by the Aave DAO. LlamaRisk is not directly affiliated with the protocol(s) reviewed in this assessment and did not receive any compensation from the protocol(s) or their affiliated entities for this work.

The information provided should not be construed as legal, financial, tax, or professional advice.