title: [ARFC] Launch GHO on Ink & set ACI as Emissions Manager for Rewards

author: TokenLogic

created: 2025-07-23

Summary

This proposal aims to launch GHO on the Ink blockchain and designate ACI as the Emissions Manager for GHO and aGHO, facilitating potential rewards and incentive programs.

Motivation

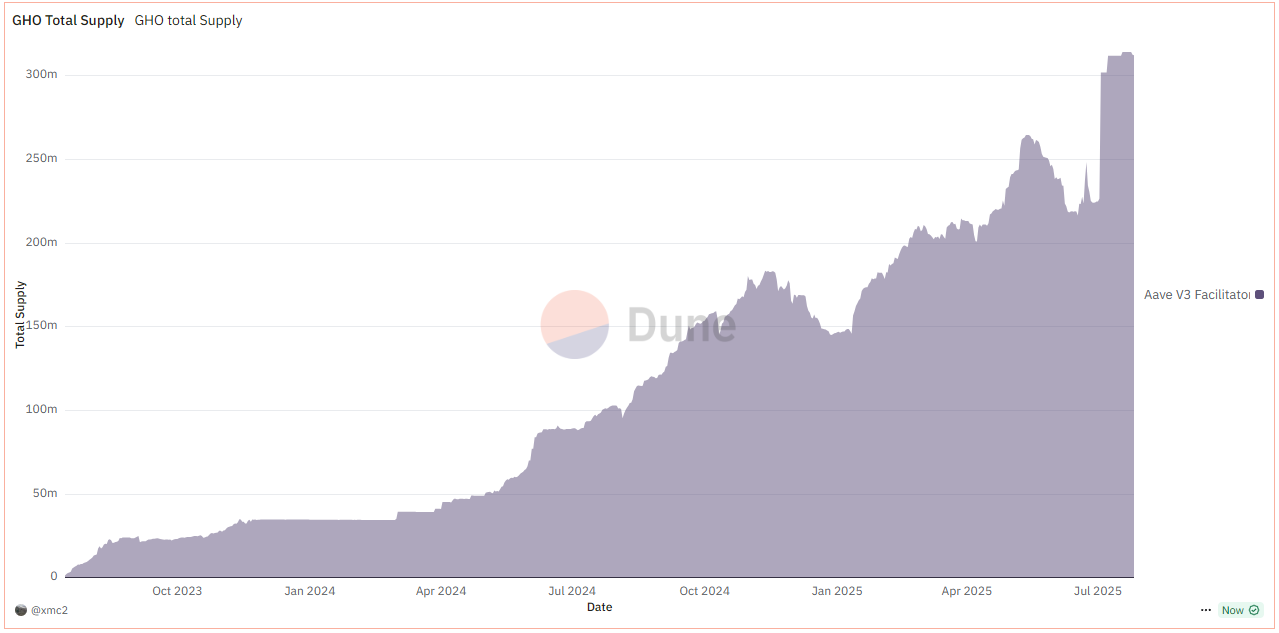

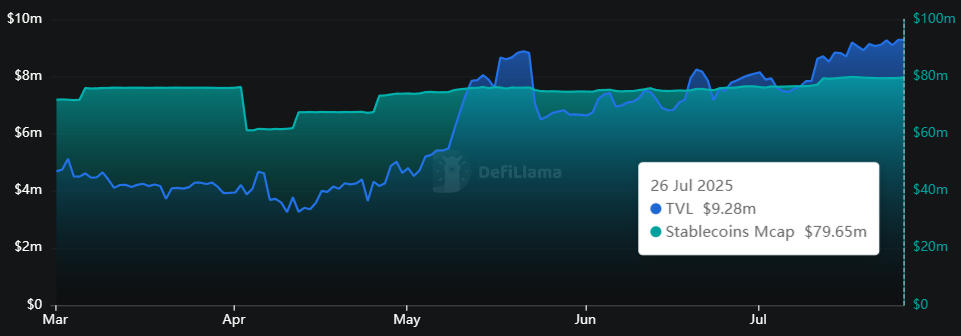

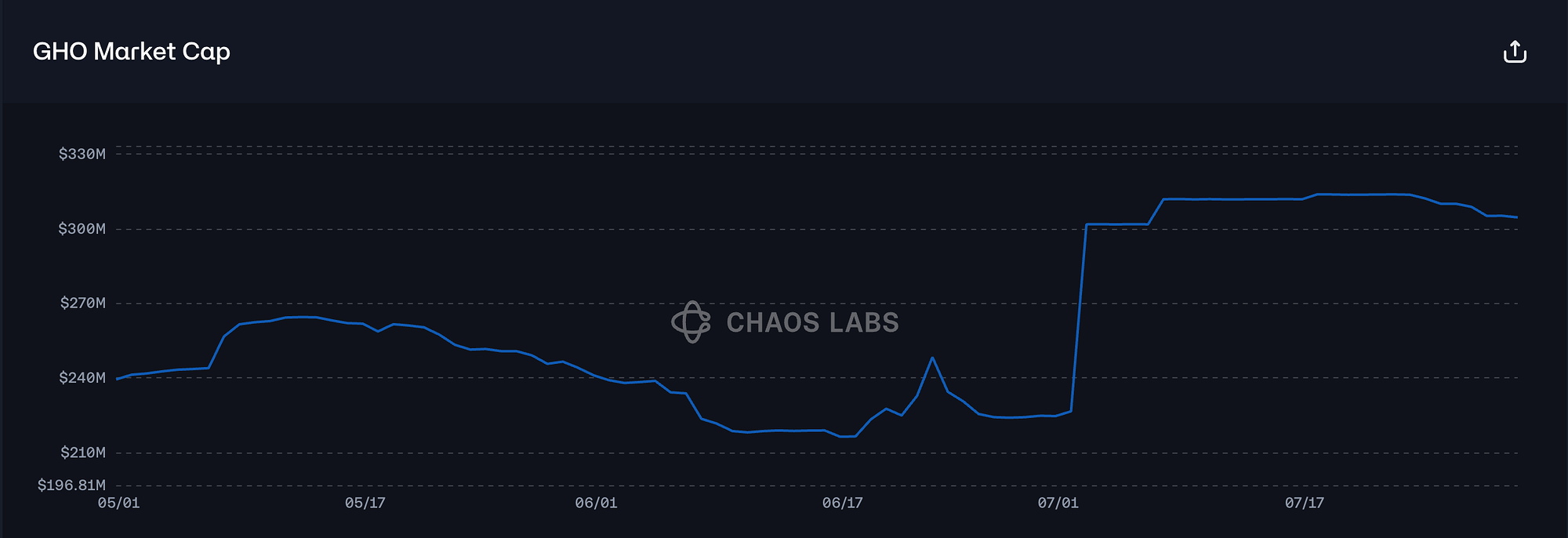

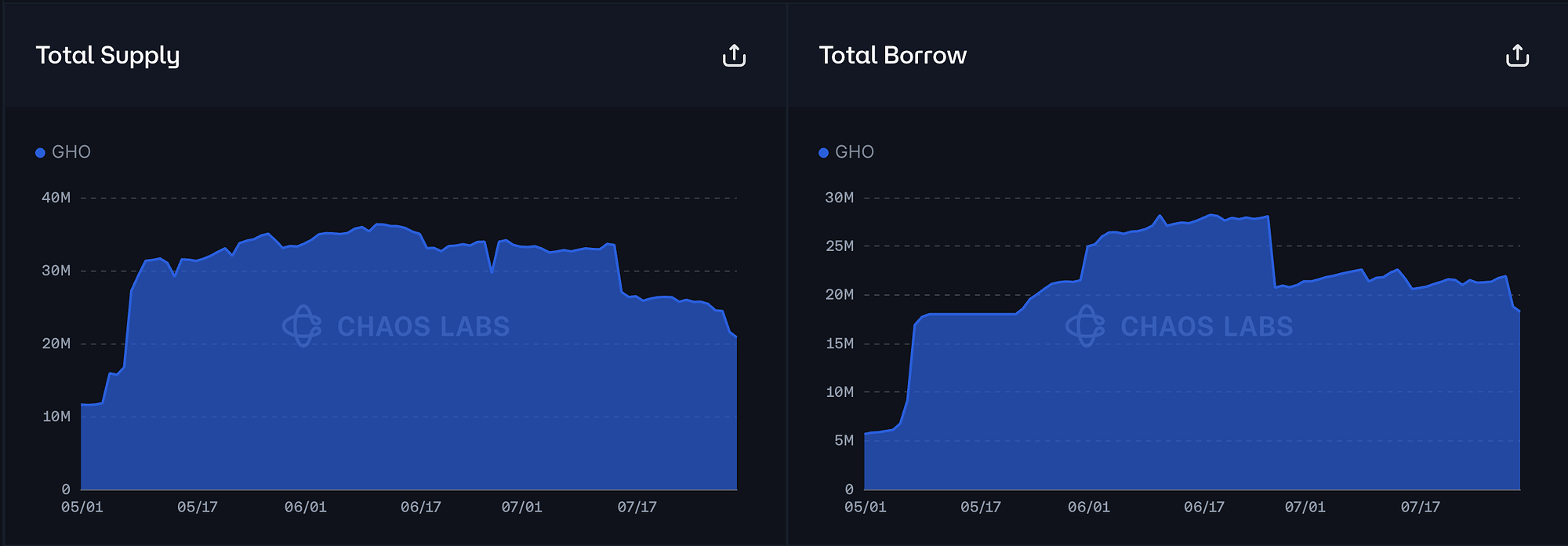

Following the successful multichain expansion of GHO to Arbitrum, Base, Avalanche launching GHO on Ink represents the next step in growing GHO’s presence.

Ink is an EVM-compatible, modular Layer 2 focused on scalable, capital-efficient DeFi applications brought to life by Kraken. With Aave’s anticipated deployment on Ink, bringing GHO to the network simultaneously ensures GHO becomes a foundational stablecoin in the ecosystem from day one.

This ARFC seeks community support to approve the launch of GHO on Ink, ensuring the coordination of technical deployment, risk management, and ecosystem alignment.

As learned from previous launches, successful expansion of GHO requires:

- Coordinated implementation of protocol and bridging infrastructure

- Definition of risk parameters tailored to Ink’s ecosystem

- Collaboration with local DEXs and applications for utility and liquidity

- Early incentive programs and strategic ecosystem engagement

Specification

Ink will be the next immediate focus for GHO growth alongside the Aave instance launch.

The proposed launch of GHO on Ink involves the following components and responsibilities:

| Service Provider | Responsibility |

|---|---|

| Aave Labs + Certora | Deploy GHO infrastructure and CCIP bridge |

| TokenLogic | Deploy Facilitator, GSM, and Steward config |

| Chaos Labs + Risk Llama | Set and monitor risk parameters |

| ACI + TokenLogic | Incentive design and emissions distribution |

| Aave Liquidity Committee | Coordinate DEX liquidity |

| GHO Stewards | Maintain risk parameters over time |

ACI multisig address: 0xac140648435d03f784879cd789130F22Ef588Fcd

Timeline and exact implementation details will follow in subsequent AIPs after ARFC approval.

GHO Parameters for Aave v3 Ink Deployment

| Parameter | Value |

|---|---|

| Asset | GHO |

| Market | Ink |

| Isolation Mode | No |

| Borrowable | Yes |

| Collateral Enabled | No |

| Supply Cap | 5,000,000 |

| Borrow Cap | 4,500,000 |

| Debt Ceiling | - |

| LTV | - |

| LT | - |

| Liquidation Bonus | - |

| Liquidation Protocol Fee | - |

| Variable Base | 0% |

| Variable Slope1 | 5.5% |

| Variable Slope2 | 50% |

| Uoptimal | 90% |

| Reserve Factor | 10% |

| Stable Borrowing | Disabled |

| Flashloanable | Yes |

| Siloed Borrowing | No |

| Borrowable in Isolation | No |

| E-Mode Category | N/A |

Facilitator and CCIP Configuration

A GhoDirectMinter facilitator will be deployed on Ethereum to support GHO issuance for Ink:

| Parameter | Value |

|---|---|

| Mint Cap | 15M GHO |

CCIP configuration to support bridging to Ink:

| Parameter | Value |

|---|---|

| Bucket Capacity | 15M GHO |

| Inbound Capacity | 1,500,000 |

| Outbound Capacity | 1,500,000 |

| Refill Rate | 300 GHO/sec |

GSM Parameters (stataUSDT0.ink)

| Parameter | Value |

|---|---|

| GHO Bucket Cap | 10.00M |

| USDT0 Exposure Cap | 5.00M |

| Freeze Lower Bound | $0.990 |

| Freeze Upper Bound | $1.010 |

| Unfreeze Lower Bound | $0.995 |

| Unfreeze Upper Bound | $1.005 |

| Mint GHO Fee | 0.00% |

| Burn GHO Fee | 0.00% |

USDT0 deposits into stataUSDT0.ink will trigger GHO transfers from Ethereum-held inventory managed by the GSM.

GHO Steward Configuration

GhoAaveSteward:

updateGhoBorrowCap: ±100%updateGhoBorrowRate: ±5% onoptimalUsageRatio,baseVariableBorrowRate,variableRateSlope1,variableRateSlope2updateGhoSupplyCap: Up to +100%

GhoGsmSteward:

updateGsmExposureCap: ±100%updateGsmBuySellFees: ±0.5% per side (FixedFeeStrategy)

Only callable by the GHO Steward.

Budget

To bootstrap the Ink instance and support initial growth, a specific allowance on Ethereum will be created and bridged to Ink.

ALC Ethereum SAFE: 0xA1c93D2687f7014Aaf588c764E3Ce80aF016229b

Initial liquidity will be sourced via aUSDT0 and routed through Aave LP partners and Ink-native DEXs.

Disclaimer

TokenLogic is not compensated for the creation or coordination of this proposal.

Next Steps

- Gather feedback from the community

- If consensus is reached, escalate to Snapshot vote

- If Snapshot vote passes (YAE), proceed with AIP implementation

Copyright

Copyright and related rights waived via CC0