Summary

LlamaRisk supports launching GHO on the Linea network. The proposed initial parameters are consistent with the initial deployments on established L2s like Arbitrum and Base, representing a measured approach to expansion.

The introduction of Linea’s Native Yield mechanism, which channels staking rewards from bridged ETH into the ecosystem, presents a compelling opportunity for GHO’s expansion on Linea’s DEXs. Even though this mechanism introduces additional dependency and rehypothecation risks, these risks would be managed by active exposure management proposed by the Linea team. Therefore, we support the proposed parameters and strategy by TokenLogic, which would allow GHO to scale safely as demand materializes.

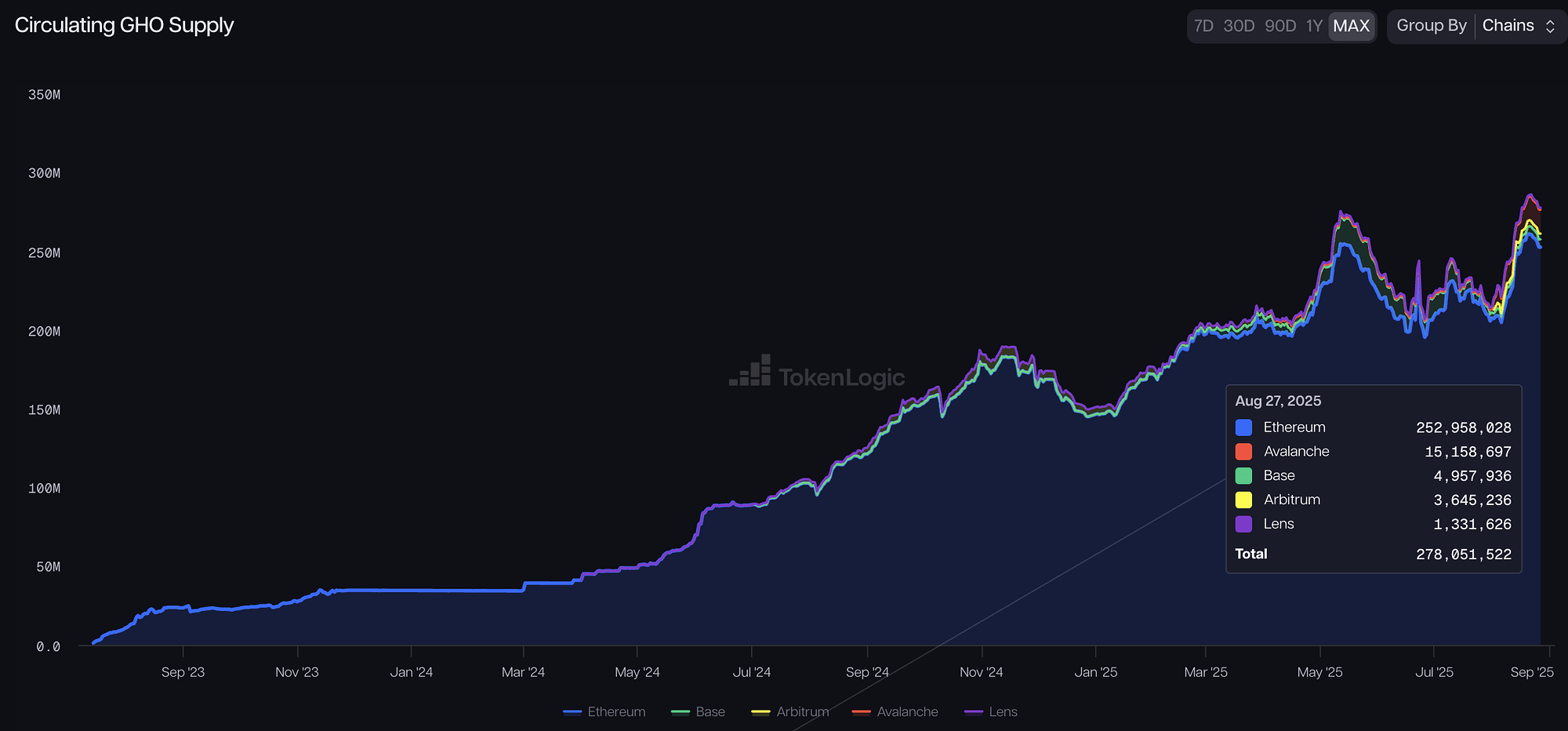

Cross-Chain Progress & Market Sizing

Since GHO’s cross-chain deployments began, GHO has grown to 280M total supply, with ~26M GHO residing on the supported L2s. The Avalanche market has seen the most success, while the Base market has contracted over time.

Source: TokenLogic GHO Dashboard, August 27, 2025

The proposed initial market size for GHO on Linea is well-justified compared to previous successful deployments. At the time of GHO’s launch on Arbitrum and Base, the Aave v3 markets on those chains had a TVL that was in line with Linea’s current Aave v3 market size of $526M, suggesting a comparable initial demand for GHO borrowing and justifying the proposed caps and incentive strategy.

Current Health of GHO

After the renewed positive market conditions and increased leverage strategies, GHO’s secondary market peg was temporarily affected, reaching a discount of up to 30 bps in late July. Slight increases in GHO borrow rates and a bump in Aave Savings Rate helped to contain the outflows and reduced secondary market pressure, with GHO now back to 10 bps (0.1%) peg bounds.

Source: CoinMarketCap, August 27, 2025

On Ethereum, GHO currently possesses a 37M sell buffer within 30 bps (0.3%) price impact, suggesting that a selling pressure of more than 10% of the total supply would be needed to destabilize the peg again.

Potential Use Cases on Linea

The introduction of Native Yield on Linea presents a unique argument for GHO adoption. As users bridge ETH that automatically earns staking rewards via Lido v3 stVaults, there will be a natural demand to borrow against this productive collateral. GHO is well-positioned to be the stablecoin of choice for these operations, especially as the Aave v3 market on Linea only has USDC and USDT onboarded on the stablecoin side. GHO DEX integrations and incentives are also expected to improve GHO’s expansion among other yield venues on the Linea network.

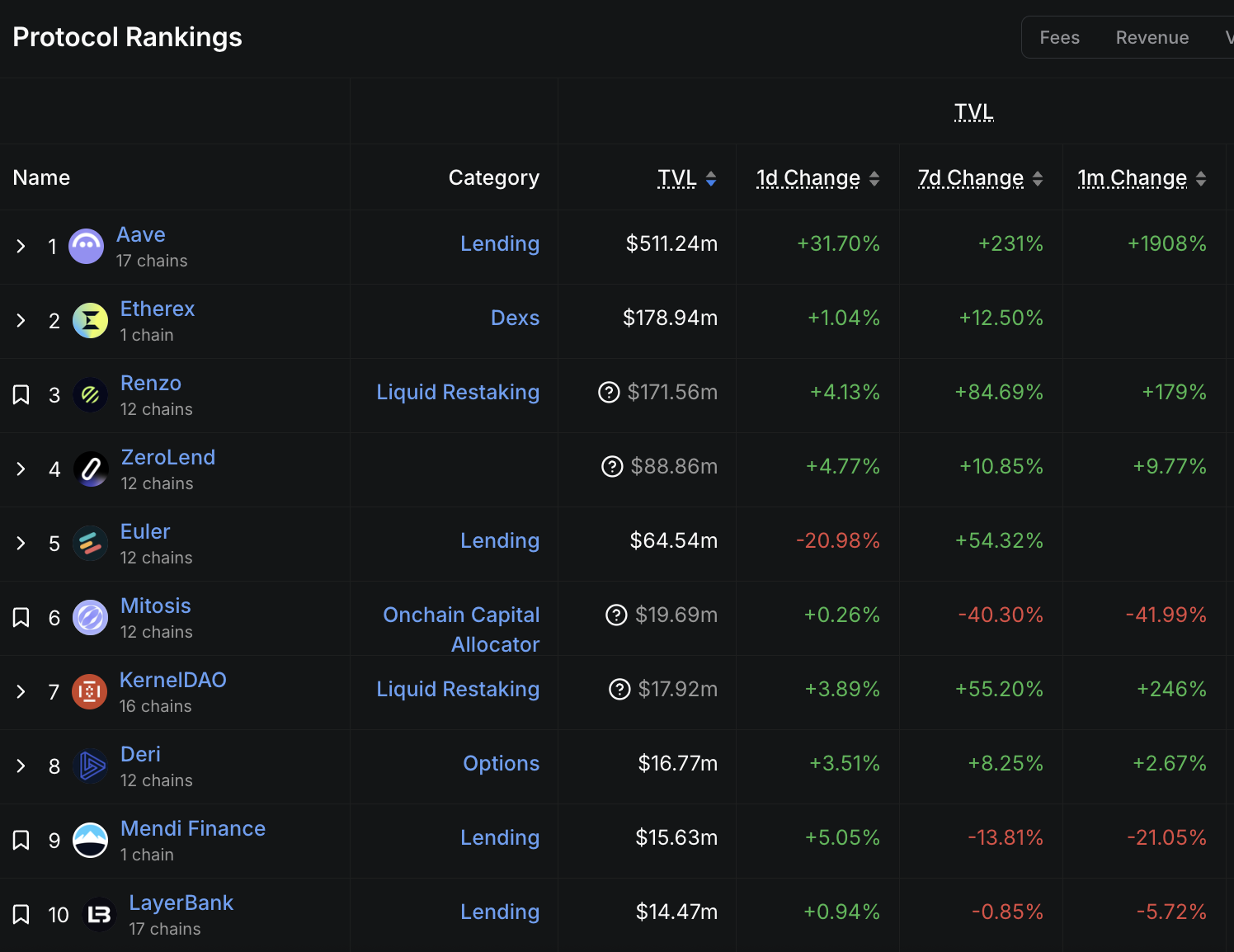

Linea Yield Venues

Currently, Aave is a dominant yield venue on Linea, with Etherex permissionless DEX being the largest notable liquidity venue. As GHO is onboarded, part of the supply will likely flow to the DEXs, where new GHO liquidity pools would be bootstraped. Given the dominance of lending protocols on this chain, the potential for other external yield integrations is currently unclear.

Source: DefiLlama, August 27, 2025

The largest pools of the Etherex exchange are pairing ETH, LSTs/LRTs, and stablecoins. This liquidity profile is suitable for GHO adoption, as ETH and ETH derivatives are also prevalent GHO collateral assets on Mainnet.

Source: Etherex DEX, August 27, 2025

Disclaimer

This review was independently prepared by LlamaRisk, a community-led decentralized organization funded in part by the Aave DAO. LlamaRisk is not directly affiliated with the protocol(s) reviewed in this assessment and did not receive any compensation from the protocol(s) or their affiliated entities for this work.

The information provided should not be construed as legal, financial, tax, or professional advice.