Summary

LlamaRisk supports launching GHO on Plasma with the initial Aave deployment on Plasma. Similarly to other GHO expansion initiatives, a measured approach is to be taken while allowing GHO to scale measurably as the demand comes. Therefore, we support the launch parameters and the strategy proposed by TokenLogic.

Planned liquidity incentives will help to sustain the secondary market stability of GHO on Plasma. At the same time, the decision to implement stataGSM will ensure that a second stability buffer starts to fill since GHO’s deployment gradually.

The Cross-Chain Progress

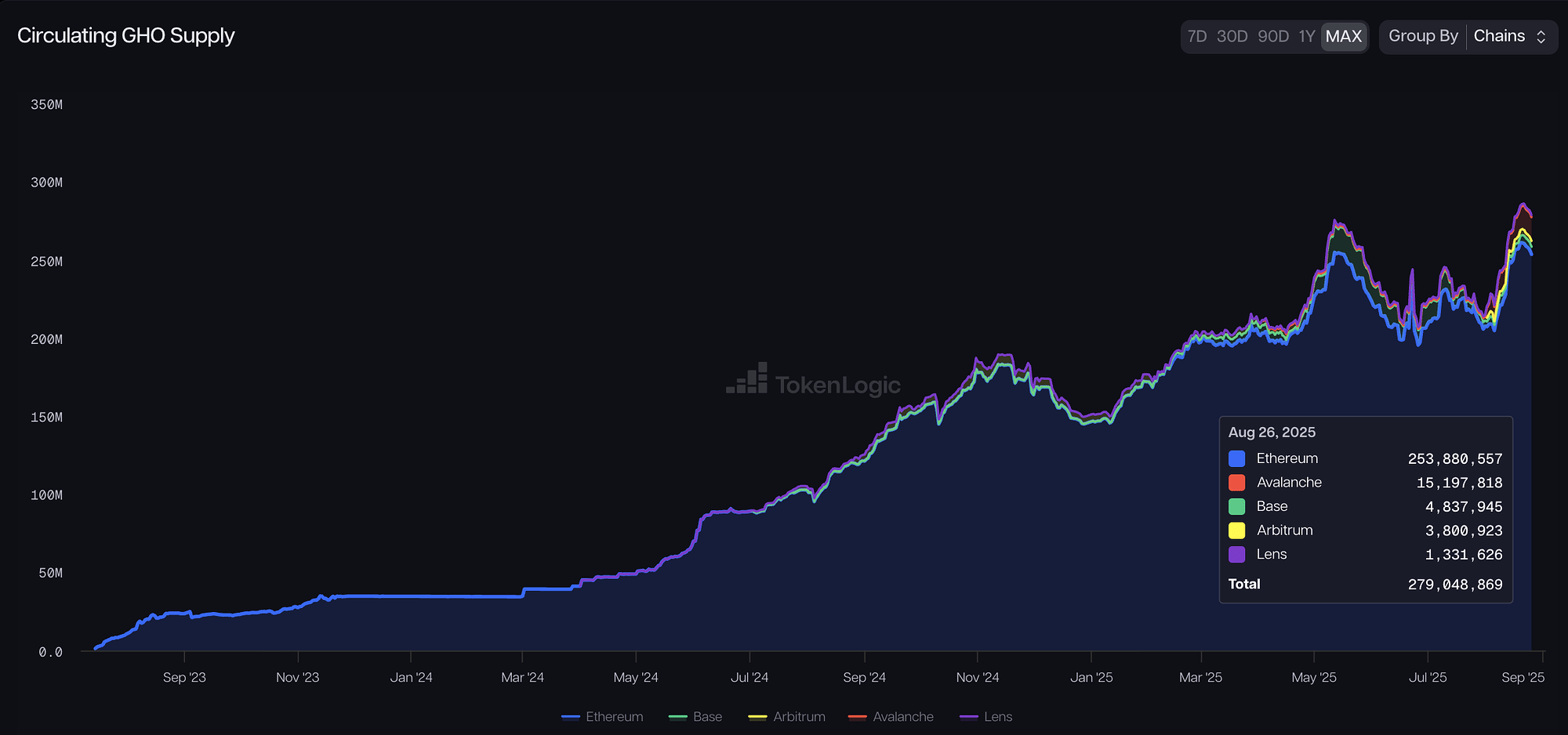

Since GHO’s cross-chain deployments began, GHO has grown to 280M total supply, with ~26M GHO residing on the supported L2s. The Avalanche market has seen the most success, while Base market has contracted over time.

Source: TokenLogic GHO Dashboard, August 26, 2025

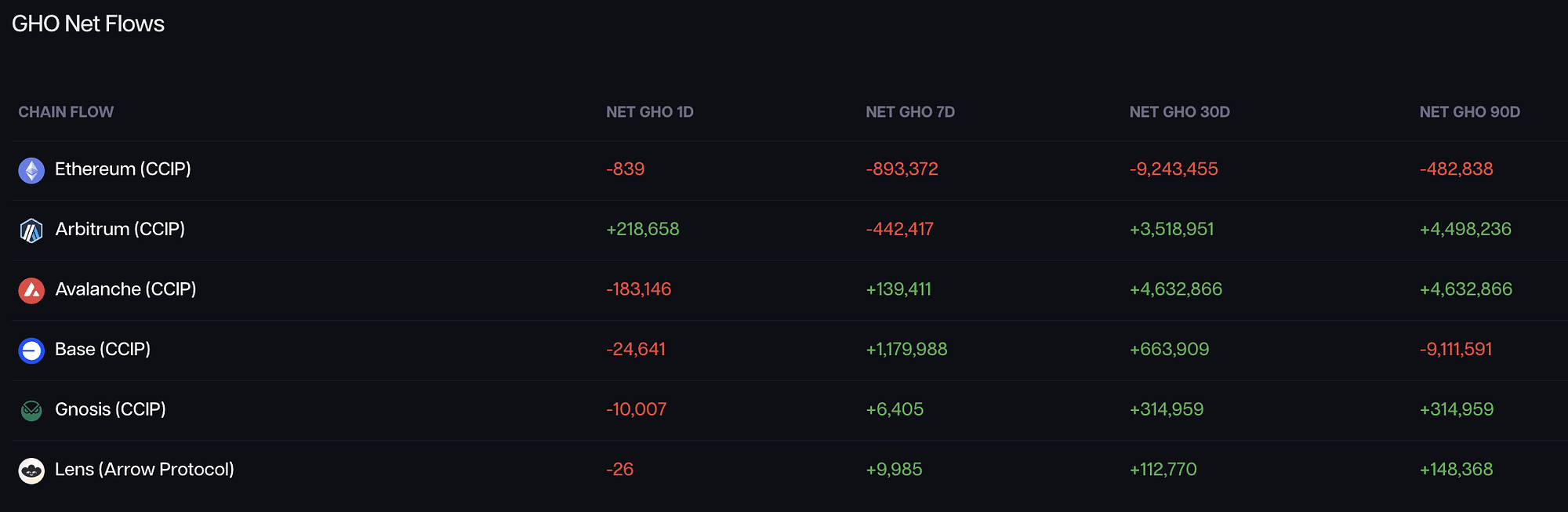

The historical GHO flows indicate that the overall GHO flows were positive for Arbitrum and Avalanche. In addition, the newly deployed Gnosis market has attracted ~300k in borrows.

Source: TokenLogic GHO Dashboard, August 26, 2025

Current Health of GHO

After the renewed positive market conditions and increased leverage strategies, GHO’s secondary market peg was temporarily affected, reaching a discount of up to 30 bps in late July. Slight increases in GHO borrow rates and a bump in Aave Savings Rate helped to contain the outflows and reduced secondary market pressure, with GHO now back to 10 bps (0.1%) peg bounds.

Source: CoinMarketCap, August 26, 2025

On Ethereum, GHO currently possesses a 37M sell buffer within 30 bps (0.3%) price impact, suggesting that a selling pressure that is more than 10% supply would be needed to destabilize the peg again.

Potential Use Cases

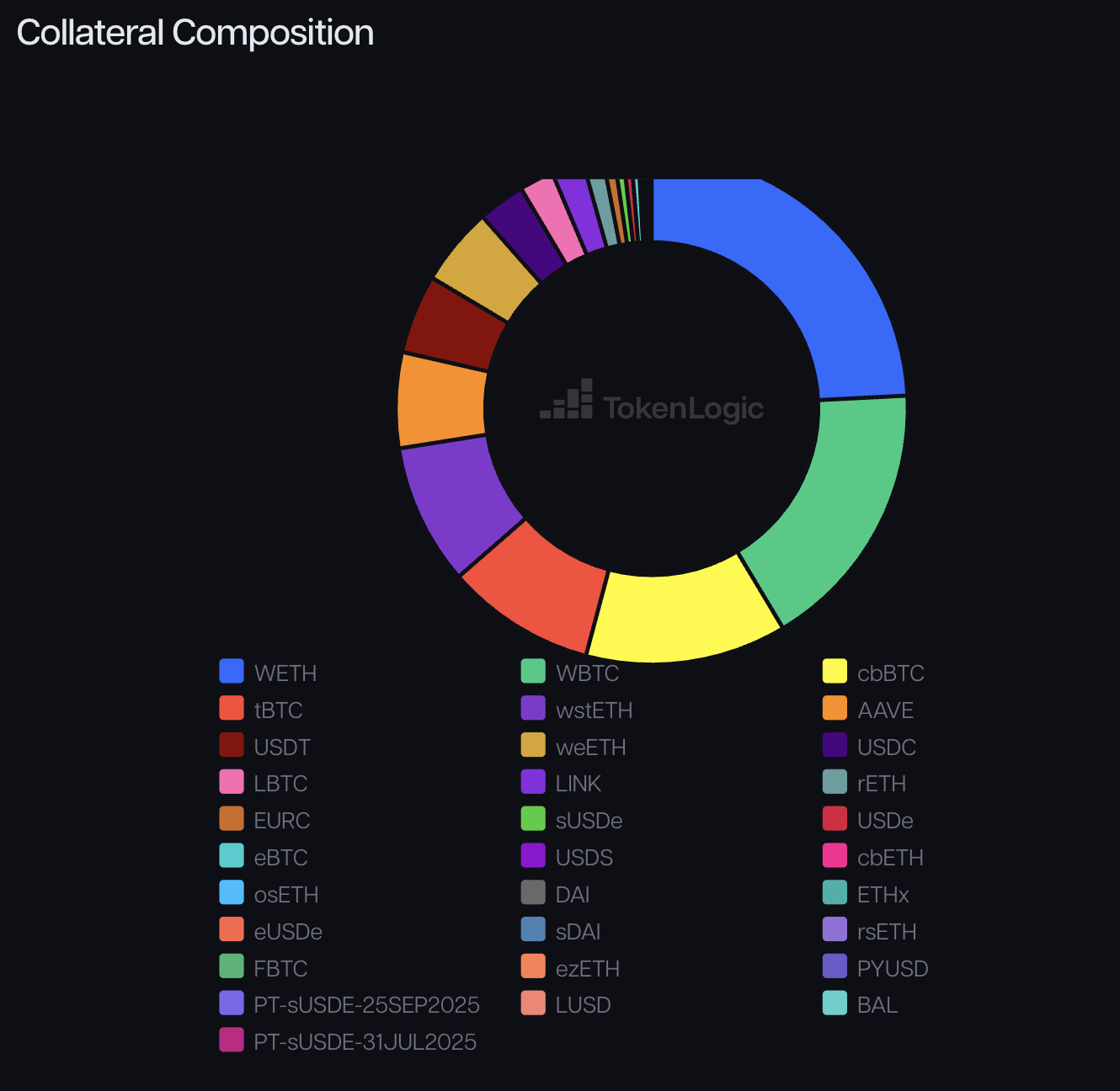

Currently, GHO has a collateral ratio of 3.4, with the most prominent collateral assets being WETH, ETH LSTs, and BTC wrappers. We expect similar assets to be onboarded on Aave’s Plasma markets, generating sufficient demand for GHO loans.

Source: TokenLogic GHO Dashboard, August 26, 2025

GHO DEX integrations and incentives are also expected to improve GHO’s expansion among other yield venues on the upcoming Plasma network.

Disclaimer

This review was independently prepared by LlamaRisk, a community-led decentralized organization funded in part by the Aave DAO. LlamaRisk is not directly affiliated with the protocol(s) reviewed in this assessment and did not receive any compensation from the protocol(s) or their affiliated entities for this work.

The information provided should not be construed as legal, financial, tax, or professional advice.