Summary

LlamaRisk supports onboarding frxUSD to the Aave V3 Ethereum Core instance. Since our previous analysis, frxUSD has improved across several dimensions, including the completion of third-party audits, the establishment of a separate balance sheet for frxUSD and legacy FRAX, and fully transparent, publicly verifiable on-chain reserves. DEX liquidity has also improved in recent months; however, moderate LP concentration remains, with nearly all depth residing on a single venue, namely Curve.

Some other risks include the absence of a bug bounty program with a recognized third-party provider (the current program is internal), limited transparency around changes to reserve composition, and the lack of a timelock mechanism for contract upgrades. In light of these considerations, we recommend onboarding frxUSD with collateral disabled on Aave.

1. Asset Fundamental Characteristics

1.1 Asset

According to the Aave Asset Class Allowlist (AAcA), Frax USD (frxUSD) is categorized as a reserve-backed stablecoin, as it is pegged to the USD and backed by tokenized U.S. Treasury funds. These reserves consist of Superstate’s USTB, WisdomTree’s WTGXX, Securitize’s BUIDL, Bridge’s USDB, and Circle’s USDC, with their respective compositions shown below. frxUSD currently maintains a collateralization ratio of 102.38%.

Source: frxUSD Reserve Composition, Frax, December 12, 2025

1.2 Architecture

frxUSD is an ERC-20 stablecoin natively minted on Ethereum and backed by tokenized U.S. Treasury funds. These reserves are held by “enshrined custodians,” who are responsible for managing the minting and burning of frxUSD and are mandated to maintain sufficient cash and cash equivalents to back the outstanding supply. Mint and redeem requests are processed either intra–business day or by the next business day, depending on the custodian and the timing of the request. Currently, frxUSD is backed by five assets, as shown below:

| Custodian | Asset | frxUSD Mint Fee | frxUSD Redeem Fee | frxUSD Mint Cap |

|---|---|---|---|---|

| Superstate | USTB | 0 bps | 1 bps | 50M |

| WisdomTree | WTGXX | 0 bps | 1 bps | 0.1M |

| Securitize | BUIDL | 0 bps | 1 bps | 0.1M |

| Bridge | USDB | 0 bps | 1 bps | 0.1M |

| frxUSD Redemption Contract | USDC | 0 bps | 0 bps | 200M |

Minting

The flow of funds for minting begins when a whitelisted user initiates a request to mint frxUSD with a custodian by depositing accepted RWA. Upon receiving the deposit, the custodian mints frxUSD equivalent to the deposited RWA and transfers the newly minted frxUSD to the user. As shown in the table above, the frxUSD minting fee is zero.

Redemption

frxUSD is redeemable on demand for any custodian asset via one of the designated frxUSDCustodian contracts shown in the table above. The redemption process begins when a whitelisted user sends frxUSD to the custodian to initiate redemption. The custodian burns the received frxUSD, after which RWA equivalent to the burned frxUSD is transferred back to the user. A redemption fee of 1 bps applies for USTB, WTGXX, and BUIDL, while redemptions for USDC incur no fee.

Source: frxUSD Mint-Redemption Flow, LlamaRisk

FraxNet

In addition to primary mint and redeem flows, frxUSD has launched FraxNet, which facilitates cross-chain transfers using LayerZero and CCTP. Through FraxNet, users can complete KYB/KYC and participate in revenue sharing from T-Bill yield, while also gaining the ability to directly redeem frxUSD into fiat to their linked U.S. bank accounts via ACH wire. While FraxNet addresses have already been deployed, further details regarding on- and off-ramp partners are still awaited.

1.3 Tokenomics

As of December 12, 2025, frxUSD has a total supply of 111.72M, of which 103M is held on Ethereum. The supply of frxUSD is not fixed and can increase or decrease based on mint and redemption activity by whitelisted users depositing or withdrawing collateral through the enshrined custodians.

1.3.1 Token Holder Concentration

Source: Etherscan, December 12, 2025

The top 5 holders of frxUSD are:

- Concrete Stable Pre-Deposit Vault: 48.48% of the total supply.

- Curve crvUSD/frxUSD Pool: 19.12% of the total supply.

- Fraxtal L1 Standard Bridge Proxy: 10.54% of the total supply.

- Curve sfrxUSD/frxUSD Pool: 3.77% of the total supply.

- Curve frxUSD/sUSDS Pool: 3.71% of the total supply.

The top 10 holders collectively own 94.76% of frxUSD on Ethereum; however, since these holdings are distributed across various DeFi applications, the associated concentration risk is low.

2. Market Risk

2.1 Liquidity

Source: frxUSD/USDC Swap Liquidity, DeFiLlama, December 12, 2025

Users can swap $26.3M frxUSD for USDC within a price impact of 7.5%.

2.1.1 Liquidity Venue Concentration

Source: LlamaRisk, December 13, 2025

The DEX liquidity for frxUSD is primarily composed of various stablecoins and is almost entirely concentrated on Curve, with the only other venue being a single Fraxswap WFRAX/frxUSD pool with approximately $3M in TVL. The largest frxUSD liquidity pool is the Curve crvUSD/frxUSD pool, which has $38.1M in TVL. Notably, there is an absence of direct, deep USDC or USDT sell-side liquidity.

2.1.2 DEX LP Concentration

frxUSD liquidity on Ethereum is moderately concentrated among a small number of entities, with the majority of liquidity provided by Frax Finance. This concentration reduces the likelihood of an abrupt liquidity withdrawal, as protocol-aligned liquidity is generally more stable and less prone to sudden outflows. Below is the breakdown for the top 5 pools by TVL on Ethereum (as of December 13, 2025):

- Curve crvUSD/frxUSD ($38.09M TVL): An EOA 1 is the top supplier via (Stake DAO) with 8.2% share of the pool’s liquidity.

- Curve sfrxUSD/frxUSD ($11.68M TVL): The top supplier is a Multisig (via Convex) with 100% share of the pool’s liquidity.

- Curve frxUSD/sUSDS ($6.92M TVL): Frax Finance is the top supplier (via Convex) with 90.48% share of the pool’s liquidity.

- Curve frxUSD/msUSD ($4.32M TVL): Another EOA 2 is the top supplier (via Stake DAO) with 22.44% share of the pool’s liquidity.

- Curve FRAX/frxUSD ($4.09M TVL): Frax Finance is the top supplier with 100% share of the pool’s liquidity.

2.2 Volatility

Source: frxUSD Secondary Market Price, LlamaRisk, December 13, 2025

The frxUSD price on Curve has generally maintained a relatively tight peg, except on June 26, 2025, when it temporarily depegged by 9.74% to $0.9026 due to a momentary depletion of sell-side liquidity in the pool. Since then, DEX liquidity has increased materially, particularly following the launch and growth of the Curve crvUSD/frxUSD pool, and frxUSD has consistently maintained its peg on secondary markets.

2.3 Exchanges

frxUSD is exclusively traded on DEXs and is not currently listed on any centralized exchange.

2.4 Growth

Source: LlamaRisk, December 12, 2025

The total supply of frxUSD on Ethereum stands at 103.15M, marking an all-time high following a recent surge between October 22 and October 24, 2025, during which the supply nearly doubled over the span of a few days. Of this amount, 89.52M is in free float, while the remaining 13.63M is locked, comprising 10.88M in the Fraxtal L1 Standard Bridge and 2.75M in the Frax Comptroller.

3. Technological Risk

3.1 Smart Contract Risk

All contracts influencing the frxUSD architecture on Ethereum have undergone independent audits by third-party security firms, and the findings were as follows:

- FraxNet - Zellic (July 7, 2025): 1 medium, 5 low, and 2 informational, with all issues fixed except for one low-severity finding which was acknowledged by the team.

- Frax0 Mesh - Zellic (September 24, 2025): 1 medium, 1 low, and 6 informational, with all issues resolved except for one informational finding.

3.2 Bug Bounty Program

Frax Finance continues to operate an internal Bug Bounty Program where participants can reach out anonymously to disclose vulnerabilities. Any contract deployed by FRAX-Deployer is in scope, including frxUSD and sfrxUSD. The bounty is calculated as the lower value of 10% of the total possible exploit or $10 million worth of FRAX+FXS (evenly split), with a “no questions asked” policy.

We recommend using a third-party provider that offers guarantees to whitehats, ensuring their findings will be treated in the fairest possible manner. This approach increases the likelihood of responsible disclosure and successful user deposit protection by involving a third party.

3.3 Price Feed Risk

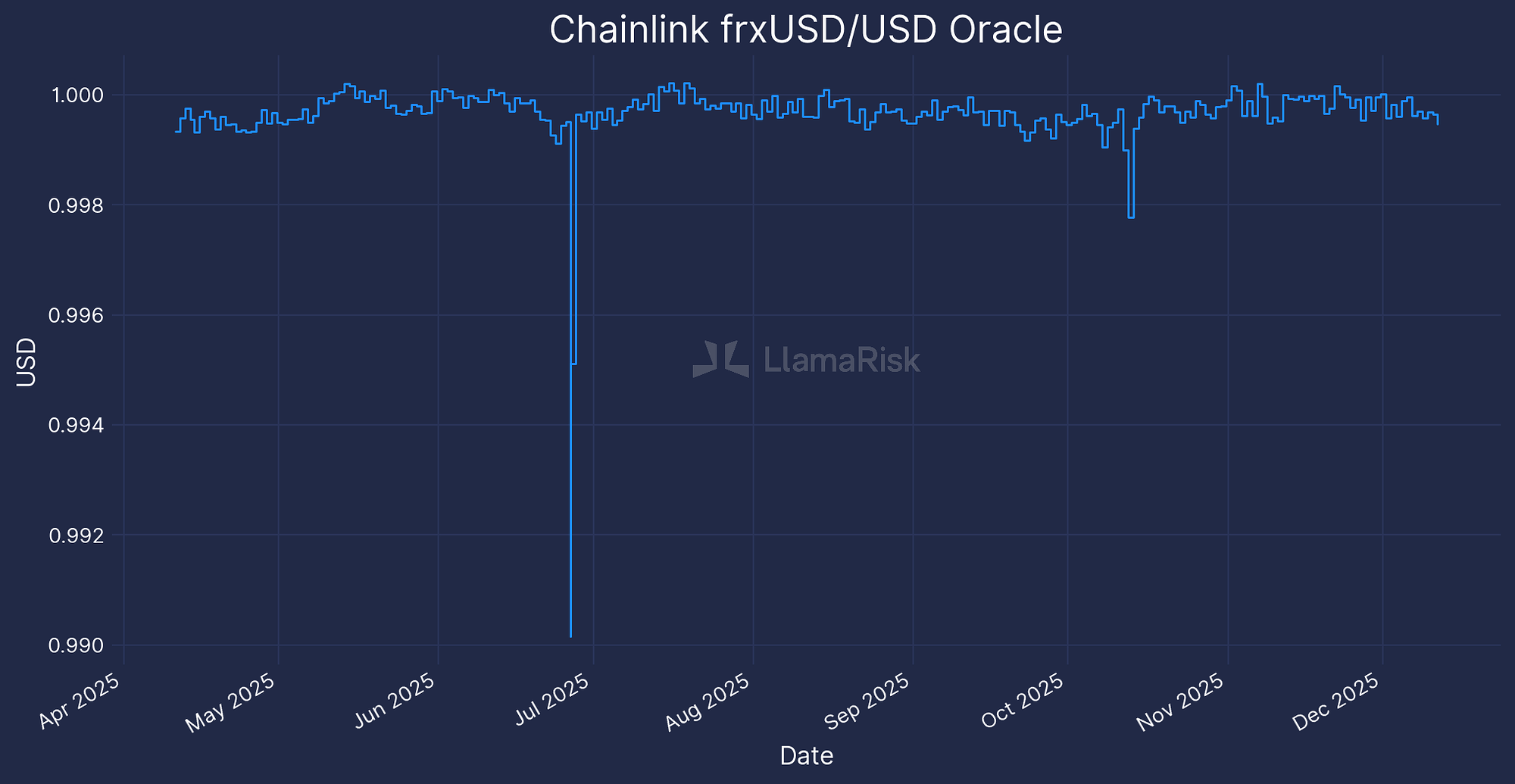

Chainlink has a frxUSD/USD price feed live on Ethereum Mainnet since April 2025. This feed is categorized as high-market risk with a deviation threshold of 0.5% and a heartbeat of 86400 seconds. The price history of the oracle is shown below.

Source: LlamaRisk, December 12, 2025

The lowest price reported by the feed, 0.990154 on June 26, 2025, coincides with the period of extremely low secondary market liquidity and the depeg observed in the Curve crvUSD/frxUSD pool, as discussed earlier. The volatility parameters are as follows:

| Std Dev Price | Avg Abs Change | Max Jump Size |

|---|---|---|

| 7.22 bps | 2.5 bps | 93.57 bps |

Given the stable behavior of the oracle alongside improving secondary market liquidity since November 2025, this feed can be considered suitable for pricing frxUSD on Aave.

3.4 Dependency Risk

Custodian Risk

frxUSD’s solvency depends on the institutional partners onboarded to back the asset. Currently, Superstate’s USTB and WisdomTree’s WTGXX together account for roughly 85% of the frxUSD backing, as shown in the balance sheet below. Users must rely on custodians to safely hold and manage the underlying assets. As a result, frxUSD’s dependency risk is primarily driven by the operational soundness, concentration, and transparency of its custodians, with the balance sheet disclosures and Chaos Labs’ proof-of-reserve feeds serving as key mitigants that provide transparency but do not eliminate this reliance.

Source: frxUSD Balance Sheet, Frax, December 12, 2025

Centralized Reserve Management

Following the successful passage of FIP-432, the Frax DAO delegated issuer-level compliance and collateral management for frxUSD to Frax Inc., making it responsible for custodian oversight, reserve composition, audits, and attestations. As a result, the reserve and custodian selection process has become more opaque. Since our previous analysis, there has been a material change in the backing composition, with Bridge’s USDB onboarded and USCC, AUSD, and JTRSY offboarded, without a prior disclosure. This limited transparency around reserve changes may reduce stakeholders’ visibility into potential shifts in backing composition, which can modestly increase collateral risk due to the absence of clear guidance on forthcoming adjustments.

That said, given Frax’s stated intention to align frxUSD with GENIUS Act compliance, we expect future reserve additions to focus on highly liquid, tokenized U.S. Treasury-based assets supported by regulated custodians, which should help constrain the risk profile of frxUSD backing over time.

Solana Exposure

Approximately $2M of Bridge’s USDB reserves backing frxUSD are held on Solana. According to the frxUSD balance sheet, the protocol currently maintains a surplus of approximately $2.84M, representing the difference between total assets (reserves) and liabilities (frxUSD supply). In the event of an exploit on Solana, the loss of the USDB backing would not render frxUSD insolvent. However, it would reduce the collateralization ratio to approximately 100.76%. Looking ahead, if RWA backing becomes increasingly distributed across multiple chains, the overall risk surface would correspondingly increase.

4. Counterparty Risk

4.1 Governance and Regulatory Risk

The governance and regulatory risk profile remains broadly consistent with our previous analysis, with recent changes reflecting frxUSD’s efforts to comply with the GENIUS Act, including the separation of the frxUSD balance sheet from legacy FRAX. However, these regulatory alignments also coincide with a shift toward more centralized decision-making, as issuer-level compliance, reserve management, and related operational responsibilities now reside with Frax Inc. solely after the implementation of FIP-432.

4.2 Access Control Risk

4.2.1 Contract Modification Options

Here are the controlling wallets:

- Multisig A: 3/5 Safe multisig also serving as Frax’s Comptroller with ownership, minter management, freeze/unfreeze, and protocol pause/unpause functionalities.

The frxUSD architecture is powered by the following contracts, and all of them are controlled by Multisig A:

- frxUSD: Upgradeable ERC20 contract for the frxUSD token.

- frxUSD-USDB Custodian Proxy: Upgradeable ERC4626 vault enabling minting/burning of frxUSD via depositing/redemption of USDB collateral.

- frxUSD-WTGXX Custodian Proxy: Upgradeable ERC4626 vault enabling minting/burning of frxUSD via depositing/redemption of WTGXX collateral.

- frxUSD-BUIDL Custodian Proxy: Upgradeable ERC4626 vault enabling minting/burning of frxUSD via depositing/redemption of BUIDL collateral.

- frxUSD-USDC Custodian Proxy: Upgradeable ERC4626 vault enabling minting/burning of frxUSD via depositing/redemption of USDC collateral.

- frxUSD-USTB Custodian Proxy: Upgradeable ERC4626 vault enabling minting/burning of frxUSD via depositing/redemption of USTB collateral.

4.2.2 Timelock Duration and Function

No timelock mechanism is implemented for the above contracts, meaning administrative actions can be executed immediately without any enforced delay.

4.2.3 Multisig Threshold / Signer identity

The Multisig A, controlled by Frax Inc., is the owner of all frxUSD-related contracts and also functions as the Frax Finance Comptroller. It is a 3-of-5 Safe multisig with the following signers:

- 0x6933BCC3e96f1C4d2cb73Cb391d854b18Ab7A4F2

- 0xcbc616D595D38483e6AdC45C7E426f44bF230928

- 0x17e06ce6914E3969f7BD37D8b2a563890cA1c96e

- 0xc8dE9f45601DA8C76158b8CAF3E56E8A037F2228

- 0x6e74053a3798e0fC9a9775F7995316b27f21c4D2

Note: This assessment follows the LLR-Aave Framework, a comprehensive methodology for asset onboarding and parameterization in Aave V3. This framework is continuously updated and available here.

Aave V3 Specific Parameters

Parameters will be presented jointly with @ChaosLabs

Price feed Recommendation

We recommend using the Chainlink frxUSD/USD feed with CAPO.

Disclaimer

This review was independently prepared by LlamaRisk, a DeFi risk service provider funded in part by the Aave DAO. LlamaRisk is not directly affiliated with the protocol(s) reviewed in this assessment and did not receive any compensation from the protocol(s) or their affiliated entities for this work.

The information provided should not be construed as legal, financial, tax, or professional advice.