Overview

Chaos Labs supports the listing of tBTC on the Aave Arbitrum deployment. Below is our analysis and initial recommendations.

Technical Overview

tBTC is a decentralized bridging solution that allows Bitcoin holders to mint tBTC tokens on the Ethereum network and participate in the DeFi ecosystem while maintaining exposure to their original BTC. Built on threshold cryptography and an honest-majority assumption, tBTC eliminates the need for centralized custodians by distributing key shares across a wide network of nodes.

At the heart of tBTC’s security lies a threshold cryptography model that distributes key generation and signing responsibilities among 100-node signer groups, each required to stake T tokens to become eligible. tBTC employs a (51,100) threshold ECDSA scheme where wallet operations require collaboration between 51 signers. This design ensures that no single entity can control private keys outright, significantly reducing custodial risk. However, an attacker who accumulates enough T stake to influence the random selection process could theoretically disrupt or commandeer wallets. To mitigate such threats, the network rotates signer groups regularly, imposes strict staking requirements, and employs slashing rules for misbehavior.

The T token underpins the system’s security budget, with each node operator staking at least 40,000 T to participate in signing groups. Historically, the staked amount has surpassed two billion T, creating a robust economic deterrent for attackers. Nodes gain yield for their service but risk significant slashing for dishonest behavior, aligning operator incentives with network integrity. For instance, nodes face a 10% stake loss for late responses, ensuring active participation in network operations. More severe penalties apply for fraudulent activity, with a 100% stake loss enforced for signature fraud. Despite this substantial protection, fluctuations in T’s market price could undermine the security budget if rapid devaluations occur.

Decentralization Model and Economics

The Threshold Network’s wallet generation protocol deploys a new Bitcoin wallet every 14 days or whenever the previous wallet’s balance crosses 100 BTC. The deployment of a new Bitcoin wallet is done through the updateWalletParameters governance function. As explained previously, the signers’ group, composed of 100 nodes, is selected randomly with a probability equal to their proportional T stake, with 51 signers required to control the wallet’s operation and the possibility of a single staker being chosen as a signer multiple times. Thanks to this information, we can calculate the likelihood of controlling a new wallet over a variable time period depending on the % of the total stake controlled:

Where p linearly represents nominal stake control. Given the creation of a new wallet every 14 days, deriving the probability of controlling at least one of those wallets over a variable timeframe under some static relative stake assumption with the singular entity:

![]()

where T represents the associated number of wallet creations within some timeframe. The relative T stake required to probabilistically control a new wallet created under specified duration assumptions can be visually observed below.

We observe that a range of 40% to 55% of the total T stake controlled by a singular entity starts to become problematic, assuming the staker maintains his share of the pool for a time window between 2 weeks to 2 years. To quantify whether such an action is economically feasible to perform under historical market valuations of the asset (which can be considered a general heuristic given the practical implications of such a scenario), the total dollar value of T stake and the associated 40% relative share representation is portrayed below, alongside the historical dollar value of 100 BTC, aiming to reflect the worst-case outcome of a new wallet generation and its comparative value to a scenario whereby malicious behavior is a rational outcome.

While the stakers can be observed to be significantly decentralized, currently, only 35 operators are whitelisted to stake T tokens, as can be found through the OperatorsInPool function on the SortitionPoolcontract. New operators can be added through governance, and some of the biggest stakers appear to be institutional Staking providers.

SPV Proofs

Verifying the Bitcoin blockchain’s state on Ethereum requires cross-chain communication. tBTC achieves this through SPV proofs, utilizing an open-source relay. The verification process involves relay nodes submitting Bitcoin block headers to Ethereum smart contracts, maintaining an up-to-date representation of Bitcoin’s blockchain state. This model still operates under “SPV assumptions,” which provide a weaker security model compared to the full verification performed by a Bitcoin full node. The proofs don’t rely on an honest federation, as the Bitcoin state is verified in the smart contract itself.

Currently, the protocol safeguards roughly $435M in bridged BTC, having peaked at higher levels in the past. However, tBTC’s Arbitrum supply has shown a market share drop and a nominal supply stagnation.

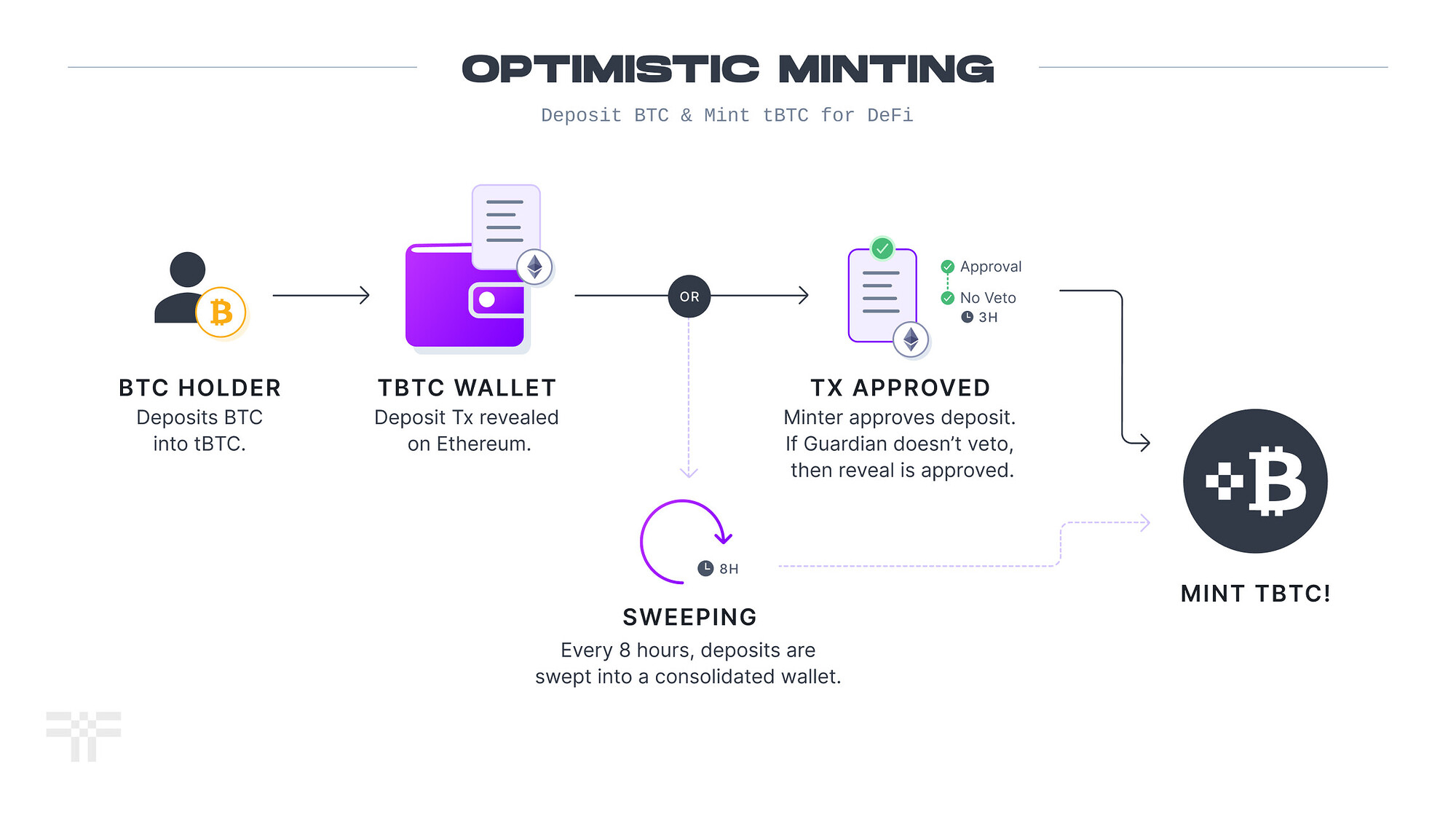

Mint and Redeem

Minting tBTC begins when users send BTC to a monitored wallet address associated with a randomly selected signing group. The Optimistic Minting System enables accelerated issuance through Trusted Accelerators. These entities detect deposits via SPV proofs and trigger rapid mint requests, subject to a three-hour dispute window where Guardians validate transaction finality and system integrity. Uncontested mints auto-finalize, minting tBTC while accruing debt until wallet sweeps reconcile balances. A 0.2% fee is applied, with proceeds funding the Treasury and Coverage Pool. Withdrawing tBTC back to Bitcoin follows a similar process, requiring proof of signer control over the original address before redemption occurs.

The primary Minters authorized for optimistic minting include Curve DAO, Synthetix, and ACI.

Bridging

tBTC leverages Wormhole’s cross-chain messaging protocol for asset transfers through Verified Action Approvals (VAAs). When users initiate transfers, the L2WormholeGateway contract on Ethereum locks tBTC and emits a VAA containing transfer details. Wormhole’s guardian network signs these VAAs, which Arbitrum’s L2WormholeGateway then verifies to mint equivalent tBTC on the destination chain.

Additionally, the Threshold Network enables native minting of tBTC on Arbitrum through its relayer system, bypassing Ethereum gas costs. Users deposit BTC into Threshold-controlled wallets, triggering SPV proof generation, coordinated threshold signature collection, and atomic minting of tBTC on Arbitrum. However, this method does not appear to have received any adoption so far, as the majority of the minting transactions on Arbitrum are performed through bridging.

Bridging tBTC from Arbitrum to Ethereum using Wormhole is estimated to take around 20-30 minutes, making dex arbitrage between the chains feasible and efficient. This ensures that the DEX liquidity on Arbitrum will better reflect that of Ethereum during market volatility.

Market Cap and Liquidity

tBTC’s market cap on Arbitrum has been stagnant over the last year, with its current supply on the chain being roughly 91 BTC or $8.8M. However, its Transaction Volume and Count have picked up considerably since September 2024. We further expect Aave’s listing to drive additional demand for the asset on Arbitrum.

tBTC’s DEX Liquidity has remained stable over the last 6 months, with the majority of it concentrated in WBTC pairs on Curve, Uniswap, and Balancer DEXs. A minor portion of the liquidity is within WETH pairs. The total buy liquidity for tBTC at the current time is $3.2M.

Volatility

tBTC’s volatility relative to BTC has remained very stable over the last 180 days, recording an average Daily Annualized Volatility of 6.56%, which is further improving in recent weeks, reaching 5.58 over the last 30 days.

Its biggest recorded price drop against BTC has been 1.95%. However, the asset tends to revert to its peg, allowing us to recommend less conservative parameters.

LTV, Liquidation Threshold, and Liquidation Bonus

As with the tBTC currently listed on the Aave Ethereum Instance, we recommend aligning its parameters to WBTC on the same chain. As such, we recommend an LTV and LT of 73% and 78%, respectively, with the Liquidation Penalty set to 7.50%.

Supply Cap and Borrow Cap

We recommend utilizing our normal methodology, in which the asset’s supply cap is set to 2x the amount of liquidity available at a price slippage equivalent to the Liquidation Penalty. This leads to a recommendation of 50 tBTC. Given the limited demand for borrowing BTC-related assets in the lack of an E-Mode involving a yield-bearing BTC, we recommend limiting the UOptimal of the asset to 45% in order to improve the withdraw liquidity available.

Pricing

Given tBTC’s higher-than-usual volatility but its consistent tendency to revert quickly to its underlying value, Similar to the mainnet implementation, we recommend using the BTC/USD feed to price tBTC on Arbitrum. This setup mitigates risks of price manipulation and protects against liquidation cascades caused by significant price fluctuations.

With a deviation threshold of just 5 bps due to minimal network transaction costs, this feed ensures accurate pricing while maintaining alignment with broader market conditions in real-time.

Recommendation

Following the above analysis, we recommend the following parameter settings:

| Parameter | Value |

|---|---|

| Isolation Mode | No |

| Borrowable | No |

| Collateral Enabled | Yes |

| Supply Cap | 50 |

| Borrow Cap | 25 |

| Debt Ceiling | - |

| LTV | 73% |

| LT | 78% |

| Liquidation Bonus | 7.5% |

| Liquidation Protocol Fee | 10% |

| Variable Base | 0% |

| Variable Slope1 | 4% |

| Variable Slope2 | 300% |

| Uoptimal | 45% |

| Reserve Factor | 20% |

| Stable Borrowing | Disabled |

| Flashloanable | No |

| Siloed Borrowing | No |

| Borrowable in Isolation | No |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this response.

Copyright

Copyright and related rights waived via CC0