Overview

Chaos Labs supports the listing of tBTC on the Aave Base deployment. Below is our analysis and initial recommendations.

Technical Overview

Chaos Labs has conducted extensive technical analyses on tBTC for its listings on Ethereum and Arbitrum. tBTC on Base can be natively minted, simplifying the minting and redeeming process and reducing the asset’s reliance on bridging. The tBTC contract on Base is owned by a 6-of-9 multisig, creating some centralization risk, though this is mitigated by the relatively high signature threshold.

Minting and Redeeming

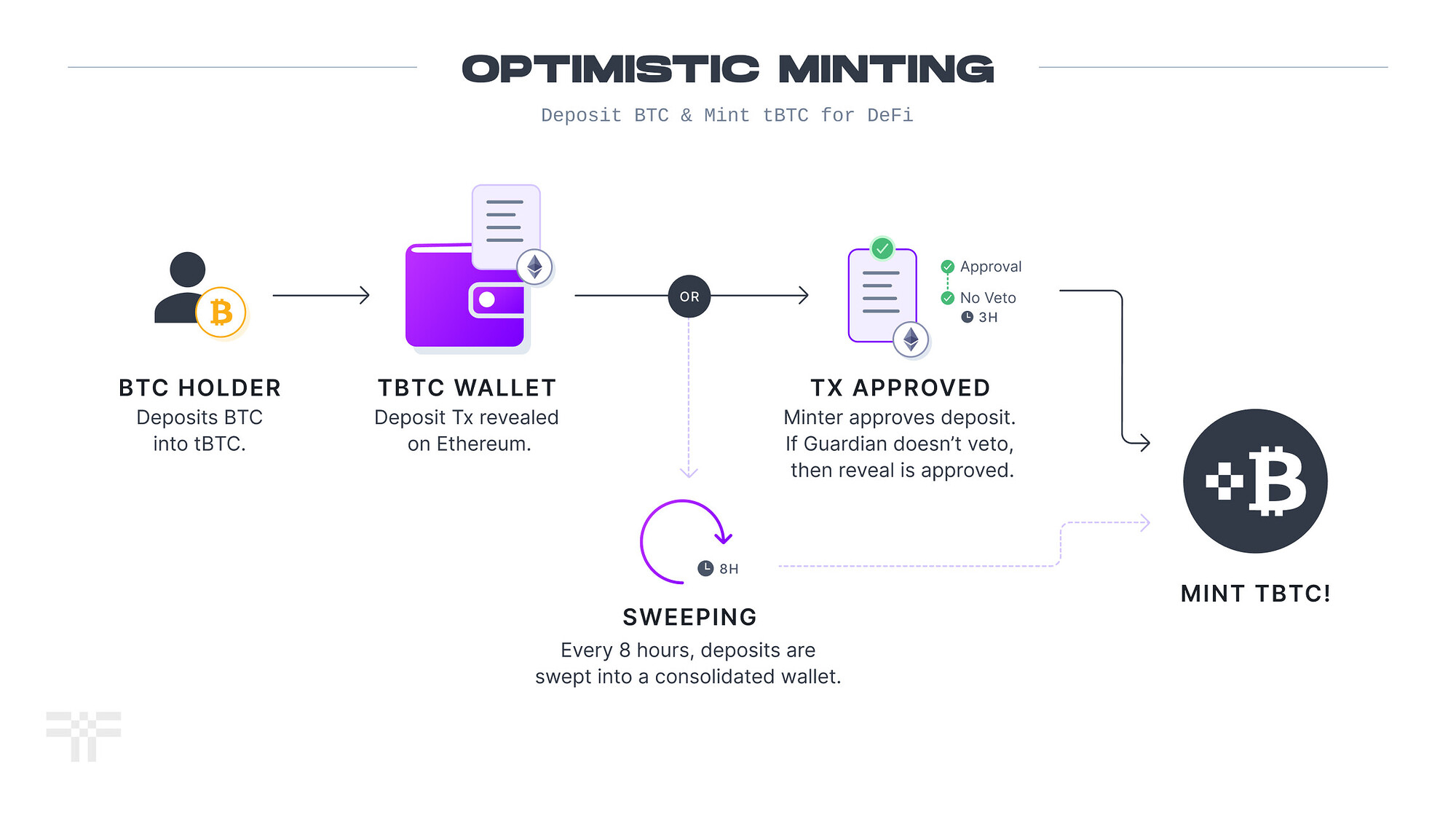

Minting tBTC begins when users send BTC to a monitored wallet address associated with a randomly selected signing group. The Optimistic Minting System enables accelerated issuance through Trusted Accelerators. These entities detect deposits via SPV proofs and trigger rapid mint requests, subject to a three-hour dispute window where Guardians validate transaction finality and system integrity. Uncontested mints auto-finalize, minting tBTC while accruing debt until wallet sweeps reconcile balances. A 0.2% fee is applied, with proceeds funding the Treasury and Coverage Pool. Withdrawing tBTC back to Bitcoin follows a similar process, requiring proof of signer control over the original address before redemption occurs.

The primary Minters authorized for optimistic minting include Curve DAO, Synthetix, and ACI.

Additionally, the Threshold Network enables native minting of tBTC on Base through its relayer system, bypassing Ethereum gas costs. Users deposit BTC into Threshold-controlled wallets, triggering SPV proof generation, coordinated threshold signature collection, and atomic minting of tBTC on Base.

Bridging

Bridging tBTC between Ethereum and Base using the Wormhole bridge involves a two-step process on each side: locking or burning the token on the source chain and minting or unlocking on the destination chain. When bridging from Ethereum L1 to Base L2, the user first locks tBTC in the Wormhole Token Bridge contract on Ethereum, waits for about 15 minutes for Ethereum block finality, then submits a mint transaction on Base to receive native tBTC there. Conversely, bridging from Base back to Ethereum requires burning tBTC on Base, waiting approximately 15 minutes for Base’s block finality, and then submitting an unlock transaction on Ethereum.

Market Cap and Liquidity

Currently, the protocol holds roughly $493M in BTC, having peaked at higher levels in the past. Additionally, tBTC’s supply on Base has shown a market share drop and stagnation, representing just over 2.5% of the total tBTC supply. However, as with the Arbitrum listing, we anticipate that listing tBTC on Aave’s Base instance will drive demand for the asset.

Despite these outflows, tBTC’s on-chain liquidity has improved significantly since last year, with some of this being due to price effects, especially in its pools with cbBTC. It also has multiple pools with WETH and USDC, providing a well distributed and relatively robust liquidity profile on Base.

Volatility

In its largest pool on Base, tBTC has traded at 0.9977 relative to cbBTC for the vast majority of the past year. Crucially, there have been no persistent negative depegs beyond this point, though there have been occasional downwards spikes because of large swaps.

These price deviations can be mitigated with the use of a fundamental oracle, as is the case on other tBTC listings.

LTV, Liquidation Threshold, and Liquidation Bonus

As with tBTC currently listed on the Ethereum Core, we recommend aligning its parameters to WBTC on the same chain. As such, we recommend an LTV and LT of 73% and 78%, respectively, with the Liquidation Penalty set to 7.50%.

Supply Cap and Borrow Cap

Taking into account the asset’s on-chain liquidity, we recommend an initial supply cap of 130 tBTC.

Given the limited demand for borrowing BTC-related assets, we recommend setting the UOptimal of the asset to 45% to ensure a healthy buffer, while setting its borrow cap to 10% of the supply cap.

E-Mode

While tBTC (borrowable) is included in an E-Mode with LBTC (collateral) on Ethereum, it is currently unused, with under $10 of LBTC being used as collateral to borrow tBTC.

Because of this, we do not recommend adding an E-Mode for this asset at this time. However, should we observe that there is demand to borrow tBTC against LBTC on Base, we may recommend this in the future.

Pricing

Taking into account tBTC’s occasional price spikes and rapid mean reversion, we again recommend using the BTC/USD feed to price tBTC on Base, as was recommended on Arbitrum. This setup mitigates risks of price manipulation and protects against liquidation cascades caused by significant price fluctuations.

With a deviation threshold of just 0.1% because of minimal network transaction costs, this feed ensures accurate pricing while maintaining alignment with broader market conditions.

Recommendation

Following the above analysis, we recommend the following parameter settings:

| Parameter | Value |

|---|---|

| Isolation Mode | No |

| Borrowable | Yes |

| Collateral Enabled | Yes |

| Supply Cap | 130 |

| Borrow Cap | 13 |

| Debt Ceiling | - |

| LTV | 73% |

| LT | 78% |

| Liquidation Bonus | 7.5% |

| Liquidation Protocol Fee | 10% |

| Variable Base | 0% |

| Variable Slope1 | 4% |

| Variable Slope2 | 60% |

| Uoptimal | 45% |

| Reserve Factor | 20% |

| Stable Borrowing | Disabled |

| Flashloanable | Yes |

| Siloed Borrowing | No |

| Borrowable in Isolation | No |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0