Summary

LlamaRisk supports listing PT-tUSDe-18DEC2025 on the Aave V3 Core instance. At the time of this analysis, the asset matures in approximately 96 days. The market for tUSDe is driven by a unique points-based yield mechanism, generating significant user demand for fixed-rate products (PTs) based on this underlying asset.

The underlying asset, tUSDe, derives its yield from Terminal’s “Roots” points system and a 50x Ethena points multiplier, differing from the delta-neutral yield of sUSDe.

Given the strong demand for tUSDe and the healthy liquidity profile of this new pool, adding this asset presents a minor incremental risk to the Aave Core market while offering a significant first-mover advantage.

Assessment of PT base asset: Link

Considered PT asset maturity: PT-tUSDe-18DEC2025

Asset State

Underlying Yield Source

The yield mechanism for the underlying tUSDe involves holding the token to accrue Roots, Terminal’s points system, with a x60 points multiplier. These points provide an additional layer of rewards, potentially convertible to tokens or other benefits in future launches. On top of this, users receive a 50x multiplier on Ethena points. The value and longevity of these points depend on Terminal’s success and future tokenomics.

For the PT-tUSDe token, the yield is implied through purchasing the token at a discount to its face value and redeeming it 1:1 for the underlying tUSDe at maturity, a standard Pendle PTs structure.

Underlying stability

The underlying tUSDe is a receipt token for USDe deposited into Terminal’s platform. The deposited USDe is staked into sUSDe within Terminal’s vaults. Users can redeem tUSDe for sUSDe at a 1:1 ratio at any time from the vault. This direct redeemability ensures that the tUSDe token inherits the stability profile and risks of the sUSDe token. The secondary market peg of sUSDe has remained stable, closely tracking its redemption value.

Source: LlamaRisk, September 15, 2025

Market Analysis

Total Supply

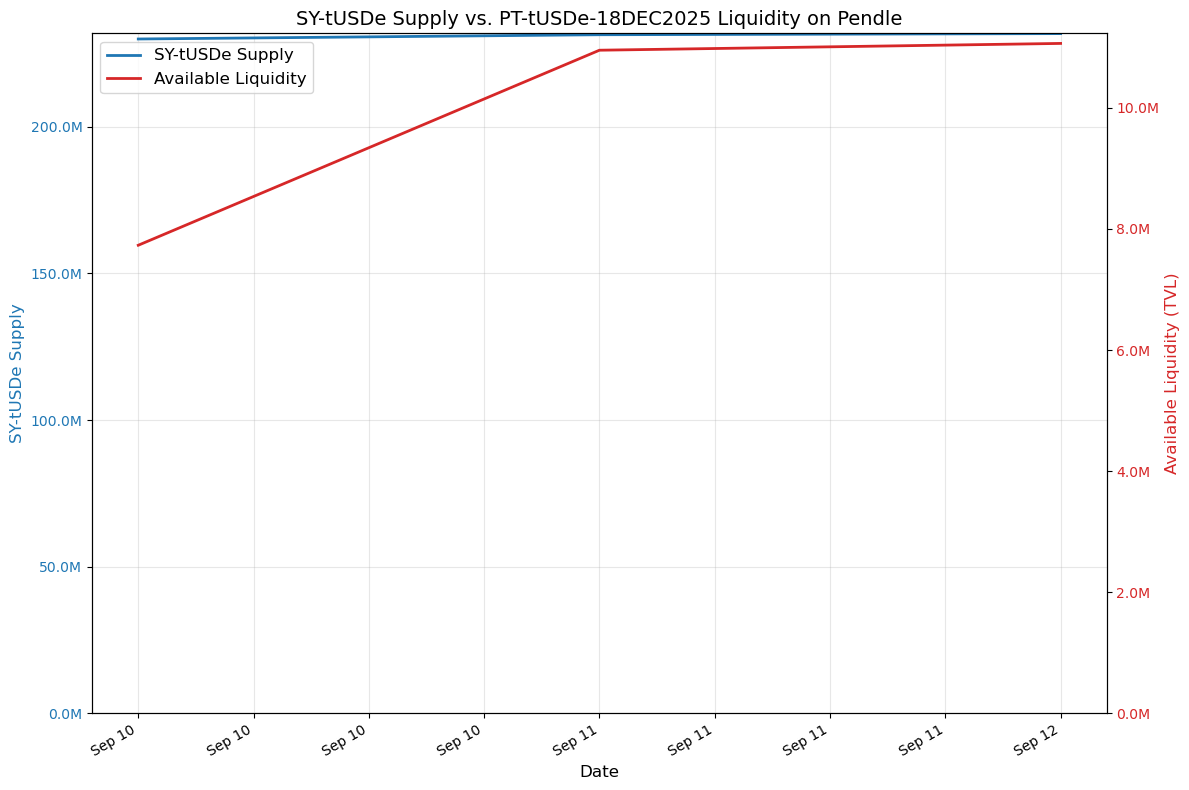

The PT-tUSDe-18DEC2025 maturity pool has demonstrated significant growth since its launch. As of September 12, 2025, the pool’s total available liquidity (TVL) is approximately $11M. The total supply of the underlying SY-tUSDe has reached nearly $230M.

Source: LlamaRisk, September 12, 2025

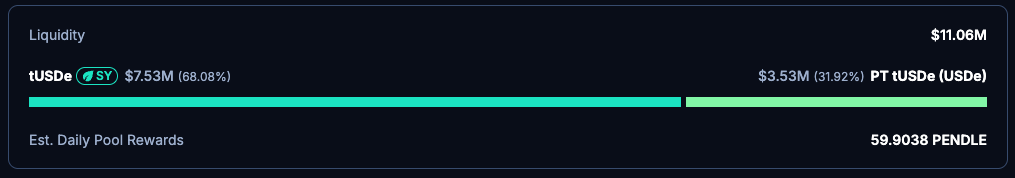

A more detailed breakdown of the pool’s composition is:

- Total Liquidity: $11.06M

- SY tUSDe: $7.53M (68.08%)

- PT tUSDe: $3.53M (31.92%)

Source: Pendle, September 12, 2025

Market Depth

The market’s order book reflects limited liquidity. The bid-ask spread on the implied yield is approximately 1.52% (12.13% sell vs 13.65% buy), indicating a young market. The liquidity is expected to continue growing as the asset gains visibility.

Source: Pendle, September 12, 2025

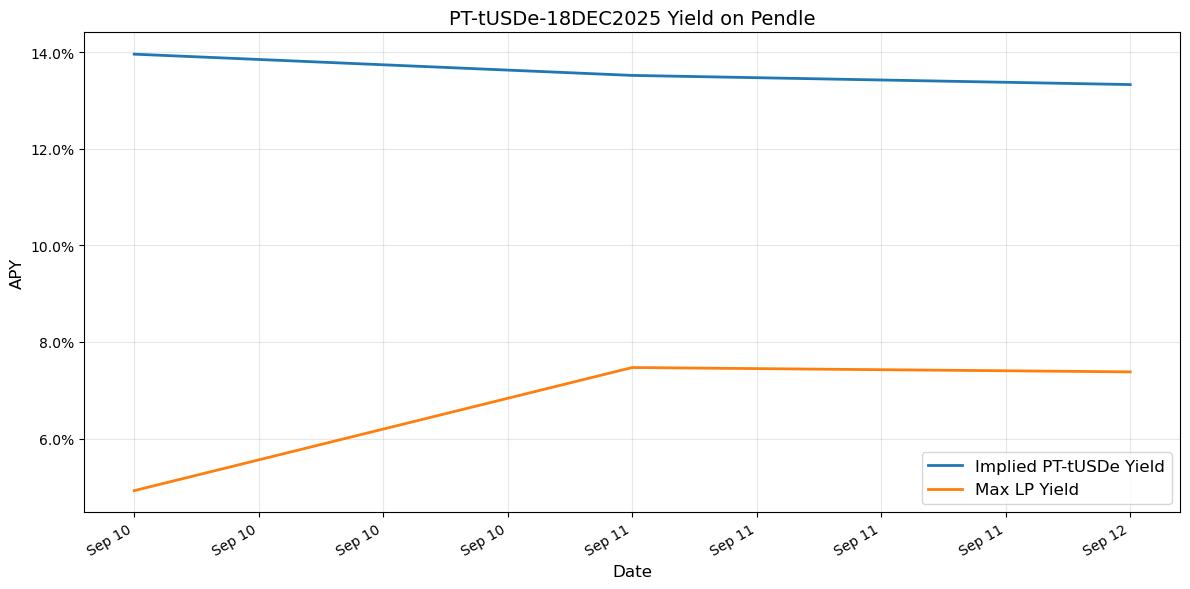

Price and Yield

The implied yields for the PT have remained stable and attractive since the pool’s inception. As of this review (96 days to maturity), the implied yield for the PT is ~13.1% APY, while the maximum LP yield has fluctuated. The stability of the implied PT yield suggests a consistent market expectation for the value of future Terminal and Ethena rewards, making it an attractive asset for users seeking predictable returns.

Source: Pendle, September 12, 2025

Maturities

The existence of multiple tUSDe maturities on Pendle, including the active September and December 2025 pools, signals strong and persistent user interest. The total TVL across these pools is nearly $230M. This double maturity availability ensures a more natural rollover for users and liquidity providers, which is also relevant for Aave’s exposure.

Source: Pendle, September 12, 2025

Integrated Venues

PT-tUSDe-18DEC2025 is not yet integrated into other lending venues due to the recency of the pool. This represents a significant first-mover advantage for Aave to capture the primary lending demand for this asset.

Recommendations

Aave Market Parameters

Will be presented jointly with @ChaosLabs. Other parameters will be handled via Risk Oracle.

Price Feed Recommendation

For pricing PT tokens on Aave, a specific dynamic linear discount rate oracle has been developed by BGD Labs. It is recommended that PT tUSDe tokens be priced using it. In addition, due to full direct redemption availability, tUSDe would be priced on par with sUSDe, therefore using sUSDe’s standard pricing mechanism on Aave’s markets.

Disclaimer

This review was independently prepared by LlamaRisk, a DeFi risk service provider funded in part by the Aave DAO. LlamaRisk is not directly affiliated with the protocol(s) reviewed in this assessment and did not receive any compensation from the protocol(s) or their affiliated entities for this work.

The information provided should not be construed as legal, financial, tax, or professional advice.