Summary

LlamaRisk supports the proposal to onboard PT-USDe-25SEP2025 to the Aave V3 Core instance and the specific parameter recommendations presented by Chaos Labs. At the time of this proposal, there remain 65 days until the maturity of this PT asset. Therefore, integration efforts are expected to be justified by the user interest, leaving 55-60 days of market availability after deployment. The PT yield opportunity is also expected to remain attractive as long as positive market sentiment continues.

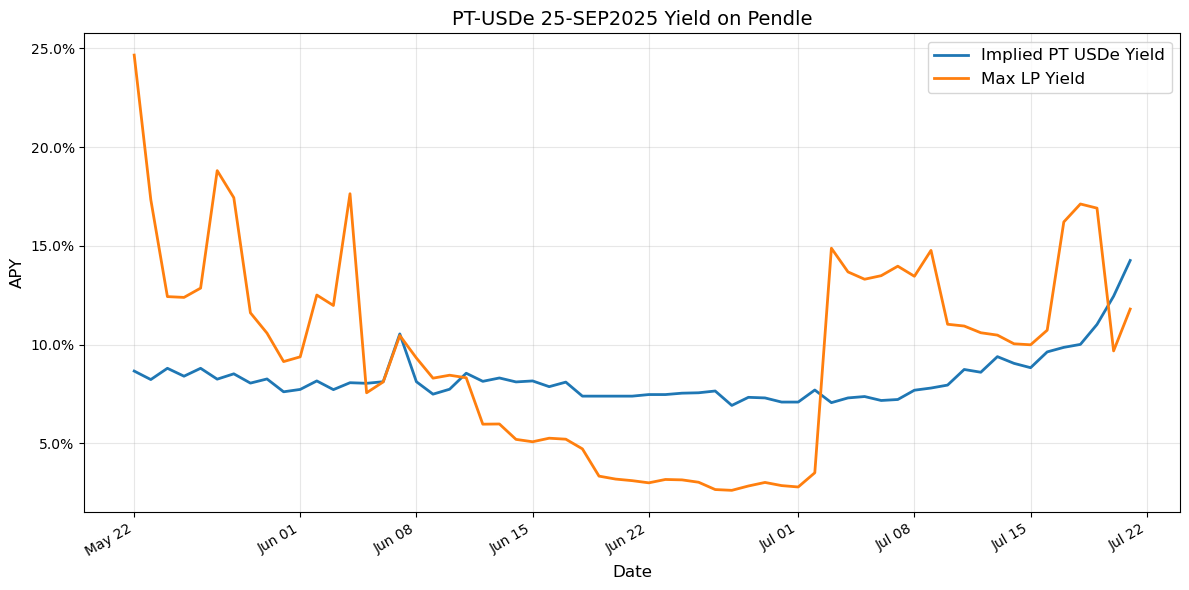

The underlying USDe PT market yield stems from Ethena’s points program, which rewards holding USDe. The implied PT yield had generally trended around 6-9% in the past months; however has increased to 13.9% over the past week due to renewed positive broader market conditions. Historically, the availability of USDe PT markets has always been persistent, with up to 2 different maturity pools and additional Pendle pool deployments on other chains.

Assessment of PT base asset: Link

Considered PT asset maturities: PT-USDe-25SEP2025

Asset State

Underlying Yield Source

The USDe’s speculative yield originates from Ethena’s continued points program season 4, which rewards holding USDe and utilizing USDe in different venues. However, the main driver of the utility for USDe is yield-bearing sUSDe, which is based on Ethena’s delta-neutral strategy, where USDe is backed by a mix of stablecoins (USDT, USDC, sUSDS, and USDtb) and is paired with short perpetual futures positions. This structure allows sUSDe to accrue funding rate revenues from the perpetual market and underlying yield-bearing stablecoins, which are passed on to sUSDe holders. The sustainability of this yield depends on the persistence of positive funding rates and the continued effectiveness of Ethena’s risk management. While the strategy is designed to be market-neutral, yields can fluctuate based on funding rate dynamics and the performance of the underlying collateral. This yield trend also directly affects the PT-USDe’s implied yield expectations.

Underlying utility

The utility of USDe as a PT asset is based on speculative interest in potential future Ethena rewards. USDe is positioned as a synthetic stablecoin, attracting users seeking delta-neutral exposure with additional yield opportunity when staked into sUSDe. Currently, the implied yield of PT-USDe September maturity tokens is higher than for the same maturity PT-sUSDe tokens, indicating higher utility than its other Ethena PT asset counterparts.

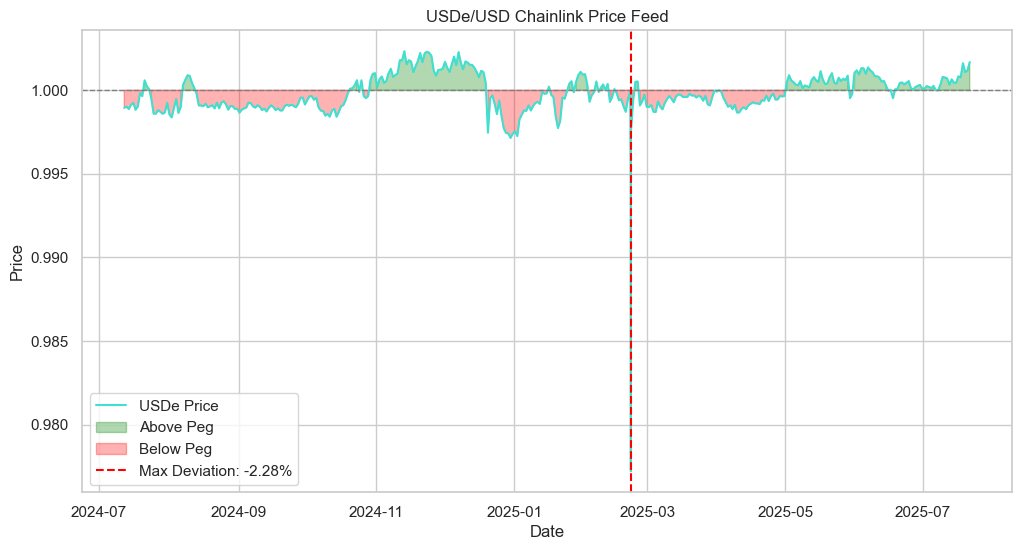

Underlying stability

The stability of USDe depends on solvency and collateralization. Nonetheless, it can also be affected by broader market stress. To provide full collateralization and coverage against market, centralization, and collateral risks, the reserve fund with ~$61M of highly liquid assets has been accumulated. Historically, the secondary market peg of USDe has remained stable, with an expectation of temporary stress events, the most recent being the Bybit exploit incident in February 2025. The secondary market discount of USDe has not exceeded 20 bps since then. Due to higher demand for the stablecoin, it is trading at a 16 bps peg premium.

Source: LlamaRisk, July 21st, 2025

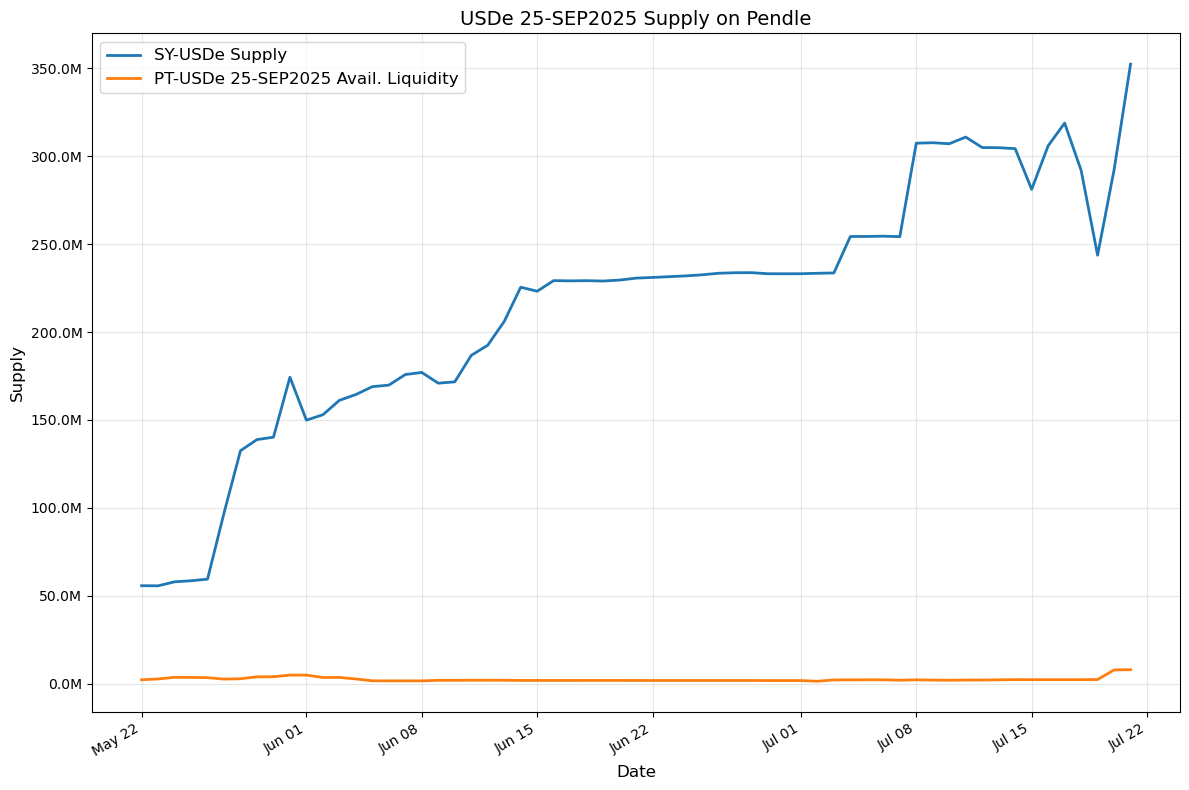

Total Supply

The pool was deployed on May 12th, 2025, and has matured to become more prominent in size. The SY-USDe supply has reached ~350M, with part of the supply coming from an older maturity pool. The available pool’s liquidity currently stands at 7.89M and is expected to grow further as liquidity migrates from the expiring July 31st maturity pool. Overall, a total PT-USDe-25SEP2025 supply is 30.07M tokens.

Source: LlamaRisk, July 21st, 2025

Holders

The PT-USDe-25SEP2025 token holder distribution is diverse and decentralized, with the largest holder being an unidentified EOA address with 13.57% of the total asset supply. Pendle’s liquidity pool is the second-largest holder, with 10.82% of PT’s supply. The 10 largest holders collectively hold ~49.7% of the asset’s supply.

Source: Etherscan, July 21st, 2025

Liquidity

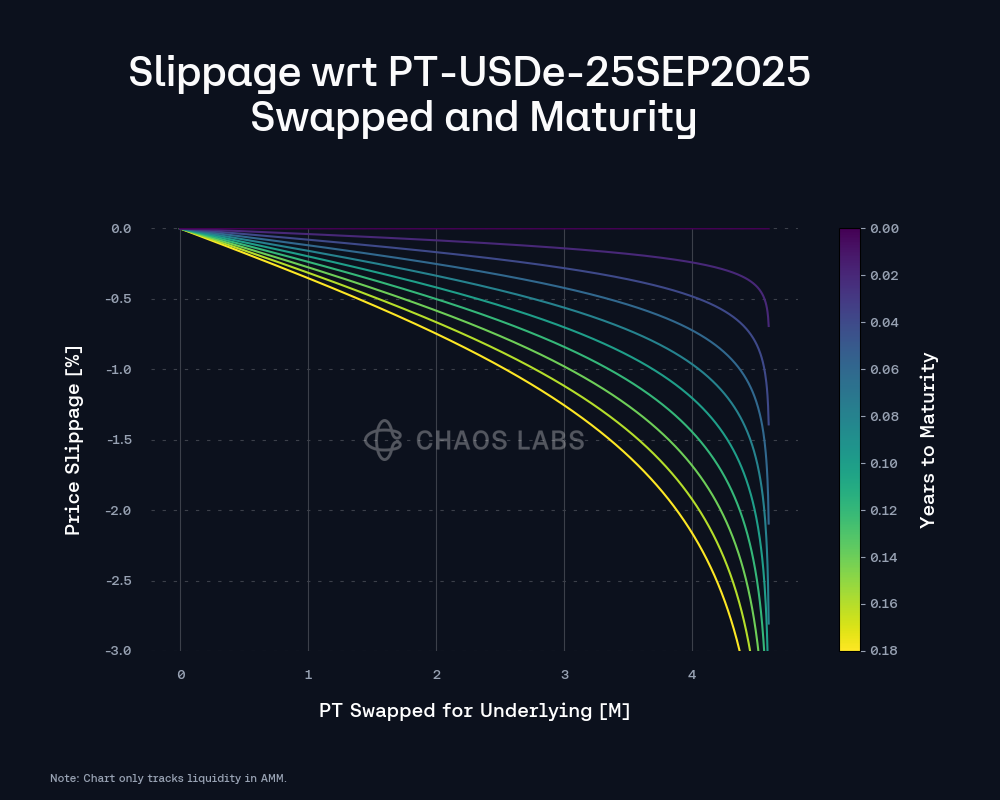

As mentioned above, the PT-USDe-25SEP2025 pool has an estimated liquidity of $7.89M. 59.64% is held in SY-USDe, while 40.36% is in PT-USDe tokens. Liquidity is currently much lower than corresponding PT-eUSDe and PT-sUSDe Pendle markets, however is expected to grow significantly as the high yield environment persists.

Source: Pendle, July 21st, 2025

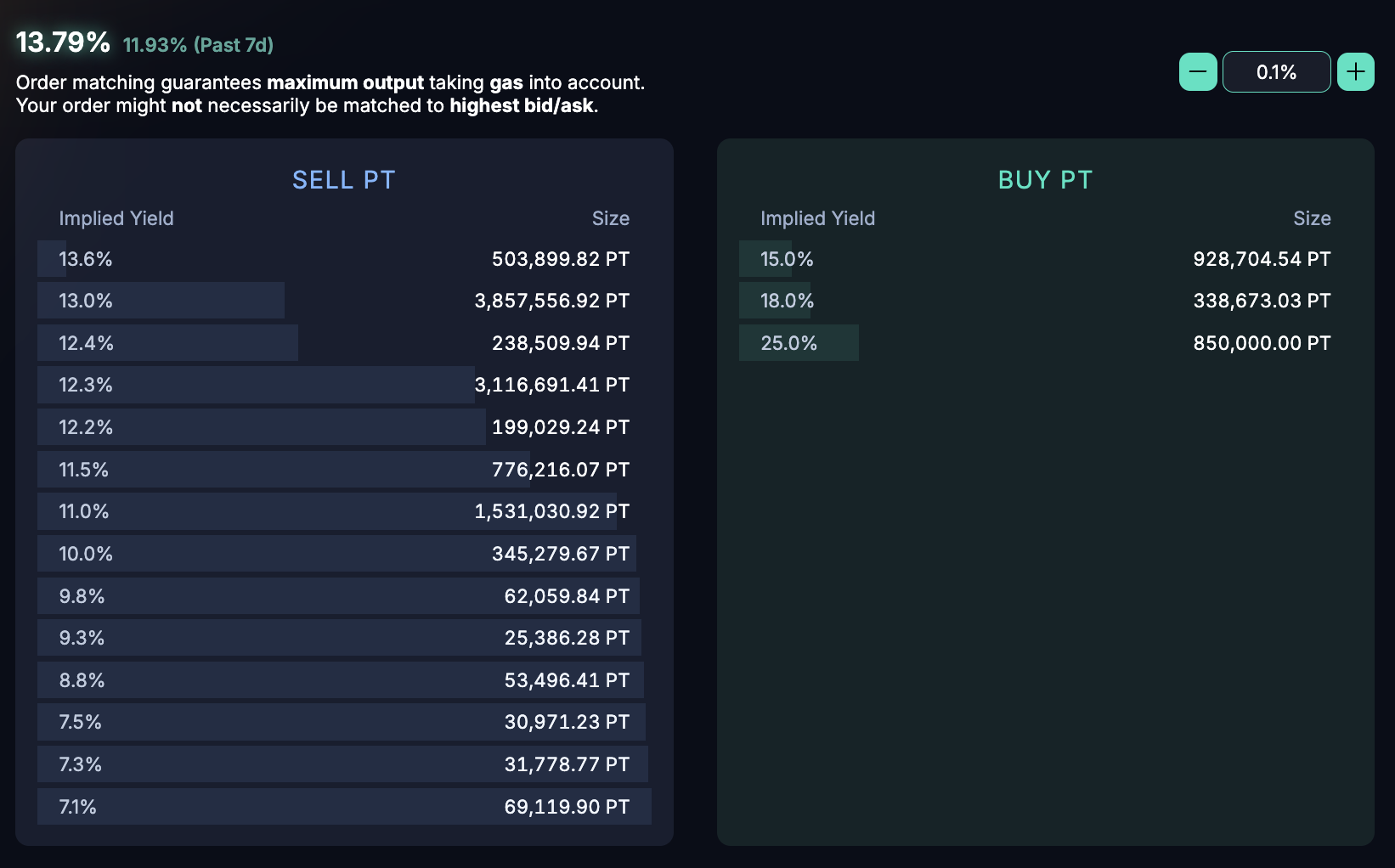

The market’s order book composition suggests lower trading activity, with a bid-ask spread at 1.4% in implied yield terms. Overall, a smaller bid side liquidity is apparent, amounting to 2.1M PT tokens in total. This may also explain more recent aggressive implied yield changes compared with more liquid PT-eUSDe and PT-sUSDe pools.

Source: Pendle, July 21st, 2025

The PT-USDe-25SEP2025 pool has the following parameters:

| Parameter |

Value |

| Liquidity Yield Range |

5% - 27% |

| Fee Tier |

0.17% |

| Input Tokens |

USDe |

| Output Tokens |

USDe |

| Reward Tokens |

PENDLE |

Market State

Price and Yield

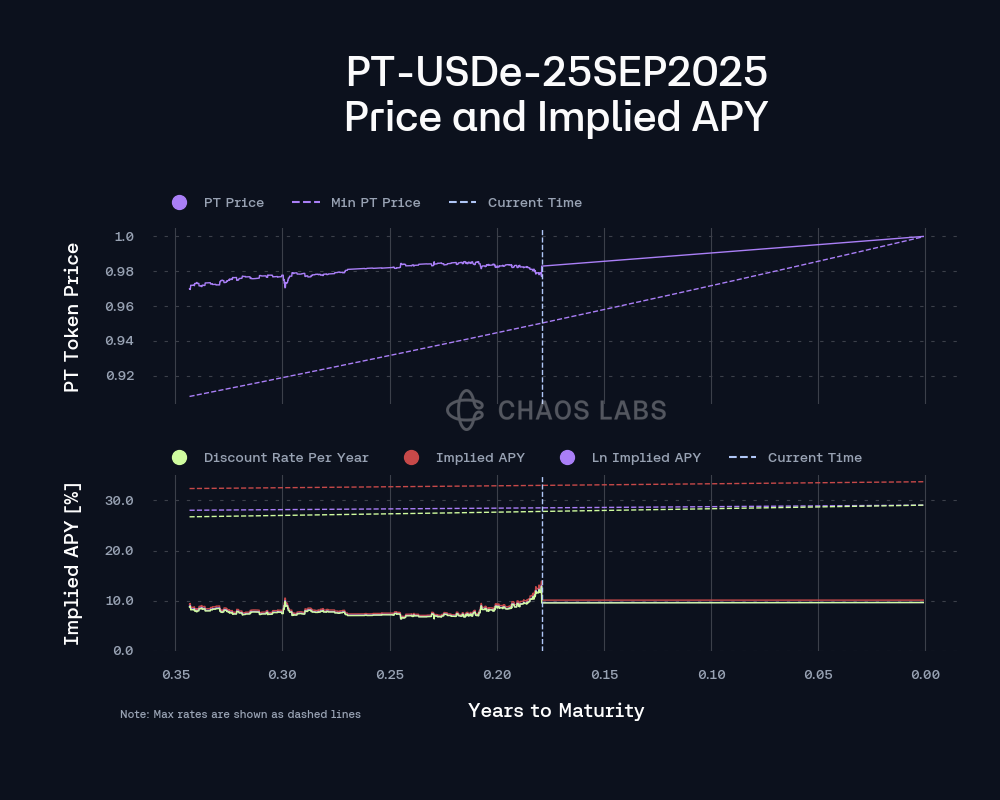

At the time of writing, there are 65 days until the pool’s maturity. The implied PT yield is at 13.79% APY, with a PT price of 0.9772 USDe. Recently, yields have been increased, which is mainly attributed to renewed positive market conditions. The LP yield has also responded accordingly.

Source: LlamaRisk, July 21st, 2025

Maturities

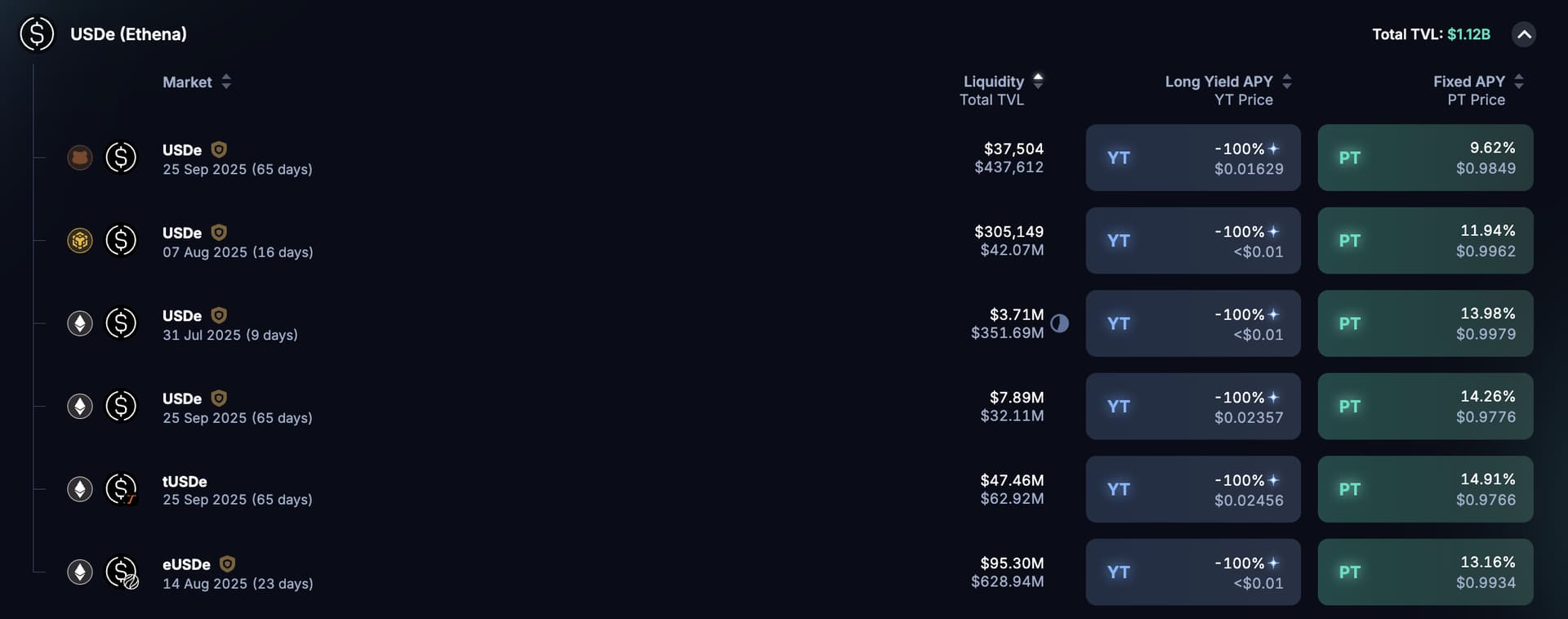

In addition to the PT-USDe-25SEP2025 maturity pool, an expiring PT-USDe-31JULY2025 pool is available on the Ethereum market, which is also onboarded on Aave’s Core market. An additional but negligibly sized pool ($437k TVL) is available on the Bera chain, as well as a moderately sized pool ($42.07 TVL) available on BNB. The historical availability of PT-USDe markets indicates that user interest has been and is expected to remain stable, especially considering PT-USDe’s popularity on Aave.

Source: Pendle, July 21st, 2025

Integrated Venues

PT-USDe-25SEP2025 is also present on Morpho. On this lending platform, 1.01M tokens are supplied to 2 different vaults (USDe, USDtb) as collateral, non-borrowable assets.

Source: Pendle, July 21st, 2025

Recommendations

Aave Market Parameters

We align with the ACI’s proposed dedicated E-Mode setup where PT-USDe-25SEP2025 would be paired with USDe, USDtb, USDC, USDT, and USDS as a borrowable asset. Also, including PT-USDe-25SEP2025 in the capital-efficient USDe E-Mode with USDe and July expiry USDe PT token would allow for more flexible yield strategies for users and enable frictionless migration to a new maturity pool.

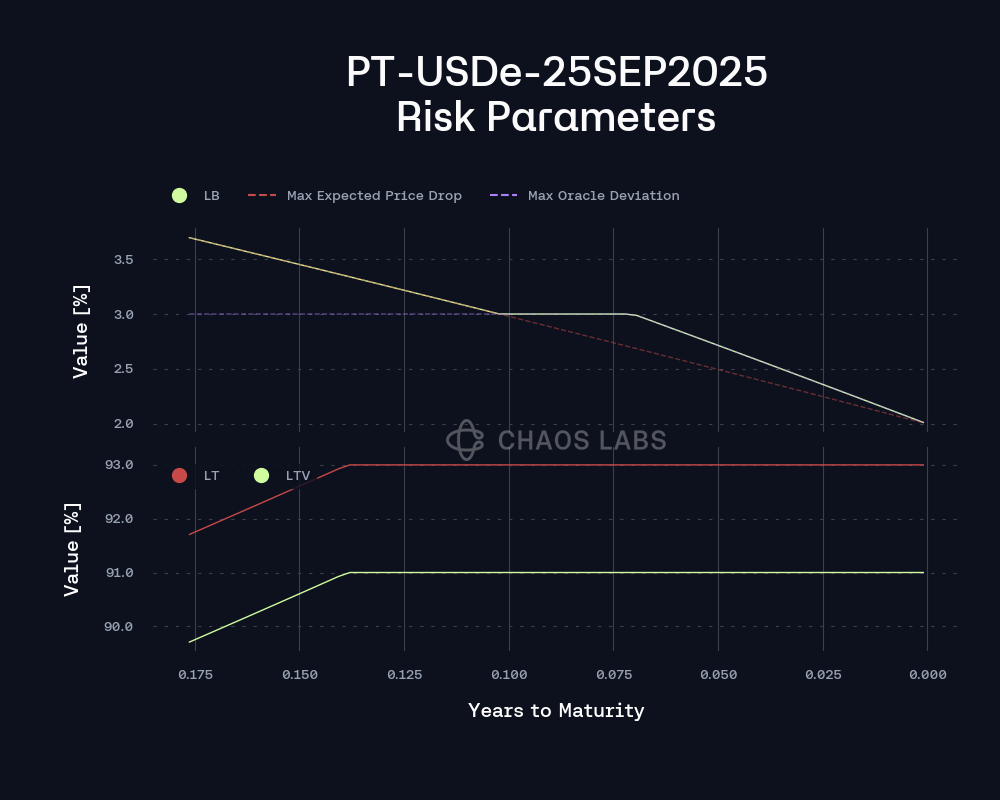

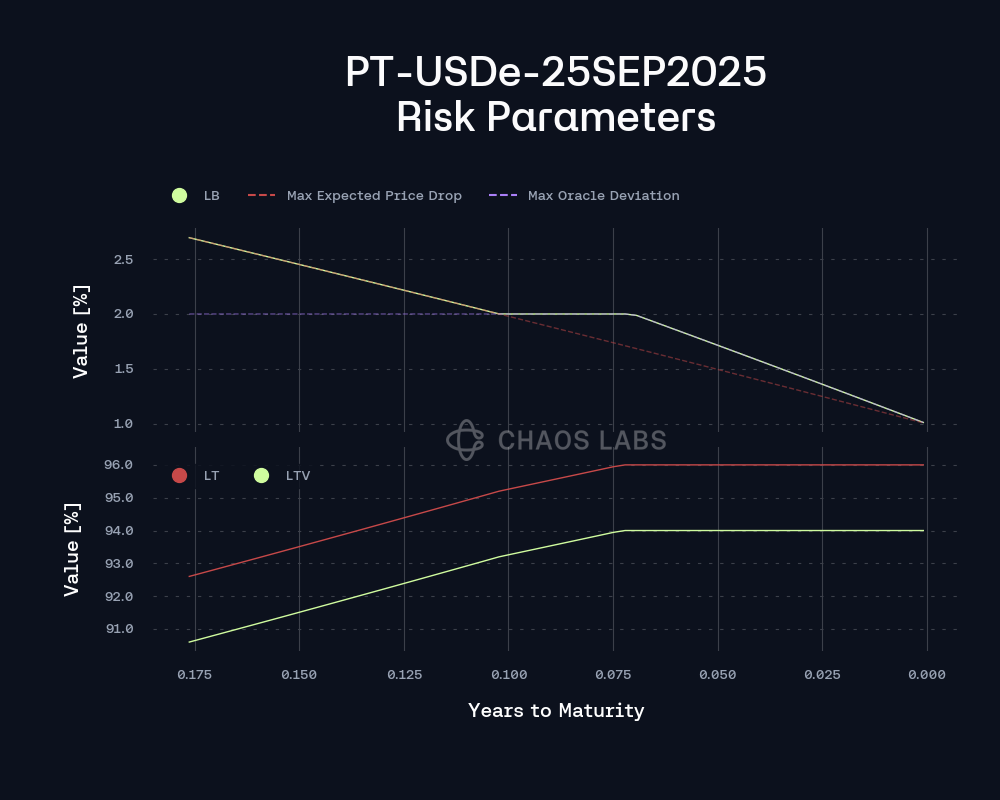

We support the parameter recommendations presented by Chaos Labs.

Price Feed

We propose using the usual USDe-denominated asset pricing on Aave, where the underlying USDe would be priced as USDT/USD. The PT token price would also be controlled under a PT linear discount rate Oracle implementation. Given the current market dynamics, we judge that the discount rate parameter should be roughly the same as the one used for PT sUSDe oracle, with maxDiscountRate being similar to the liquidity yield range upper bound of 27%, just like Chaos Labs proposed.

Disclaimer

This review was independently prepared by LlamaRisk, a community-led decentralized organization funded in part by the Aave DAO. LlamaRisk serves as Ethena’s Risk Committee member and Ethena’s PoR attestor. LlamaRisk did not receive compensation from the protocol(s) or their affiliated entities for this work.

The information provided should not be construed as legal, financial, tax, or professional advice.