Summary

LlamaRisk supports changes in sAVAX LTV & LT values. The proposed risk parameter adjustments are rational, given the justifications provided by @ChaosLabs. Moreover, we see minimal incremental risks associated with introducing new Liquid E-Modes. This update will allow for a fine-grained risk control for the LST yield leveraging strategy that is dominant on Aave.

LTV Adjustments

The main use case for sAVAX collateral on Avalance is LST yield leverage, where WAVAX is mainly borrowed. Looping through WAVAX has been the primary driver, accounting for 90% of borrowing. A proposed LTV increase would enhance borrow capital efficiency. At the same time, borrowing activity in ETH and USDC against sAVAX is growing, signaling its expanding role beyond recursive strategies and strengthening its position as a versatile source of liquidity within Aave.

Source: Chaos Labs dashboard, September 10, 2025

Supply Caps

When assessing proposed changes to LTV and LT for sAVAX, it is important to consider the current supply cap dynamics. sAVAX has already reached over 60% of its available capacity, and adjustments to collateral efficiency are likely to accelerate further utilization. Ensuring supply caps are calibrated in parallel with risk parameter updates will be critical to avoid constraining market growth while maintaining risk control.

A similar consideration applies to WAVAX, where utilization exceeds 90% of the supply cap. Without adjustments, high utilization risks create bottlenecks, increasing rates, and reducing the effectiveness of LTV changes.

Source: Aave Dashboard, September 10, 2025

Source: Aave Dashboard, September 10, 2025

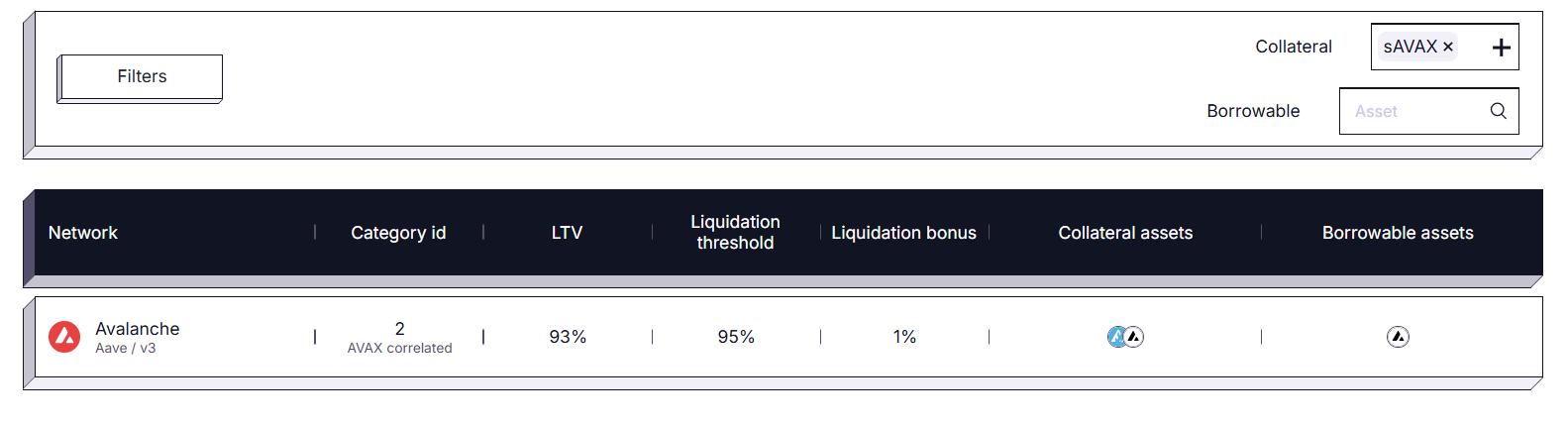

sAVAX/WAVAX E-Mode

The sAVAX/WAVAX Correlated E-Mode is live on Avalanche and offers up to 93% LTV with a 95% liquidation threshold. This specialized mode recognizes the tight correlation between AVAX and its liquid staking derivative, allowing users to maximize capital efficiency for recursive strategies such as looping.

Source: Aave Dashboard, September 10, 2025

By enabling significantly higher borrowing power than standard parameters, E-Mode strengthens sAVAX’s role as a core collateral asset while maintaining controlled risk buffers. This framework deepens liquidity, enhances yield opportunities, and gives users a more efficient structure for leveraging sAVAX in Aave’s Avalanche market.

Risks

This proposal introduces higher LTV levels for sAVAX, reflecting its role in LST yield looping strategies on Aave. While Avalanche staking does not impose slashing penalties on delegators, validator underperformance can still reduce rewards, marginally impacting the yield that underpins these strategies.

In addition, sAVAX carries liquidity and peg risks. During periods of stress or high redemption demand, sAVAX may trade at a discount to AVAX, which could amplify liquidation risk for highly leveraged users. Recognizing these risks ensures that adjustments to collateral efficiency are made with a balanced view of both opportunity and potential downside.

Disclaimer

This review was independently prepared by LlamaRisk, a DeFi risk service provider funded in part by the Aave DAO. LlamaRisk is not directly affiliated with the protocol(s) reviewed in this assessment and did not receive any compensation from the protocol(s) or their affiliated entities for this work.

The information provided should not be construed as legal, financial, tax, or professional advice.