Overview

Based on recent market trends, Chaos Labs proposes an adjustment to the LT and LTV for sAVAX on the Aave V3 Avalanche instance. This change is intended to improve capital efficiency, building on sAVAX’s consistent liquidity and stable peg performance.

Motivation

sAVAX Market

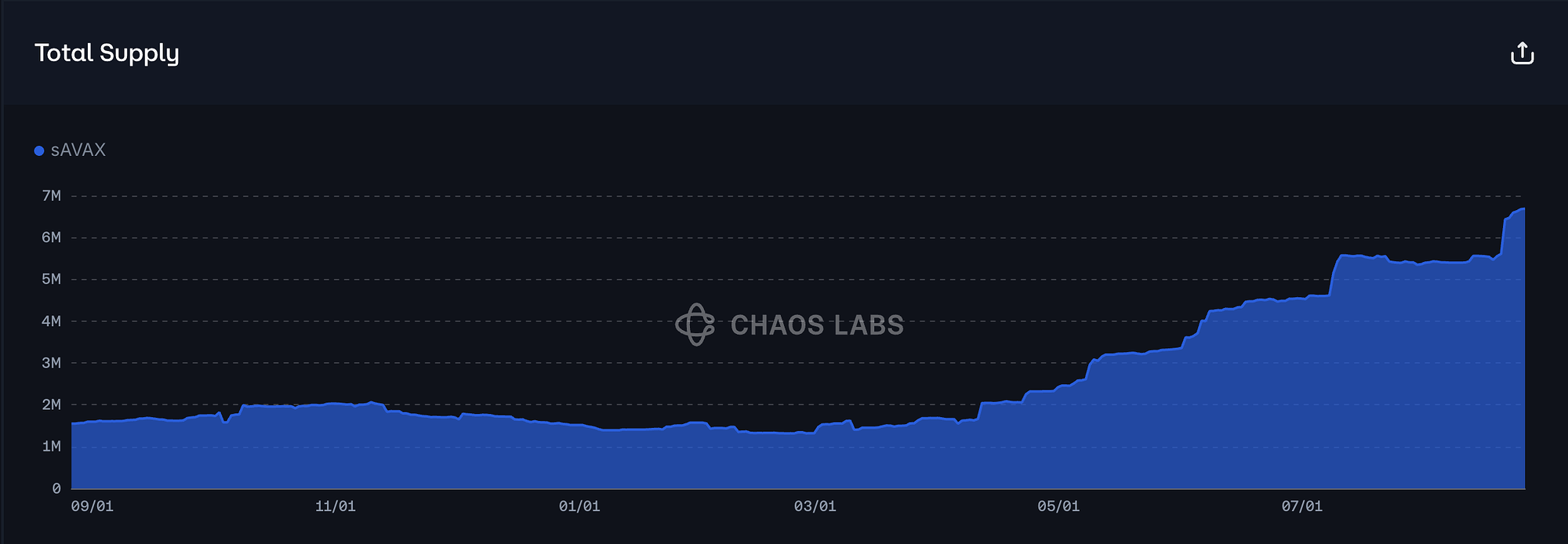

Since April 2025, the total supply of sAVAX on Aave has shown a sharp upward trend. It increased from 1.68M sAVAX on April 1st to 6.93M sAVAX at the time of writing, representing nearly 300% growth over the past five months.

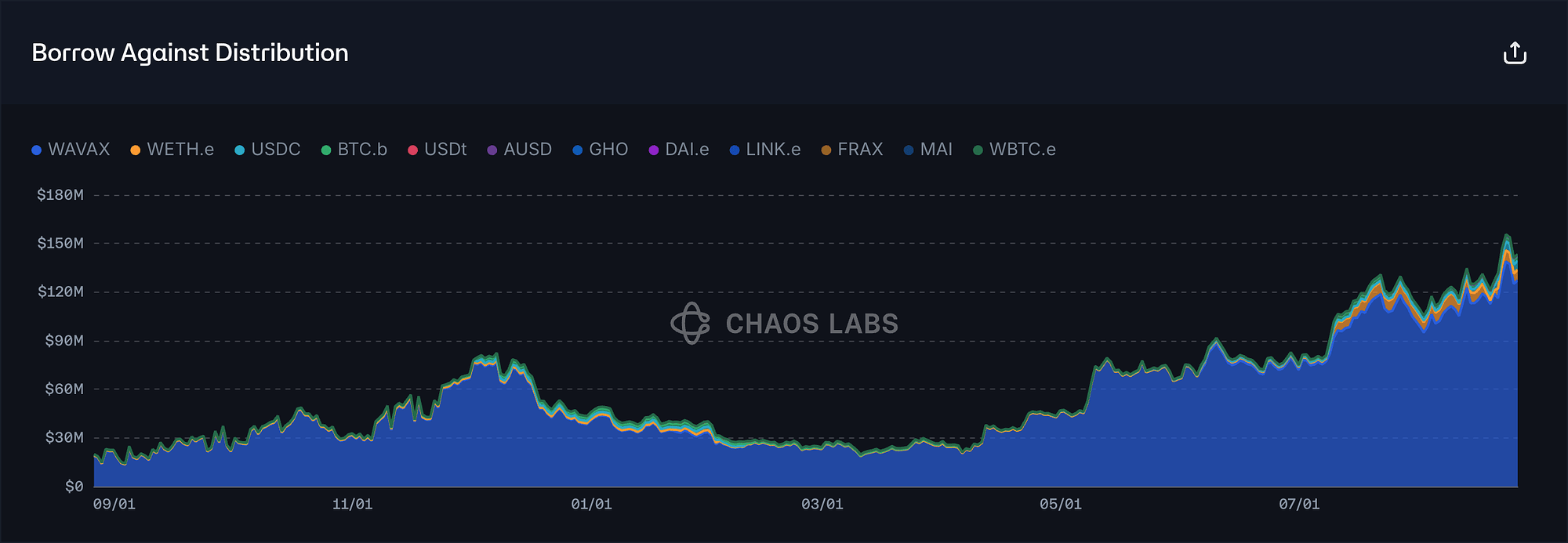

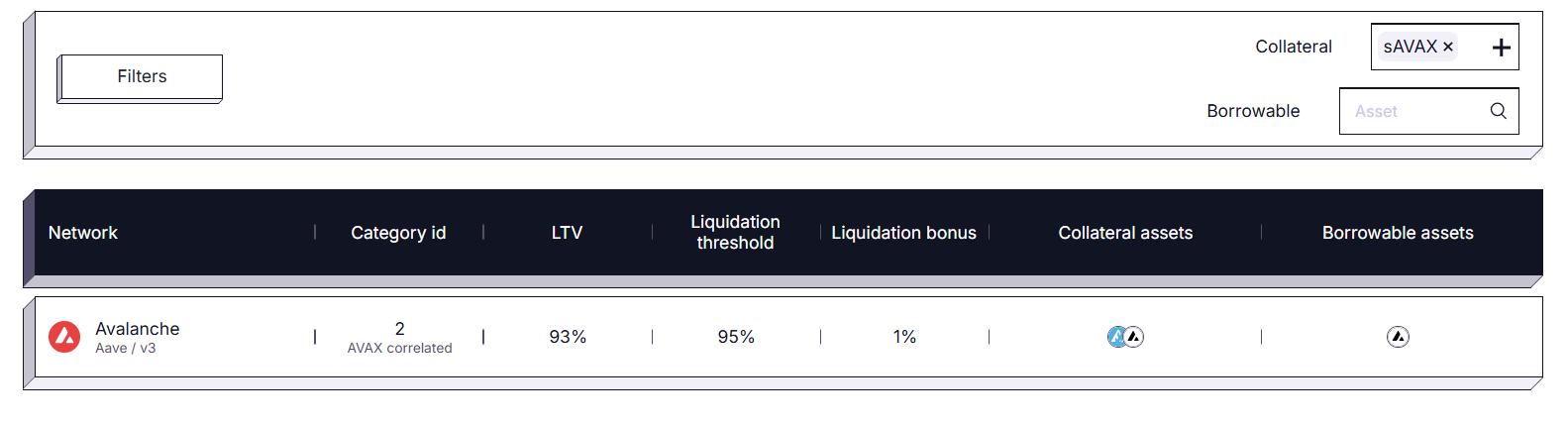

This growth has been driven primarily by looping activity between sAVAX and WAVAX. Users supply sAVAX to Aave and borrow WAVAX against it. The borrowed WAVAX is then deposited into Benqi to mint additional sAVAX, which is supplied back into Aave as collateral. By repeating this cycle, users effectively leverage their positions, increasing exposure to sAVAX and enhancing the yield they capture. As proven below, WAVAX has remained the dominant borrow asset against sAVAX throughout the period of rapid supply growth. As of the time of this writing, WAVAX represents 88.75% of the total borrowed asset distribution.

This sustained increase in sAVAX supply, largely driven by looping, signals growing confidence in the asset as collateral. While looping itself is handled within e-mode, the strong adoption reflects trust in the stability and utility of sAVAX. More importantly, demand for sAVAX as collateral has expanded well beyond looping. Since July 2025, ETH debt positions backed by sAVAX have grown from $1M to $5M, and USDC borrowing against sAVAX has increased from $500K to $6.5M. Raising LT would directly support this trend by improving capital efficiency in these broader markets, making sAVAX more productive and attractive for users across different strategies.

Supply Distribution

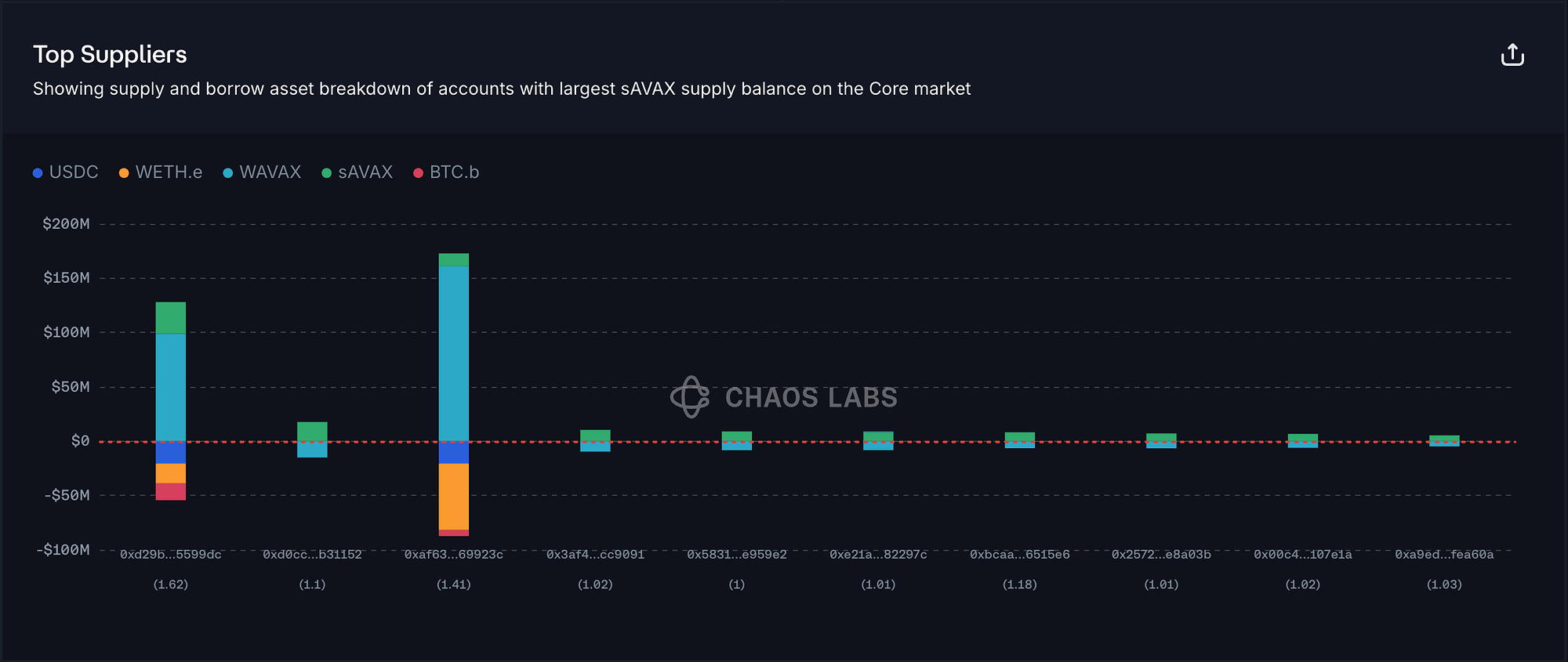

The current supply distribution of sAVAX supports a case for increasing LT. sAVAX’s supply distribution does not exhibit concentration risk, as the largest supplier accounts for only about 14% of total supply. Moreover, 8 of the top 10 suppliers are engaged in the looping activity described above, which significantly reduces liquidation risk given the strong price correlation between sAVAX and WAVAX. The remaining two top suppliers maintain robust health factors, further limiting the likelihood of liquidations. Taken together, this user behavior indicates that positions are being managed in a relatively safe and stable manner, providing room to increase LT without materially raising systemic risk.

Liquidity

The major liquidity venues for sAVAX are concentrated in the following pools: the sAVAX/WAVAX Pharaoh CL Liquidity Pool with a TVL of $1.93M, the sAVAX/WAVAX LFJ Liquidity Pool with $22.98M, and the sAVAX/WAVAX BlackHole Liquidity Pool with $3.08M TVL. As shown in the chart, the liquidity of sAVAX has remained stable over the past 6 months, with a notable increase in the last month. This healthy liquidity trend further supports the case for adopting more permissive risk parameters.

Volatility

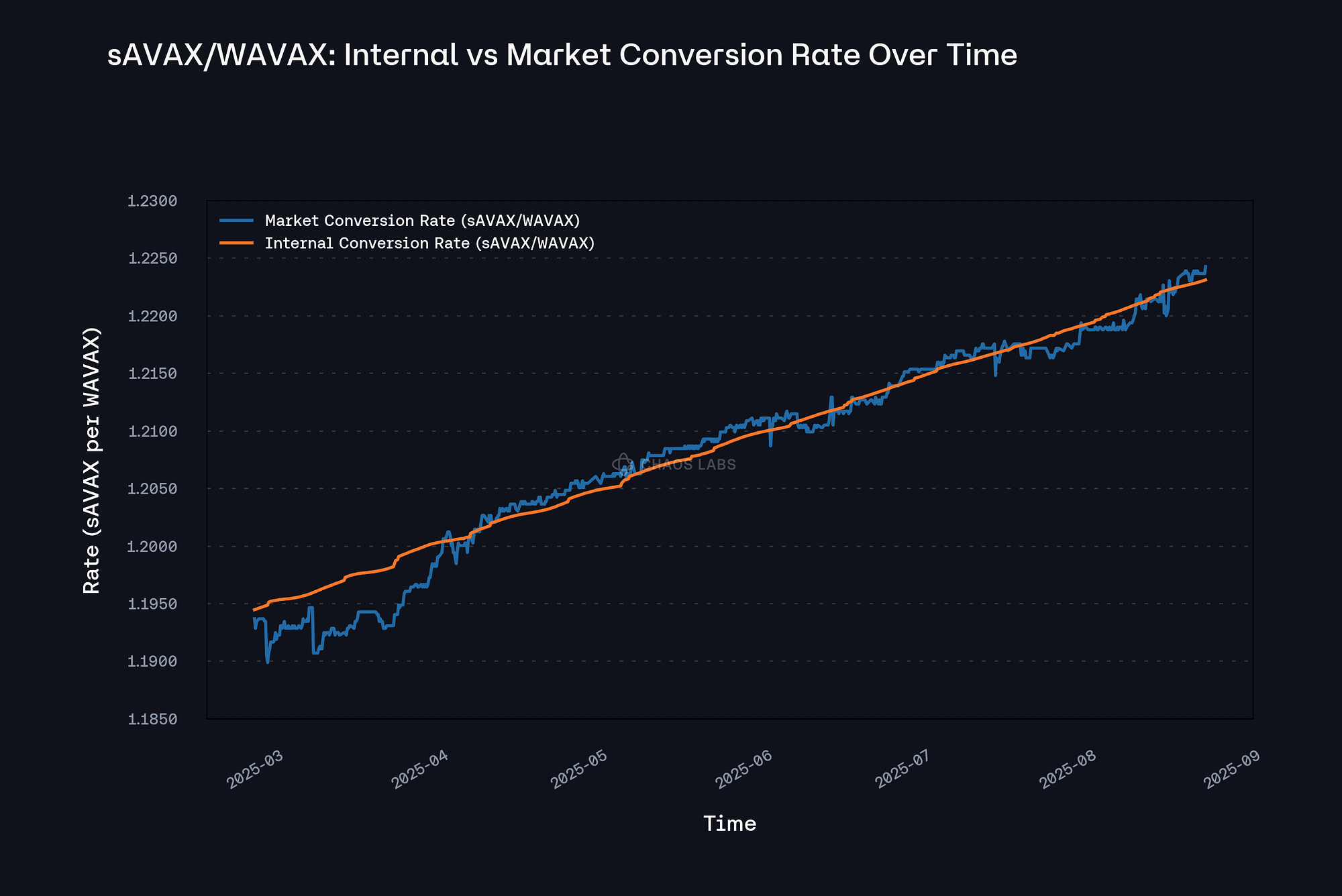

Over the past six months, the market conversion rate between sAVAX and WAVAX has remained closely aligned with the internal conversion rate, with deviations generally within 20 bp, demonstrating a highly stable peg. The only notable exception was in March 2025, when several moderate deviations were observed, peaking at 50 bps.

However, we do not view this as a material risk, as the deviations were relatively limited in magnitude and mainly driven by a few large trades when TVL was relatively thin. For example, a single 14.79K sAVAX sell when the pool’s TVL was only $7M temporarily amplified conversion rate deviation. With liquidity having since increased significantly, to $22M as of this writing, we have observed that such deviations have been substantially reduced.

Recommendation

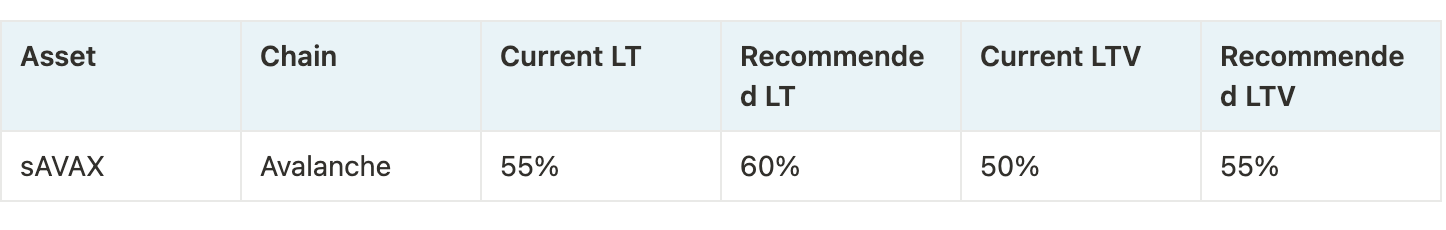

sAVAX has demonstrated stable risk characteristics, with prudent supplier behavior, sufficient on-chain liquidity, and a consistently strong peg. These factors indicate that raising the LT would not materially increase systemic risk. At the same time, demand for sAVAX as collateral has expanded beyond e-mode, with significant growth in borrowing activity across multiple assets such as ETH and USDC. Raising the LT would improve capital efficiency in these non–e-mode use cases. Therefore, we recommend increasing the LT for sAVAX from 55% to 60% and the LTV from 50% to 55%.

Specification

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this ARFC.

Copyright

Copyright and related rights waived via CC0