Summary

A proposal to:

- Increase USDe’s supply cap and debt ceiling on the Ethereum Core instance.

- Increase eBTC’s supply cap on the Ethereum Core instance.

- Increase cbBTC’s supply and borrow caps on the Ethereum Core instance.

- Increase wstETH’s borrow cap on the Base instance.

- Increase cEUR’s borrow cap on the Celo instance.

- Decrease sUSDe’s supply cap on the Ethereum Core instance.

All increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

USDe (Ethereum Core)

USDe’s supply cap utilization has reached 100%, and its borrow cap utilization stands at 31%.

Supply Distribution

The supply of USDe is highly concentrated with a single user, who has supplied $209M worth of USDe, accounting for 87% of the total distribution. However, given that this user currently maintains a very high health score of 2.81 and is borrowing USDT, we believe the risk of immediate liquidation is minimal. Nevertheless, we will continue to closely monitor this user and take any necessary measures if required.

The remaining top suppliers either have no borrowing activity or are borrowing stablecoins, posing no significant concerns at this time.

The most borrowed asset against USDe is USDT, accounting for 95% of the total borrowed asset distribution.

Recommendation

Given user behavior and on-chain liquidity, we recommend increasing the supply cap to 480M USDe and the debt ceiling to $72M.

eBTC (Ethereum Core)

eBTC’s supply cap utilization has reached 100%.

Supply Distribution

The supply distribution of eBTC is concentrated, with the top supplier accounting for 39% of the total distribution. However, given that this user currently maintains a health score of 1.65 and is actively managing their position, we believe there is no significant concern at this time.

The remaining top suppliers either maintain healthy health scores or are borrowing against WBTC, significantly reducing liquidation risk.

The largest borrowed asset against eBTC is USDC, followed by WBTC. This further reduces overall risk, as USDC is one of the most liquid assets on Ethereum.

Liquidity

eBTC’s liquidity has remained generally stable over the past three months, with a current 20 eBTC sale incurring less than 1% price slippage. While we do not believe this relatively limited amount of eBTC pose significant concern given the user behavior, we will offer a cautious mindset while providing recommendations.

Recommendation

Given user behavior and on-chain liquidity, we recommend increasing the supply cap to 860 eBTC.

cbBTC (Ethereum Core)

USDe’s supply cap utilization has reached 100%, and its borrow cap utilization stands at 82%.

Supply Distribution

The supply of cbBTC is well-distributed, with the top supplier holding only 15% of the total distribution. All top suppliers maintain strong health scores (>1.3), largely reducing liquidation risks.

The largest borrowed assets against cbBTC are USDC, WETH, and USDT, which together account for 92% of the total distribution.

Borrow Distribution

The borrow distribution of cbBTC presents limited liquidation risk, as top borrowers are either collateralizing assets highly correlated with cbBTC, such as LBTC or cbBTC itself, or maintaining high health scores. These factors significantly reduce the risk of liquidation.

The top collateral asset against cbBTC is LBTC, which is highly correlated with cbBTC. This aligns with our earlier analysis of top borrower behavior.

Liquidity

cbBTC’s liquidity has shown fluctuations, with a current 350 cbBTC sale incurring less than 7.5% price slippage. While this liquidity is relatively limited compared to its current supply, we believe it does not pose a significant risk at this time given observed user behavior. Nonetheless, we will take this into consideration and recommend a conservative cap increase.

Recommendation

Given user behavior and on-chain liquidity, we recommend increasing the supply cap to 16.4K cbBTC and borrow cap to 1.44K cbBTC.

wstETH (Base)

wstETH’s borrow cap utilization has reached 94%, while its supply cap utilization stands at 63%.

Supply Distribution

wstETH’s supply distribution presents limited liquidation risk at this time, as top suppliers are either borrowing assets highly correlated with wstETH, such as WETH, weETH, or wstETH itself, or maintaining high health scores. These factors significantly reduce the potential for liquidation.

Borrow Distribution

The borrow distribution of wstETH presents limited liquidation risk, as all top borrowers are collateralizing assets highly correlated with wstETH, such as WETH, weETH, or ezETH.

The top collateral assets against wstETH are weETH, WETH, wstETH, and ezETH, collectively accounting for 94% of the total collateral distribution, which aligns with our earlier analysis of top borrower behavior.

Liquidity

wstETH’s liquidity has shown some volatility but remains sufficient to support a borrow cap increase, with a current 600 wstETH sale incurring 2% slippage.

Recommendation

Given user behavior and on-chain liquidity, we recommend increasing the borrow cap to 33K.

cEUR (Celo)

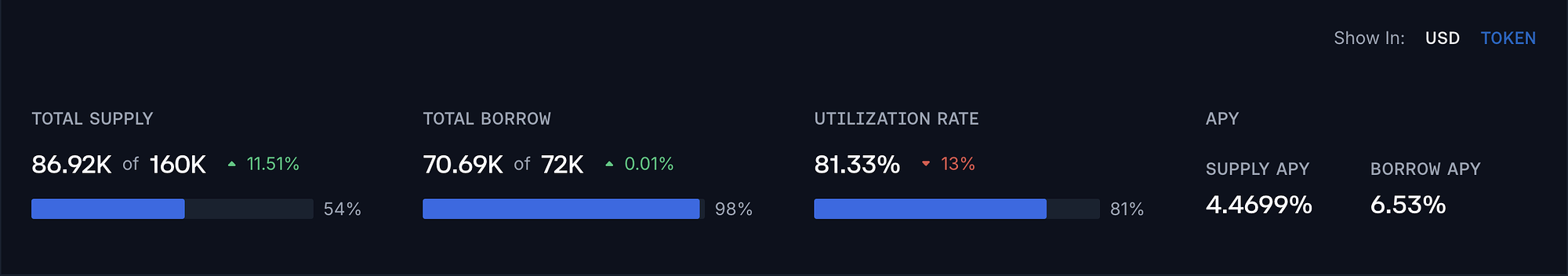

cEUR’s borrow cap utilization has reached 98%, while its supply cap utilization stands at 54%.

Supply Distribution

The supply distribution of cEUR presents limited immediate liquidation risk, as all top suppliers currently have no borrowing activity.

Borrow Distribution

The borrow distribution of cEUR also presents limited liquidation risk. Currently, two top borrowers account for nearly the entire cEUR borrow distribution. Both borrowers have collateralized USDC, which, like cEUR, is a stablecoin, significantly reducing the risk of liquidation.

Recommendation

Given user behavior and on-chain liquidity, we recommend increasing the borrow cap to 144K.

sUSDe (Ethereum Core)

sUSDe’s supply on the Ethereum Core market has reduced significantly over the last 90 days, leading to its supply cap being only 16% utilized.

This supply reduction is likely driven by the simultaneous drop in sUSDe underlying yield which limits profitability for looping positions on Aave. sUSDe yield dropped from a peak of 18% to its current level of 4% over the last 90 days.

As the current highest position indicates a similar composition to its highest utilization point, with all of them utilizing sUSDe collateral to borrow highly correlated stablecoins, the liquidation risk of the market remains limited.

However, in order to more accurately size the market according to its demand and to limit the impact of unexpected events, we recommend reducing the supply cap to 500,000,000 sUSDe.

Following the change, the utilization of the supply cap will reach 37%, leaving significant space for future deposits.

Chaos Labs will monitor the market in order to propose further adjustments and supply cap increases following a growth in the asset’s demand.

Specification

| Instance | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Ethereum Core | USDe | 240,000,000 | 480,000,000 | 110,000,000 | - |

| Ethereum Core | eBTC | 750 | 860 | - | - |

| Ethereum Core | cbBTC | 14,300 | 16,400 | 720 | 1,440 |

| Ethereum Core | sUSDe | 1,150,000,000 | 500,000,000 | - | - |

| Base | wstETH | 36,000 | - | 20,800 | 33,000 |

| Celo | cEUR | 160,000 | - | 72,000 | 144,000 |

| Instance | Asset | Current Debt Ceiling | Recommended Debt Ceiling |

|---|---|---|---|

| Core | USDe | 60,000,000 | 72,000,000 |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0