Summary

A proposal to:

- Increase GNO’s supply and borrow caps on the Gnosis instance.

- Increase GHO’s supply cap on the Base instance.

- Increase ezETH’s supply cap on the Linea instance.

GNO (Gnosis)

The supply cap for GNO has reached 85% utilization, while its borrow cap has reached full utilization at 100%.

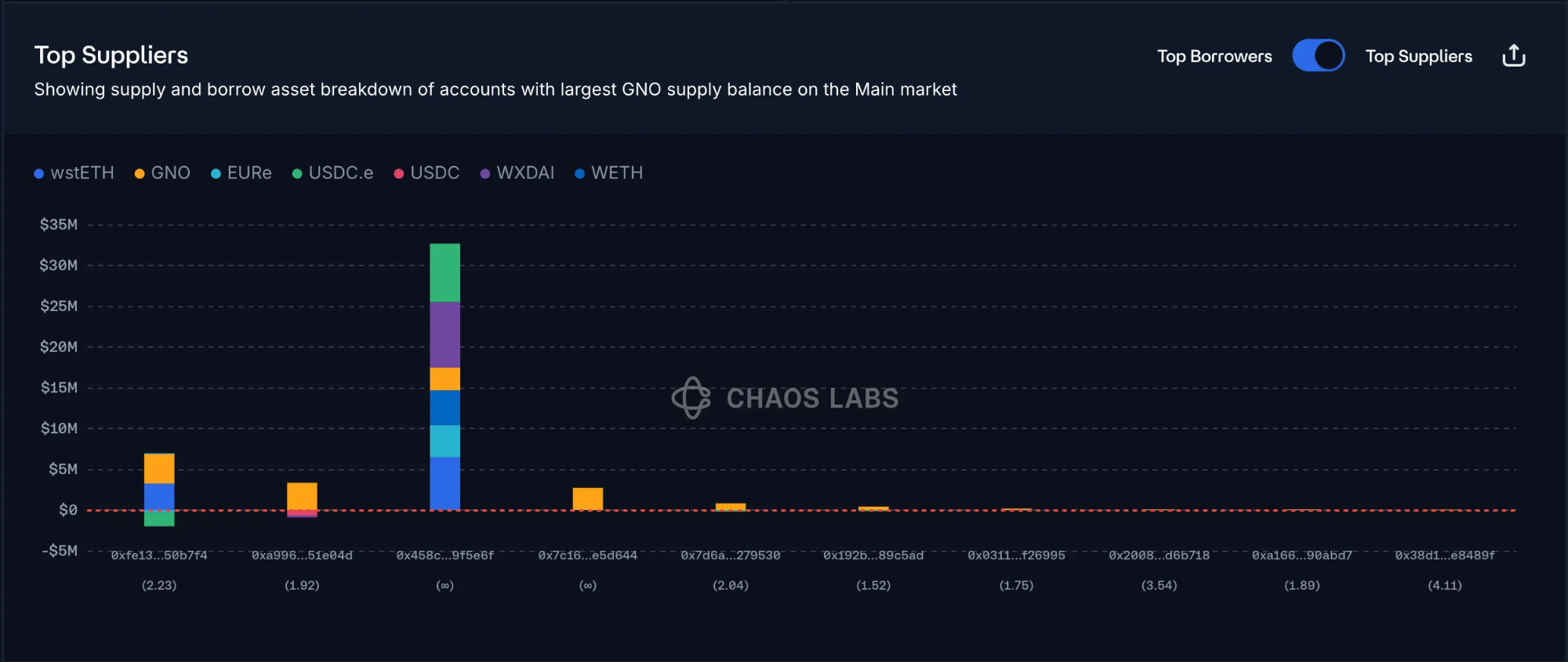

Supply Distribution

The supply of distribution of GNO presents limited liquidation risks. The largest supplier holds around 25% of total supply, presenting concentration risks. However, given this user maintains a high health score of 2.23 and is actively managing their position, it does not raise significant concern at this time.

The remaining top suppliers of GNO either maintain a high health score (>1.8) or have no borrowing activity, significantly reducing the liquidation risks.

The largest borrowed asset against wstETH is USDC.e, making up approximately 49% of the total borrowed asset distribution, followed by USDC, which accounts for 31% of the distribution.

Borrow Distribution

All of GNO’s top borrowers present limited liquidation risk, as most maintain a strong health score at this time. The only position with a health score near 1 does not pose a significant risk concern, as it remains relatively small compared to the overall distribution.

The largest collateral asset against GNO is wstETH, followed by sDAI as the second largest. Together, they account for 82% of the total collateral distribution.

Liquidity

GNO’s liquidity has remained stable over the past three months and has increased in the past 20 days. Currently, a 200 GNO sell incurs less than 5% price slippage. While this liquidity is relatively small compared to the overall supply, given user behavior, it does not present a significant concern at this time.

Recommendation

Given user behavior and on-chain liquidity, we recommend doubling the supply and borrow caps.

GHO (Base)

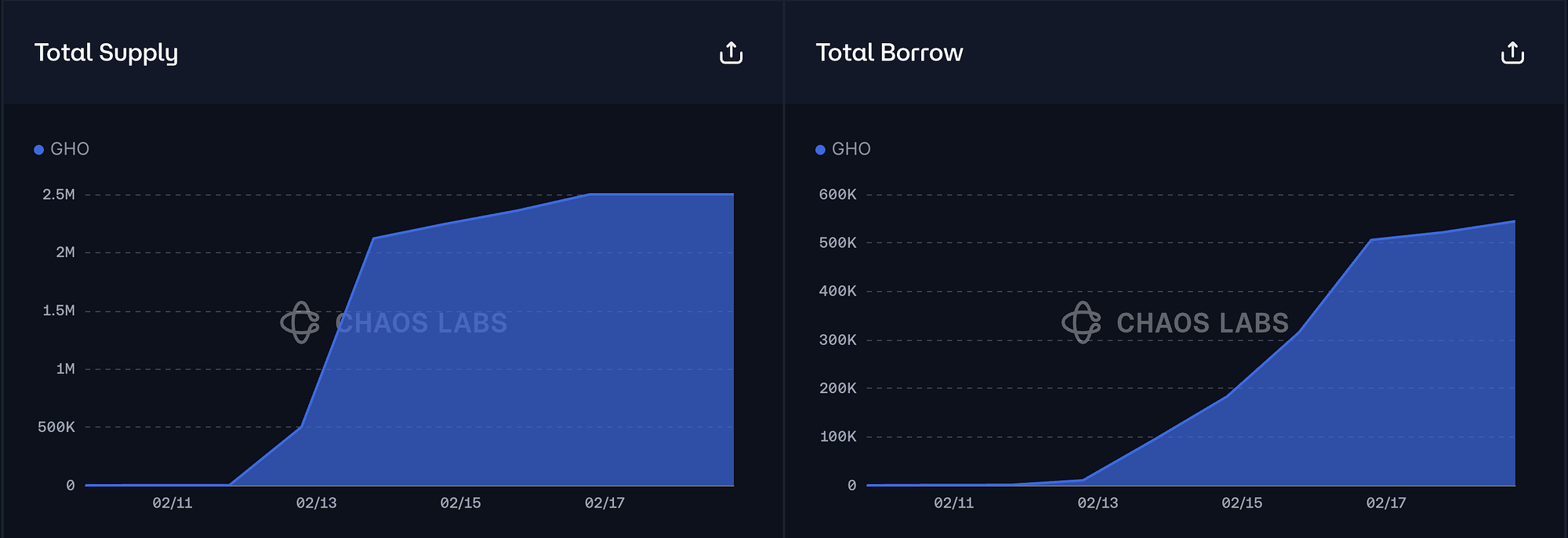

GHO’s supply cap utilization has reached 100%, while its borrow cap utilization stands at 24%.

Supply Distribution

The supply of GHO is single-handedly concentrated through an aBaseGHO Balancer liquidity pool paired with USDC.

Recommendation

Given the role of supplier capital in supporting robust relative liquidity, we recommend doubling the supply cap.

ezETH (Linea)

ezETH’s supply cap utilization has reached 100%.

Supply Distribution

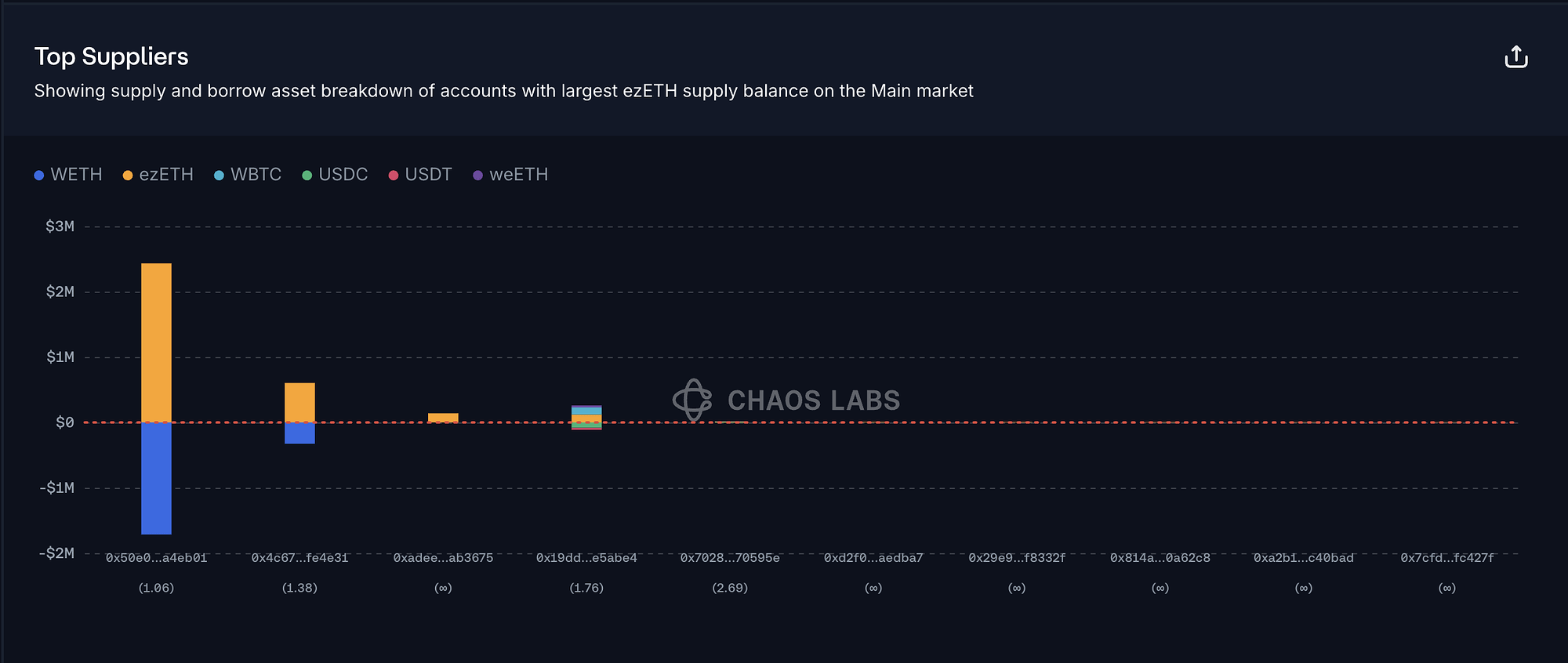

The top supplier of ezETH holds 71% of the total supply, presenting a concentration risk. However, since this user is borrowing WETH, the risk of liquidation is significantly reduced.

Among the remaining top suppliers, all except three have no borrowing activity, posing no liquidation risk at this time. Of the three with active borrowing, two maintain a high health score, while the other is borrowing WETH, significantly reducing liquidation risk.

Currently, the top borrowed asset against ezETH is WETH, accounting for 97% of the total distribution, reducing the likelihood of large-scale liquidations.

Liquidity

The liquidity of ezETH currently supports a 400 ezETH sell with less than 3% price slippage, making a supply cap increase feasible.

Recommendation

Given user behavior and on-chain liquidity, we recommend doubling the supply cap.

Specification

| Instance | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Gnosis | GNO | 90,000 | 180,000 | 10,000 | 20,000 |

| Base | GHO | 2,500,000 | 5,000,000 | 2,250,000 | 4,500,000 |

| Linea | ezETH | 1,200 | 2,400 | - | - |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0