Summary

A proposal to:

- Increase USDC’s supply and borrow caps on the Sonic instance.

- Increase wS’s supply cap on the Sonic instance.

- Increase WETH’s supply cap on the Sonic instance.

USDC (Sonic)

The supply cap utilization of USDC has reached 100%, while its borrow cap utilization stands at 33.4%.

Supply Distribution

The supply distribution of USDC is highly concentrated, with the top user representing 48% of the deposits. Half of the top 10 users in the USDC pool maintain supply-only positions, while the remaining users perform USDC to USDC looping, hence maintaining a 1:1 correlation between collateral and borrowed assets. None of the top positions pose a liquidation risk.

Borrow Distribution

While the borrow distribution of USDC is less concentrated than its supply, the top two addresses still represent a significant portion of the demand. Out of the top 10 USDC borrow positions, 7 of them maintain USDC collateral, making their positions safe from price deviation, while 3 positions use WETH as a collateral asset.

However, these 3 users maintain a safe health score and don’t pose a significant liquidation risk.

Recommendation

Given user behavior and on-chain liquidity, we recommend increasing the supply cap to 40M USDC and borrow cap to 38M USDC to allow for the full utilization of the asset.

wS (Sonic)

wS’s supply cap utilization has reached 100%, while its borrow cap remains at 15.5%.

Supply Distribution

The wS supply distribution is highly concentrated,with the top supplier holding the entirety of the supply. This user maintains a safe health score of 4.2 while looping over its USDC borrow position, hence making its liquidation risk minimal.

USDC currently represents the only asset being borrowed against wS collateral.

Liquidity

Despite the recent market drawdown, WS’s liquidity has remained stable since listing. A 1M wS sell incurs 1% price slippage. This liquidity remains sufficient to support a supply cap increase.

Recommendation

Given user behavior and on-chain liquidity, we recommend increasing the supply cap to 40M wS.

WETH (Sonic)

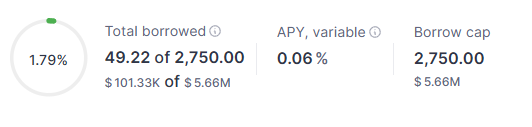

WETH’s supply cap utilization has reached 78%, while its borrow cap remains at 1.7%.

Supply Distribution

The WETH supply distribution is highly concentrated, with the top supplier holding 45% of the WETH supply on Aave. The majority of the top 10 users borrow USDC or wS assets against WETH. However, they maintain safe health scores, which, combined with active management of the positions, pose a minimal liquidation risk.

Liquidity

Despite the recent market drawdown, WETH’s liquidity has remained stable since listing. A 500 WETH sale incurs 1% price slippage. This liquidity remains sufficient to support a supply cap increase.

Recommendation

Given user behavior and on-chain liquidity, we recommend increasing the supply cap to 6,000 WETH.

Specification

| Instance | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Sonic | USDC | 20,000,000 | 40,000,000 | 19,000,000 | 38,000,000 |

| Sonic | wS | 20,000,000 | 40,000,000 | 10,000,000 | - |

| Sonic | WETH | 3,000 | 6,000 | 2,750 | - |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this ARFC.

Copyright

Copyright and related rights waived via CC0