Summary

Chaos Labs supports listing WXPL on Aave V3’s Plasma instance. Below we present our analysis and initial risk parameter recommendations, designed to balance user utility with prudent protocol risk.

Motivation

Per our initial assessment of the deployment of Aave V3 on Plasma, along with assets for initial listing, XPL was excluded due to concerns about high asset volatility, shallow liquidity, and actively ongoing price discovery. Elevated volatility would add substantial risk exposure to the protocol; hence, the decision to list the asset was delayed. Now, as XPL has matured, we are revisiting the assessment.

Asset Overview

XPL is Plasma’s native utility token, primarily used for transaction fees. Unlike bridged assets, XPL is issued natively and underpins the network’s security and economic alignment. WXPL is a wrapped ERC-20 representation of XPL, based on the WETH9 standard. As Plasma grows, we expect the XPL to play a progressively more significant role in further ecosystem development; listing the asset is expected to provide additional utility within the protocol.

Dislocations

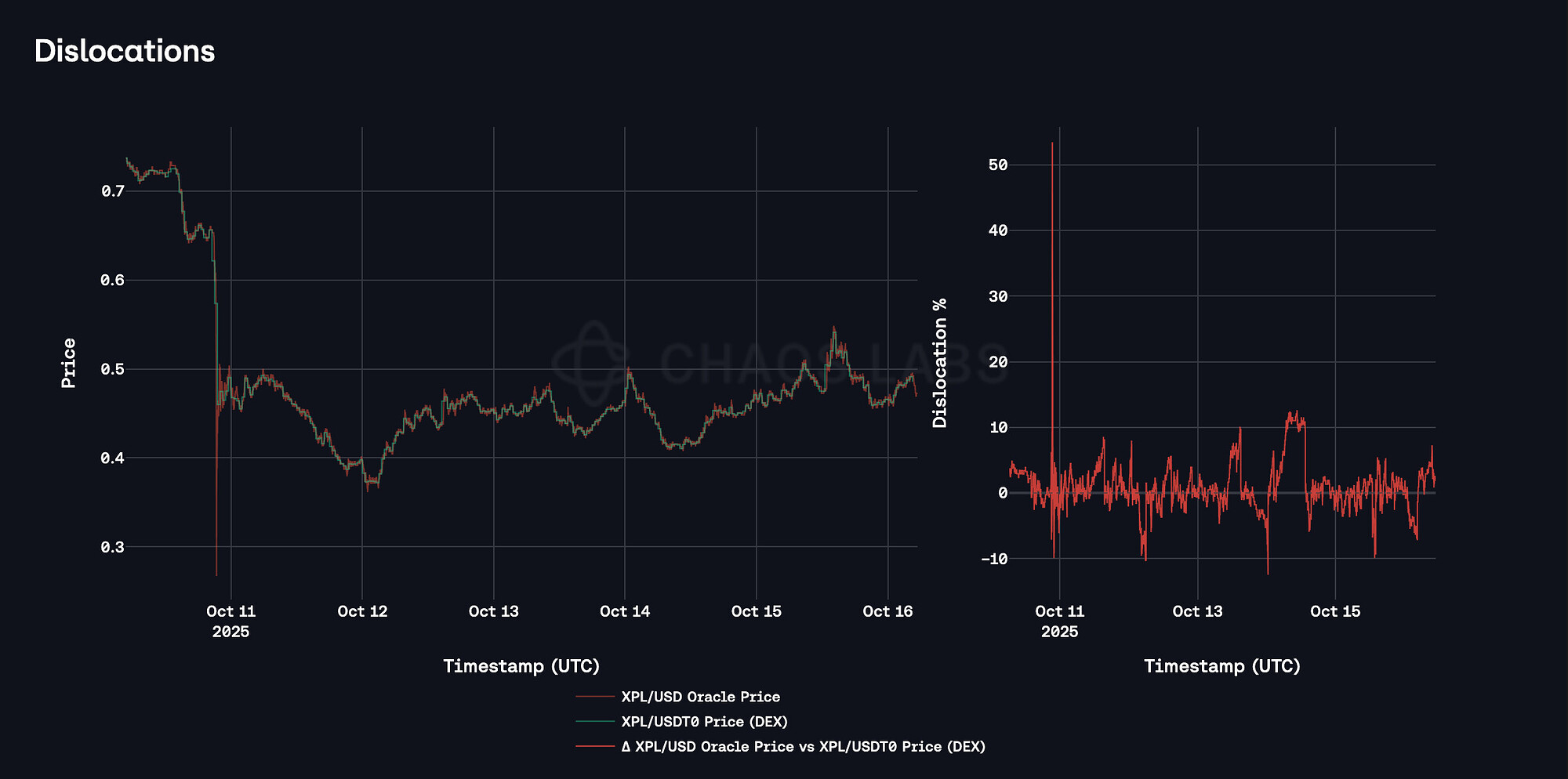

To assess XPL’s market and pricing efficiency, we compare Chainlink Oracle price feed updates with the mean 1-minute prices from the WXPL/USDT0 Uniswap V3 pool. Observed dislocations between the two sources have been substantial but decaying with time. Peak dislocation of approximately 50% was observed on October 10th, during the largest liquidation cascade in recent history.

Additionally, since October 12th, the dislocations have been consistently high, at times exceeding 10% and averaging 5%, further supporting the recommendation of conservative risk parameters and limited exposure to volatile asset borrowing.

Volatility

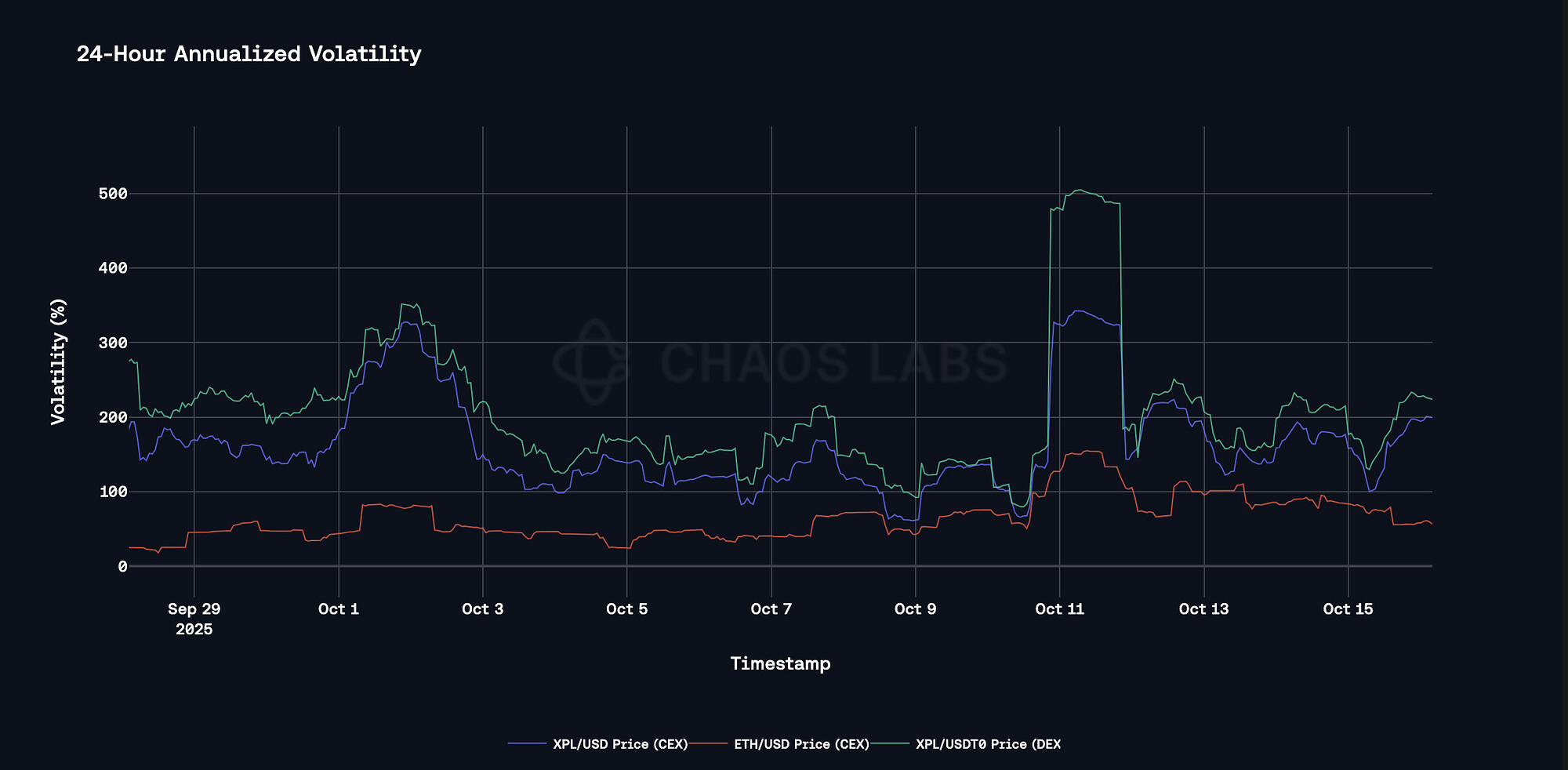

During recent price discovery stages, XPL has exhibited high volatility. As the token was created and listed recently, we measured 24-hour annualized volatility instead of 30-day due to substantial limitations around DEX price availability. We observe that XPL’s volatility profile derived from CEX and DEX prices is slightly different due to some inefficiencies in pricing and, as previously shown, a substantial but decaying number of dislocations between the two venues.

Additionally, we observe that the token’s volatility has been decreasing over the last week and has converged to 150-200% annualized. To put the number into context, ETH is currently at 50% annualized volatility, implying that WXPL is substantially more volatile over the same period, supporting the case for conservative risk parameters and Isolation Mode.

Liquidity

At the time of writing, the largest liquidity pool for XPL is the Uniswap V3 WXPL/USDT0 pool, which has a TVL of over $20 million. While the pool size is significant, a sell order of 10 million WXPL tokens is estimated to incur a 15% slippage. Additionally, Plasma’s team has established a $300 million liquidation backstop to ensure timely execution of liquidations during periods of high market stress, which substantially reduces the risk of bad debt for the protocol.

LTV, Liquidation Threshold, and Liquidation Bonus

We expect XPL to continue exhibiting elevated volatility; hence, we recommend limiting its utility to a dedicated E-Mode. Specifically, we propose setting the LTV at 0.05%, the Liquidation Threshold at 0.1%, and the Liquidation Bonus at 10%.

E-Mode

We recommend listing WXPL in with a dedicated E-Mode to prevent it from being used as collateral to borrow other volatile assets. Significant price movements in borrowed asset prices, combined with potential dislocations of XPL’s on-chain price, delayed oracle updates, and XPL’s underlying volatility, could elevate the risks of liquidations and bad debt. Hence, we recommend limiting WXPL’s collateral utility to USDT0 and GHO for the time being.

Supply and Borrow Caps

We recommend an initial supply cap of 14,000,000 and initially listing WXPL as a non-borrowable asset.

Oracle

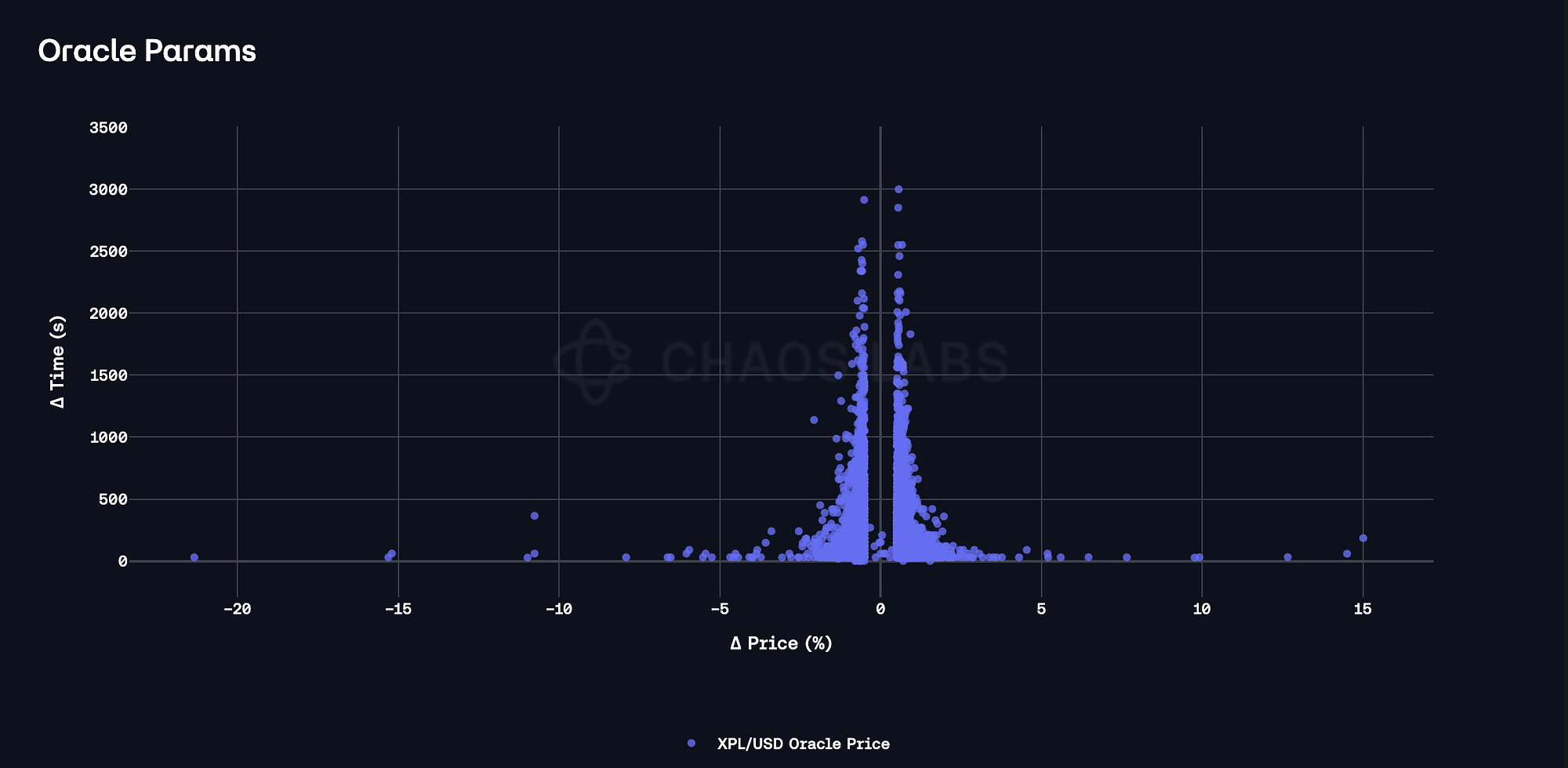

We recommend using an XPL/USD price feed with a 0.5% deviation threshold and a 24-hour heartbeat. The distribution of empirically observed oracle updates is presented below. While such configuration usually balances responsiveness with stability in the presence of market fluctuations, some irregularities in pricing have occurred during the market crash on October 10th, which was the case for a broad range of other volatile assets.

Specification

| Parameter | Value |

|---|---|

| Asset | WXPL |

| Isolation Mode | No |

| Borrowable | No |

| Collateral Enabled | Yes |

| Supply Cap | 14,000,000 |

| Borrow Cap | - |

| Debt Ceiling | - |

| LTV | 0.05% |

| LT | 0.1% |

| Liquidation Bonus | 10% |

| Liquidation Protocol Fee | 10% |

| Variable Base | - |

| Variable Slope1 | - |

| Variable Slope2 | - |

| Uoptimal | - |

| Reserve Factor | - |

E-Mode

| Parameter | Value | Value | Value |

|---|---|---|---|

| Asset | WXPL | USDT0 | GHO |

| Collateral | Yes | No | No |

| Borrowable | No | Yes | Yes |

| Max LTV | 50% | - | - |

| Liquidation Threshold | 55% | - | - |

| Liquidation Bonus | 10% | - | - |

Disclosure

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0.