Summary

LlamaRisks supports the onboarding of XPL to the Plasma instance. Wrapped XPL represents the network’s native token as an ERC20-compliant asset. Based on the WETH9, wXPL utilizes a well-established wrapper pattern. Approximately 7 million worth of wXPL (~$6.3M) could be swapped within a 10% price impact at the time of our analysis, with most DEX liquidity paired with USDT0. As of now, asset remains volatile, albeit the initial price discovery phase is over. A Chainlink XPL/USD price feed is available, and like WETH, the wXPL contract exhibits no admin or ownership functions and is non-upgradeable.

1. Asset Fundamental Characteristics

1.1 Asset

XPL is Plasma’s native token, facilitating transactions and rewards to consensus validators. Wrapped XPL (wXPL) represents the ERC-20 compliant token.

1.2 Architecture

wXPL uses the Wrapped ETH pattern (WETH9) for the minting and burning of wXPL.

1.3 Tokenomics

By depositing native XPL into the contract, users can mint wXPL at a 1:1 ratio. Sending wXPL back to the contract redeems native XPL.

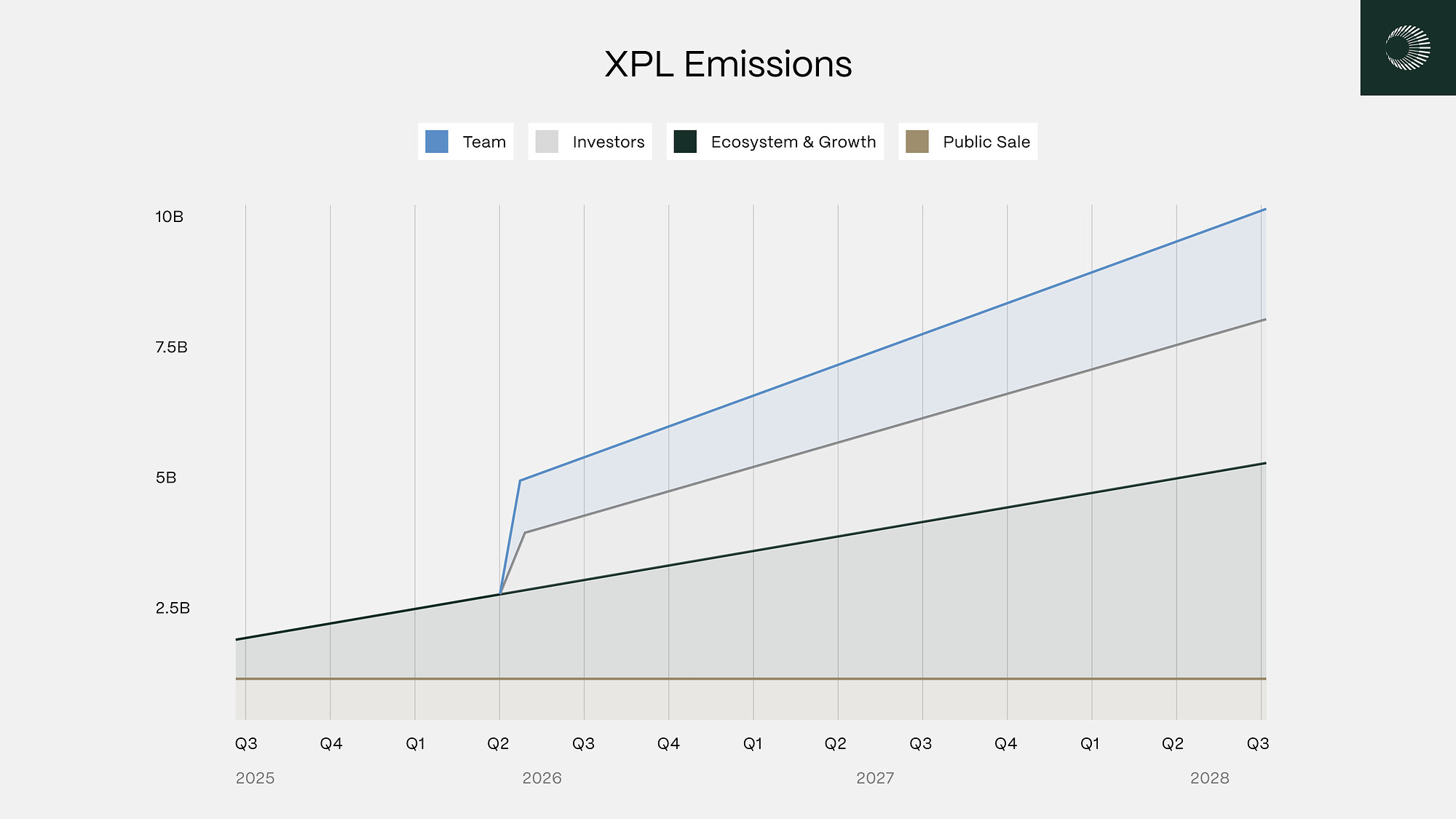

XPL distribution is split: 25% investors, 25% team, 40% ecosystem and growth, and 10% to the public sale. This distribution centralizes half the token supply, with only 10% made immediately available to the public.

Source: XPL Allocation, Plasma Docs, October 6, 2025

The planned unlock schedule for XPL that is not immediately made available from the mainnet launch includes:

- XPL purchased by US investors, is subject to a 12-month lockup

- 80% ecosystem and growth allocation (32% of the 40%) unlocks monthly over 3 years

- ⅓ of the team and investor allocations are subject to a 1-year cliff, and the remaining ⅔ unlock monthly over 2 years

Source: XPL Emissions Schedule, Plasma Docs, October 6, 2025

1.3.1 Token Holder Concentration

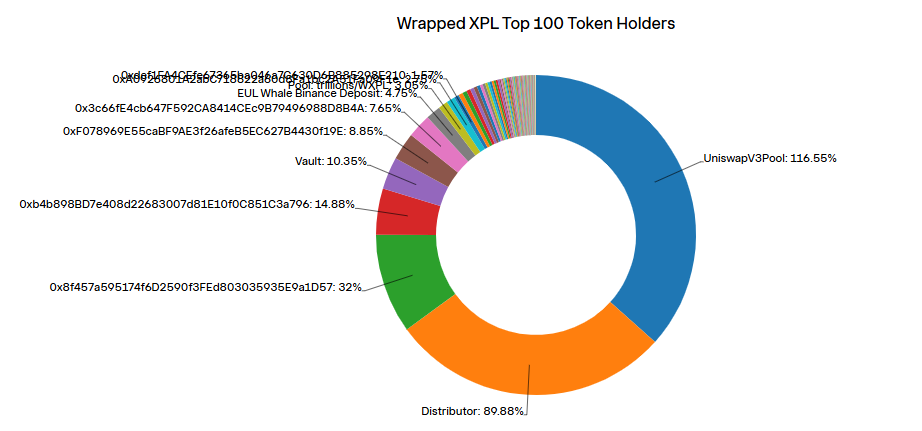

A total of 17,403 accounts hold ~43M wXPL. Using the Plasmascan explorer, we noted an irregular accounting of circulating wXPL supply, with over 116% of the supply attributed to a single contract and an underreporting of ~13M total supply. XPL supply is capped at 10B.

Source: Top 100 Holders, Plasmascan, October 5, 2025

The 3 largest EOAs based on Coingecko circulating supply:

Source: Top 10 Holders, Plasmascan, October 5, 2025

2. Market Risk

2.1 Liquidity

7 million worth of wXPL (~$6.3M) can be sold on DEXs within a 10% price impact. Additional significant liquidity is residing on CEXs, however is not considered for onchain liquidation processing.

Source: Kyberswap, October 5, 2025

2.1.1 Liquidity Venue Concentration

Meaningful XPL liquidity (>$100K) can be found on Uniswap, Balancer, DYOR swap, and Lithos. The most significant pools from each venue include:

Source: Geckoterminal, October 6, 2025

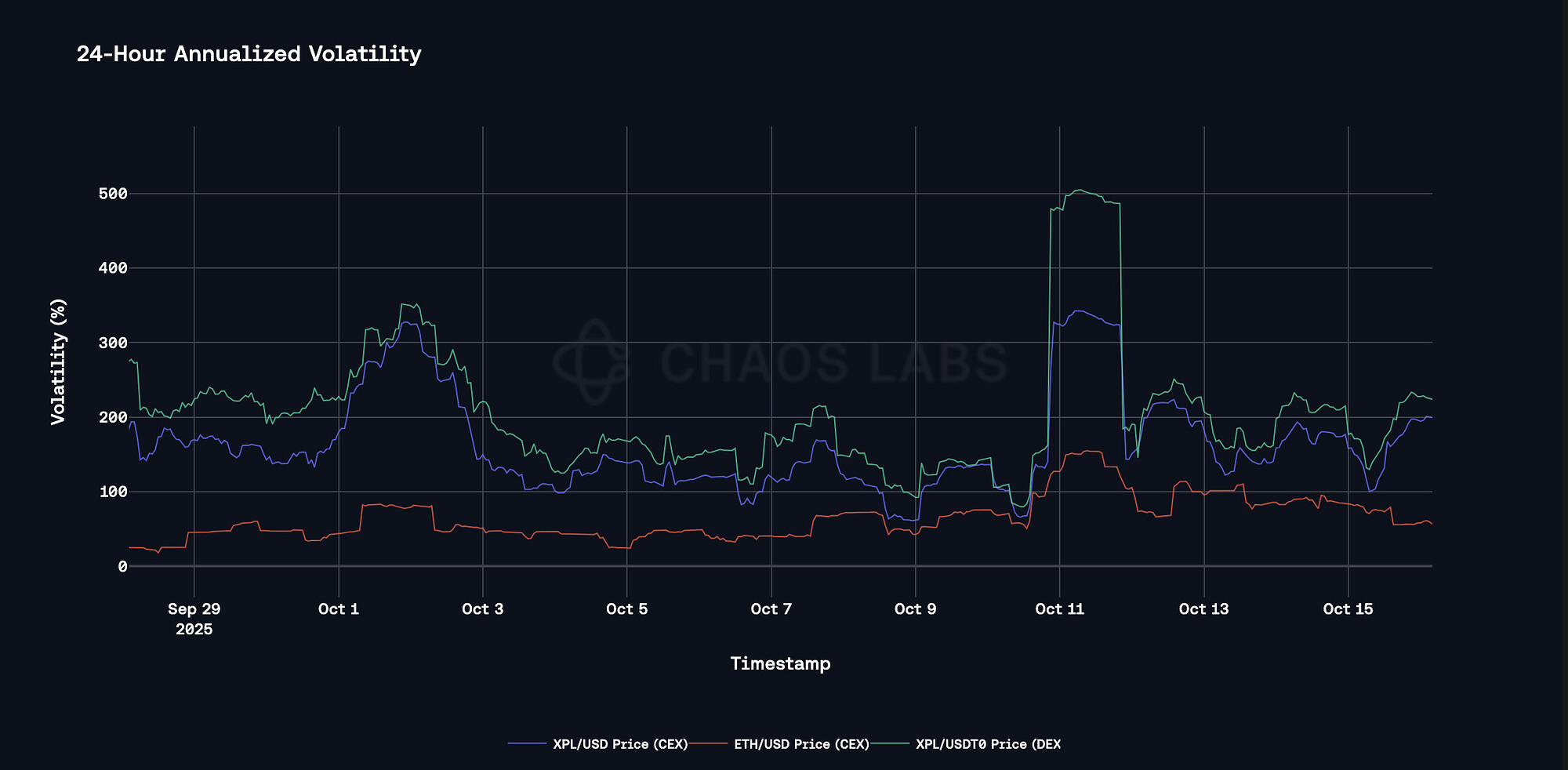

2.2 Volatility

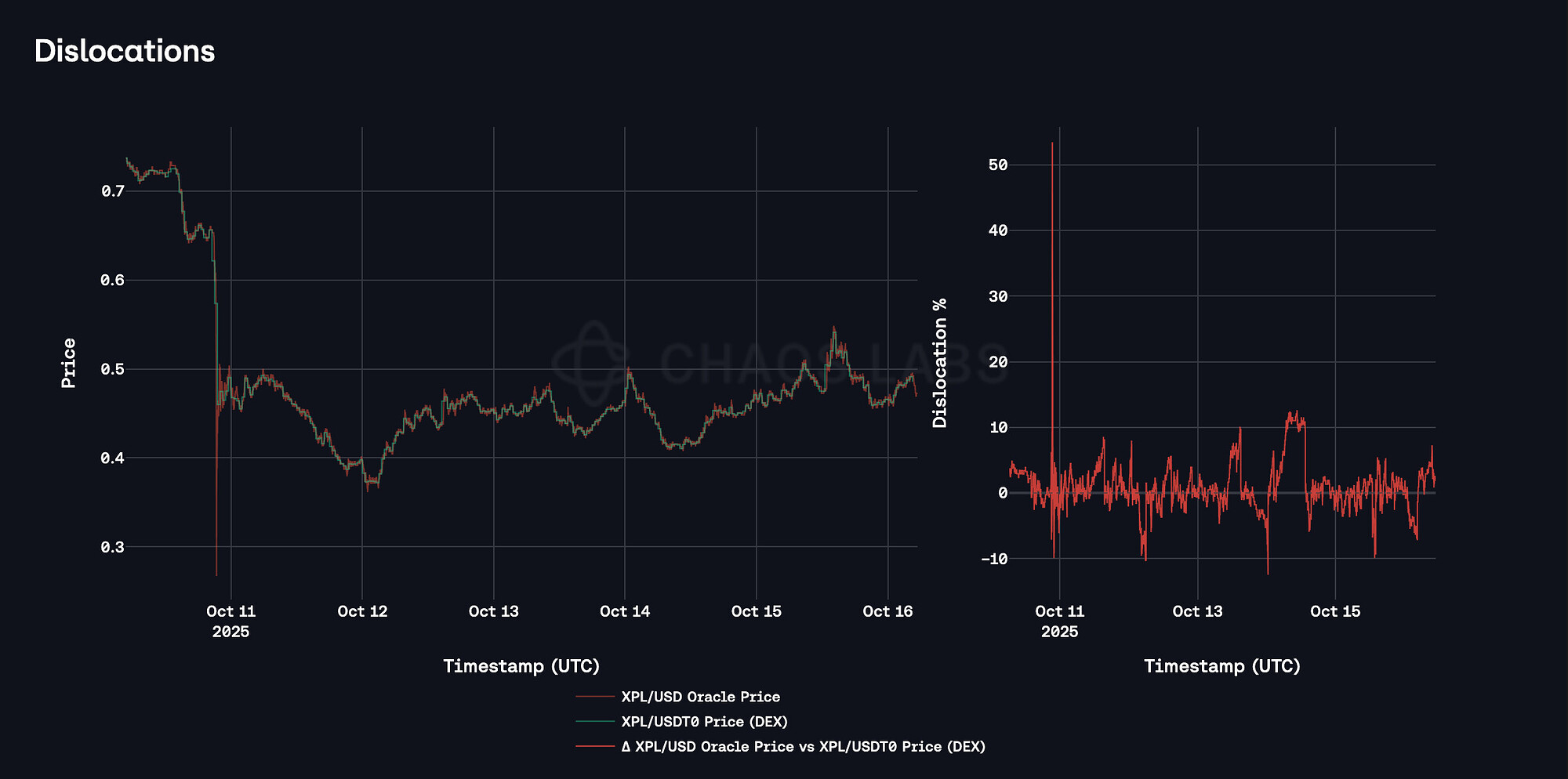

Shortly after Plasma’s mainnet launch on September 25, 2025, XPL saw initial sharp volatility. However, later the price saw a significant drop off, subduing at the range of $0.8-$1. 24-hour trading volume amounted to ~$47M on October 5th, 2025.

Source: XPL/USD Chart, Coingecko, October 6, 2025

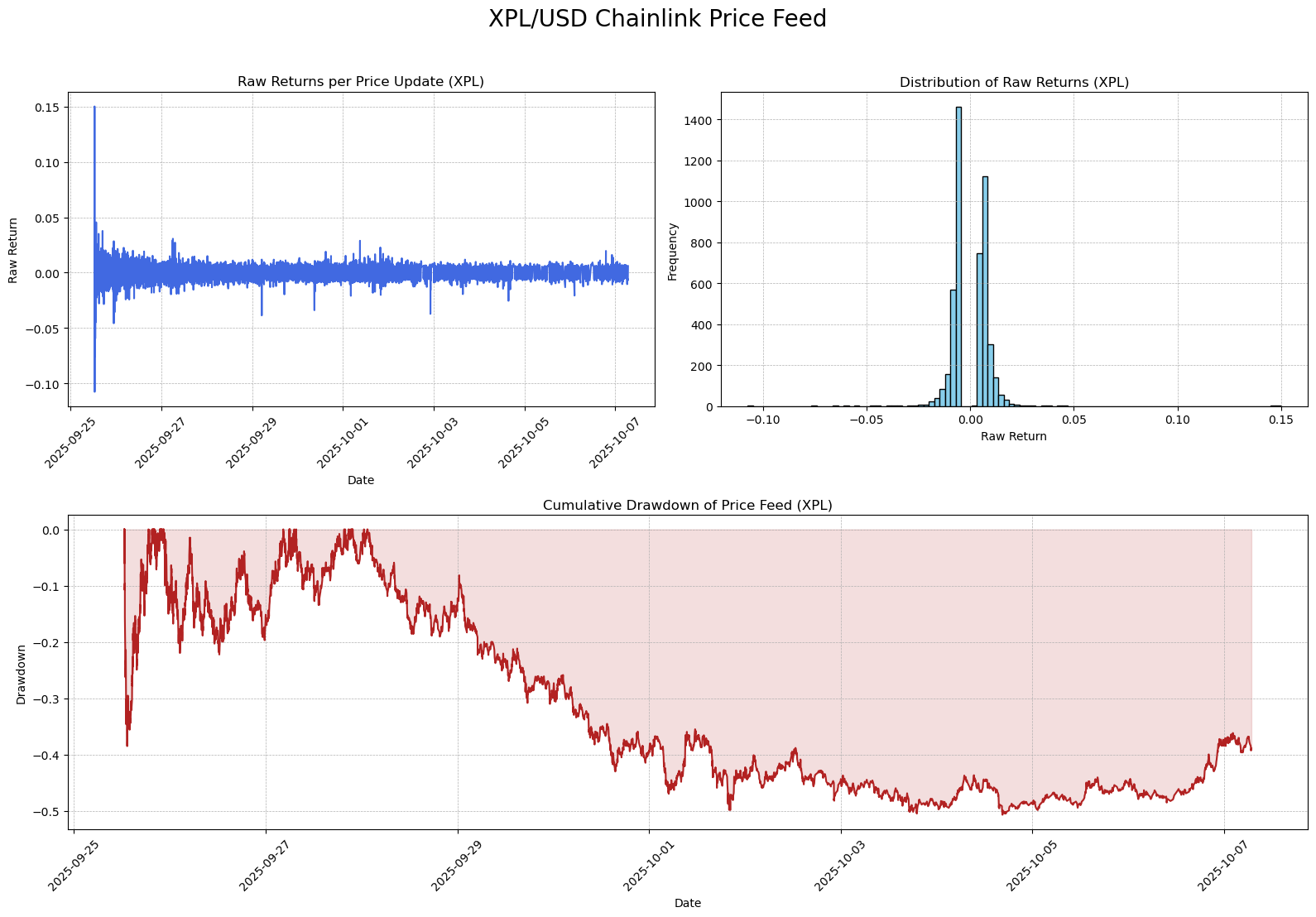

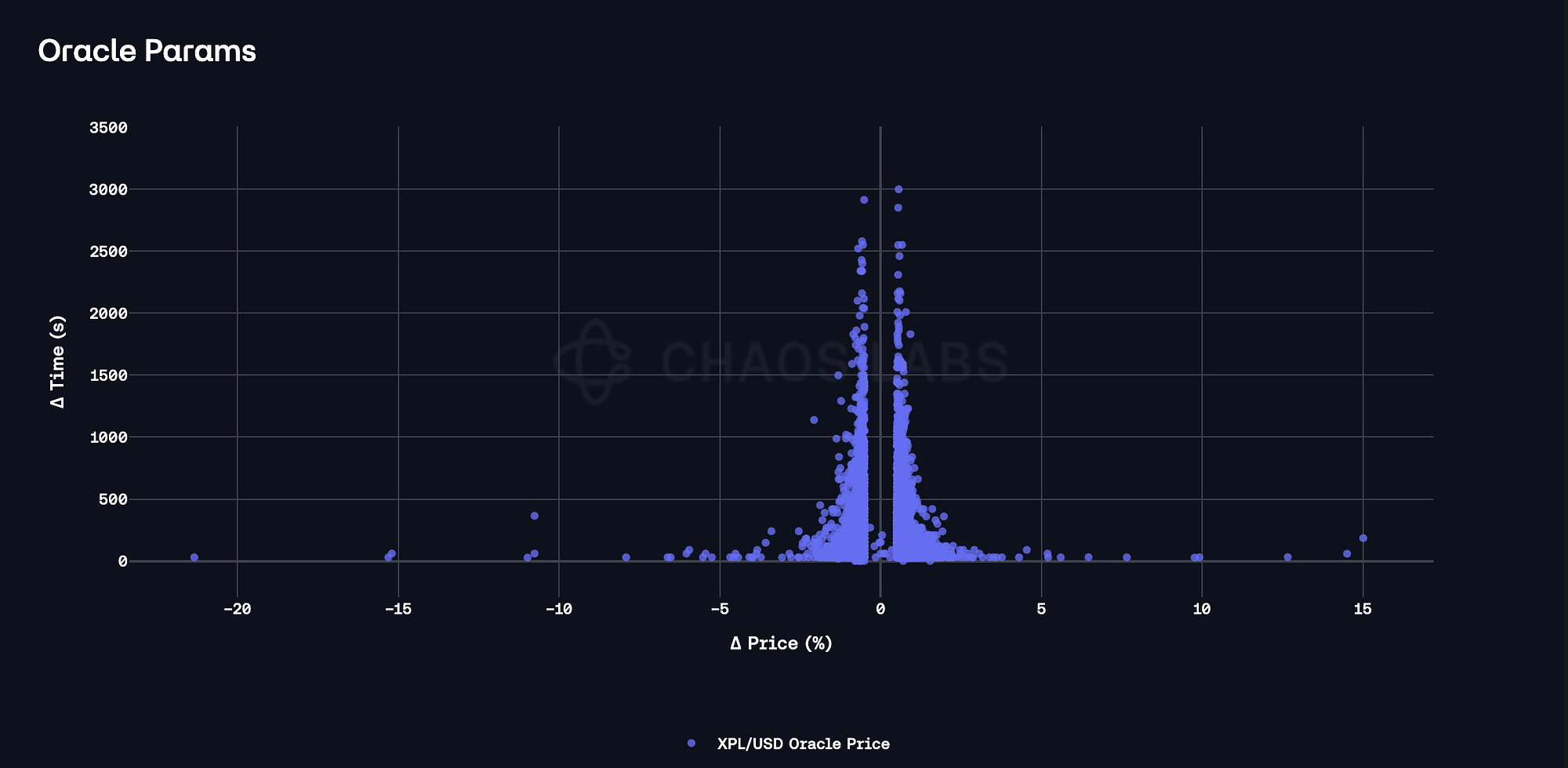

Inspecting Chainlink XPL/USD price feed, we can observe that after the initial price volatility subdued, the inter-update price changes are now limited to at most 4.5% in either direction. Even though the price saw a large drawdown post TGE, we can deem that the asset has now finalized the price discovery phase. Nonetheless, this data supports more conservative parameters, with specific attention to the liquidation bonus and LTV-to-LTV buffer in order to minimize possible liquidation stress.

Source: Chainlink XPL/USD Feed, October 7, 2025

2.4 Growth

As the network’s native token, the growth of XPL should linearly follow usage growth on the network and applications. At the time of writing, ~43M XPL has been wrapped of the total circulating supply of 1.8B.

3. Technological Risk

3.1 Smart Contract Risk

The WETH was developed as an open-source project by a team comprised of members from MakerDAO, 0x Labs, and Gnosis. The WETH9 contract represents a well-established and adopted pattern.

As a widely used wrapper implementation, WETH code often forms part of protocol audits that integrate it, for example:

3.2 Bug Bounty Program

No bug bounty could be found for wXPL.

3.3 Price Feed Risk

A Chainlink XPL/USD price feed is available, featuring a 0.5% deviation threshold and a 24-hour heartbeat.

3.4 Dependency Risk

The wXPL contract is based on WETH, with minor changes implemented. The only change effect was a change to the token metadata to reflect XPL.

4. Counterparty Risk

4.1 Access Control Risk

The Wrapped XPL contract is a permissionless, non-upgradeable contract similar to WETH9.

Aave V3 Specific Parameters

The elevated asset price volatility and low maturity necessitate restricting the asset’s usage to stablecoins only. This cautious approach may be reconsidered as the asset matures. The initial parameters will be jointly posted with @ChaosLabs, who will then follow up on this thread.

Price feed Recommendation

We recommend using the Chainlink XPL/USD price feed to price the asset on Aave’s Plasma market.

Disclaimer

This review was independently prepared by LlamaRisk, a DeFi risk service provider funded in part by the Aave DAO. LlamaRisk is not directly affiliated with the protocol(s) reviewed in this assessment and did not receive any compensation from the protocol(s) or their affiliated entities for this work.

The information provided should not be construed as legal, financial, tax, or professional advice.