The AIP has not passed. In light of this, we thought it would be helpful to provide more clarity on the rationale for freezing CRV.

Why does Gauntlet recommend freezing CRV on Aave v2?

Freezing prevents the continued excessive buildup of CRV, preventing further concentration. We don’t know how much CRV the user has on the backend that he can add to add this concentration.

-

The tradeoff is that user cannot use CRV to protect their position should it become liquidatable.

- This is the point - freezing compels the user to either provide additional collateral or repay their debts. There is speculation that the user may be unable to access funds to repay their USDT debt, but this cannot be measured. It’s important to note that the user has already started repaying a portion of their debt since the proposal was introduced.

-

Unfrozen CRV incentivizes the user to protect their position by depositing CRV, which will add further concentration risk, rather than repaying their debt.

We cannot predict how liquidity and market conditions will evolve in the future, so we cannot assign a probability to this. Consequently, adding more CRV to this position will increase future risk. We want to avoid a situation where the position has a higher amount of CRV as collateral and the liquidity of CRV has further decreased, making it harder to remove the position.

Why do increases in CRV collateral add additional risk?

-

Increases in CRV collateral add insolvency risk linearly with respect to the marginal increase in CRV position, which can be superproportional with respect to the original position. In other words, increasing the CRV position by x% can increase insolvencies by MORE THAN x%.

-

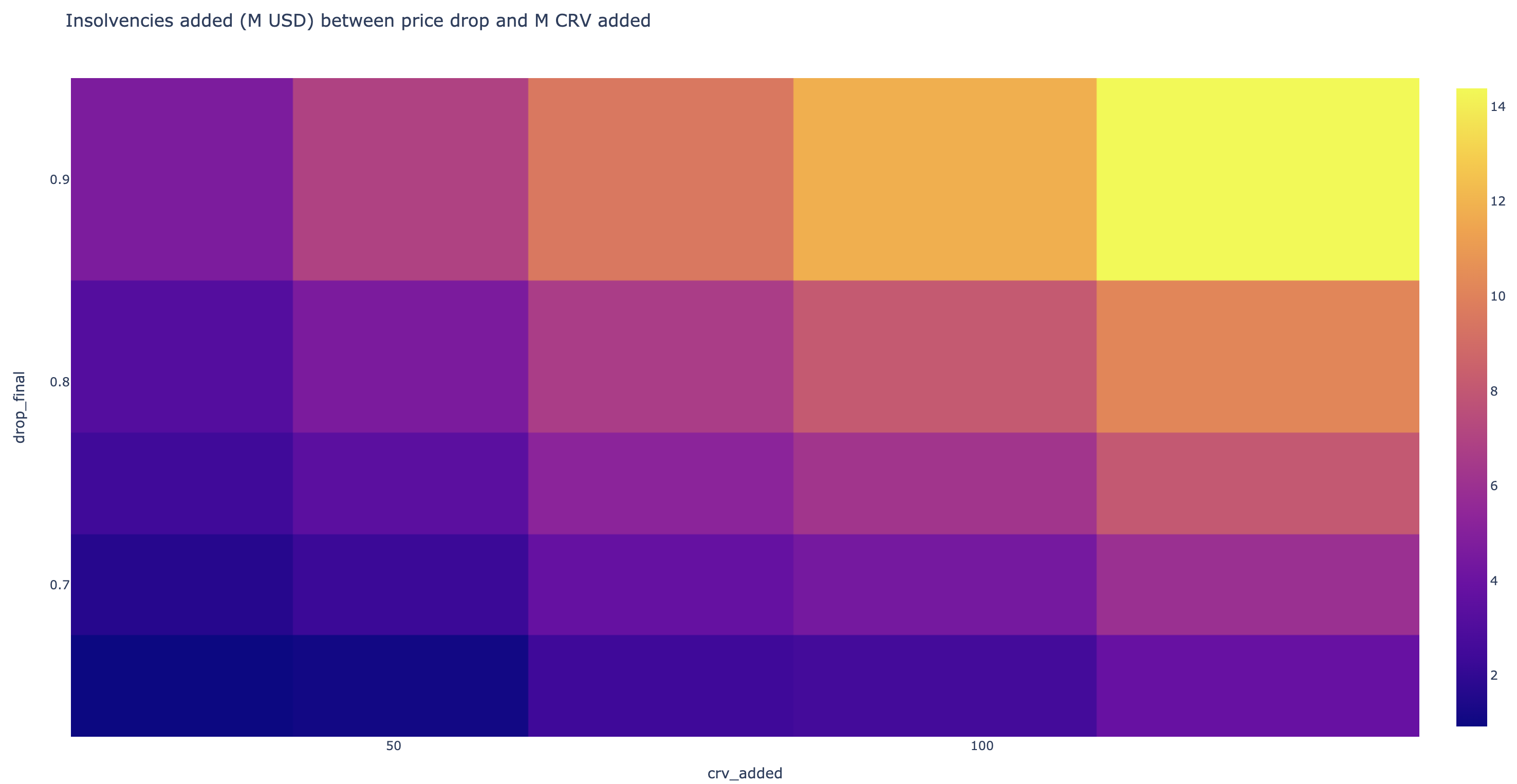

Given the user’s current position, suppose there was an initial CRV price drop that forces the user to adjust their positions, and the user needs to either repay USDT debt or refill CRV collateral to maintain a “safe” HF. For example - suppose the user’s target HF is 1.6, and CRV drops 16%. That means the user’s HF has dropped to 1.4 (supply 288m CRV, borrow 62m USDT, CRV price $0.62, current data as of 2023/06/16 23:30 UTC). This implies the user either needs to repay 7.7m USDT or deposit 41m CRV to return the HF to 1.6. The following heat map shows the relationship of increased insolvencies between adding CRV collateral vs repaying USDT debt when HF is held constant, to the CRV price drop and the amount of additional CRV added.

-

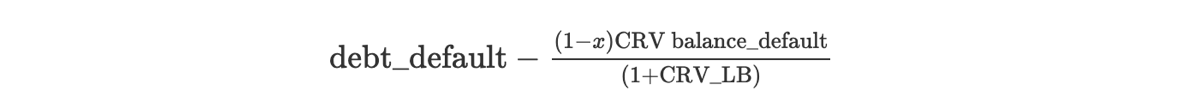

Let the initial drop be drop_init (the above example is 16%). Then the user’s default insolvencies, assuming liquidations occur after the price has stabilized after a big drop of x%, are

-

The user’s insolvencies after repaying are

-

This implies that the insolvency is linear with respect to how much CRV we refill, and by how much CRV price drops by

-

The user’s insolvencies after refilling with CRV are the same as the user’s default insolvencies since USD balances remain the same.

-

Therefore, refilling relative to repaying debt can increase final insolvencies by 1/(1-drop_init) - 1, which is the same as the CRV refill amount.

-

-

Liquidations will mostly occur once the price has stabilized, if the stabilized price is lower than -70%, liquidations will drive the account towards realized insolvency. HF is currently 1.7, and currently, CRV needs to decrease by 40% to trigger liquidations and 70% to trigger insolvencies. Our simulations show that there is current liquidity levels can only support ~$6m in liquidation as CRV decreases in price. Drawing parallels to USDC depeg, liquidity deteriorates as CRV price drops, thresholding liquidation volume. Only when the price stabilizes and begins to trend flat does liquidation volume increase.

- As a result, final_price(CRV) stabilizes at a price less than the min_price_no_insolvency(CRV), any liquidation will continue to drive the HF downwards. Moreover, if increased CRV supply from refills can continue to exert downward pressure on the stabilized CRV price, so the more CRV refill/supply, the lower the effective liquidation price could be and the greater the harm to the user HF.

- To illustrate the potential speed of liquidations, during the previous CRV incident on 2022-11-22, 50m of CRV debt was repaid in 1 hr of time as CRV went from 0.61 to 0.71.

-

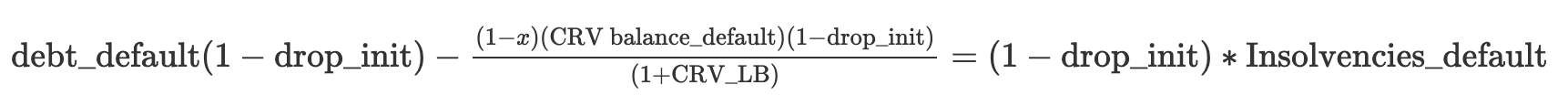

The user has the capacity to greatly increase their CRV position. For context, the user’s CRV position has doubled over the past half year. The user has roughly 150m CRV on other lending platforms, and 60m CRV unlock in the next year, which means he has the capacity to potentially increase their Aave v2 position by almost 70%.

On preventing borrow from increasing

- This was our intention behind setting LTV to 0, and we look forward to improvements across Aave v2 to make that check more rigorous and non-circumventable. As we previously discussed, managing the user’s position requires addressing both sides of the problem. This involves preventing further supply growth and restricting the user from borrowing more in order to minimize risk.

On freezing being too extreme

- This is the philosophical problem of DeFi - Gauntlet is looking to absolutely minimize bad debt on Aave that can result from market risk. At times, the best course of action is to intervene in a fairly extreme manner, similar to our pause suggestions during the USDC depeg. As DeFi gets more developed, we look forward to new automated, algorithmic mechanisms that serve as killswitches to stop normal behavior in abnormal events.