Hi everyone,

We have been busy and can now share our latest efforts. First up, we have a new GHO price feed (Redstone API) and the upgraded TradingView price chart.

The new chart offers a lot of interactive features curtsey of the TradingView upgrade and the new API provide a lot more granular price data. The Redstone API by itself on retains 30-days of history and because we archive this data, we are now able to offer the best API with the longest data history to more accurately reflect GHO’s price performance.

With several liquidity pools across various DEXs and each pool generating a slightly different GHO price, we have created an Oracle Dashboard that shows GHO’s price in each pool.

It is worth noting here that Maverick is showing $1.000 as there is no liquidity above the peg, so the Boosted Positions are outside of range. The full range pools on Balancer and Curve reflect a higher GHO price.

Pivoting away from the Aave Portal, we built our first app for the Aave DAO, a GHO Stability Module Frontend.

To bring the Aave Portal, GHO Stability Module and Delegate Platform together, we have created an aave.tokenlogic.xyz landing page.

If you want to check out the latest additions, please click below:

Link: https://aave.tokenlogic.xyz

Another huge shout out to @Scottincrypto and @agentmak for pulling all this together.

1 Like

Hi Everyone,

With the Aave DAO engaging new service providers and extending the Merit program, we have revised the Runway Dashboard to include forecasted spend and introduced various spend categories.

There are now seven distinguished spend categories:

- Growth

- Technical

- Risk

- Security

- Finance

- Orbit

- Operations

The previous runway was based solely upon data available on-chain and the revised runway now features two types of forecasted spend:

- DAO Commitment

- Governance approved spend subject to a scope of work being delivered.

- For example: Catapulta is remunerated 15k GHO plus gas reimbursement (assumed to be 1 ETH) per deployment. We have budgeted for 3 Aave v3 deployments over the 6 month period.

- Projected Spend

- Spend likely to be incurred by the Aave DAO that has not yet been approved by governance.

- For example: Avara’s Aave v4 funding proposal which is 3M upfront and 9M GHO via a 12 month stream.

We have also introduced an Adhoc Security Funding budget to cater for any bounty payment whilst still retaining a separate 1M ImmuneFi Bug Bounty Budget.

Link: Aave Portal | TokenLogic

This work is the contribution of @Scottincrypto and @agentmak.

1 Like

Link: Aave Portal | TokenLogic

Hi Everyone,

We are excited to share the new Treasury Holdings dashboard spanning Ethereum, Arbitrum, Optimism, Avalanche and Polygon networks.

There are a lot of features that enable users to dive down into the performance of each asset holding on each network. The default setting provides a high level overview, like below, and then depending on how granular the user wants to go, it is possible to select a type of asset, network and/or Aave deployment.

For example, the DAO has acquired over $850,000 in revenue of EtherFi’s weETH since it was listed on the 14th April 2024 on Aave v3 Ethereum. Users can see when this revenue was earned via our Revenue dashboard.

The initial iteration of the Frontier section of the Treasury dashboard, showcases the expected returns relative to passively holding the underlying asset. We will soon introduce actual data streams to verify the return being generated and add the ETHx holding to the Treasury assets holdings along with some data points to highlight the magnitude of the program, plus the additional yield being generated. For now, we are showing the expected return being generated from the Frontier program relative to passively holding different Liquid Staking Tokens.

Excluding the AAVE balance from the Treasury holdings, the chart below shows both the Treasury and stablecoin holdings value are at an all time high measured in USD.

This work is the contribution of @Scottincrypto and @agentmak.

2 Likes

We are excited to announce the release of our new dedicated to stkGHO analytics. This page provides comprehensive insights into the staking and cooldown activities of stkGHO tokens. Below are the key features and metrics available on the new page:

This chart offers a high-level overview of key stkGHO metrics, including information on current stakers, earning APY, and supply dynamics.

We’ve also included information on GHO cooldown activity. This provides a comprehensive view of GHO tokens to be released and GHO address holders.

In the near future, we will be adding data that tracks the performance of the stkGHO/GHO liquidity on Maverick supporting the @ACI Fast Past program.

We believe this new addition will provide valuable insights and enhance transparency for the Aave community. Check out the new stkGHO analytics page for the latest analytics and data.

Link: Aave Analytics | TokenLogic

This work is the contribution of @Antonidas @Scottincrypto and @agentmak.

4 Likes

We are glad to share our latest dashboard focusing on the performance of the USDC and USDT GHO Stability Modules (GSM). The below shows a clear overview of the GSMs current status with current holdings, Exposure Capacity and Bucket Capacity. Currently, more GHO is approved to be minted against USDC and USDT deposits, but the GSMs have reached there exposure to USDC and USDT thresholds.

The relationship between the holding balance, Exposure Capacity and Bucket Capacity over time is evident below. The GHO Stewards are able to configure the Exposure and Bucket Capacity parameters.

We also show the fees generated by the GSMs.

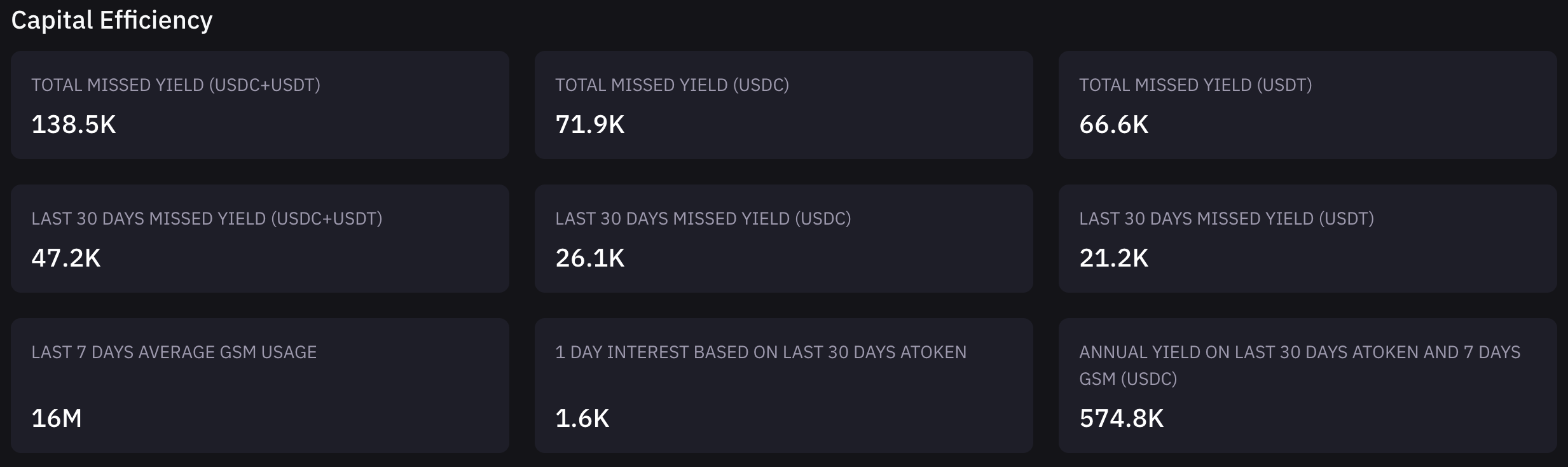

And further to this, we also show the opportunity cost of using passive USDC and USDT as opposed to aTokens which would earn yield. A new forum post will be published later today that proposes migrating from USDC to aEthUSDC, ie: USDC deposited into Aave v3 with the yield going to Aave DAO as additional revenue. The upside for this transition is visible below.

Link: GHO Stability Module

This work is the contribution of @Antonidas, @Scottincrypto and @agentmak.

5 Likes