Link: https://aave.tokenlogic.com.au/

Summary

We are delighted to introduce the GHO Analytics dashboard from TokenLogic, designed to serve as the central hub for all GHO Analysis.

In our continuous effort to enhance user experience, we welcome submissions of analyses, metrics, and API feeds. Our dedicated team at TokenLogic will diligently develop and incorporate these submissions into the dashboard.

The GHO dashboard offers a comprehensive platform where users can effortlessly request, review, and access GHO data. Our overarching goal is to establish the most reliable and comprehensive source of GHO data available.

Introduction

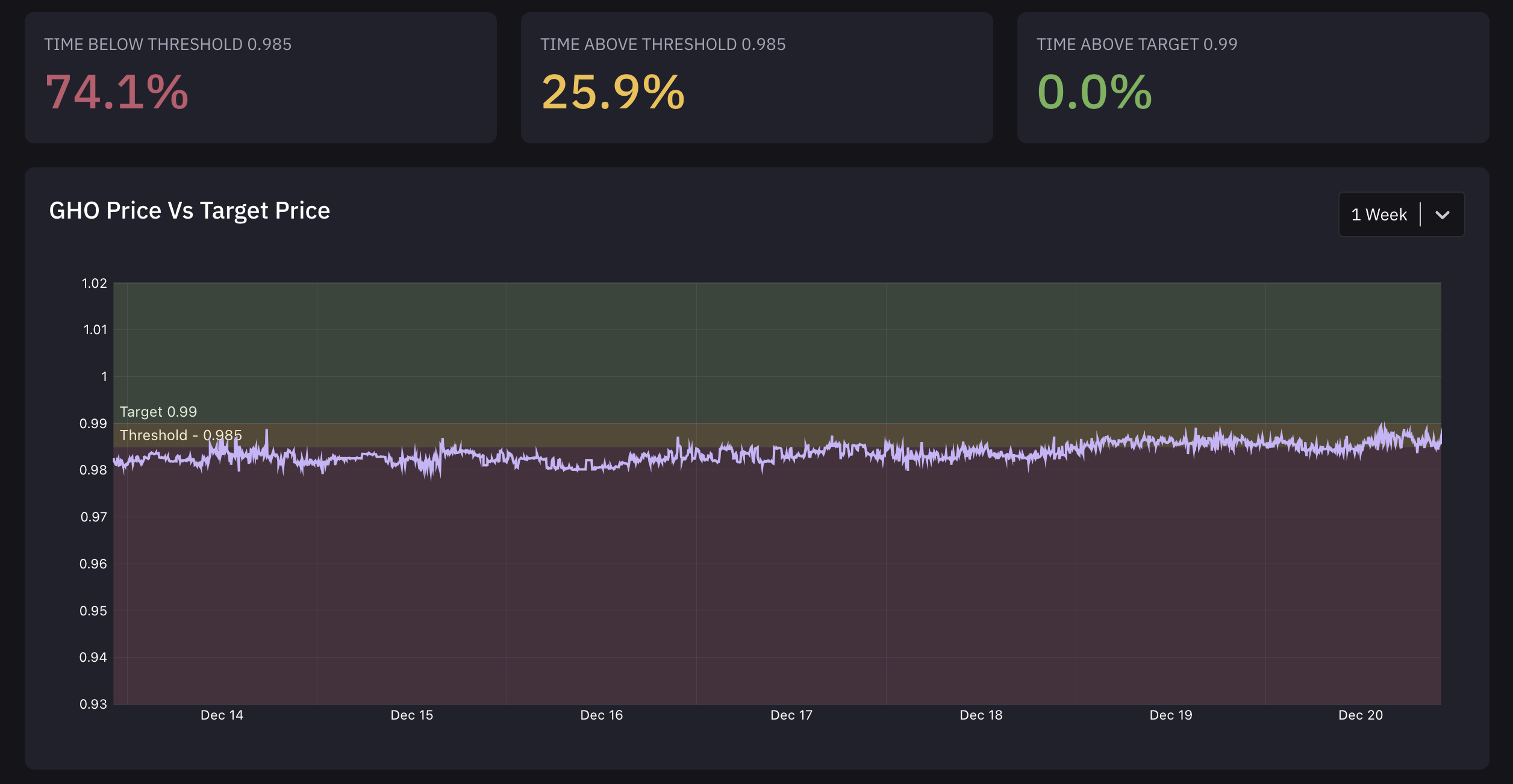

Over the last month, TokenLogic has been setting up an analytics platform capable of providing live GHO data (1-minute feeds) and running customised simulations. We aim to facilitate the seamless integration of GHO data across DeFi by offering profound insights into GHO’s performance and API feeds that teams like Messari and DeFiLlama can integrate as a free service.

To enhance the appeal of the UI, we invite anyone with ideas and unique perspectives to submit requests for analysis/API feeds. The TokenLogic team will then develop the requested analytics/API features and make them available for everyone in a single place.

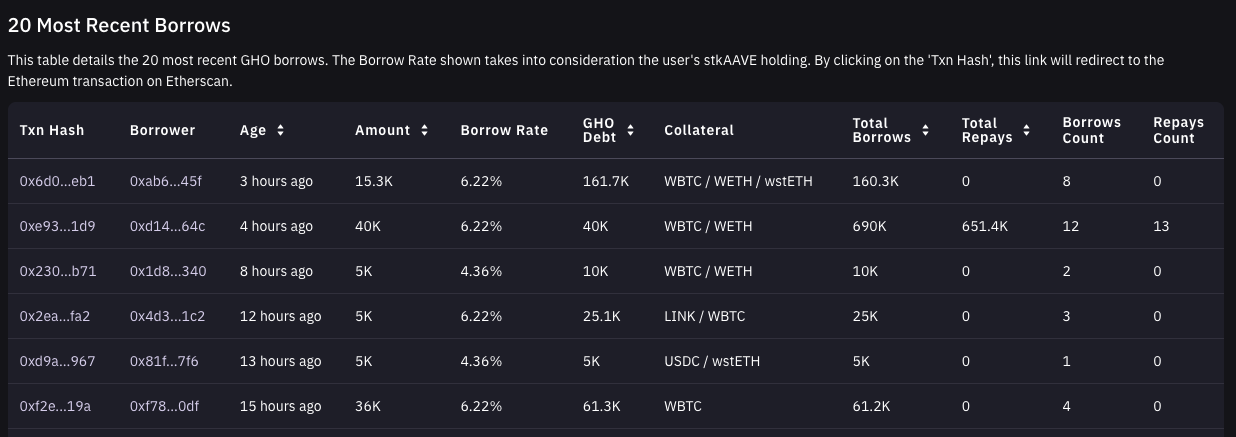

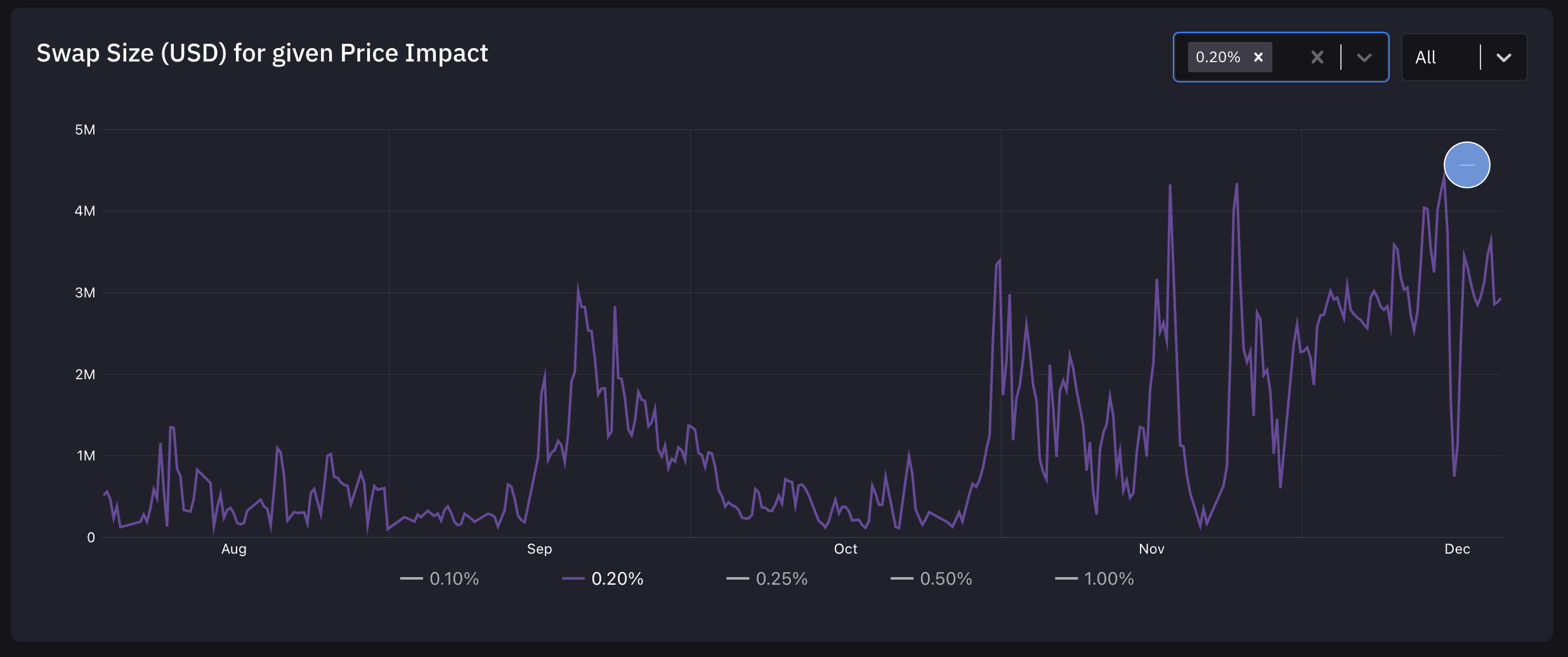

The initial launch is just the beginning of a larger journey to provide everything from high-level aggregated statistics like circulating supply and revenue to granular details like how each user/wallet is interacting with GHO. Soon, Aave DAO will gain insights into each GHO swap, such as the pools the swap is routed through (CEX, DEX, etc.), the size, price impact incurred by the user, and the overall distribution of swaps. This will provide insights into arbitrage swap flows versus real adoption over time. Aave can then prioritise liquidity pools that add value for users by maximising non-arbitrage order flow.

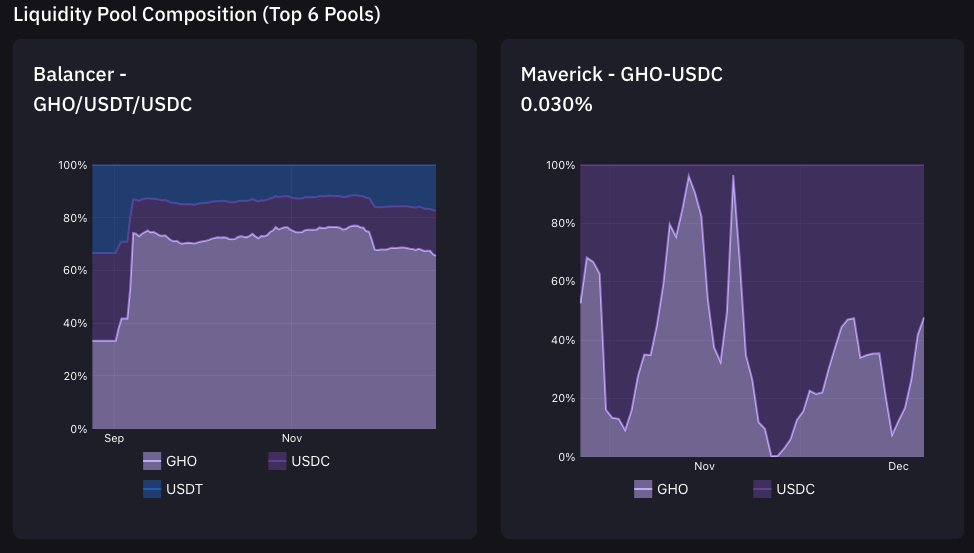

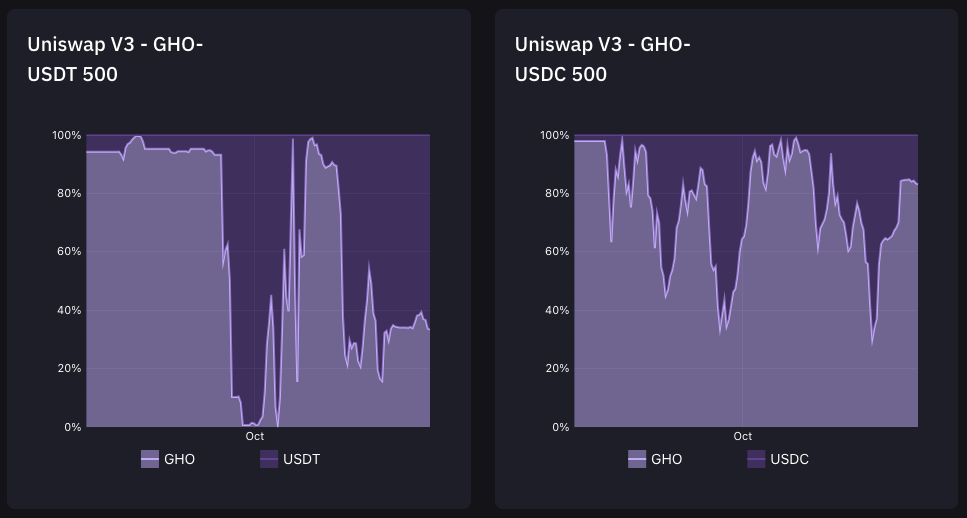

When developing a liquidity strategy for GHO, we can calculate the desired price impact for a swap of a given size to determine the ideal pool size. This will help shape how Aave uses its veBAL. Furthermore, liquidity depth and order fill routes from DEX aggregators like Paraswap will be periodically queried and logged to provide a historical database that can only be created through actively logging and storing data over time. This will provide a true image of GHO liquidity transition over time that cannot be retrospectively generated.

By analyzing the transactions before and after each GHO interaction at the wallet level, we will show how and potentially why users are interacting with GHO. This level of granularity is intended to help shape Aave DAO’s decisions relating to GHO. Understanding which integrations drive growth for GHO will help shape Aave Grants’ pivot to the Request for Grant Proposal approach to awarding grants, as well as how Aave DAO pursues growing GHO adoption.

With the ability to run customised simulations, we aim to provide a level of insight that other more commonly used platforms are unable to offer. When it comes to understanding GHO risk, the platform with supporting computational power to run simulations will not only help integrate GHO across various lending markets but also model the effect of including GHO and BPTs containing GHO in the Safety Module.

For anyone wanting to learn more about GHO, whether it be a deeper understanding through analysis or just integrating GHO data via an API feed, please visit the GHO Analytics Dashboard and submit a request. There is a lot to build right now, and we will do our best to meet the community’s needs.

Copyright

Copyright and related rights waived via CC0.