Hi all,

Today, we’re launching Llama’s Aave dashboard: a one-stop shop for the protocol and analytics about the Aave protocol and DAO. Our goal is to provide the most useful data to contributors, users, and voters of Aave to make informed decisions. For instance, it’s been difficult for contributors in the past to get data on treasury addresses across various networks, understand how much each service provider is owed and in what tokens, and even see simple breakdowns of the treasury. We hope our dashboard makes getting and using this data easier and empowers the community to make more better decisions.

Over the last few months, we’ve worked on building a robust data warehouse for Aave. This data has powered our financial reporting efforts for Aave as well as our work relating to the treasury and protocol growth.

Below, we share some highlights from the current site.

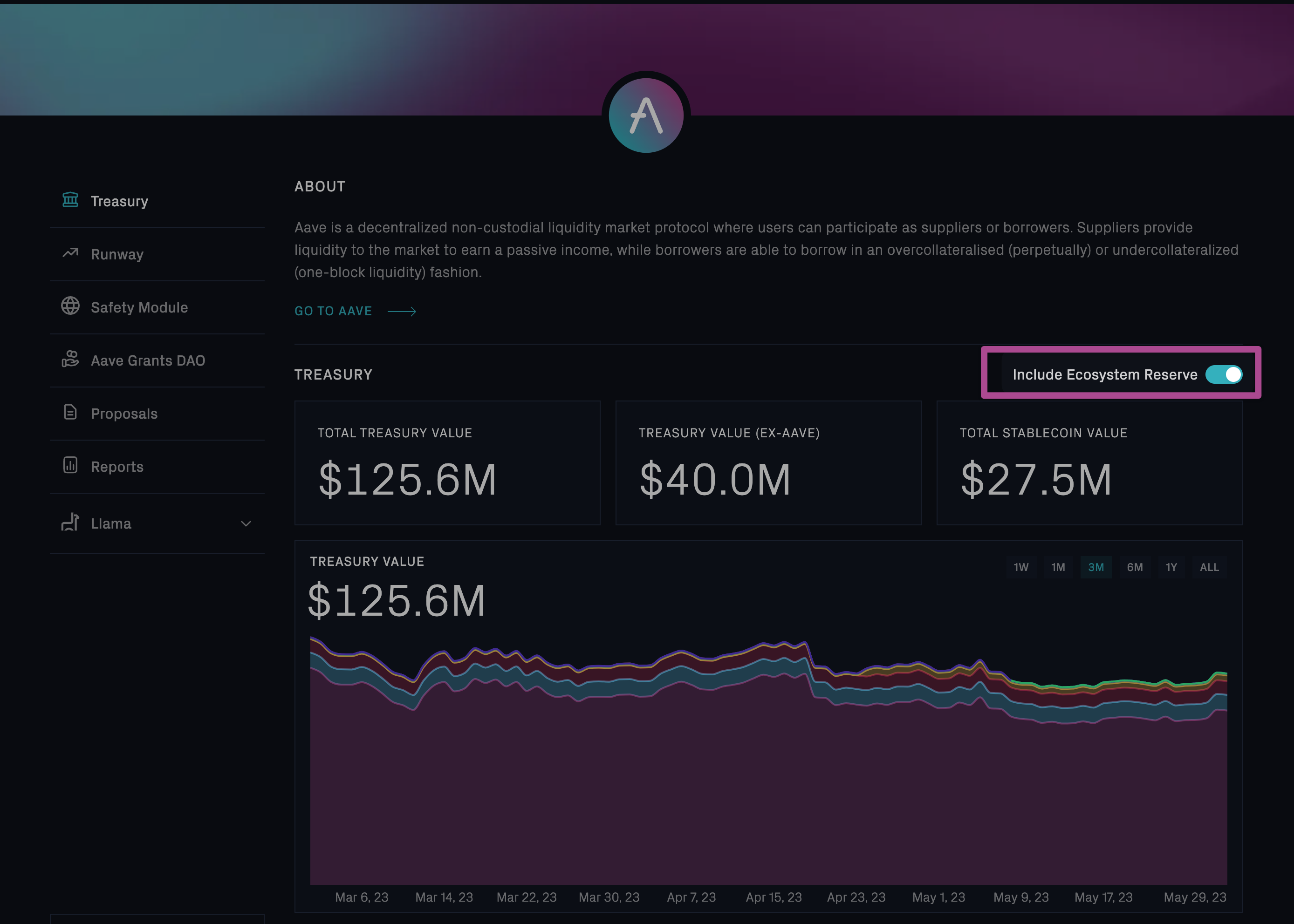

Treasury

High level data on Aave’s treasury.

An overview of Aave’s stablecoin balances and other treasury assets.

Treasury balances by instance, with links to each address.

Detailed view of all of Aave’s treasury assets. Community members can download a CSV in order to manipulate the data or create their own reports.

Today, the website contains the following sections:

- Treasury - summary and detailed data on Aave’s treasury holdings

- Proposals - links to all of Aave’s governance proposals

- Reports - links to Llama’s financial & runway reports

- Llama - monthly updates on Llama’s work

In the coming weeks, we plan to add additional data to this website, including data on:

- Aave’s runway. Users will be able to see an overview of Aave’s service providers, stablecoin balances, and the assets owed to various service providers. We hope this data will help the community make smart decisions about onboarding and paying its service providers.

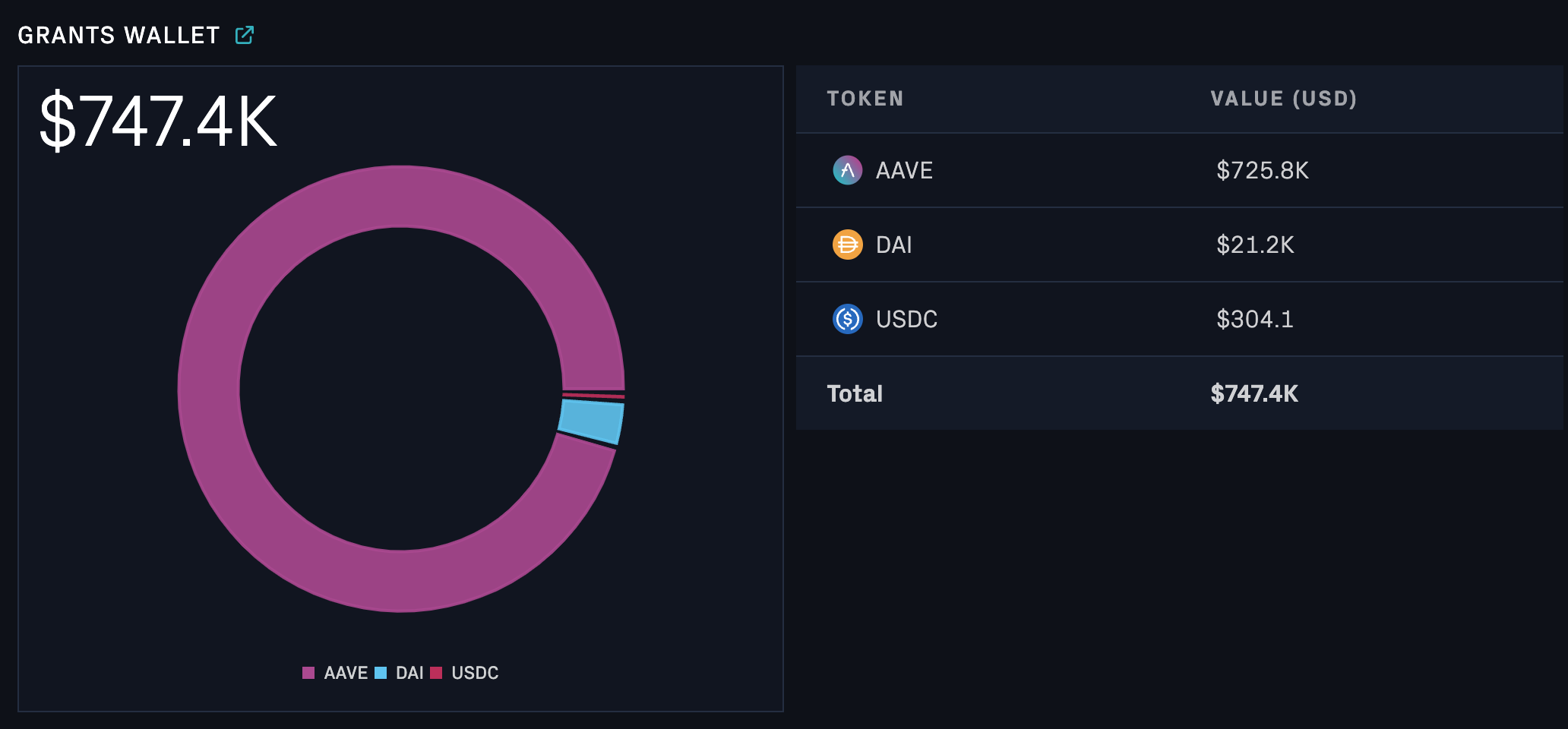

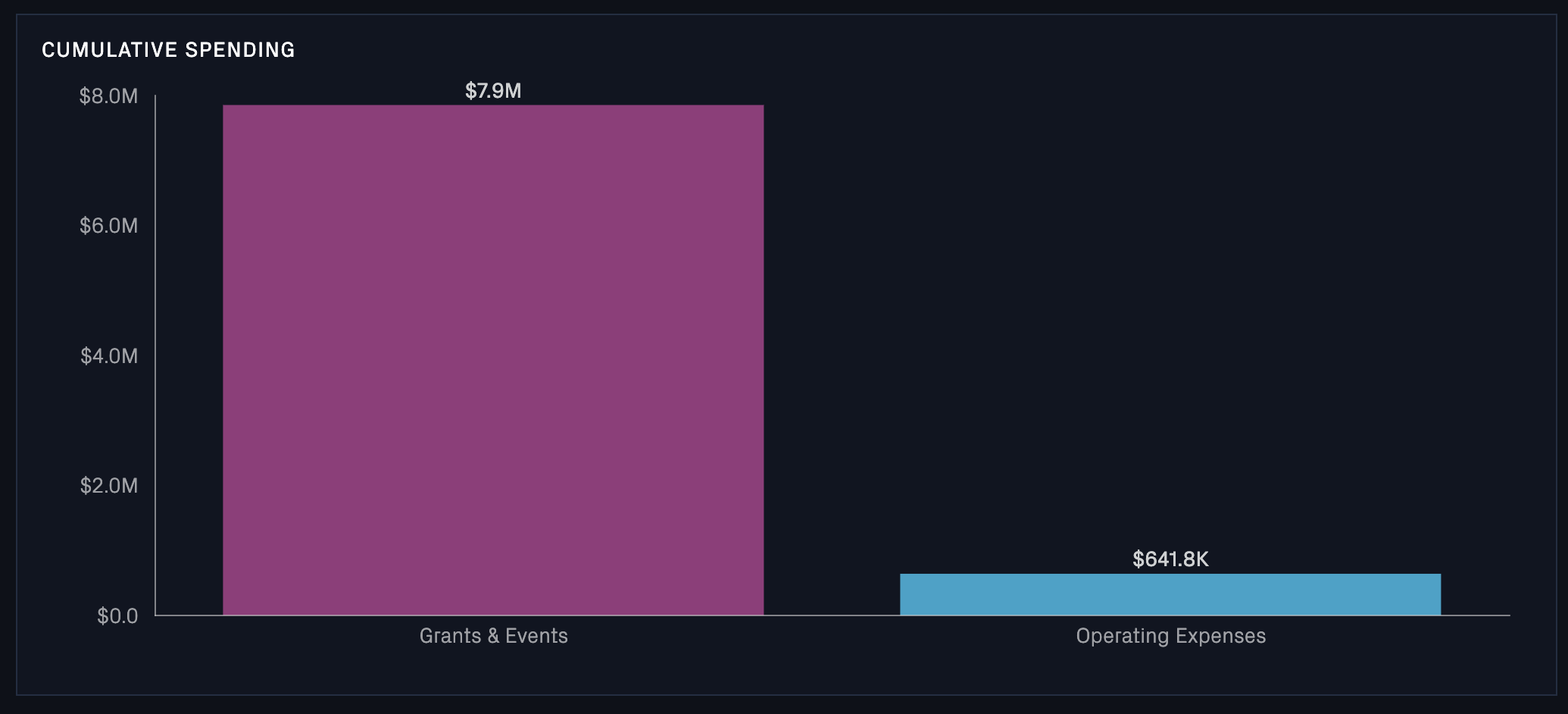

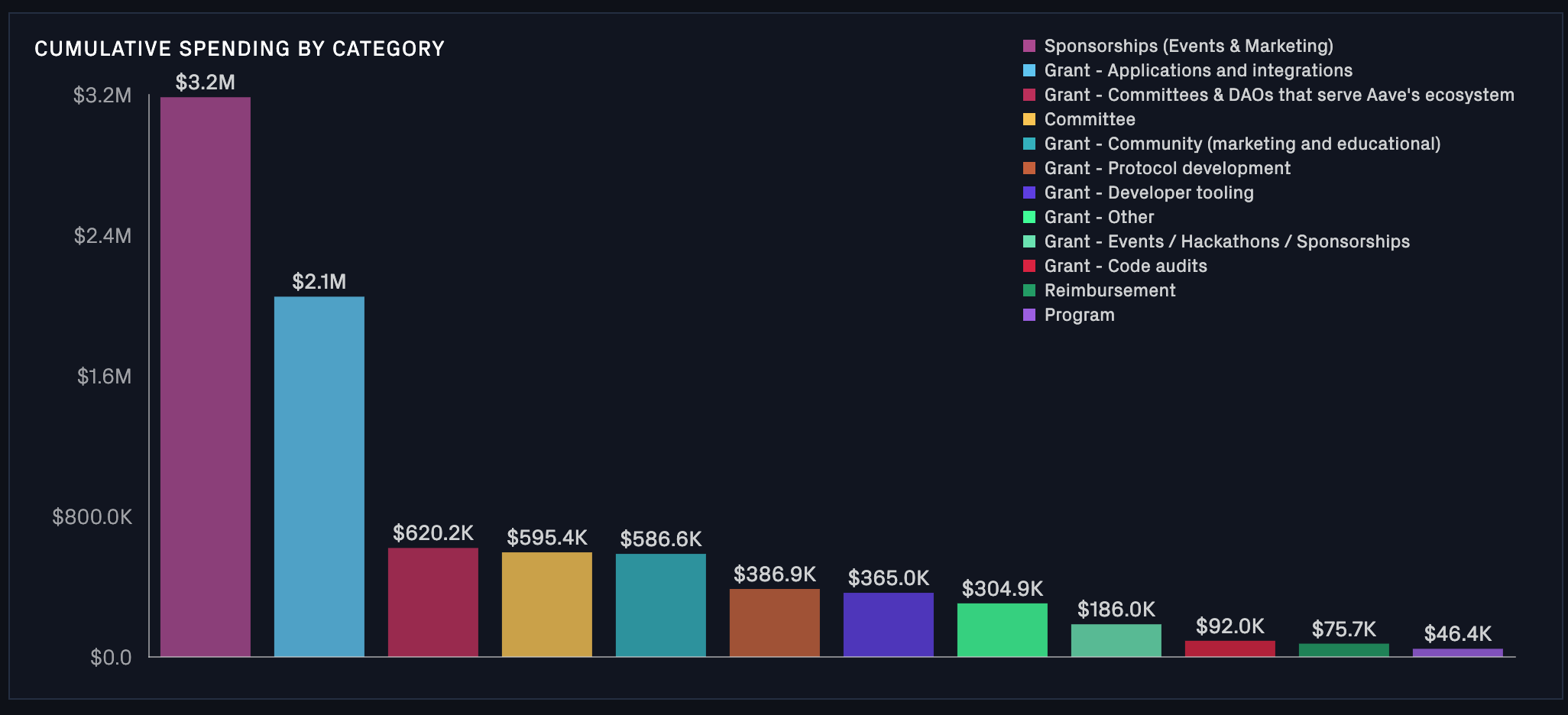

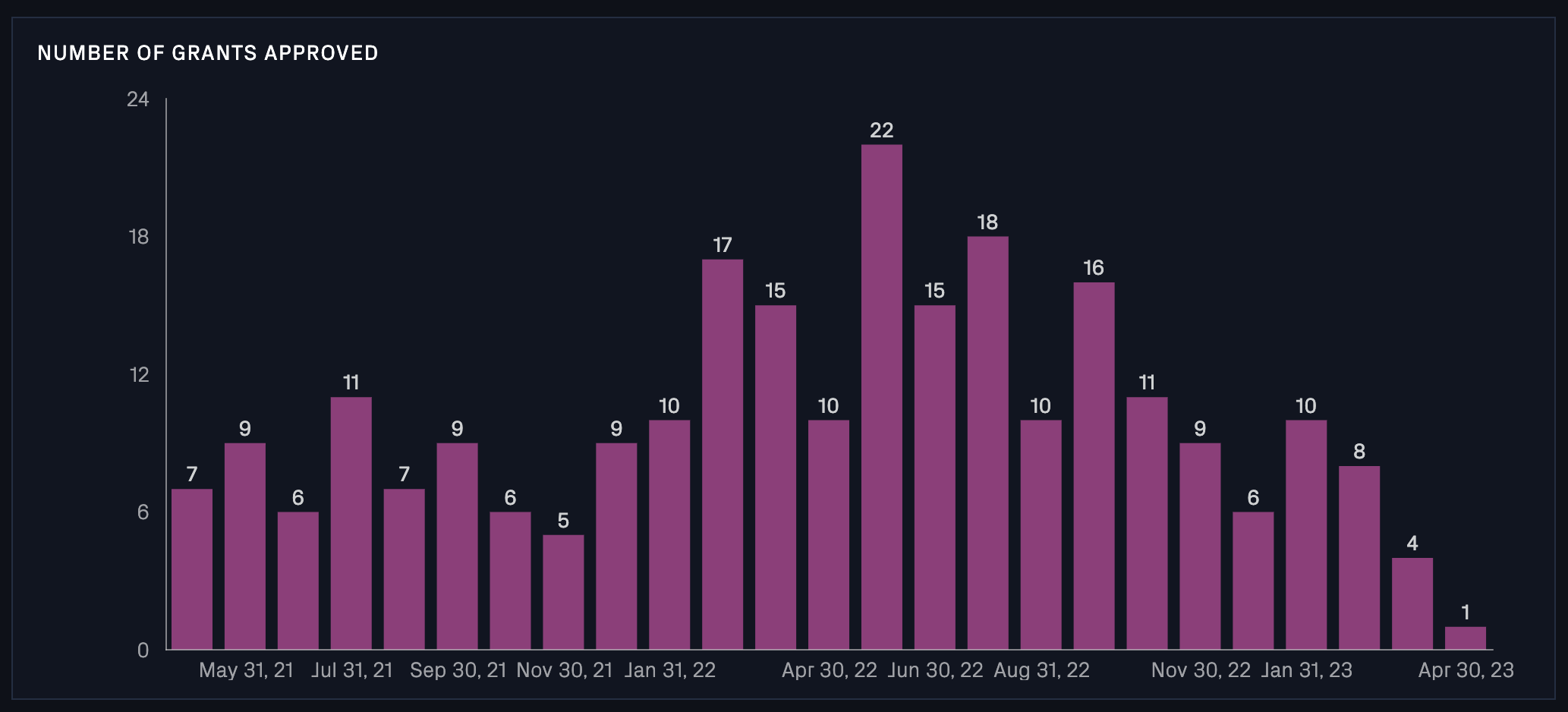

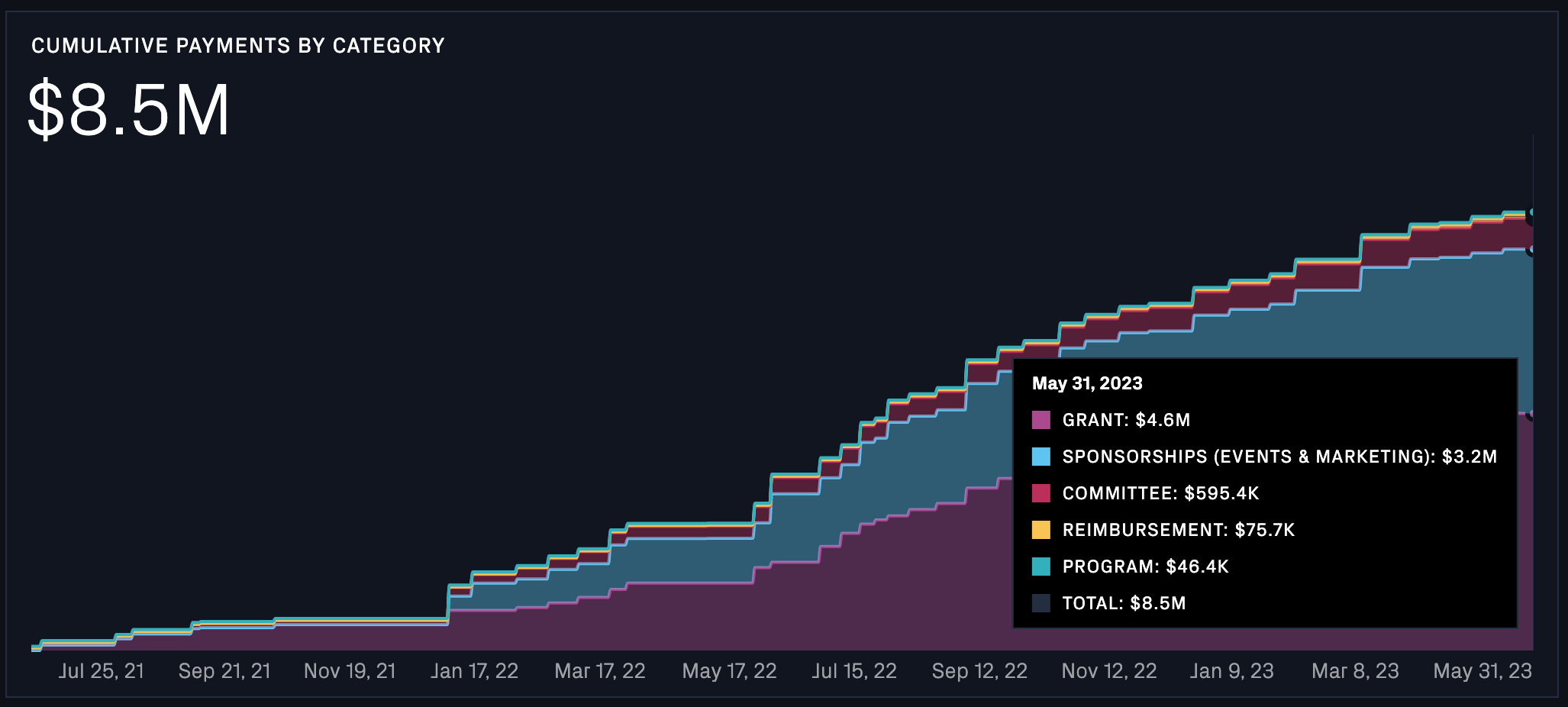

- Aave Grants DAO

- Aave financials dashboard (supplementing our PDF reports)

- Protocol metrics

We’d love for this page to be highly useful to the Aave community. If you have feedback or ideas for data that you’d like to see on the UI, please feel free to share in the comments below.