[TEMP CHECK ] State of Aave Health — August 2025 Report

Author: Abdulaziz Kikanga (Independent Web3 Storyteller)

Date: 2025-08-28

Summary

This report provides a monthly snapshot of Aave’s adoption, treasury strength, and risk resilience.

It draws from on-chain metrics and Dune dashboards to highlight:

- Protocol health

- Financial sustainability

- Areas requiring governance attention

Motivation

Context

Aave’s multi-chain growth and treasury operations demand transparent monitoring to sustain confidence across depositors, borrowers, and governance participants.

Why It Matters

August showed meaningful growth in activity and fee capture, but also underscored the need for treasury stability and safety module funding.

These insights can help shape upcoming governance discussions on capital allocation and risk management.

Key Metrics (August 2025)

Key Metrics (August 2025)

- Treasury Buffer: $18,020,981,132

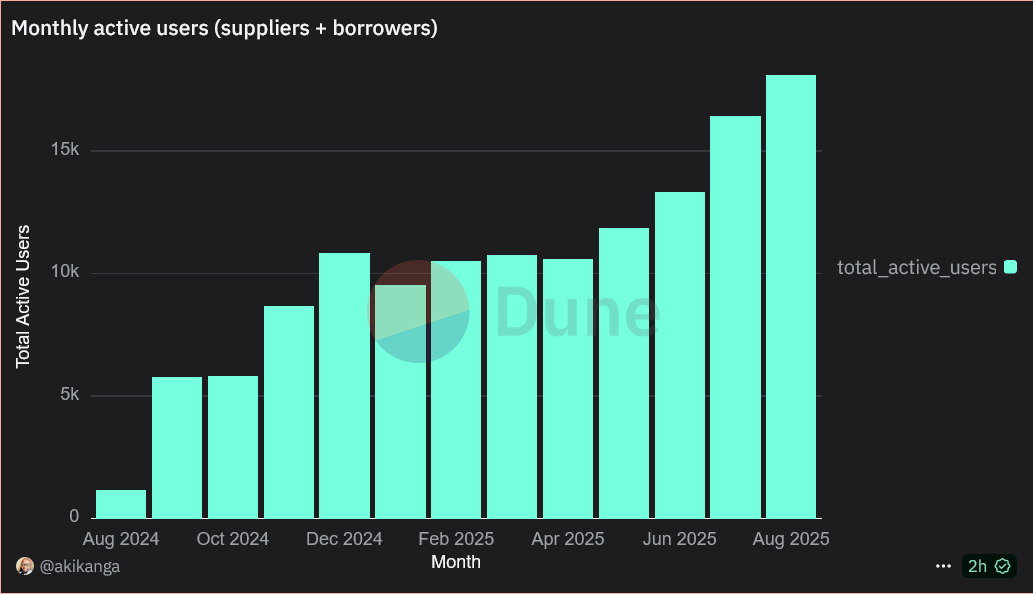

- Total Active Users: 19,082

- Total Liquidated Value: $25

Full Dashboard on Dune : State of Aave Health Report

Section One: Adoption Metrics

Section One: Adoption Metrics

Goal: To Track how Aave is scaling in usage and attracting new participants.

Key Metrics

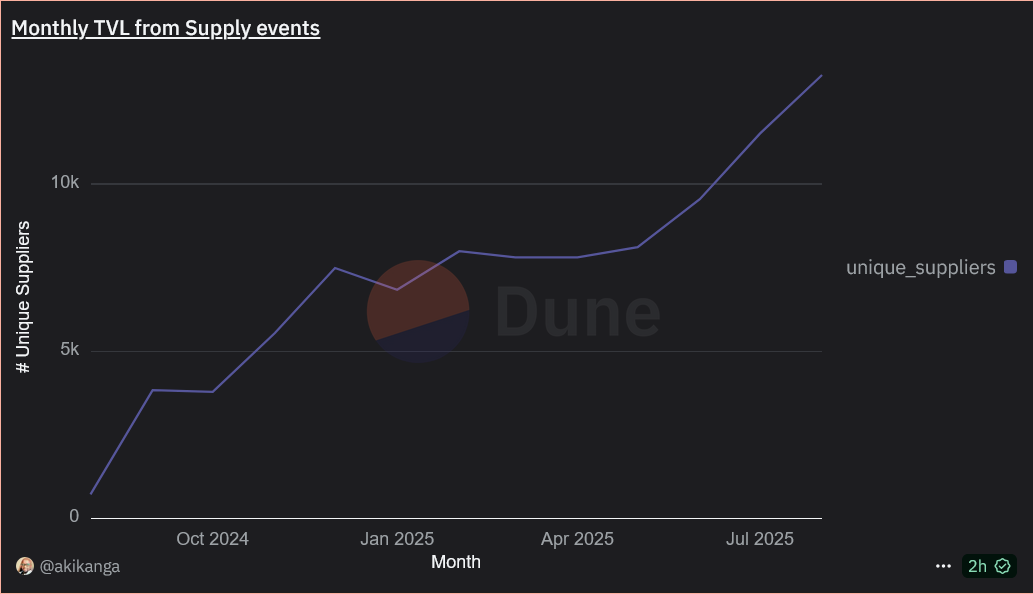

- Monthly token supply growth

- Unique active users

- Monthly transaction volume

August Insights

- Supplier deposits expanded +41.6% MoM, led by ETH and USDC inflows.

- Borrow demand rose moderately, supported by stablecoin activity.

- Total transaction volume surpassed $4.5B, highest in 6 months.

Section Two: Treasury Analysis

Section Two: Treasury Analysis

Goal: Evaluate Aave’s financial position to cover operations and safety outflows.

Key Metrics

- Revenue events logged

- Protocol fees collected

- Reserve fund health

August Insights

- 248,626 revenue events, showing strong fee generation.

- Fees climbed steadily, with ETH + USDC pairs driving inflows.

- Despite volatility, reserves cover 9+ months of operating runway.

Section Three: Risk Resilience

Section Three: Risk Resilience

Goal: Assess how Aave manages liquidations and withstands stress events.

Key Metrics

- Borrow vs Supply ratios

- Collateral usage patterns

- Monthly liquidations

- Price volatility impact

August Insights

- Liquidations were minimal ($25 total), indicating stable borrower health.

- Collateral usage remained concentrated in ETH, stables, and wBTC.

- Volatility analysis showed No systemic spillovers to protocol solvency.

Benefits for the DAO

- Improves decision quality for governance participants.

- Reduces reliance on ad hoc or external reports.

- Establishes a standardized, repeatable framework for evaluating protocol health.

Disclaimer

- The report is a community initiative.

- No direct financial compensation or third-party involvement is included at this stage.

- Metrics are sourced from public Dune dashboards; minor discrepancies may exist due to indexing delays.

Next Steps

- Gather community feedback on the format and coverage.

- If consensus is positive:

- Maintain the report as a monthly DAO artifact.

- Use insights to support future ARFCs/AIPs on parameter changes, treasury allocation, or risk management.

Copyright

Copyright © 2025 Abdulaziz Kikanga.

This proposal is released under CC0 1.0 Universal (Public Domain Dedication) to ensure open access, reuse, and modification.