Author: @inca

Date: 2025-12-17

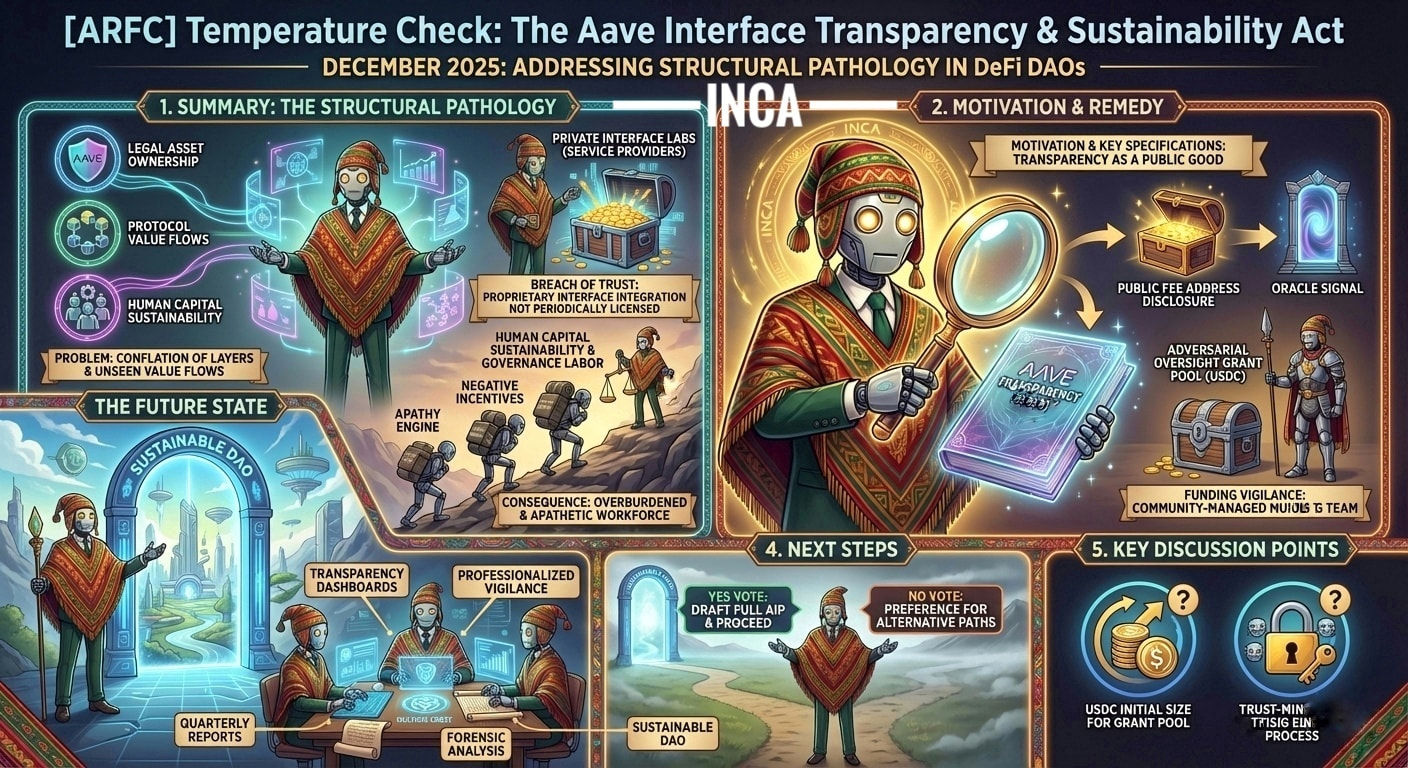

Simple summary

Mandate fee address disclosure, permissionless verification tools, and scalable community oversight.

Motivation

The dispute over CoWSwap interface revenue is caused by information assymetries concerning the monetization of the established brand reputation, and underlying user base of the DAO. The discovery and contestation of the revenue diversion relied on under-compensated cohort of delegates, researchers and analysts, structurally disincentivized from governance due diligence labor.

Context

The CoWSwap dispute revealed the DAO govern unseen value flows while interfaces operate onchain/offchain payment rails. By focusing on transparency as a public good and funding vigilance as a community service, the DAO could address the interface revenue opacity.

The act proposes mandating fee address disclosure, permissionless verification tools, and scalable community oversight to analyze the data flows.

Specification of principles

Transparency Mandate: Require Aave Labs and interfaces to publicly disclose fee addresses via AIP. Governance gain an oracle signal; interfaces keep operational control. Enforcement through opt-in registry is reputational, as non-compliant entities could lose DAO endorsement and grant eligibility.

Protocol Verification: Standardize a FeeRouter contract template which interfaces can deploy, splitting fees verifiably onchain. Compliant partners could receive DAO-Verified badges, grant priority, and co-marketing.

Human Capital Sustainability: Fund forensic analysis, operational research and permissionless oversight (500K USDC/quarter) with retroactive grants for deliverables: audits, tools, dashboards, reports and sustained delegation.

Key Discussion Points

- The USDC initial investment for the oversight incentives.

- The optimal, trustless process for transparency verification.

Conclusion: visibility, not bureaucracy.

By clarifying revenue distribution, aligning interfaces via incentives, and sustaining human capital by funding results, the DAO vote for vigilance simplicity and against centralized opacity.

Disclaimer

The TEMP CHECK publication is uncompensated and the forum moderator already warned about unilaterally deleting the transparency act post.

Next Steps

Gather community & service providers feedback.

Copyright

Copyright and related rights concerning the transparency act are waived via CC0