Summary

A proposal to:

- Increase USDC’s borrow cap on Aave V3’s Avalanche deployment.

- Increase BAL’s supply cap on Aave V3’s Ethereum deployment.

- Increase ETHx’s supply cap on Aave V3’s Ethereum deployment.

- Increase OP’s supply cap on Aave V3’s Optimism deployment.

Motivation

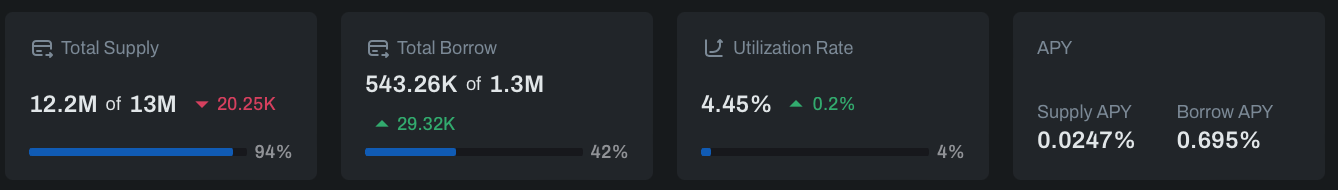

USDC (Avalanche)

Following significant new borrowing activity, USDC has reached 94% borrow cap utilization; its supply cap is 62% utilized. Overall, the market is 80% utilized, close to the UOptimal of 90%.

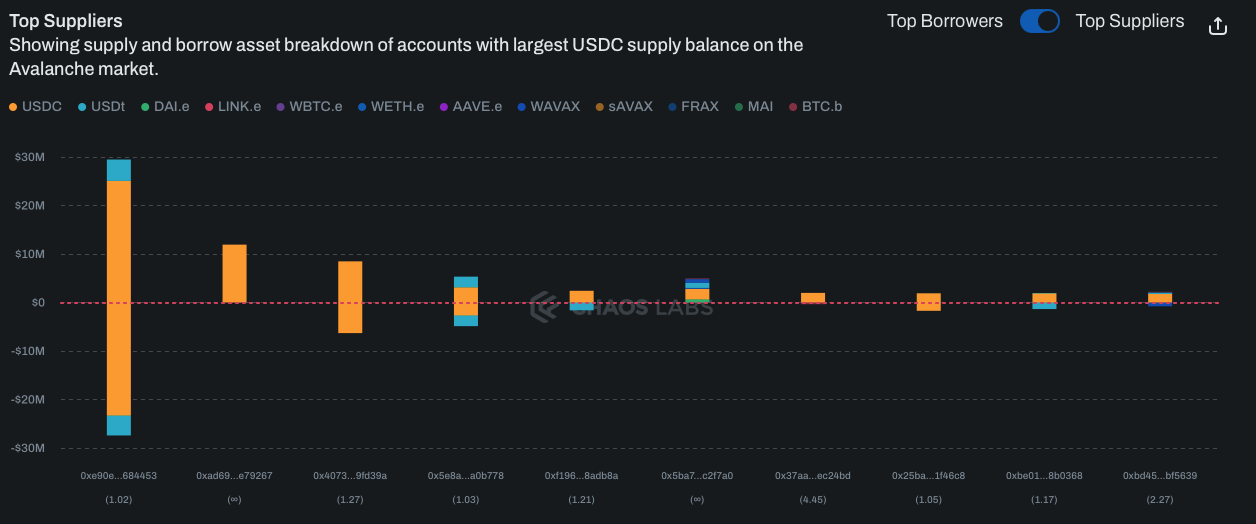

Supply Distribution

Supply is well distributed, with the top supplier representing about 20% of the total deposited. The top user is looping USCD and USDT with USDC and USDT, with 23M USDC borrowed. This position composition reduces the likelihood of large-scale liquidations.

Borrow Distribution

Borrows are also well distributed, with the user above representing 23% of the total amount borrowed. The second largest borrower accounts for 9% of the total borrowed, using USDC itself as collateral; this position is also at limited risk of liquidation.

Recommendation

Given on-chain liquidity and user behavior, we recommend increasing the borrow cap by roughly 50%.

BAL (Ethereum)

BAL has reached its supply cap following a large new deposit on Aave.

Supply Distribution

Supply is heavily concentrated in two positions, with health scores of 1.88 and 1.81, respectively.

However, given BAL’s relatively conservative parameters, including the fact that it is in isolation mode, and on-chain liquidity, these positions do not pose a serious risk to the protocol.

Recommendation

Given BAL’s on-chain liquidity and user distribution, we recommend increasing the supply cap by 50%.

ETHx (Ethereum)

ETHx has reached its supply cap following new deposits; its borrow cap remains relatively little utilized.

Supply Distribution

Supply is somewhat concentrated, with the largest supplier accounting for 37.5% of total deposits. However, they maintain a strong health score of 2.71. The second largest supplier represents a limited risk of liquidation, given they are borrowing WETH against ETHx and stablecoin collateral.

We find that the supply cap can be increased without posing significant new risks to the protocol.

Recommendation

Given on-chain liquidity and user distribution, we recommend increasing the supply cap.

OP (Optimism)

OP is approaching its supply cap following a surge of deposits on Aave.

Supply Distribution

The largest supplier accounts for 30% of total deposits and maintains a deposit-only position. The second largest borrows USDC and USDT against OP collateral (13% of total supply), with a strong health score of 2.9. Overall, this market is relatively distributed.

Additionally, the largest suppliers in this market do not present an immediate liquidation risk. Given this, we find that the supply cap can be safely increased.

Recommendation

Given user behavior and on-chain liquidity, we recommend increasing OP’s supply cap.

Specification

| Chain | Asset | Current Supply Cap | Rec. Supply Cap | Current Borrow Cap | Rec. Borrow Cap |

|---|---|---|---|---|---|

| Avalanche | USDC | 170,000,000 | - | 90,000,000 | 130,000,000 |

| Ethereum | BAL | 3,800,000 | 5,700,000 | 500,000 | - |

| Ethereum | ETHx | 3,200 | 5,000 | 320 | - |

| Optimism | OP | 13,000,000 | 20,000,000 | 1,300,000 | - |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

For transparency, we aim to execute the risk steward transaction on August 8th at 09:00 am GMT

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this ARFC.

Copyright

Copyright and related rights waived via CC0