Summary

A proposal to:

- Increase USDC’s supply and borrow caps on Aave V3’s Ethereum - Main instance

- Increase USDC’s supply and borrow caps on Aave V3’s Optimism - Main instance

- Increase USDC’s supply and borrow caps on Aave V3’s Polygon - Main instance

USDC (Ethereum-Main)

USDC has reached 88% supply cap utilization on the Ethereum Main instance, while its borrow cap utilization has reached 87%.

Supply Distribution

The supply of USDC on Ethereum is well distributed, with the largest supplier accounting for 13% of the total and maintaining a deposit-only position.

All of the top suppliers maintain deposit-only positions, significantly reducing the likelihood of a large liquidation causing a rapid supply decrease.

Overall, the value borrowed against USDC collateral is small, at just $66.33M relative to a total supply of nearly $2B. The most popular borrowed asset is WETH, meaning some users could be liquidated if WETH’s price increases.

Borrow Distribution

The top borrowers of USDC borrow against a variety of liquid collateral and maintain differing health scores, reducing the chance of widespread liquidations.

The top borrower is relatively new, beginning to open their sUSDe/USDC position at the end of November. While they have a low health score, the correlation between the two assets reduces the chances of liquidation.

The top collateral assets for USDC borrows are all highly liquid, reducing risk to the protocol in the event of liquidations.

Liquidity

DEX liquidity between USDC and WETH on Ethereum has remained stable since September, supporting an increase in supply and borrow caps.

Recommendation

Given user behavior and on-chain liquidity, we recommend increasing the supply and borrow caps by roughly 30% each. This increase is backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that the higher cap does not introduce additional risk to the platform.

USDC (Optimism-Main)

USDC on Optimism has reached 84% and 98% supply and borrow cap utilization, respectively, with a significant surge in both beginning on December 1.

Supply Distribution

The top USDC suppliers on Optimism are also highly distributed, with no single user accounting for more than 10% of the total. However, there are top suppliers who are borrowing against their USDC, the largest being a $900K borrow of WBTC at a 1.59 health score.

While this does increase the chances of large liquidations, the distribution of the market ensures that any liquidations will not cause significant decreases in the market size. There are $4.29M worth of borrows against $42.2M supplied, again indicating that the market is not highly leveraged and reducing risk.

Borrow Distribution

Borrows are more concentrated, with the top user borrowing $11.5M USDC against $17.4M WETH. The risk of this position is mitigated by the fact that WETH is highly liquid and that the user is actively managing their position. Other borrow positions are significantly smaller and do not present a risk to the protocol.

As above, the majority of USDC borrows are against highly liquid collateral assets like WETH, WBTC, and wstETH.

Liquidity

While USDC-WETH liquidity fell at the start of October, it has remained stable since, with a 2M USDC for WETH swap able to be completed under 5% price slippage. This liquidity supports an increase in caps.

Recommendation

Taking into account user behavior and on-chain liquidity, our risk simulations recommend a 75% increase to each cap.

USDC (Polygon-Main)

USDC’s supply cap is 88% utilized and its borrow cap is 90% utilized.

Supply Distribution

The top suppliers on Polygon are not highly concentrated. However, the top supplier does borrow against their position, though it is a highly correlated asset (USDT). The second largest borrows WBTC, but maintains a relatively strong health score of 1.91.

There are more borrows against USDC on Polygon relative to the size of the market, though much of these are highly correlated assets or USDC itself. This significantly reduces the likelihood of large-scale liquidations.

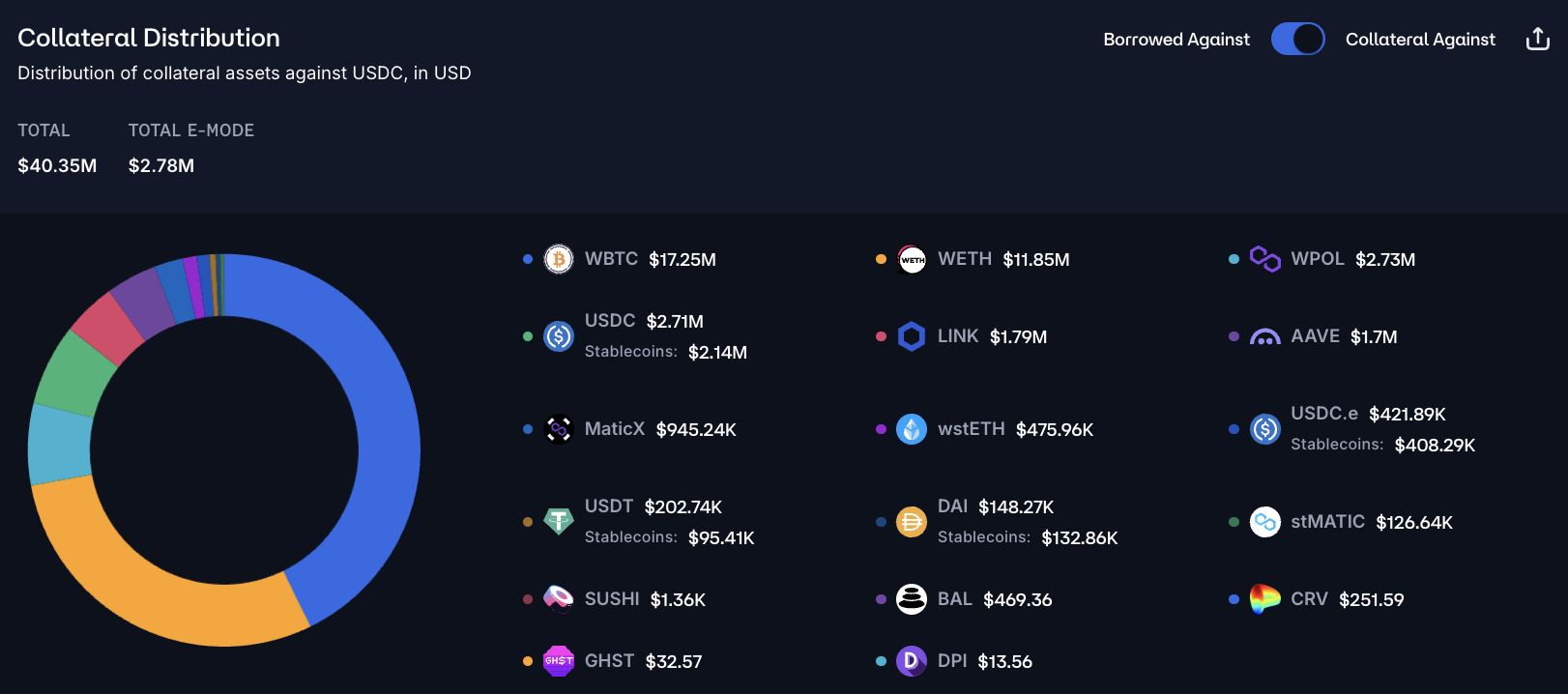

Borrow Distribution

The top borrowers are highly distributed and use a variety of liquid collateral assets. These positions do not present a risk to the protocol at this time.

The most popular collateral assets against USDC are WBTC and WETH; these are highly liquid assets, reducing the risk of these positions.

Liquidity

USDC-WBTC liquidity on Polygon has remained relatively stable since September and is sufficient to support a supply and borrow cap increase.

Recommendation

Chaos Labs’ risk simulations indicate that doubling the supply and borrow caps does not introduce significant new risk to the protocol.

Specification

| Chain | Instance | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|---|

| Ethereum | Main | USDC | 2,250,000,000 | 3,000,000,000 | 2,100,000,000 | 2,750,000,000 |

| Optimism | Main | USDC | 50,000,000 | 87,500,000 | 40,000,000 | 78,750,000 |

| Polygon | Main | USDC | 50,000,000 | 100,000,000 | 45,000,000 | 90,000,000 |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this ARFC.

Copyright

Copyright and related rights waived via CC0