Summary

A proposal to:

- Increase GHO’s supply and borrow caps on the Ethereum Prime instance.

GHO (Ethereum Prime)

The supply cap for GHO has reached 96% utilization, and its borrow cap is at 66%.

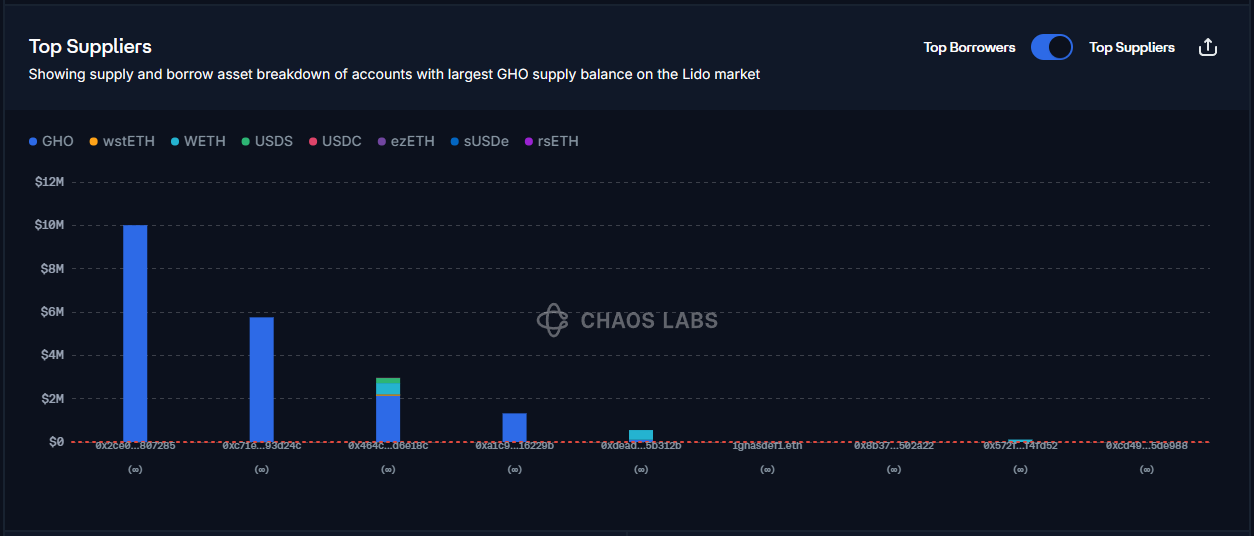

Supply Distribution

As GHO on the Ethereum Prime instance cannot be used as collateral, the top suppliers all represent supply-only positions. However, it is worth noting that two of the three biggest supplies in the pool are all closely related to Aave itself. The GHO Prime Facilitator represents the biggest position, the second one represents the GHO deposits into Balancer pools, and the third one by Aave’s Treasury and DAO service provider streams.

Given the launch of the Aave GHO/USDT/USDC pool on Balancer, we expect supply demand for the pool to grow in order to provide liquidity using GHO’s aToken.

Borrow Distribution

GHO’s borrow distribution is highly concentrated, with a single user representing the majority of the borrowing demand and using sUSDe as collateral. Following the liquidity pool’s launch, we also expect the demand for GHO borrowing to grow so that it can be used to provide liquidity and earn rewards on Balancer.

At the current time, sUSDe represents 90% of the collateral used to borrow GHO. Given the high correlation between the two assets, the position does not represent a significant liquidation risk.

Recommendation

Given user behavior and on-chain liquidity, we recommend increasing the supply and borrow caps.

Specification

| Instance | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Ethereum Prime | GHO | 20,000,000 | 25,000,000 | 2,500,000 | 5,000,000 |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this proposal.

Copyright

Copyright and related rights waived via CC0