Summary

A proposal to:

- Increase GHO’s supply and borrow caps on the Ethereum Prime instance.

- Increase sUSDe’s supply cap on the Ethereum Prime instance.

GHO (Ethereum Prime)

The supply cap utilization of GHO has reached 100%, while its borrow cap utilization stands at 96%.

Supply Distribution

The supply distribution of GHO poses no liquidation risk at this time. Since GHO on the Ethereum Prime instance cannot be used as collateral, all top suppliers hold supply-only positions.

Borrow Distribution

The supply distribution of GHO is highly concentrated in a single user who uses sUSDe as collateral. However, given the correlation between these two assets, this does not pose a significant risk. Among the remaining top borrowers, five positions use wstETH as collateral, while the other four use sUSDe. The positions backed by wstETH maintain high health scores above 1.3, further reducing liquidation risk.

sUSDe is the largest collateral asset backing GHO, representing 96% of the total distribution, followed by wstETH at 4%.

Liquidity

GHO’s liquidity has remained stable over the past two months, with a 10M GHO sell incurring less than 1% price slippage. This liquidity level is sufficient to support increases in both the supply and borrow caps.

Recommendation

Given user behavior and on-chain liquidity, we recommend increasing the supply cap to 60M GHO and borrow cap to 20M GHO.

sUSDe (Ethereum Prime)

sUSDe’s supply cap utilization has reached 100%.

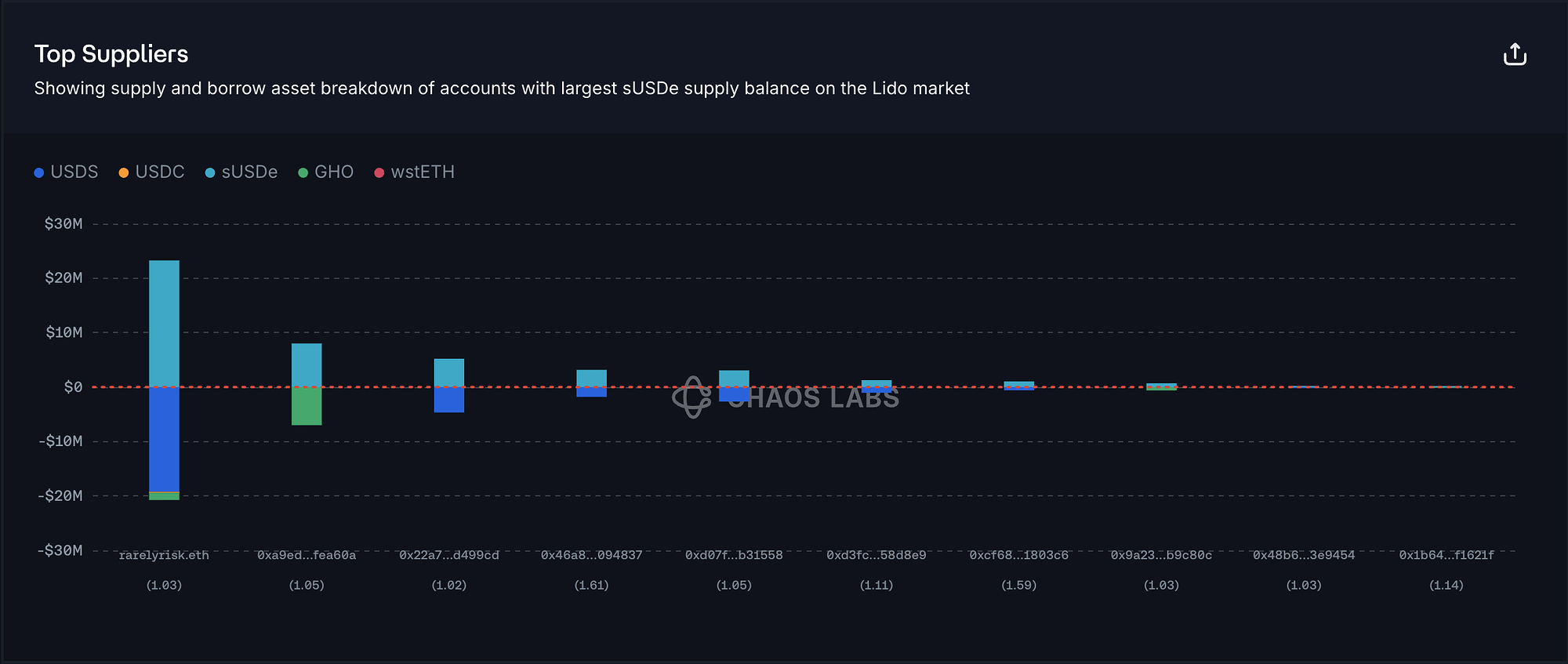

Supply Distribution

The supply distribution of sUSDe is highly concentrated, with the top supplier holding approximately 58% of the total supply. This user is currently borrowing USDC, GHO, and USDS, with USDS being the largest borrowed asset. Since all three borrowed assets are correlated with sUSDe, the liquidation risk is significantly reduced.

The remaining top suppliers have predominantly borrowed GHO and USDS. Despite some maintaining health scores near 1, the strong correlation between these assets and sUSDe minimizes the overall liquidation risk.

The largest borrowed asset against sUSDe is USDS, accounting for 76% of the total borrowed asset distribution.

Liquidity

The liquidity of sUSDe has remained stable over the past two months, with a 15M sUSDe sell incurring less than 1% price slippage. However, this liquidity remains limited relative to the total supply of sUSDe and its supply on Aave. While current user behavior does not indicate significant concerns, we will take this into account when considering cap increases.

Recommendation

Given user behavior and on-chain liquidity, we recommend increasing the supply cap to 60M sUSDe.

Specification

| Instance | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Ethereum Prime | GHO | 30,000,000 | 60,000,000 | 10,000,000 | 20,000,000 |

| Ethereum Prime | sUSDe | 40,000,000 | 60,000,000 | - | - |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this ARFC.

Copyright

Copyright and related rights waived via CC0